For the sake of transparency towards our community, on a monthly basis we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report will be subject to change based on your feedback and the evolution of the information we receive.

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, as well as offering some of the best yielding conditions available in the market. Learn more about how Smart Yield works.

The DeFi landscape

Activity in DeFi has largely followed the wider crypto-market trend in July. For Binance Smart Chain and Polygon, total value locked (TVL) denominated in BNB and ETH respectively remains constant throughout the month, showing that the net flow of assets from DeFi platforms on these chains is neutral regardless of how crypto assets perform. The exception to this is activity on Ethereum. TVL in terms of ETH inversely correlates with the price of ETH and we see this throughout July. In the first 20 days, as the ETH price steadily decreased, TVL in ETH increased on Ethereum. Once the trend in price reverses to the upside, TVL steadily decreases.

Drawing conclusions by looking at the above in isolation is difficult, and the reasons can be bullish or bearish. The bearish case states that people already holding ETH have capitalised on returns from yielding, and as prices rise across the market, assets are withdrawn from DeFi yield platforms to sell at a profit. The difference in the bullish case is in the reasoning for selling. A more positive outlook in the market tends to increase risk-taking behaviour, where assets (ETH, BTC and stablecoins, all of which form the majority of deposits on DeFi platforms) are exchanged for smaller and riskier tokens. With the London upgrade to Ethereum in early August and continued rising prices in the large-cap crypto assets, it is likely the bullish case.

We saw an interesting new trend in July, where several new projects came into existence with cross-chain capabilities. This new selling point has attracted significant liquidity, such as $500 million in TVL on O3Swap in just two weeks. This interest isn’t limited to retail speculation. DinoSwap raised just under $5 million from well known crypto VC funds, which is unusual for DeFi platforms. However, as with any new development, there is an increased security risk as the platforms are novel and have not been battle-tested. Four of the six platforms exploited in July focused on cross-chain services, with Thorchain being exploited twice in the space of 10 days. After this initial teething period, we are sure to see new household names who manage to safely push DeFi on this front.

Smart Yield wallets analysis

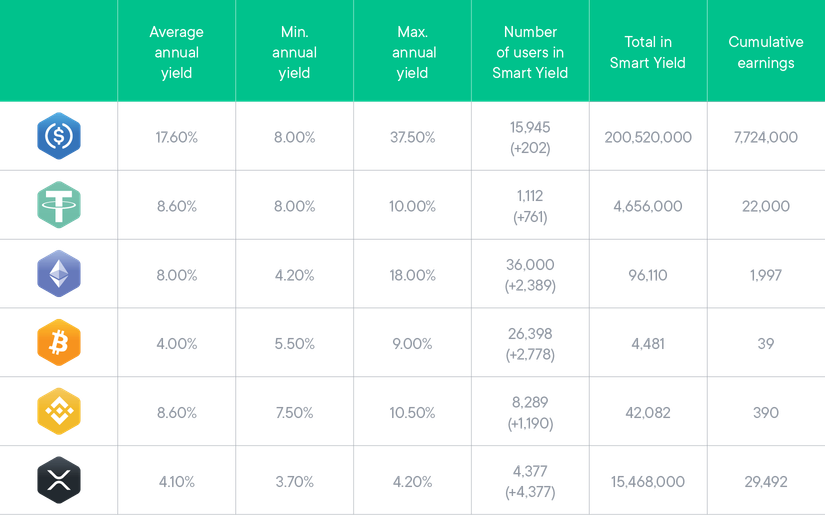

For clarification and a better overview of all the yield wallets, we have restructured the information presented in this section with a table that summarises the different performance of the Smart Yield wallets. With the recovery of the BTC and ETH price, we have seen a slowdown in the growth of the USDC Smart Yield wallet while BTC, ETH and BNB have shown significant growth in terms of number of users using the different Smart Yield. However, the amount in the USDC Smart Yield stayed relatively stable, which highlights the fact that users are still diversifying their wealth in unpredictable market conditions. In August, several milestones will be reached, with more than 8M in USDC, 2000 ETH and 40 BTC being earned by our users since the Smart Yield wallets launched.

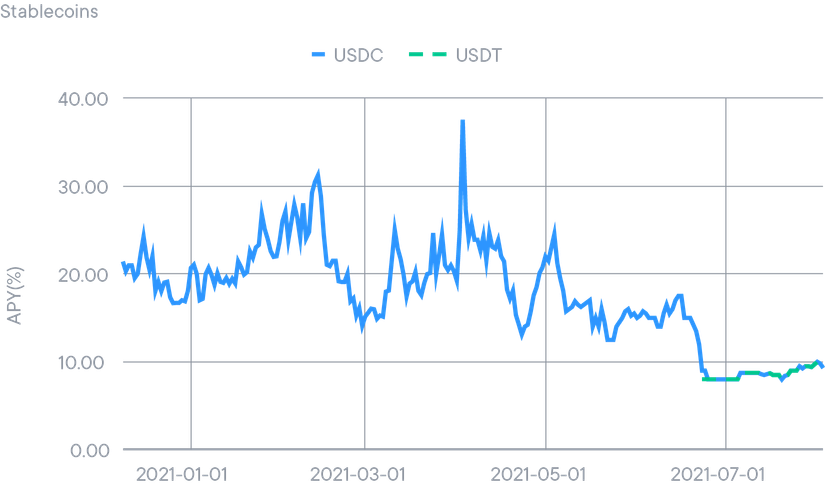

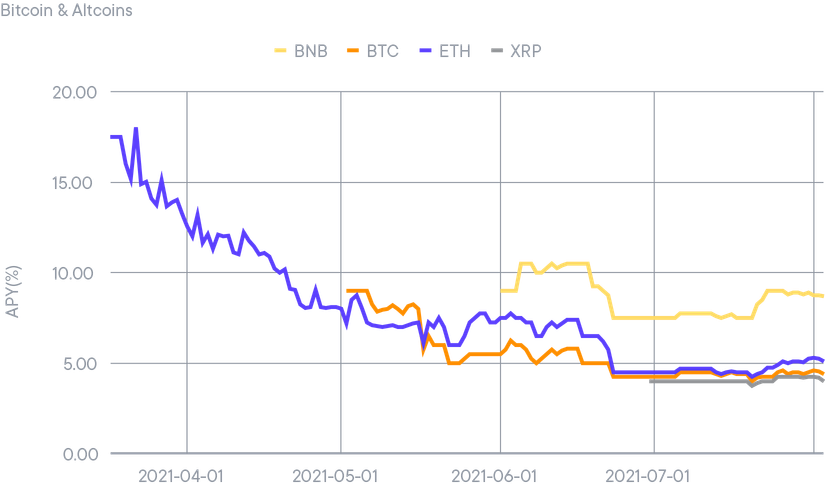

With the actual market conditions and the normalisation across DeFi platforms, we are still experiencing lower yields than before but the strategy optimiser was able to lower the volatility of the yields earned. Further volatility is expected in August, with events such as the London Hard Fork that could cause some variability in the yield rates as well as flow between the different Smart Yield wallets.

Smart Yield

Strategy Optimiser

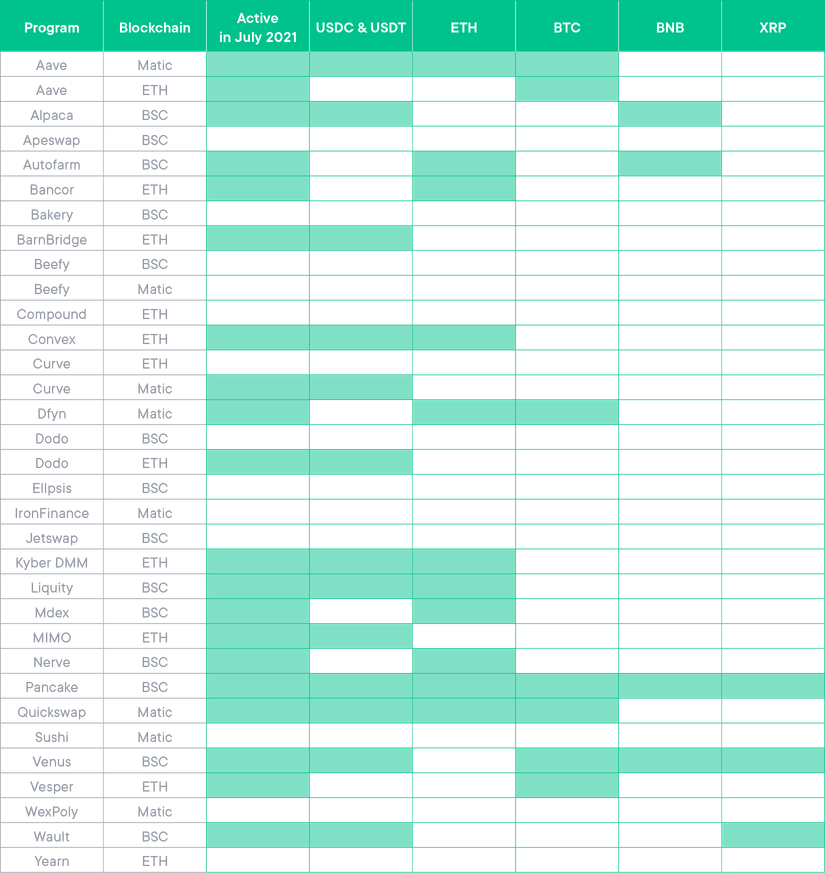

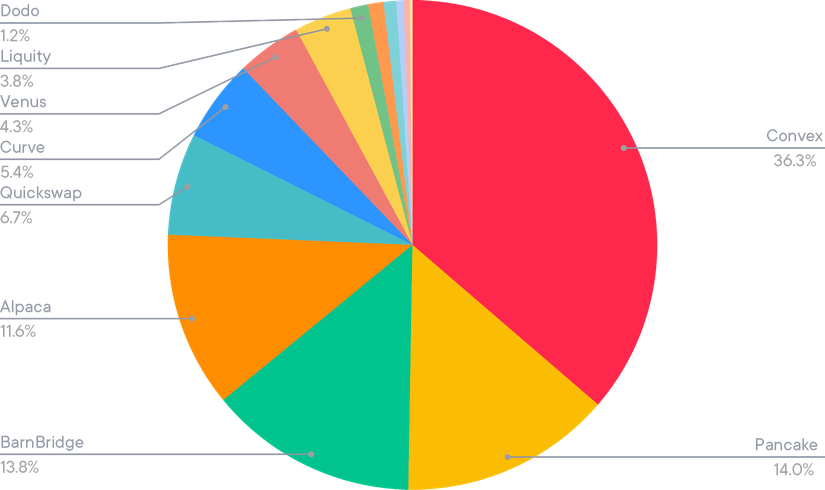

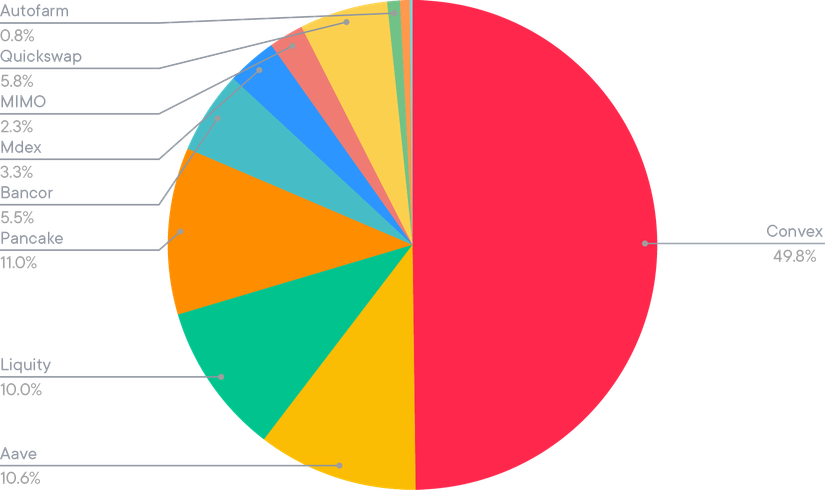

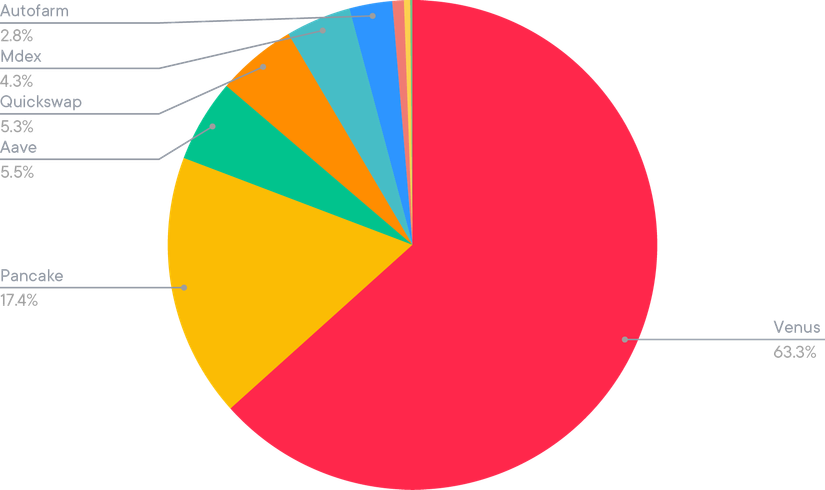

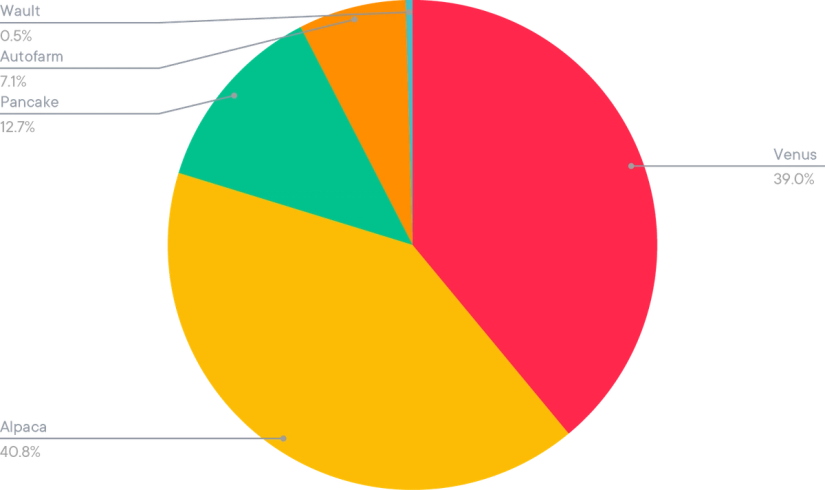

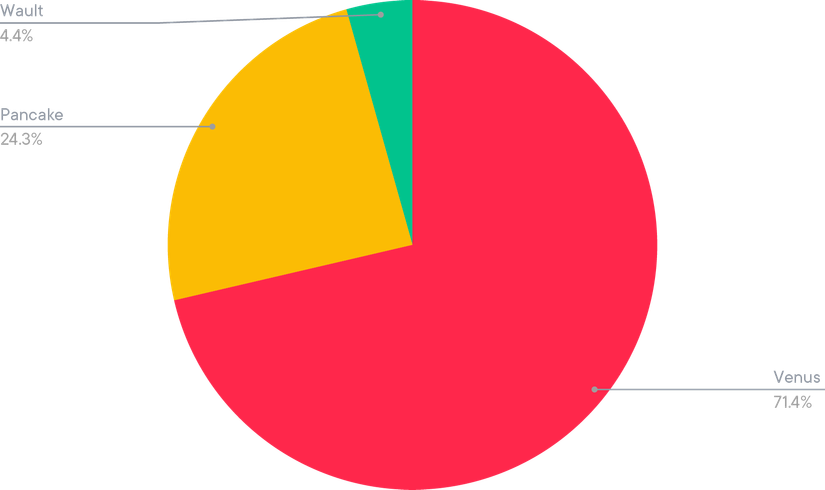

In order to obtain the best possible return for the optimal level of risk, the Smart Yield strategy involves diversifying into numerous DeFi and CeFi applications.

72 different applications were used in July for maximum diversification in 3 different blockchains, which is more than twice than the previous month.

Safety Net Program

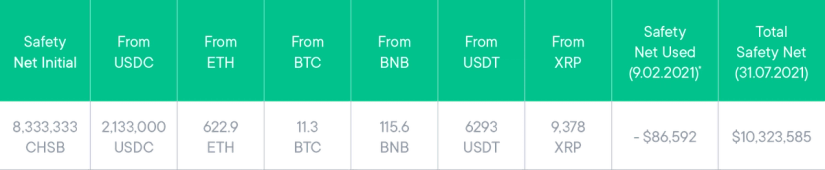

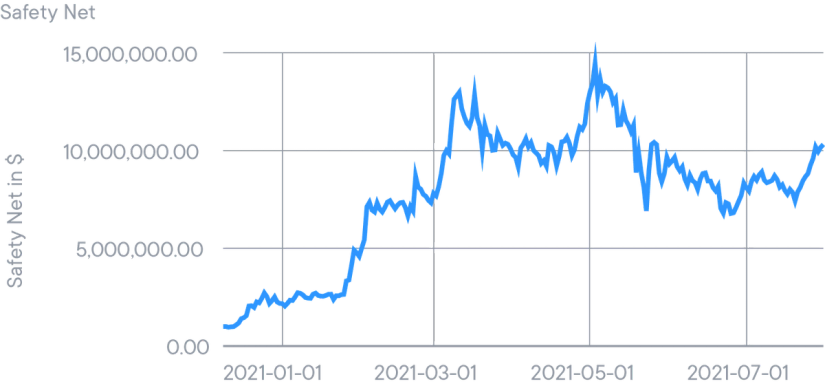

SwissBorg has also established a USD1 million Safety Net Program in CHSB (8,333,333 CHSB) to protect against Smart Contract risk, and we put the equivalent of 25% of max yield earnings into that program to ensure it grows alongside our community’s investments.

The Safety Net is a common pot for all Smart Yield wallets and therefore benefits from the yield of all wallets. With the compound growth of the other Smart Yield wallets and the recovery of the market, the Safety Net is above US10 million at the time of writing.

Disclaimer: The information contained in or provided from or through this article (the "Article") is not intended to be and does not constitute financial advice, trading advice, or any other type of advice, and should not be interpreted or understood as any form of promotion, recommendation, inducement, offer or invitation to (i) buy or sell any product, (ii) carry out transactions, or (iii) engage in any other legal transaction. This article should be considered as marketing material and not as the result of financial research/independent investments.

Neither SBorg SA nor its affiliates (“Entities”) make any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of the Article, nor to it being free from error. The Entities reserve the right to change any information contained in this Article without restriction or notice. The Entities do not accept any liability (whether in contract, tort or otherwise howsoever and whether or not they have been negligent) for any loss or damage (including, without limitation, loss of profit), which may arise directly or indirectly from use of or reliance on such information and/or from the Article.