For the sake of transparency towards our community, on a monthly basis we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report will be subject to change based on your feedback and the evolution of the information we receive.

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, as well as offering some of the best yielding conditions available in the market. Learn more about how Smart Yield works.

The DeFi landscape

The month of May saw some interesting shifts in trends. Until the end of April, there was a steady growth in TVL (Total Value Locked) for the ETH and BSC networks. Growth stagnated in May, primarily due to a significant market-wide correction. However, it is interesting to note that even though the TVL has dramatically decreased over the month in USD value, market participants have largely stayed in DeFi. This can be seen from the ETH and BNB denominated TVLs remaining relatively constant; ~31m ETH and ~42m BNB for the ETH and BSC networks respectively. This is contrary to typical behaviour during bearish periods, where people tend to exit risky strategies (DeFi in general), and shows that appetite for DeFi remains.

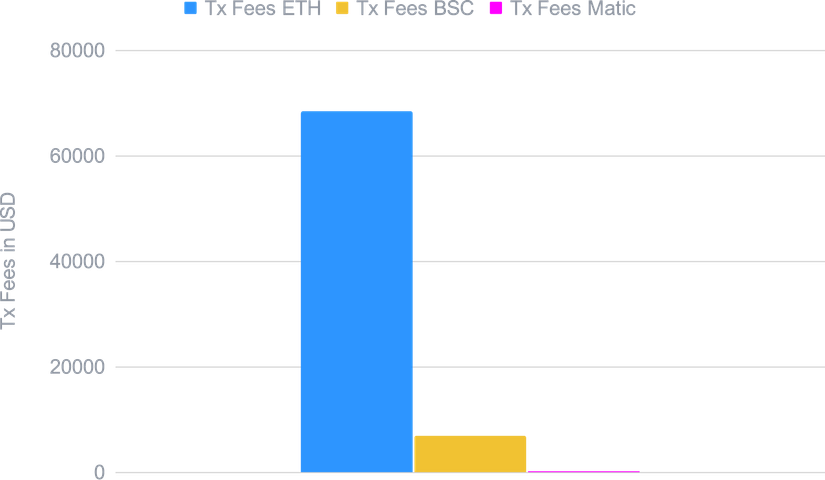

Another indicator showing the market’s enthusiasm for DeFi is the emergence of the Matic (Polygon) network. Significant liquidity has flowed to various projects on Matic, going from $0.5bn mid-May to just under $6bn by the end of the month. The attraction is even cheaper fees than on BSC, with the added appeal of being a layer-2 solution for the Ethereum network. The latter proves to be a significant factor in pulling new users as this is something we have seen with BSC previously. Binance’s size and marketing power enabled it to use its brand to attract users, and possibly explains why brand-identity has allowed Matic to beat other competing chains for the current third spot in DeFi. Aave has also deployed on Matic, giving the network a seal of approval from an established DeFi platform. In relation to this, we foresee significant interest in Arbitrum over the next couple of months. Several established projects have already planned to deploy on this layer-2 solution, including Uniswap V3 and SushiSwap.

In our last report we continued to stress the risks of DeFi, specifically pertaining to hacks/exploits. The frequency of exploits on BSC increased over the month, with five exploits coming in just the final week of May. With each exploit, attacks become more sophisticated as developers rush to patch known vulnerabilities. One of the exploits was carried out on Belt.fi, a pool the Strategy Optimiser had invested in. The impact to our Yield program was minimal, and more details can be found in the Safety Net section towards the end of this report.

Smart Yield wallets analysis

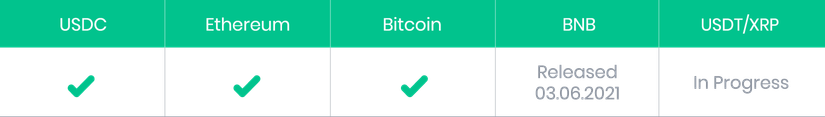

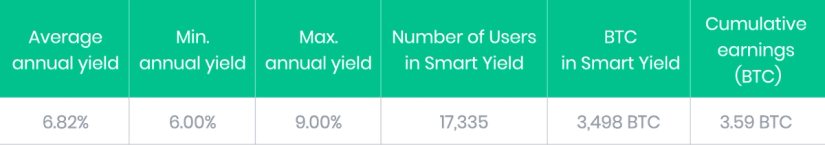

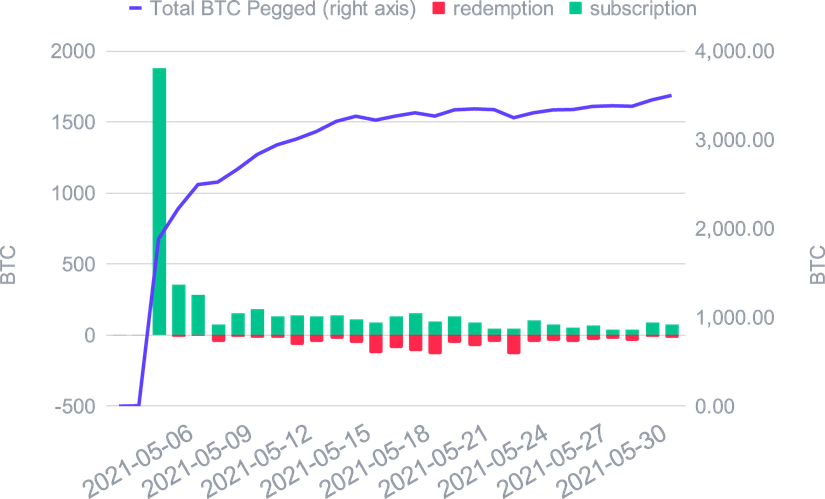

The Smart Yield offer has been enriched with the release of the Smart Yield wallet on BTC. The release of this wallet was impressive - in less than 24 hours, nearly 2,000 BTC were collected (mostly BTC from outside the SwissBorg app) to reach 3,500 BTC by the end of the month.

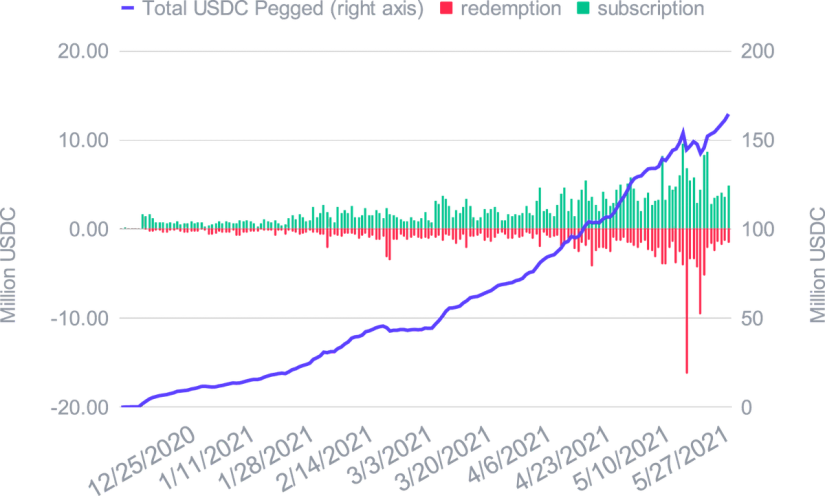

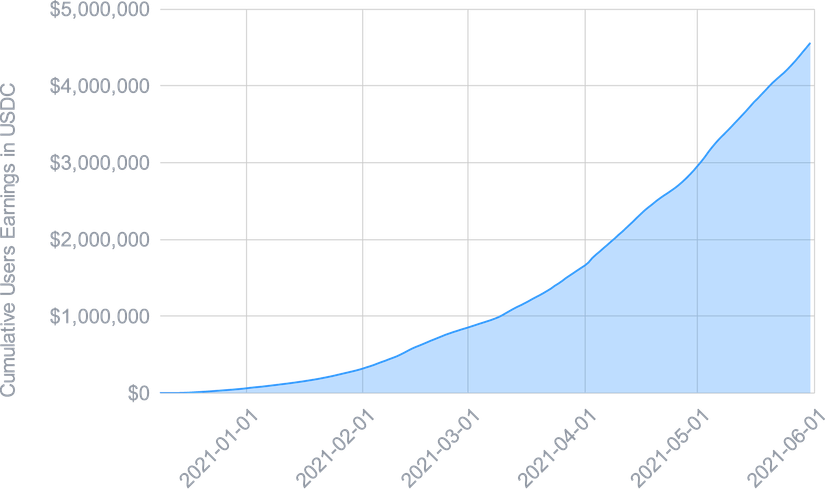

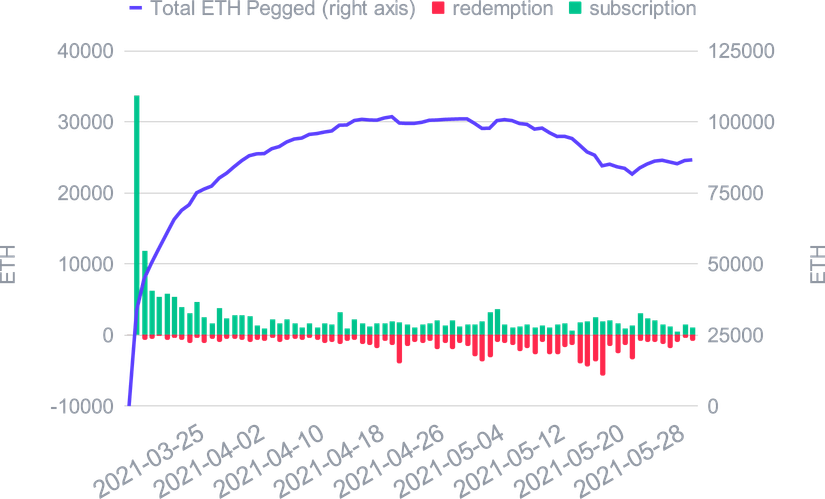

With the high volatility in the markets and the correction experienced, we have noticed an acceleration in the growth of the USDC Smart Yield wallet as well. Indeed, some of our users switched from Smart Yield on Ethereum to USDC after taking profits on their locked Ethereum. With the growing range of yield wallets on offer in the SwissBorg app, it is now possible to diversify dynamically according to the market conditions while receiving a yield on the major cryptos.

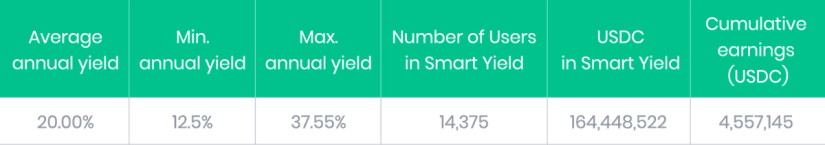

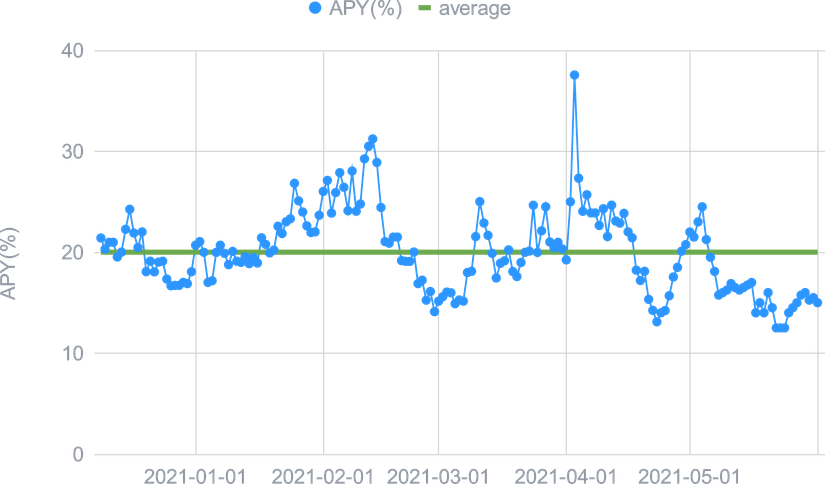

In general, the rates offered have decreased slightly this month due to market conditions. It is important to note that rates are subject to volatility and it is likely that rates will rise again when market conditions improve. The goal of Smart Yield is to adjust exposures to limit risk and give a long-term average yield that is sustainable and competitive. Indeed, in an uncertain market, violent movements can limit performance in the DeFi ecosystem and expose the users to additional risks, which are lowered with the Smart Yield strategy optimiser.

We invite you to discover the details of the different Smart Yields and strategy optimiser below. Please note that the number of users in the Smart Yields has been adjusted, removing users with a very low number of tokens have been removed from the account to more clearly reflect the growth in our yield wallets.

USDC Smart Yield

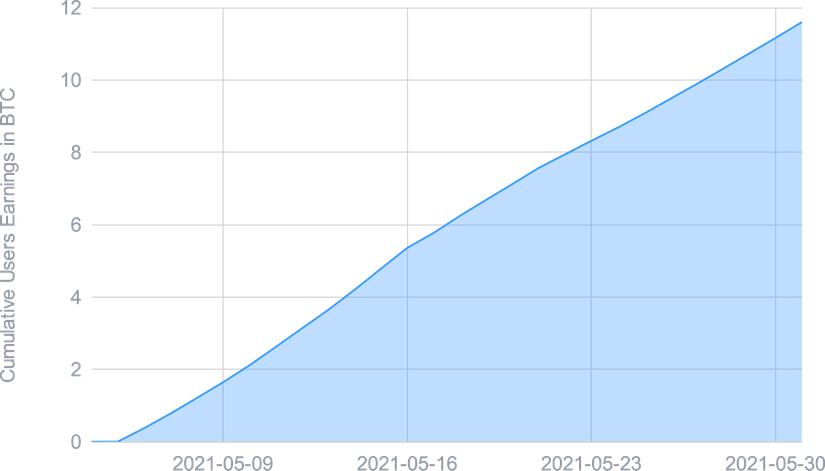

BTC Smart Yield

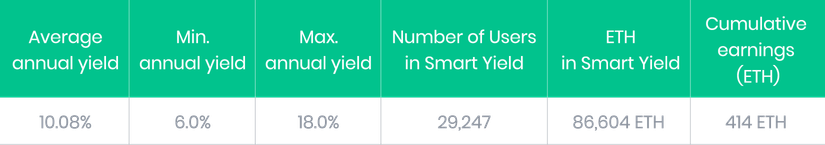

ETH Smart Yield

Strategy Optimiser

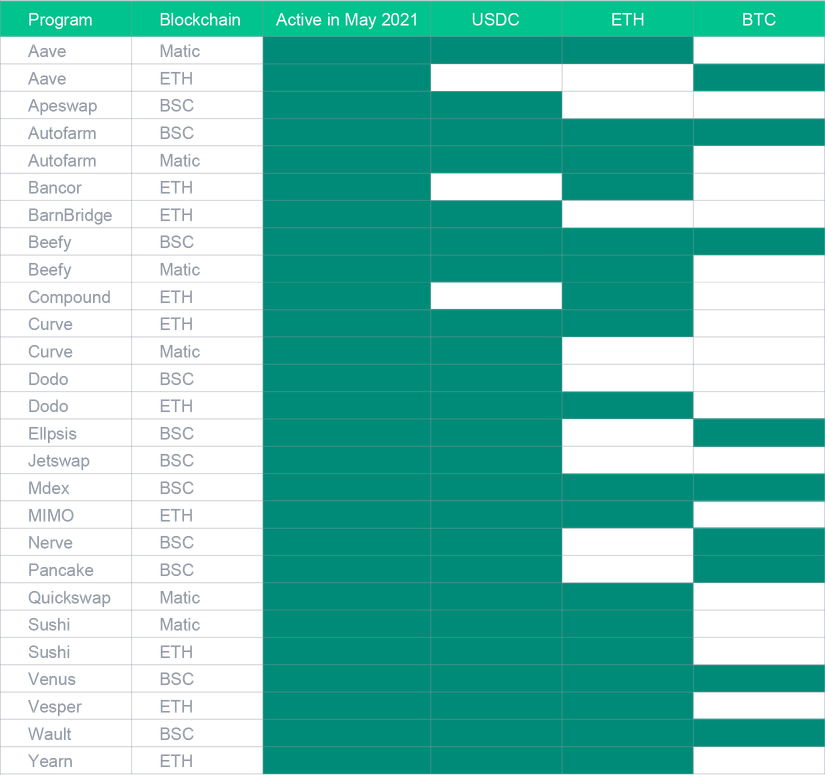

In order to obtain the best possible return for the optimal level of risk, the Smart Yield strategy involves diversifying into numerous DeFi and CeFi applications once they have been audited (smart contract and due diligence) in order to limit the risks.

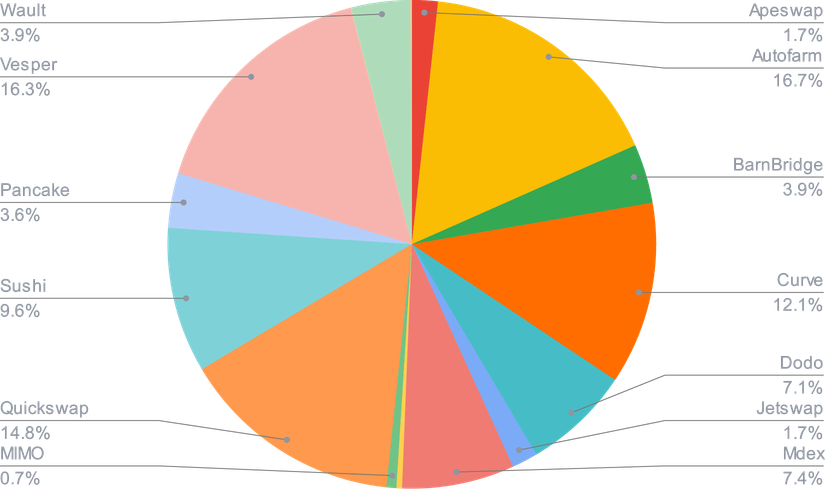

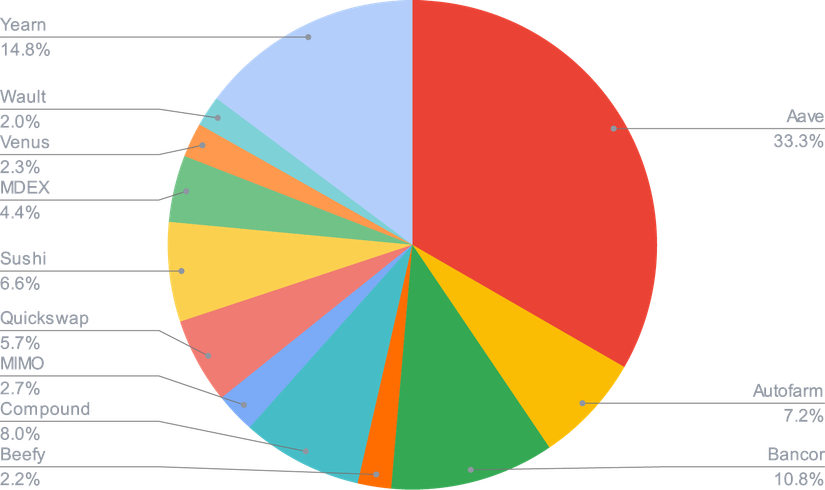

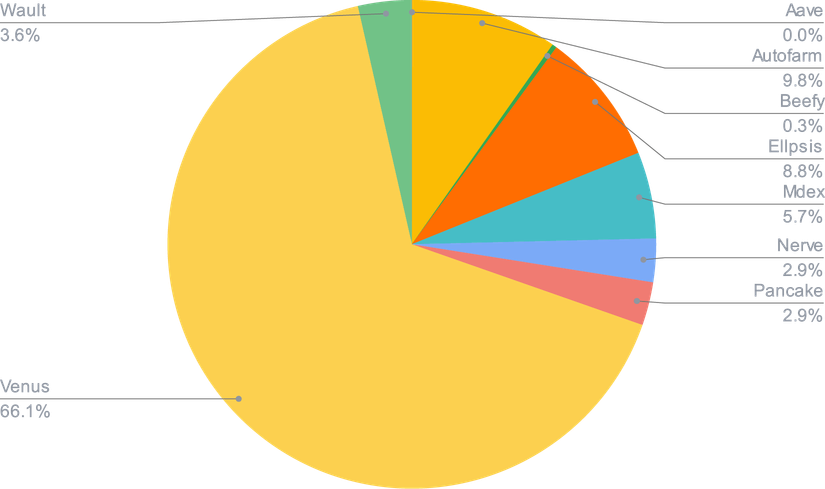

21 different applications were used in May for maximum diversification in 3 different blockchains.

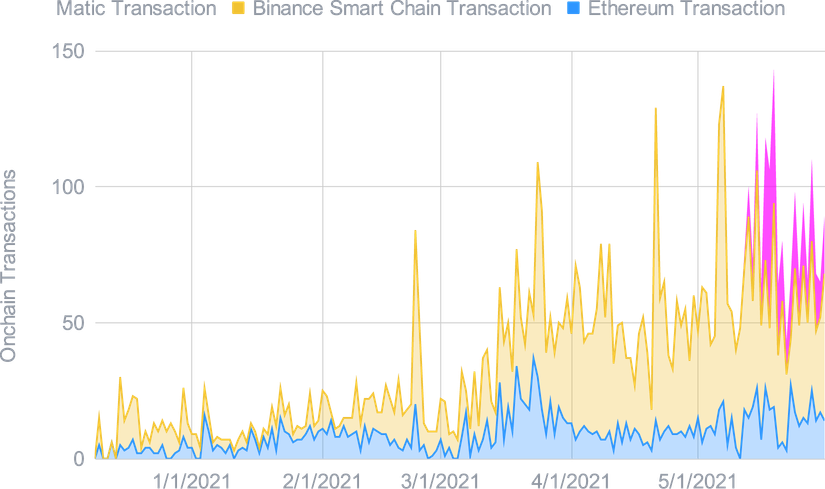

Indeed, with the explosion of the DeFi ecosystem on the Matic blockchain, it was possible to add further diversification and optimisation by deploying the strategy on the Matic blockchain, in addition to Binance Smart Chain and Ethereum. The Matic blockchain allows transactions to be carried out at a lower cost while offering competitive rates.

The diversification across multiple blockchains and the extremely volatile market is responsible for the increase in transactions in the Smart Yield program, demonstrating the complexity and power of the strategy optimiser. With the increase of offers on the DeFi ecosystem and additions of new Smart Yield wallets, this diversification is set to continue.

It is noted here that the increase in the number of transactions is a healthy sign for risk management and optimisation and also demonstrates the fierce competition in the DeFi ecosystem, which is not manageable without a complex system such as the strategy optimiser.

Safety Net

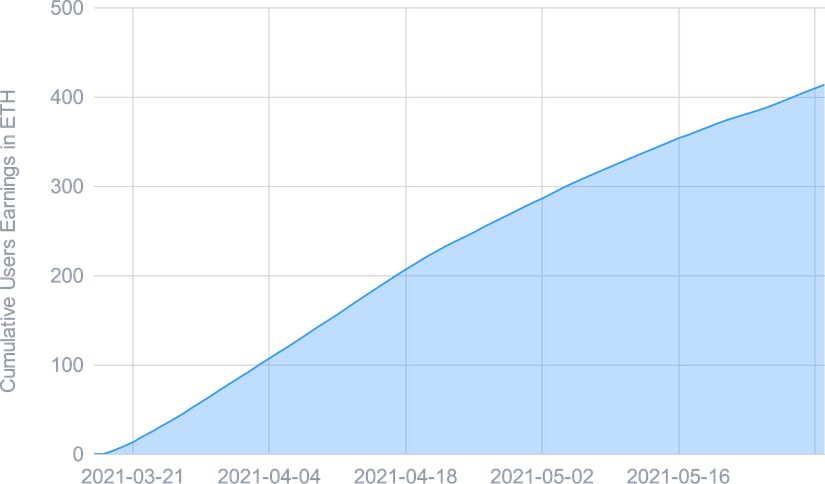

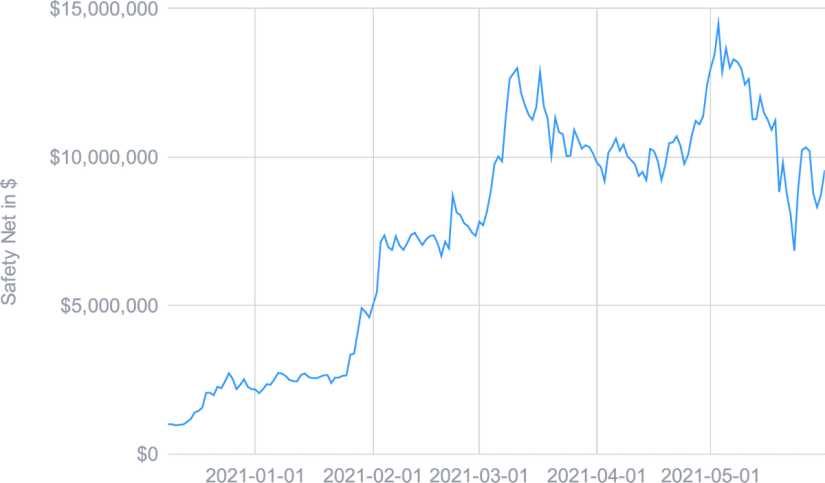

SwissBorg has also established a USD1 million Safety Net Program in CHSB (8,333,333 CHSB) to protect against Smart Contract risk, and we put the equivalent of 25% of max yield earnings into that program to ensure it grows alongside our community’s investments.

The Safety Net is a common pot for all Smart Yield wallets and therefore benefits from the yield of all wallets. Thus, with the arrival of BTC as well as the compound growth of USDC and ETH, the Safety Net is above USD9.5 million at the time of writing, despite the fact that CHSB suffered from a correction in May.

In May, the 4Belt pool - one of the pools the Smart Yield strategy optimiser had invested in - was a victim of a sophisticated flash loan attack. The pool lost around 5% of its value as a result, which impacted the value of the Smart Yield program. However, the loss was below 0.30% of the program.

As the 4Belt pool was rated as a “complex strategy pool”, the strategy optimiser applied conservative risk management to this investment. Thanks to this risk management, the Smart Yield program was able to compensate for the loss without having to use the Safety Net Program to compensate our users.

Disclaimer: The information contained in or provided from or through this article (the "Article") is for informational purposes only, and does not constitute financial advice, trading advice, or any other type of advice. Neither SwissBorg Solutions OÜ nor its affiliates (“Entities”), make any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of the Article, nor to it being free from error. The Entities reserve the right to change any information contained in this Article without restriction or notice. The Entities do not accept any liability (whether in contract, tort or otherwise howsoever and whether or not they have been negligent) for any loss or damage (including, without limitation, loss of profit), which may arise directly or indirectly from use of or reliance on such information and/or from the Article.