For the sake of transparency towards our community, on a monthly basis, we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report, updated monthly, will be subject to change based on your feedback and the evolution of the information we receive.

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, as well as offering some of the best yielding conditions available in the market. Learn more about how Smart Yield works.

The DeFi landscape

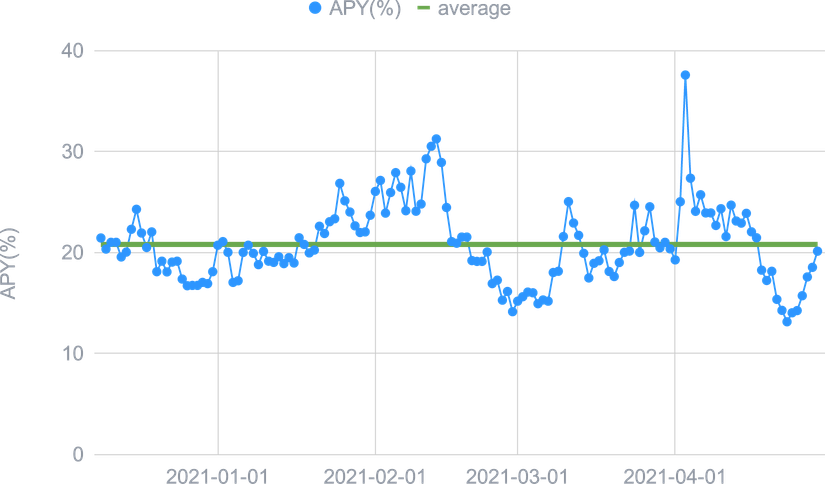

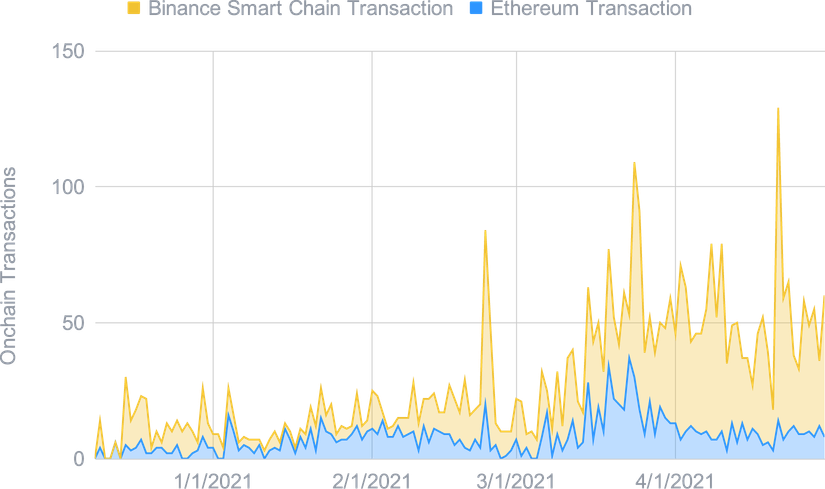

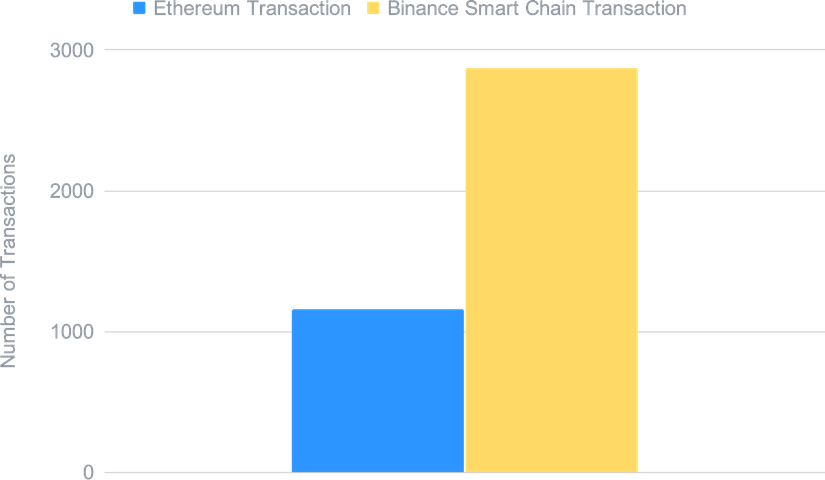

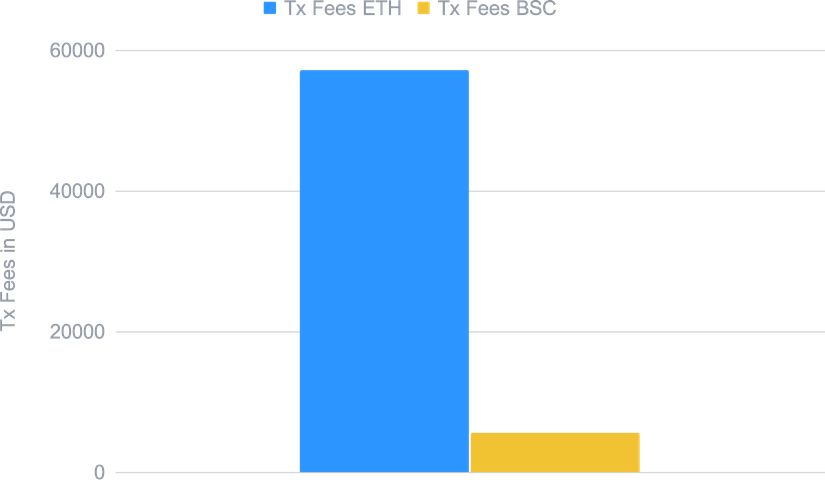

Throughout April, DeFi continued its impressive growth for the top two networks. Total Value Locked (TVL) crossed the $65 billion level for Ethereum, with BSC closely behind at $43 billion. DeFi on BSC is growing at a faster rate, having more than doubled in April alone. It still remains to be seen whether BSC can continue its rapid growth and match Ethereum in TVL size, particularly as other networks have also started attracting more users.

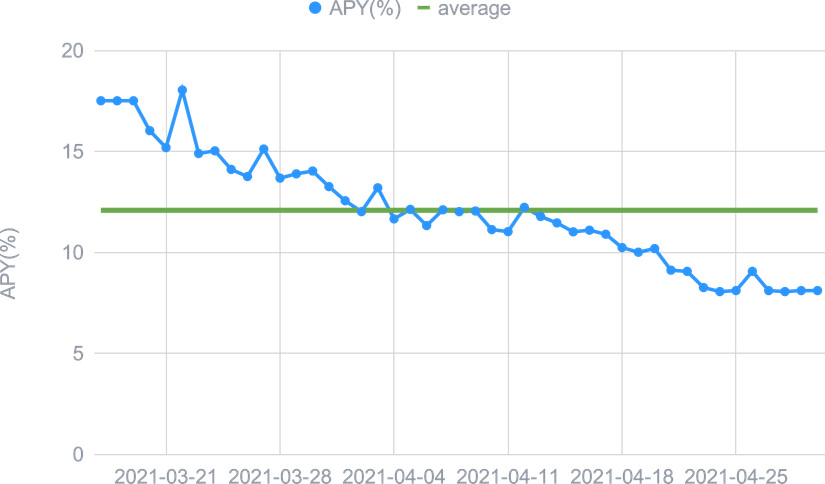

The DeFi expansion has had little impact on the USDC Smart Yield, and apart from a new all time high for this yield being set in the beginning of April, it has remained close to the average of 2021 so far. This is likely due to the market remaining in an uptrend, and any additional competing TVL for yield is being offset by an appreciation in reward token prices. For the ETH Smart Yield, we see a different story of a clear downtrend in APYs throughout the month. The reason for this is an increased TVL in DeFi is likely in the form of non-stablecoin assets (particularly ETH), as people tend to hold these in uptrending markets. This is further supported with an increasing ETH price, making it more likely to be a hold-asset of choice. We expect the program to deliver higher returns as soon as the ETH price stabilises.

The risk of exploits is always present, and April was no different. Uranium Finance and EasyFi were exploited for $57 million and $59 million respectively, both being some of the largest exploits in DeFi history. The former was due to a smart contract bug, whereas EasyFi suffered losses due to inadequate admin security measures. The Smart Yield program tries to ensure appropriate due diligence is carried out for the projects eligible for investment. Consequently, funds that were part of the Smart Yield program were unaffected by these exploits. However, it is a risk one should always be aware of.

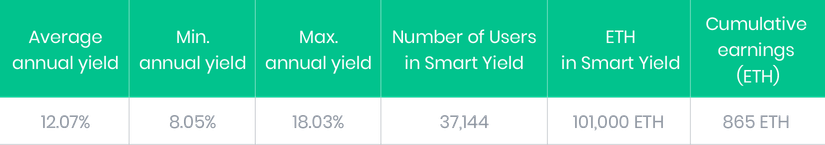

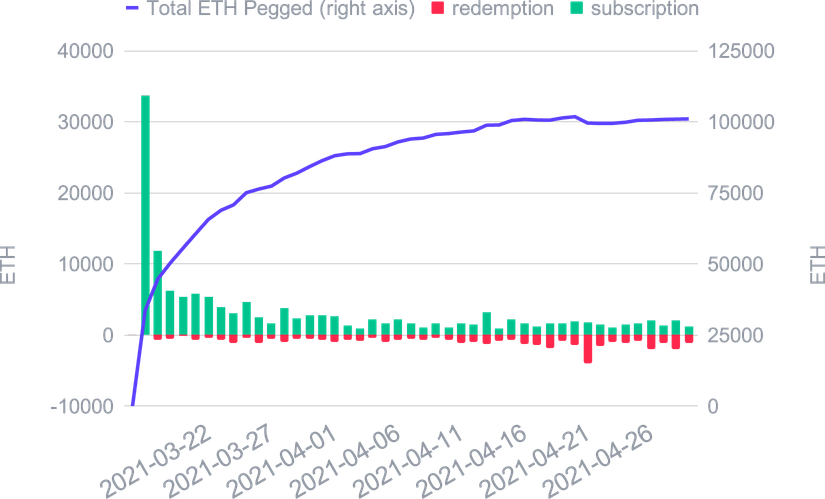

ETH Smart Yield

The number of new users in the ETH Smart Yield wallet continues to grow significantly, and we now have more than 35,000 unique users in the Smart Yield. This wallet is now the most popular in terms of number of users. However, the growth of the pool has slowed down for two reasons: with the strong rise of the ETH price, some users may have decided to exit the Smart Yield to take profits and diversify (into the USDC Smart Yield, for example) and new users decide to diversify directly for the same reasons, which shows a different dynamic between our Smart Yield accounts this month.

In terms of performance, rates fell this month. Indeed, the rapid rise in the value of Ether (albeit in a bull market) is causing the value of the rewards tokens of the various pools to decrease relative to the value of Ether, thus inducing a natural decrease in yield rates.

Since its launch, the Smart Yield wallet on Ethereum has delivered an average yield of 12.07%. Smart Yield is therefore in an extremely competitive position in the market for Ether with significant yields.

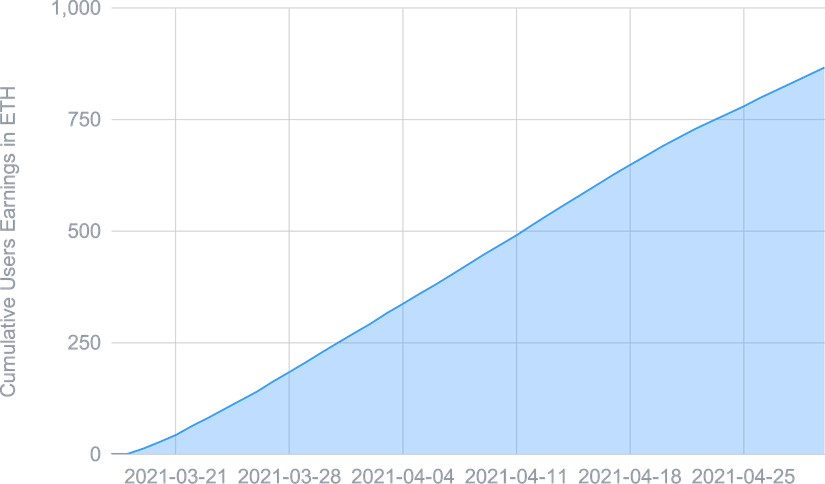

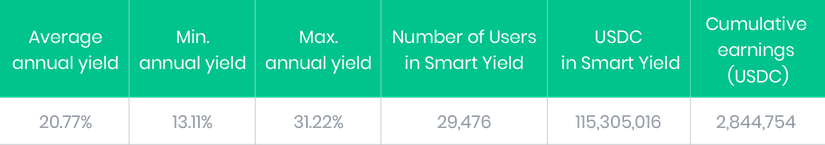

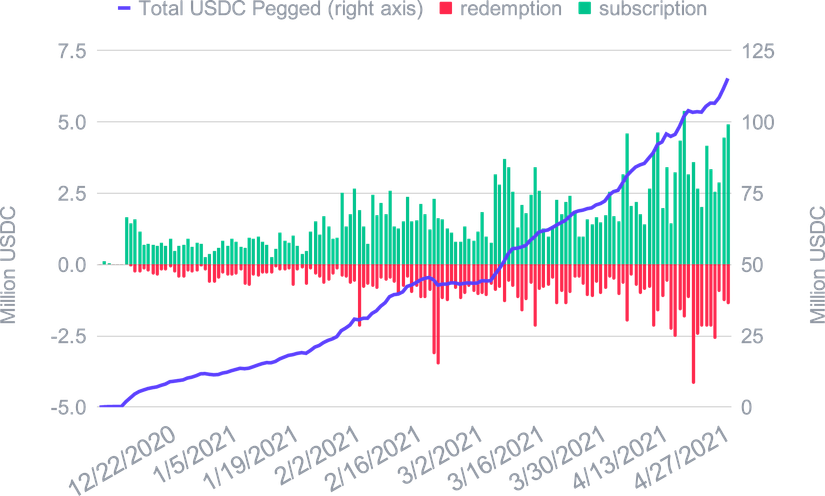

USDC Smart Yield

As mentioned above, the slowdown in Ether Smart Yield was compensated for by one of the most successful months for the USDC Smart Yield. The yield offered for USDC continues to average more than 20% p.a. for Premium users and this stability offers a unique opportunity to diversify in the medium and long term. Thus, a flow from the ETH Smart Yield and profits taken on gains generated at the beginning of the year were injected into the USD Smart Yield.

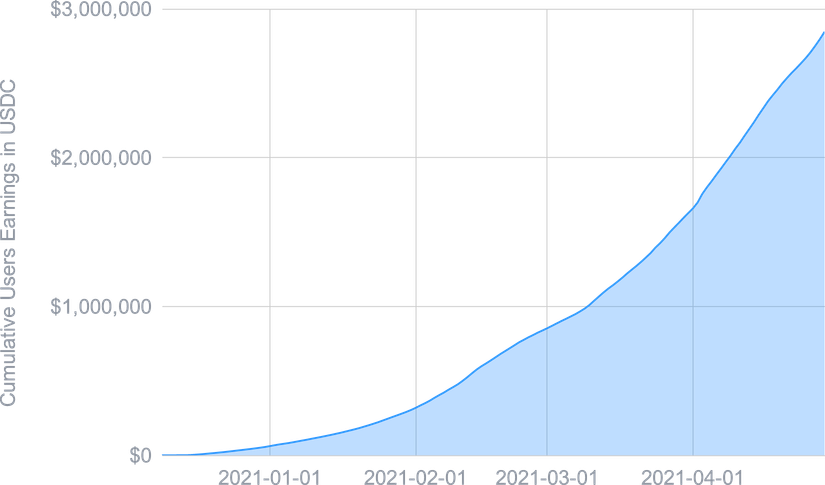

With almost six months of operation and an average of over 20%, the effect of compound interest is showing up more and more on the charts below. We remind you that these are composed on a daily basis.

Strategy Optimiser

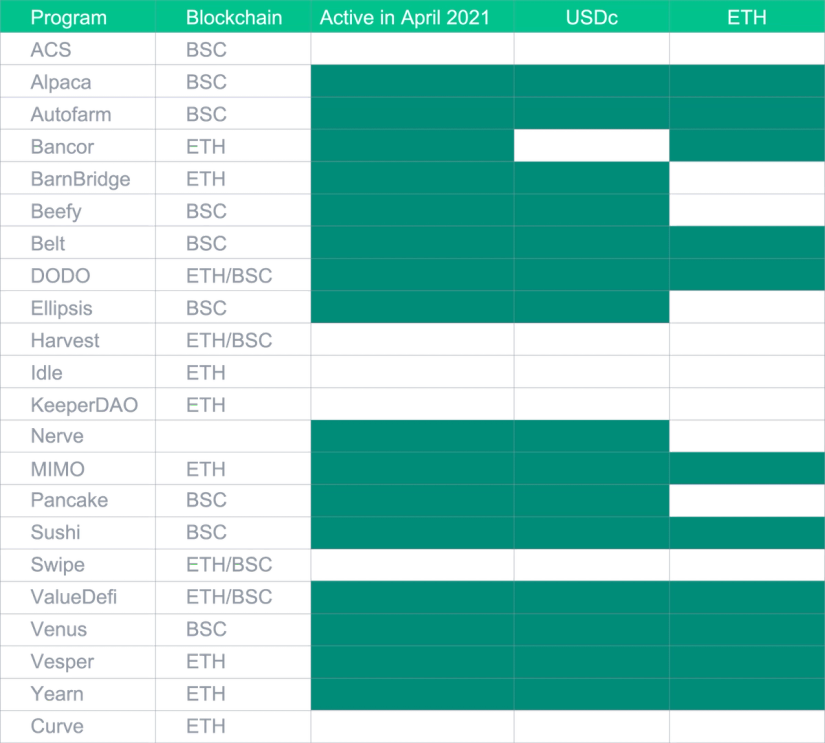

In order to obtain the best possible return for the optimal level of risk, the Smart Yield strategy involves diversifying into numerous DeFi and CeFi applications once they have been audited (Smart Contract and due diligence) in order to limit the risks.

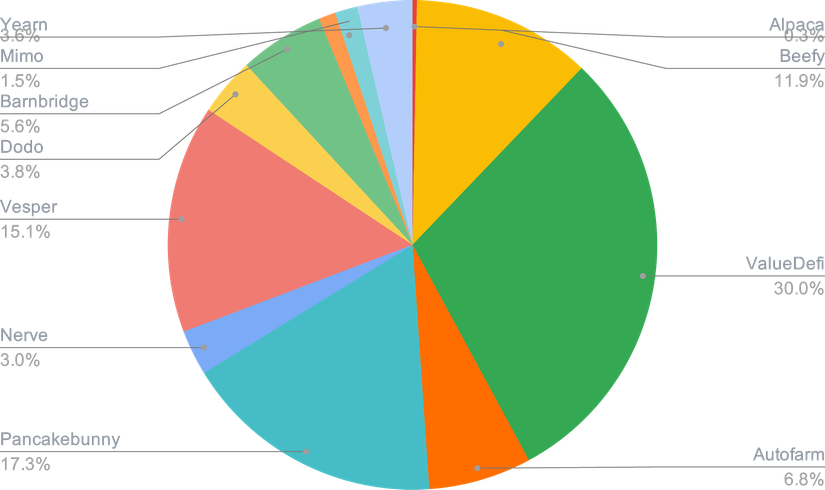

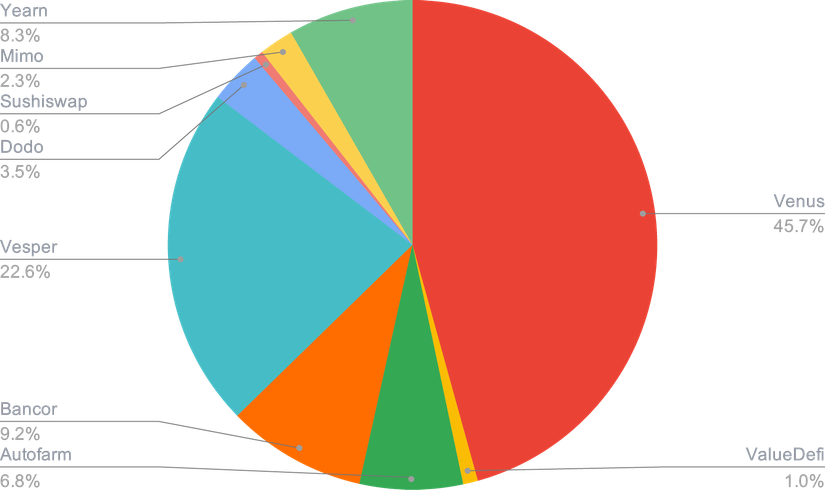

16 different applications were used in April for maximum diversification - nine for the ETH wallets and 12 for USDC. Eight applications were common to both.

Some of these applications are used for ETH and USDC and it's important to highlight the diversification (and thus the complexity) of the assets allocation. Indeed for USDC, only one project covers more than 30% of assets and five projects have an allocation of 5% or more, which allows for more effective risk hedging. For Ether, the largest proportion of the pool is injected into one of the least risky projects for the same purposes as mentioned above.

Safety Net

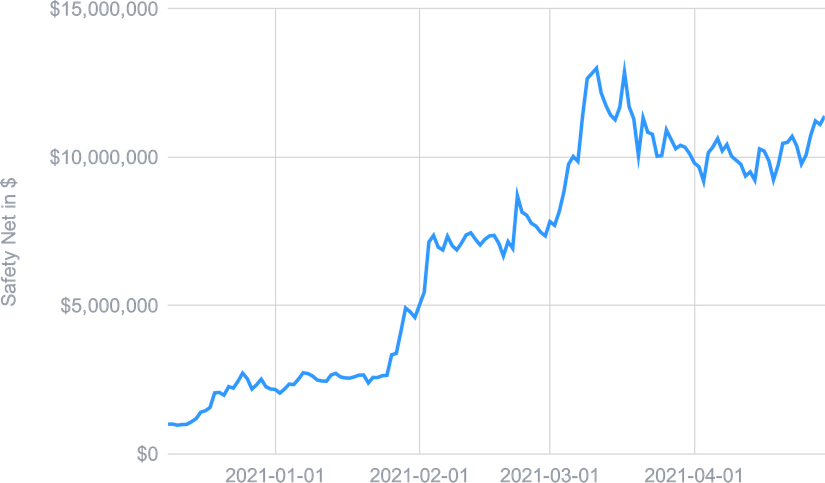

SwissBorg has also established a USD1 million Safety Net Program in CHSB (8,333,333 CHSB) to protect against Smart Contract risk, and we put the equivalent of 25% of max yield earnings into that program to ensure it grows alongside our community’s investments.

The Safety Net is a common pot for all Smart Yield wallets and therefore benefits from the yield of all wallets. Thus, with the arrival of Ether as well as the compound growth of USDC and a significant increase in the price of CHSB, the Safety Net is above USD11 million at the time of writing.

Disclaimer: The information contained in or provided from or through this article (the "Article") is for informational purposes only, and does not constitute financial advice, trading advice, or any other type of advice. Neither SwissBorg Solutions OÜ nor its affiliates (“Entities”), make any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of the Article, nor to it being free from error. The Entities reserve the right to change any information contained in this Article without restriction or notice. The Entities do not accept any liability (whether in contract, tort or otherwise howsoever and whether or not they have been negligent) for any loss or damage (including, without limitation, loss of profit), which may arise directly or indirectly from use of or reliance on such information and/or from the Article.

Make your crypto work for you with SwissBorg's Smart Yield wallets!