For the sake of transparency towards our community, on a monthly basis, we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report, updated monthly, will be subject to change based on your feedback and the evolution of the information we receive.

This third report presents the metrics for the USDC wallet as well as, for the first time, the Ethereum wallet, which was successfully launched in March.

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, as well as offering some of the best yielding conditions available in the market. Learn more about how Smart Yield works.

The DeFi landscape

March was a busy month for the DeFi community as the number of new project launches was particularly high. This was specifically true for the Binance Smart Chain with two forks (of Curve.fi - Ethereum Blockchain) which increased their total value locked (TVL) to over $1 billion within a few days.

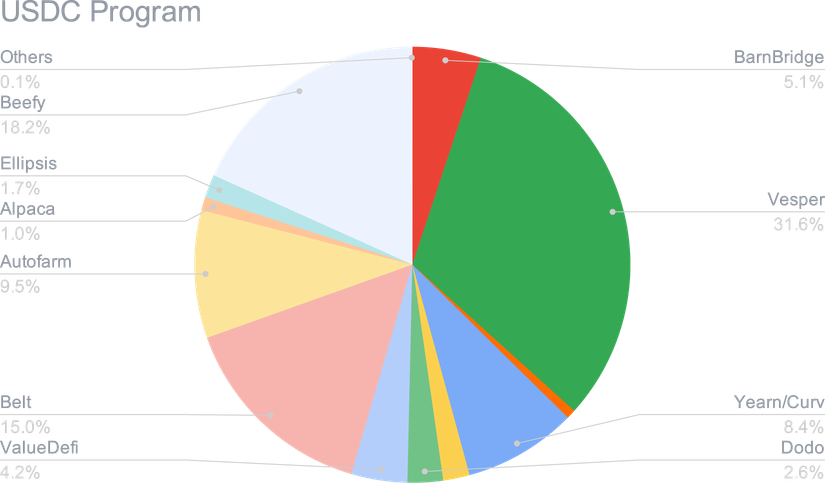

According to Defi Pulse, the total TVL of Ethereum DeFi has grown by 20% in March, reaching over $50 billion while the total TVL in Binance Smart Chain has reached $24 billion. Liquidity is still quick to chase the platforms that promise the highest yields, and this was exemplified with Belt losing a substantial portion of TVL upon the release of Ellipses.

As the Smart Yield program operates in the DeFi space, it is exposed to the risks associated with it, though this is largely mitigated by SwissBorg’s due diligence process (stay tuned for an upcoming article on our risk assessment framework). There has been a flash loan attack almost every month since last summer, which is why our investment framework analyses the probability of whether a platform will be victim to a flash loan attack. For instance, in March, DODO Exchange saw $3.8m drained from a few of its pools, with $1.8m returned afterwards. The risk assessment framework identified this risk and therefore didn’t use DODO Exchange as part of the Smart Yield program in March.

Throughout March, the rapid growth of the environment has helped our Smart Yield wallets deliver good returns while maintaining a good level of diversification. We have now reached over $230 million in the ETH and USDC Smart Yield wallets.

ETH Smart Yield

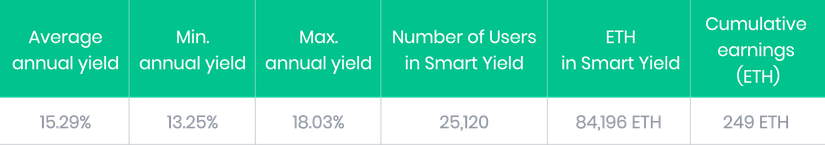

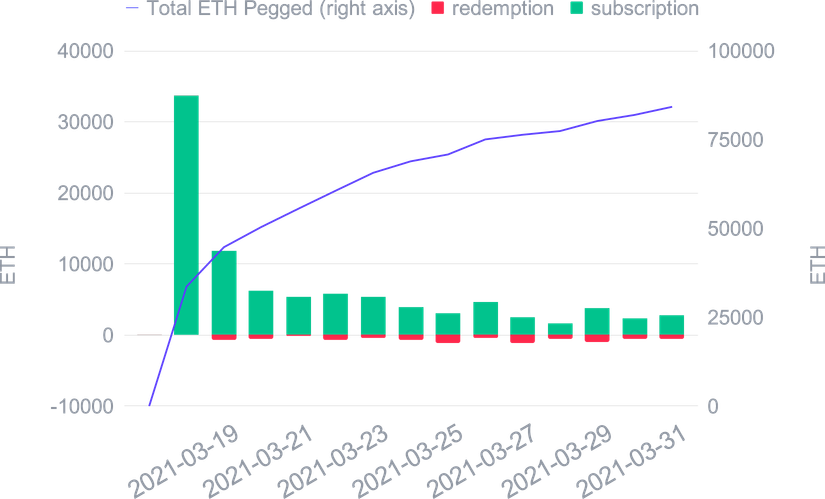

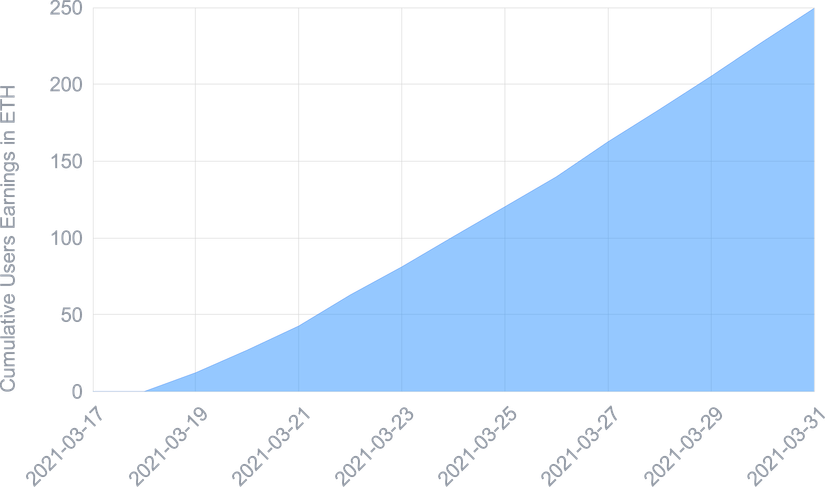

Our ETH Smart Yield wallet was met with record demand on its release, with over 50,000 ETH collected in just two days, and almost 85,000 ETH by the end of March.

With more than 25,000 users participating in the ETH Smart Yield, this wallet has become the most popular SwissBorg product in these bullish markets conditions, though the USDC wallet has continued to grow steadily. There are also more extreme numbers of ETH in individual Smart Yield wallets than in the USDC Smart Yield wallets, with nearly 300 users holding more than 50 ETH.

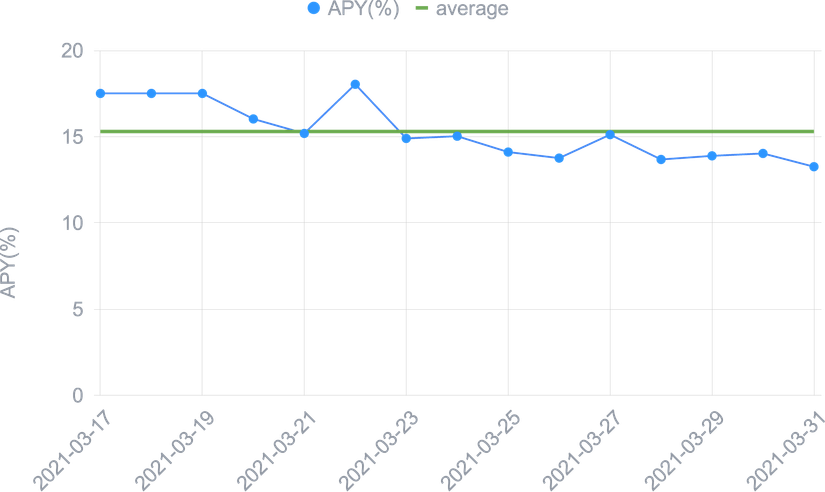

Since its launch, the Smart Yield wallet on Ethereum has delivered an average yield of 15.2%. Smart Yield is therefore in an extremely competitive position in the market for Ether with stable and significant yields.

USDC Smart Yield

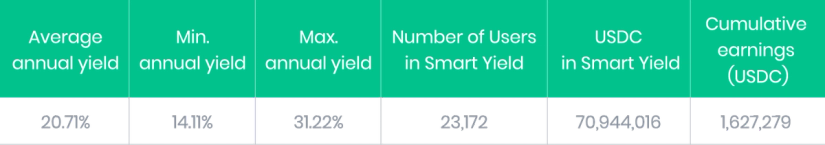

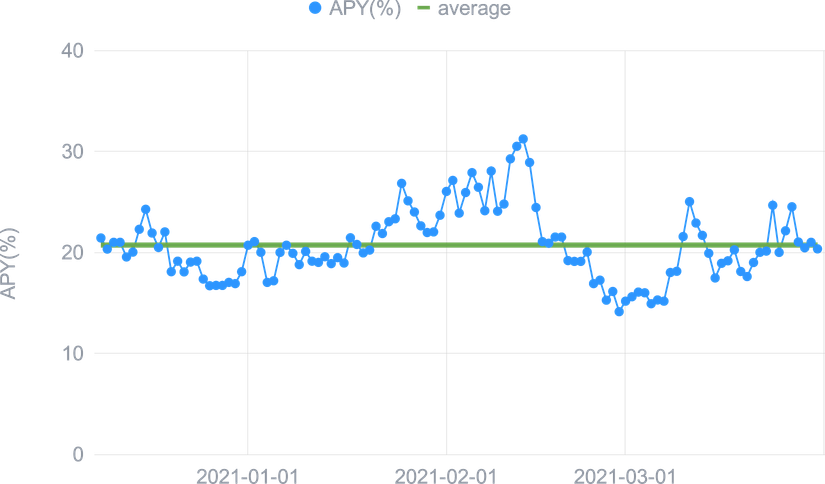

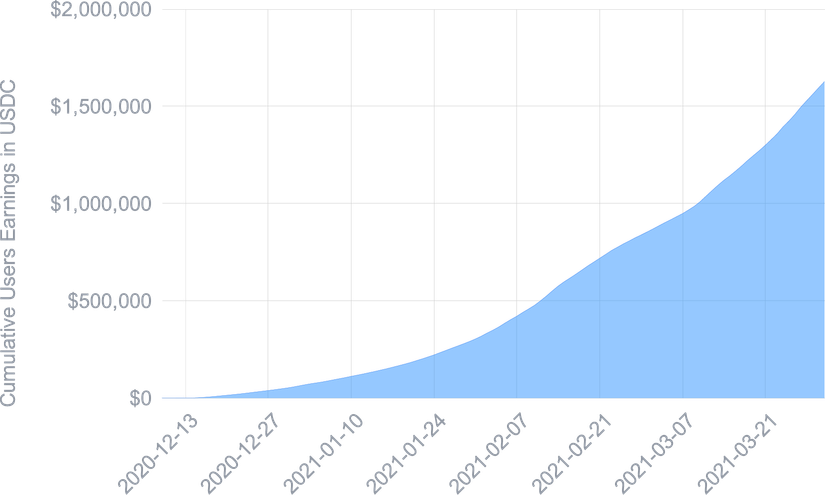

The yield offered for USDC continues to average more than 20% p.a. for Premium users. In the past three and a half months, users have gained more than 1.6 million USDC through their Smart Yield wallets.

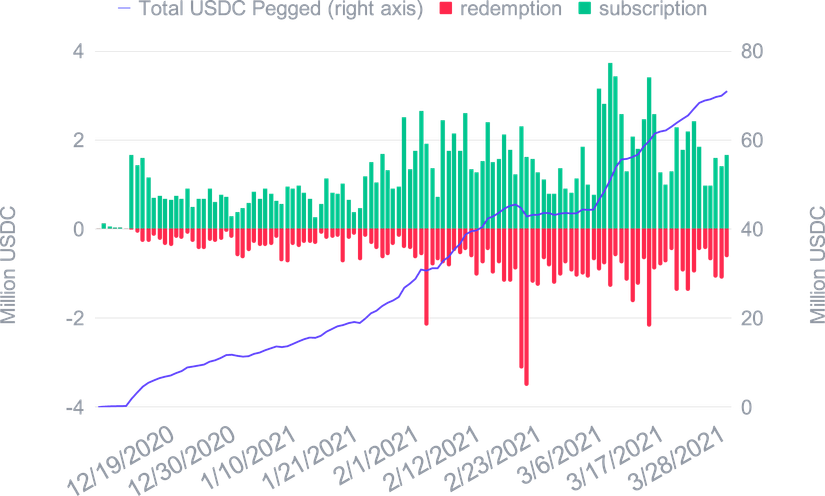

After a slowdown in growth at the end of February and a major redemption that was seen when Bitcoin had significant bullish momentum, the growth of USDC Smart Yield wallets has resumed. Indeed, since Bitcoin has stabilised and is struggling to break the $60,000 mark, users have diversified their portfolios with the Smart Yield on USDC, which allows positive performance with reduced volatility.

Today, more than 10,000 users benefit from both Smart Yield wallets at the same time to combine the volatility of Ethereum and the stability of USDC while earning a yield on both.

Strategy Optimiser

In order to obtain the best possible return for the optimal level of risk, the Smart Yield strategy involves diversifying into numerous DeFi and CeFi applications once they have been audited (Smart Contract and due diligence) in order to limit the risks.

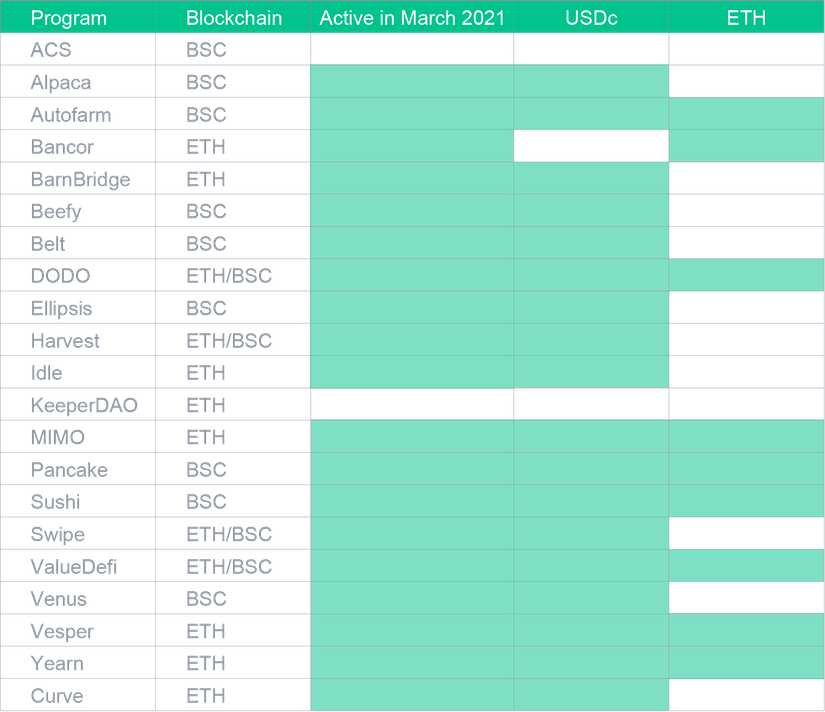

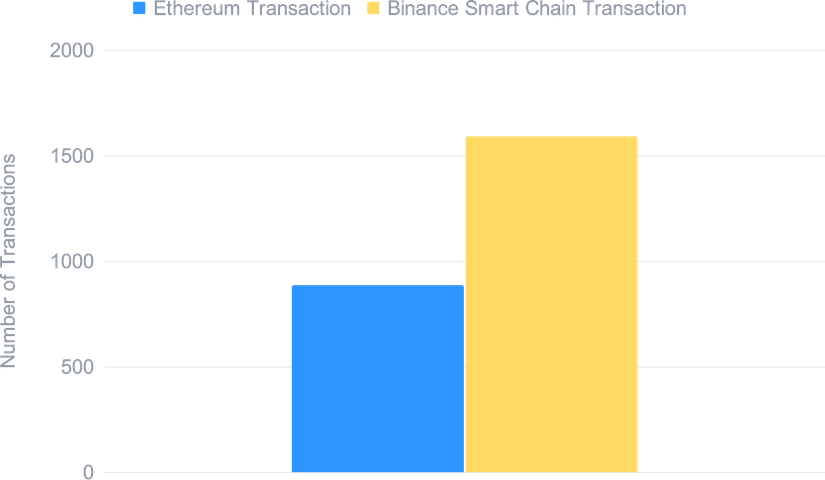

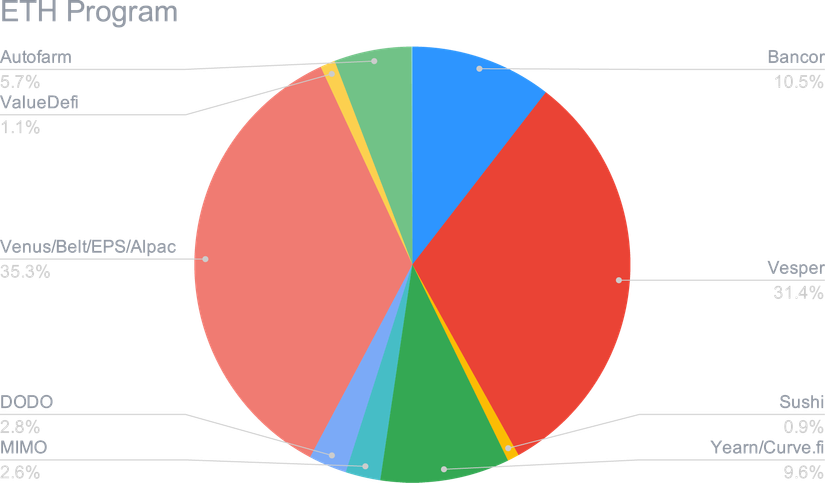

19 different applications were used in March for maximum diversification - nine for the ETH wallets and 18 for USDC. Eight applications were common to both.

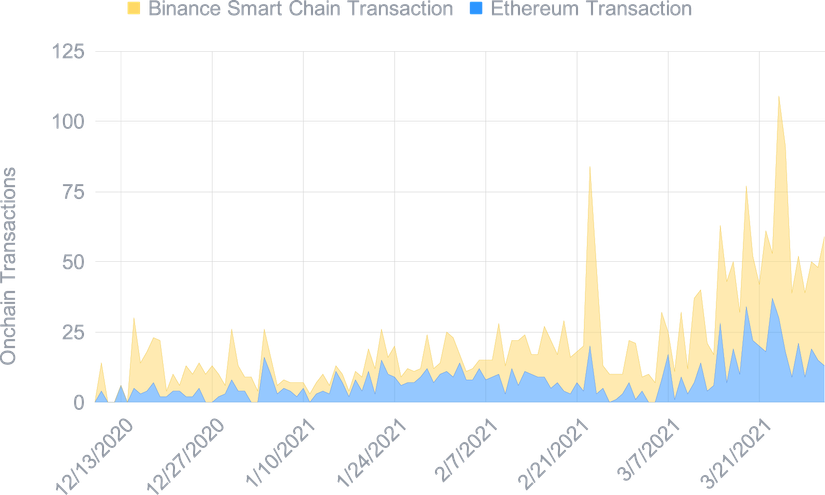

Thus, as shown below, the number of transactions have significantly increased with more than 1,200 transactions on the Binance Smart Chain and Ethereum blockchain. This is a 100% increase on the total number of transactions recorded since the Smart Yield wallets were launched.

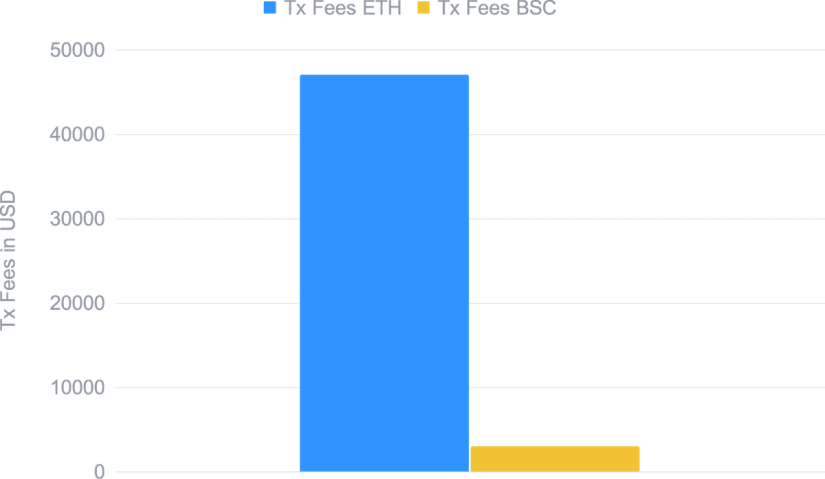

Since gas fees are much cheaper in BSC as opposed to ETH, this facilitates the creation of a more dynamic strategy that increases returns for the program (i.e more frequent harvesting). This is highlighted in the chart of the strategy optimiser transactions over time.

It is important to note here that these transactions are performed securely. Indeed, a double signature is required for all transactions.

It is not only in time saved, risk and complexity that the Smart Yield wallet is optimal. In terms of fee impact, gas fees have been over $50,000 since the beginning. It is therefore almost impossible to obtain the proposed yield at optimal risk without holding a significant amount of money to make these transactions.

Safety Net

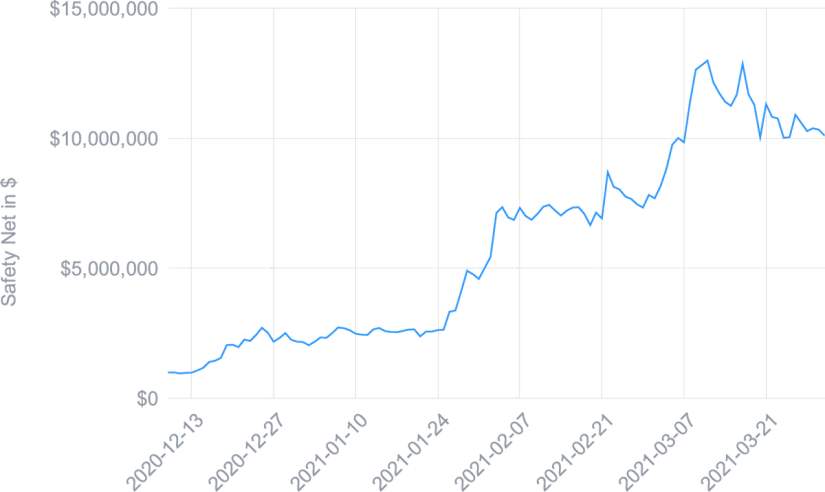

SwissBorg has also established a USD1 million Safety Net Program in CHSB (8,333,333 CHSB) to protect against Smart Contract risk, and we put the equivalent of 25% of max yield earnings into that program to ensure it grows alongside our community’s investments.

The Safety Net is a common pot for all Smart Yield wallets and therefore benefits from the yield of all wallets. Thus, with the arrival of Ether as well as the compound growth of USDC and a significant increase in the price of CHSB, the Safety Net is above $10 million at the time of writing.

Disclaimer: The information contained in or provided from or through this article (the "Article") is for informational purposes only, and does not constitute financial advice, trading advice, or any other type of advice. Neither SwissBorg Solutions OÜ nor its affiliates (“Entities”), make any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of the Article, nor to it being free from error. The Entities reserve the right to change any information contained in this Article without restriction or notice. The Entities do not accept any liability (whether in contract, tort or otherwise howsoever and whether or not they have been negligent) for any loss or damage (including, without limitation, loss of profit), which may arise directly or indirectly from use of or reliance on such information and/or from the Article.

Make your crypto work for you with SwissBorg's Smart Yield wallets!