For the sake of transparency towards our community, on a monthly basis, we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report, updated monthly, will be subject to change based on your feedback and the evolution of the information we receive.

For this second report, we will cover the month of February 2021.

Smart Yield wallets results covered in this report:

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, as well as offering some of the best yielding conditions available in the market. Learn more about the Smart Yield wallet.

USDC

Performance Overview

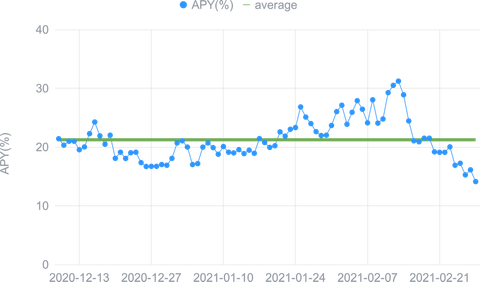

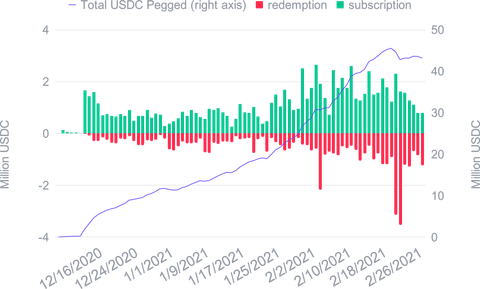

After more than two and a half months, the average proposed annual yield is still above 20% with a maximum yield of 31.22% reached in very good market conditions. Indeed, for more than one week, the yield proposed averaged more than 24%.

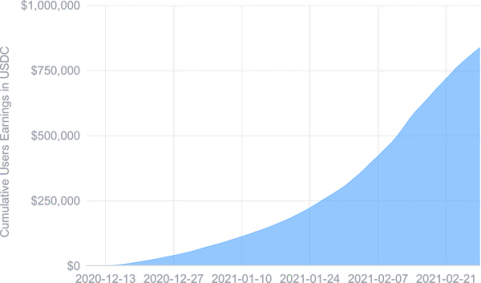

We noticed a growth of 60% in terms of the number of users using the Smart Yield wallet versus the previous month. Today, more than 16,000 users have benefited from Smart Yield for a total cumulative compounded return of more than $840,000.

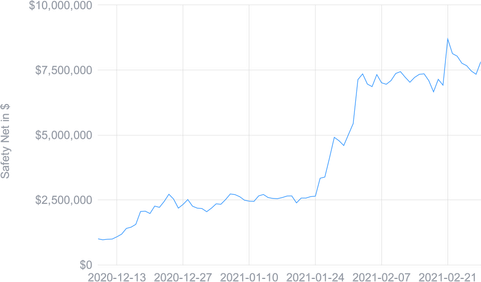

SwissBorg has also established a USD1 million Safety Net Program in CHSB (8,333,333 CHSB) to protect against Smart Contract risk, and we put the equivalent of 25% of max yield earnings into that program to ensure it grows alongside our community’s investments.This fraction of yield earnings has represented an additional contribution to the Safety Net Program of more than $230,000 in USDC since the beginning of the program.

In February, these funds helped to protect from a loss in a small allocation (explained in more detail below). Today, despite this, the Safety Net Program has increased by more than 35% to approach $8M.

Strategy Optimiser

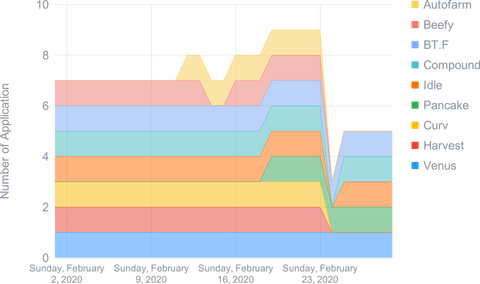

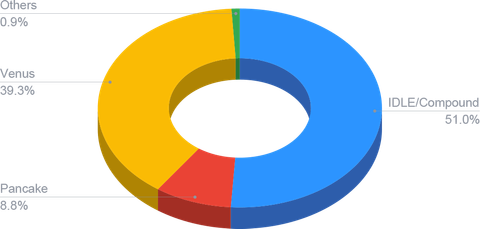

In order to obtain the best possible return for the optimal level of risk, the optimisation of the yielding strategy consists of diversifying into numerous DeFi and CeFi applications once they have been audited (Smart Contract and due diligence) in order to limit the risks.

Nine different applications were used over February with a maximum diversification. One of the applications used in January was replaced by a new one for optimisation and risk management purposes.

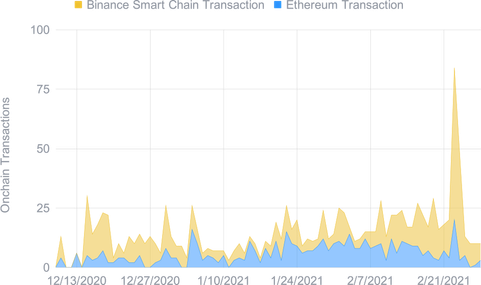

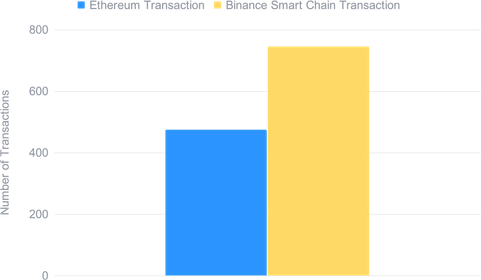

In total, more than 1,220 transactions have been performed since the launch of the Smart Yield wallet. This number is double the previous month, with more than 60% of these transactions on the Binance Smart Chain.

Since gas fees are much cheaper in BSC as opposed to ETH, this facilitates the creation of a more dynamic strategy that increases return for the program (i.e more frequent harvesting). This is highlighted in the chart of the strategy optimiser transactions over time.

It is important to note here that these transactions are performed securely. Indeed, a double signature is required for all transactions.

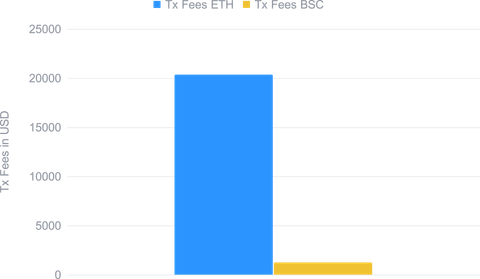

These transactions had a cost of more than $20,000 in transaction fees. Even though the number of transactions were made in majority on the BSC, the costs on these blockchain are stable while the costs on Ethereum increased by almost 100% due to the significant increase of gas fees.

Safety Net Triggered

February was a period of both highs and lows. The Smart Yield wallet broke its all time high to achieve a maximum yield of 31.22%, but also hit a low of 14.11%.

The investment allocation changed frequently over the course of the month, with yield variability across platforms and the volatility of the rewards driving our optimiser to rebalance multiple times. The Smart Yield program is currently concentrated in platforms with little exposure to DAI, since the volatility of the ETH token has led to risk management concern with regards to the DAI systematic risk.

The Safety Net Program was triggered on February 9th following the economical attack of BT.Finance. Thanks to adequate risk management, the Smart Yield had very little exposure to the BT.Finance protocol, so the risk was fully covered by the Safety Net Program at a cost of $86,592.95. Due to the performance of the CHSB token throughout the month, alongside the increased use of the Smart Yield wallet, the Safety Net Program still experienced net growth of $2,813,000, and had a value of $7,820,687 at the end of the month.

Disclaimer: The information contained in or provided from or through this article (the "Article") is for informational purposes only, and does not constitute financial advice, trading advice, or any other type of advice. Neither SwissBorg Solutions OÜ nor its affiliates (“Entities”), make any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of the Article, nor to it being free from error. The Entities reserve the right to change any information contained in this Article without restriction or notice. The Entities do not accept any liability (whether in contract, tort or otherwise howsoever and whether or not they have been negligent) for any loss or damage (including, without limitation, loss of profit), which may arise directly or indirectly from use of or reliance on such information and/or from the Article.