Liquid Staking on Stader

Key Takeaways:

- Liquid staking represents one of the safest options in DeFi to generate yield.

- Stader is considered a secure and trustable liquid staking protocol.

- The yield (APY) is derived from staking NEAR tokens – contributing to the Proof-of-Stake consensus mechanism.

- NEAR protocol is a decentralised cloud-based software application platform designed to make apps similar to those used on today’s internet. The network runs on a proof-of-stake (PoS) consensus mechanism called Nightshade. Its mainnet went live in April 2020, and network validators voted to unlock token transfers in October 2020.

- NEAR liquid staking represents a mid term liquidity yield-generating investment. A lockup period of 60 days applies to this yield strategy and funds can be redeemed only at the end of this period.

- Risk Checklist In our view the predominant risks for this strategy are as follows:

- Counterparty risk

- Sustainability risk

- Liquidity risk of staking

1. Strategy Explained

The strategy involves liquid staking NEAR tokens in Stader.

Pre-Subscription Period: 2 days

Lockup period: 60 days

2. Strategy Risks

Trust Score

Stader is the liquid staking protocol employed by the strategy.

Stader Labs is a non-custodial innovative contract-based staking platform that helps users conveniently discover and access staking solutions.

The protocol went live in December 2021 and displays a TVL of around $150m.

In August 2022 the protocol was exploited. However, this didn’t affect users who staked $NEAR on Stader’s Decentralized Application (dApp).

SwissBorg trust score for Stader is ‘green’, i.e. the protocol is trustable. The score value is 70% signaling that the protocol is reliable.

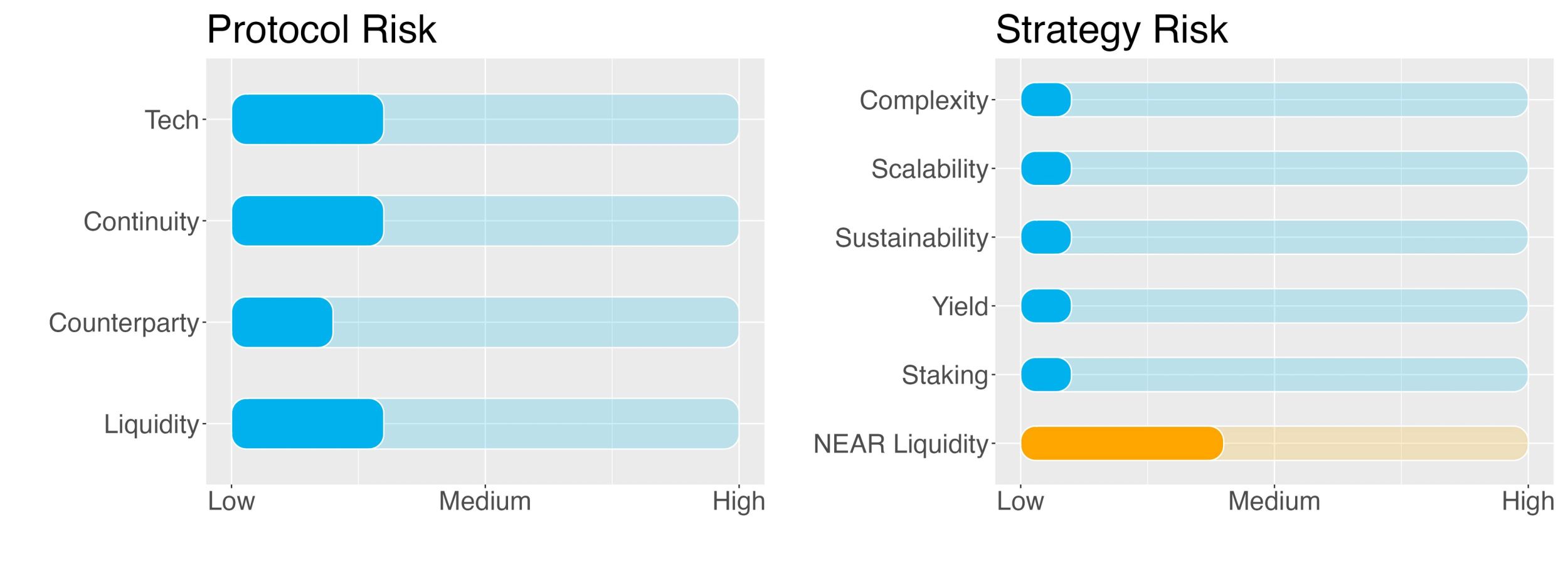

Protocol Risks

Project Continuity Risk

Project continuity risk is low.

Stader displays a TVL $150m. This puts it in the top 10 staking protocols. The difference with the largest staking protocol, Lido, is however abysmal with Lido having over $9b locked in.

To assess the sentiment around Stader we look at its token price and volatility, as well as at the Google Trend for the last 30 and 90 days. Overall sentiment is medium.

Stader continuity risk is set to 3/10.

Counterparty Risk

Counterparty risk is deemed low.

Counterparty risk exists whenever an asset is handed over to an external provider. Any credit events involving the staking provider could affect the assets that have been entrusted to them.

That said, staking via a 3rd party is fundamentally different from depositing funds into a lending protocol that later becomes insolvent.

We seek to select only trustable staking providers in order to minimise counterparty risk.

Stader places utmost importance to ensure users' funds are staked with the best-in-class validators in the ecosystem. In order to be considered for Stader pools, validators need to meet threshold performance criteria (e.g. on up-time).

Each pool has a unique characteristic based on which validators are selected for that particular pool. In the long run Stader would select the validators programmatically and rebalance delegations based on performance filters. Additionally, as the Stader platform is decentralized, governance will determine validator selection criteria, policies, and so on.

Last, a Slashing Insurance will be provided by validators via the Stader tokens staked.

Counterparty risk is 2/10.

Liquidity Risk

Liquidity risk is deemed low.

Funds held by the staking provider are redeemable after the lockup period of 60 days.

Liquidity risk is 3/10.

Strategy Risks

Complexity

Complexity of the strategy is low.

The strategy involves depositing NEAR on Stader to perform staking. One chain (NEAR), 1 token and one protocol is employed with no leverage.

The complexity risk of the strategy is 1/10.

Scalability

The scalability risk is low.

Staking is a highly scalable practice. Indeed, the more stakers are participating, the higher the safety of the blockchain.

The scalability risk of the strategy is 1/10.

Sustainability

The sustainability risk is low.

The yield obtained from this strategy is fully sustainable as it comes from participating in the validation of NEAR transactions, the Proof-of-Stake mechanism.

Proof-of-Stake is quite energy efficient when compared to Proof-of-Work chains like Bitcoin and has therefore practically no negative impact on the environment.

The sustainability risk of the strategy is 1/10.

Yield Risk

Yield risk of strategy is low.

Staking provides a constant stream of income with low variability.

The yield risk of the strategy is 1/10.

Slashing Risk

The slashing risk of the strategy is low.

The Proof of Stake consensus mechanism requires participants to behave responsibly for the overall good of the ecosystem. For this reason, blockchains penalise validators if they step out of line by slashing the value of their stake. The two most common offenses are double-signing or going offline when the validator should be available to confirm a new block.

Slashing is currently not enabled on the NEAR blockchain but is planned to be implemented in the future. Validators do not get slashed for being offline, however their rewards will be adjusted by the % of their online participation, for example a validator with 95% uptime will only receive approximately half of the epoch rewards that they could earn. If a validator misses out on too many blocks, they will be removed from the active set in the next epoch, missing out on rewards for at least two epochs.

The slashing risk of the strategy is 1/10.

Liquidity Risk of Staking

Liquidity Risk on staking NEAR is medium.

Liquid staking on Stader requires the investor to lock-up their NEAR tokens for a period of 60 days. Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

The liquidity risk is therefore set to 4/10.

3. Conclusions

NEAR staking comes with little risk.

Liquid staking per se is generally considered a very safe investment. Stader, the chosen liquid staking protocol, has been reviewed and approved by the SwissBorg tech team.

NEAR staking comes with a 60-day lock-up period. This means that redemptions are possible only at the end of the period. Liquidity is therefore not always available.

The SwissBorg Risk Team ranks NEAR staking as a Low risk investment, one for an investor with some understanding of DeFi and yielding, who is willing to take on a minimum amount of risk – while remembering that there is no free lunch! – in exchange for an acceptable reward on NEAR.

Try the SwissBorg Earn today!