Junior Tranche staking in Idle

Key Takeaways:

- This strategy fits the profile of an investor who is willing to take on a little of risk in exchange for a greater reward.

- The strategy invests MATIC into the Idle Finance vault Junior tranche. This is equivalent to staking MATIC in Lido except the Junior tranche holders will provide protection to Senior tranches in case of slashing or key management related losses.

- The strategy is basically equivalent to staking MATIC on Lido. Idle Finance builds on the top of Lido staking by matching more and less risk averse investors, and rewarding them accordingly.

- The Yield (APY) is composed of

- Staking reward for securing the Polygon network

- Premium for securing the first losses of Senior tranche holders

- Additional Lido incentives - A material proportion of the APY comes in the form of Lido and Idle incentives. Because of this the sustainability of the offered APY could not be guaranteed in the long term. Additionally an increase in vault TVL could result in a dilution of the offered APY which would not be lower than that offered by Lido itself for staking MATIC (sustainability risk).

- By entering the Junior tranche the investor is bearing the losses first in order to protect the Senior tranches. The impact of this would however be minimal given that only a small proportion of the vault TVL is in the Senior tranche (Junior tranche risk).

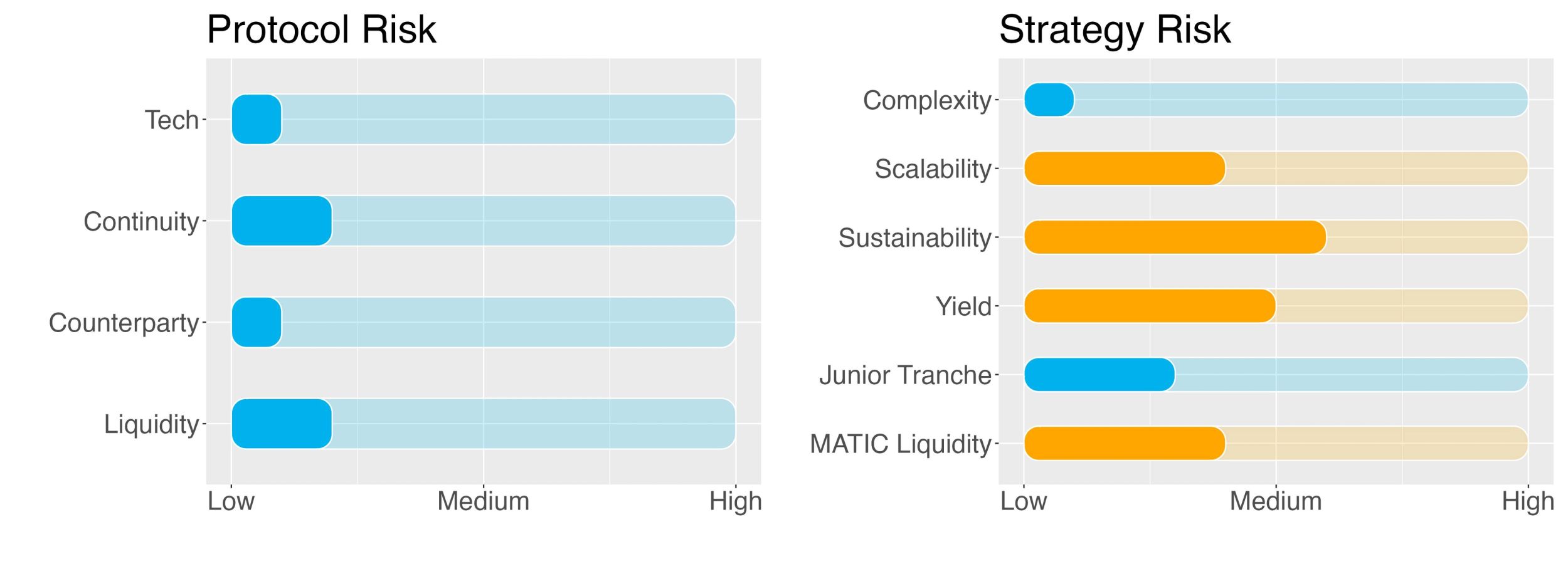

- Risk Checklist: in our view the predominant risks for this strategy are

- Sustainability risk

- Yield risk

- Risks of holding a Junior tranche

1. Strategy Explained

The strategy is fairly simple: deposit MATIC into the Idle Finance ‘Lido MATIC’ junior tranche and collect the staking and Lido boosted APY.

On Idle Finance the yield source can be chosen in accordance with two risk-adjusted investment profiles. These are called ‘tranches’ and are respectively, Senior and Junior.

Tranches allow users to enjoy DeFi yields with built-in protection on deposits by holding the Senior class, and leveraged yield with the Junior one.

In practice, following a credit event (in the list of ensured events by Junior):

- Losses are first borne by Junior Tranche holders

- then by Senior Tranche holders

Junior tranche is designed to receive a higher share of yield compared to the Senior class, which will proportionally compensate their Junior counterparts for taking higher risks.

2. Strategy Risks

Trust Score

Lido is a liquid staking solution for Ethereum. It allows users to deposit their tokens and take part in the Proof-of-Stake consensus mechanism via delegated staking. Currently, Lido supports the liquid staking of ETH, SOL, MATIC, DOT and KSM. In exchange for the provided tokens, the users receive a staked version, e.g. stMATIC for MATIC. These can be used to earn an additional yield in the DeFi universe. Lido launched its staking app on December 19, 2020 with 1 billion LDO tokens created at genesis.

SwissBorg trust score for Lido is ‘green’, i.e. the protocol is trustable. The score value is 8/10 signalling that Lido is one of the safest options out there.

Idle Finance is a decentralised protocol and set of products that aims to unlock the power of decentralised finance as a one-stop source of yield. It allows users to algorithmically optimise their digital asset allocation across leading DeFi protocols, whether they want to maximise it or keep tabs on their risk/return profile.

In a nutshell, what Idle does is to help risk averse investors to hedge part of their risks in exchange for a lower APY (Senior tranche). In exchange for the additional risk, Junior tranche investors are rewarded with a higher APY.

So far the protocol was not subject to any exploit or hack.

Idle Finance went live in August 2019 and displays a TVL of $70m, almost entirely on the Ethereum blockchain (the other network available being Polygon).

SwissBorg trust score for Idle Finance is ‘green’, i.e. the protocol is trustable. The score value is 9/10 signalling that Idle is one of the safest options out there.

Protocol Risks

Project Continuity Risk

Project continuity risk is medium to low.

Idle Finance displays a TVL of around $70m,. This puts it in sixth place in the ‘yield aggregator‘ category in terms of TVL. The difference with the top 2 protocols (Yearn and Beefy is striking ($439m and $285m TVL, respectively).

In addition, Idle TVL is dwarfed by that of the top DeFi protocols such as AAVE ($4.6b TVL) or Curve ($4.7b).

In terms of valuation the token market capitalization to its TVL is only 0.03. IDLE token’s market capitalization is indeed only $1.4m. A value below 1 means the protocol could be seen as undervalued. Compared to its peers, this figure is well below the median of the yield aggregators which is 0.45.

To assess the sentiment around Idle Finance we look at its token price and volatility, as well as at the Google Trend for the last 30 and 90 days. Overall sentiment is medium.

Idle Finance continuity risk is 4/10.

Lido is the leading protocol for liquid staking, displaying a staggering TVL of $8,1b (and a ATH of over $20b). In terms of valuation the token market capitalization to its TVL is close to 0, in front of a median for the category of 0.16. Overall sentiment is medium.

Lido continuity risk is 2/10.

Counterparty Risk

Counterparty risk is deemed low.

Idle Finance is a yield aggregator, that is, it provides strategies which help aggregate yield from diverse protocols. Because of this, the protocol has no counterparty risk, except for the tech risk assessed above. There are no borrowing/lending facilities or liquidity provisioning. Counterparty risk could be found in the protocols employed by the MATIC staking strategy, i.e. Lido.

Lido connects users wanting to stake MATIC with node validators requiring MATIC to perform the Proof-of-Stake mechanism. The process is regulated by a smart contract so there is no real counterparty credit risk on the Lido side. For the risk of slashing please refer to the relevant section below.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

The strategy can be exited at any time from Idle with no liquidity risk.

Notice however that a lockup period applies to this strategy.

Liquidity risk is 2/10.

Strategy Risks

Complexity

Complexity of strategy is low.

The strategy is basically equivalent to staking MATIC on Lido. Idle Finance builds on the top of Lido by matching more and less risk averse investors.

Complexity of the strategy is 1/10.

Scalability

Scalability risk of strategy is low.

The strategy will be capped at 1 million MATIC. Idle vault displays a TVL of $3m between Senior and Junior tranches so there exists the risk of diluting the APY.

Idle incentives however would initially compensate for this.

Scalability risk of the strategy is 4/10.

Sustainability

Sustainability risk of strategy is medium.

There are three sources for the APY. First, from staking MATIC in Lido. Basis APY for the service is around 6.3%. Second, the additional APY for entering the Junior tranche and finally some Lido and Idle boosted rewards. At the time of writing the Junior tranche APY comes half from MATIC staking and half as in Lido/Idle rewards.

Because of these incentives the sustainability of the offered APY could not be guaranteed in the long term. Additionally, since some incentives are fixed, an increase in vault TVL would also be reflected in the decrease of such incentives and in a dilution of final APY.

Sustainability risk of the strategy is 6/10.

Yield Risk

Yield risk of strategy is low.

The yield on the strategy comes staking MATIC and is therefore expected to remain relatively stable over time. However, since a material portion of the APY comes in form of Lido and Idle rewards, as mentioned earlier, two events could affect it negatively:

- TLV increase and dilution of rewards

- Changes in the Senior/Junior ratio. The higher the proportion of Junior over Senior, the lower will be the APY (e.g. with no Senior liquidity, Junior tranches would not take any loss ‘first’ but just the loss that a MATIC staker in Lido would take).

Since inception the APY of this strategy has been constantly decreasing. This decrease was mostly due to the increased TVL of the pools. While this trend has somewhat shown signs of stabilisation, we remain conservative and assign it a medium risk rating.

Yield risk of the strategy is 5/10.

Junior Tranche Risks

Within the Idle MATIC vault, the Earn strategy allocates funds into the Junior tranche. This means that the first losses in case of adverse events will be borne by this tranche.

Two events in particular are ‘insured’ by the Junior tranche:

- Validator key management: Loss of multisig keys holding staked MATIC. This could result in a partial loss of funds.

- Slashing: Staking penalties for validators' network. This could also result in a partial loss of funds.

- Depeg events: stMATIC vs MATIC loss of peg is NOT COVERED.

So if any of these two events were to happen, the losses would first be absorbed by Junior tranche holders. The risk/return trade-off is here perfectly reflected. The larger the coverage of Junior tranche (i.e. assets deposited into Junior compared to Senior), the lower the APY differential between tranches, but also the lower the risk for a single Junior tranche investor in case of loss since a large pool would better absorb it. On the other hand, small coverage would imply very high APY with Junior tranche holders, but also the risk that a loss wipes out the entire pool (and eventually attacks also the Senior tranche holders).

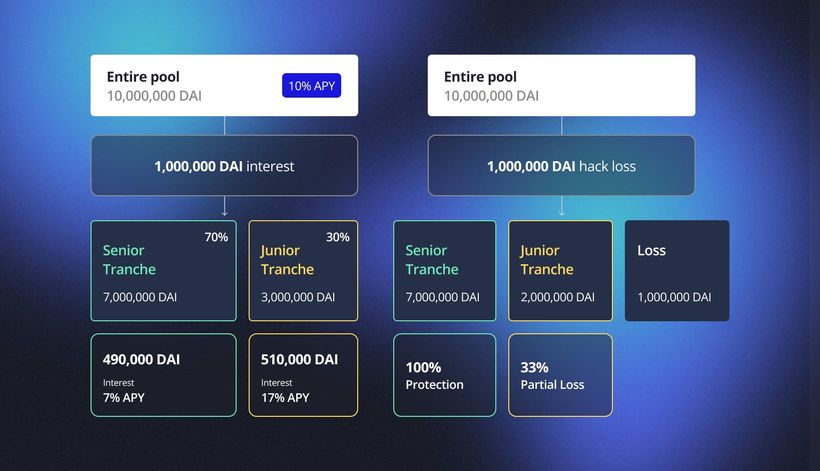

The figure below shows how this works in terms of APY (left) and loss case (right).

Yield Case

A pool of 10m DAI is assumed yielding in aggregate a 10% APY. 3m DAI are allocated in the Junior tranche, the remaining 7m DAI in the Senior. Resulting APY are 17% for the Junior tranche and 7% for the Senior one.

Loss Case

A 1m DAI loss due to a hack is experienced. This is first absorbed by the Junior tranche, which loses 33% of its deposited DAI (1m over 3m). The Senior tranche, on the other hand, experiences no loss.

Investors must clearly understand the consequences of entering into a Junior tranche. The current pool coverage (assets in Junior to assets in Senior) is 9.1, that is, most of MATIC are deposited in the Junior tranche and the difference in risk profile when comparing to a simple Lido staking is minimal. This is why in the event of a loss the Junior tranche holders would be left to bear their own losses (that would happen with direct Lido staking) plus the loss on the additional 10% MATIC invested in the Senior tranche.

Given that the Junior tranche APY is more than triple than that of the pure Lido staking, we think taking such risk is justifiable.

Indeed, both slashing and key management events are deemed unlikely given that:

- Lido protocol underwent and passed our due diligence

- Lido minimises the risk of slashing by staking across multiple professional and reputable node operators with heterogeneous setups, with additional mitigation in the form of insurance that is paid from Lido fees.

The risk associated with entering a Junior tranche is set to 3/10.

Liquidity Risks of staking

Liquidity Risk on staking MATIC is medium.

Liquid staking on Beefy plus Balancer LPing requires the investor to lock-up their MATIC tokens for a period of 30 days. Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

Liquidity risk is therefore set to 4/10.

3. Conclusions/Recommendations

Idle is a decentralised protocol and suite of products aimed at leveraging the power of decentralised finance as a one-stop source of yield. It enables users to optimise their digital asset allocation across leading DeFi protocols algorithmically, whether they want to maximise it or keep track of their risk/return profile.

In terms of the user process, it’s good and smooth, with a helpful interface and a simple enough process to understand, and this removal of confusion is key in our book. When it comes to the ‘real’ APY, the yield currently provided to users comes from staking MATIC, providing protection to Senior tranche holders, as well as from protocol incentives.

The Idle strategy in MATIC comes with some risks. The investment strategy is fairly simple but yet it requires some understanding of how DeFi operates, and to acknowledge the different tranches system. Rewards are paid out at the end of the lockup period.

The SwissBorg Risk Team ranks MATIC on Idle as a Satellite investment, one for an investor with some understanding of DeFi and yielding, who is willing to take on a little bit of risk in exchange for an interesting reward on MATIC.

Try the SwissBorg Earn today!