Key Takeaways:

- Liquid staking represents one of the safest options in DeFi to generate yield. The yield is further improved by farming the liquid staking tokens. Obviously, this additional yield comes with some additional risk.

- Stader is considered a secure and trustable liquid staking protocol. Wombat has successfully passed SwissBorg tech due diligence.

- The yield (APY) is derived from BNB staking – contributing to the Proof-of-Stake consensus mechanism plus the farming of liquid staking tokens by depositing them in a BNB liquidity pool.

- Launched on 01 September 2020, the Binance Smart Chain (BSC) attempted to be a solution to the network congestion issues and high fees that plagued the Ethereum blockchain. BSC can handle smart contracts and be used to build dApps (decentralized applications) and enjoy really fast speeds and low transaction fees while being programmable. BSC transactions are validated using the Proof-of-Stake consensus algorithm via BNB staking.

- BNB liquid staking represents a mid term liquidity yield-generating investment. A lockup period of 90 days applies to this yield strategy and funds can be redeemed only at the end of this period.

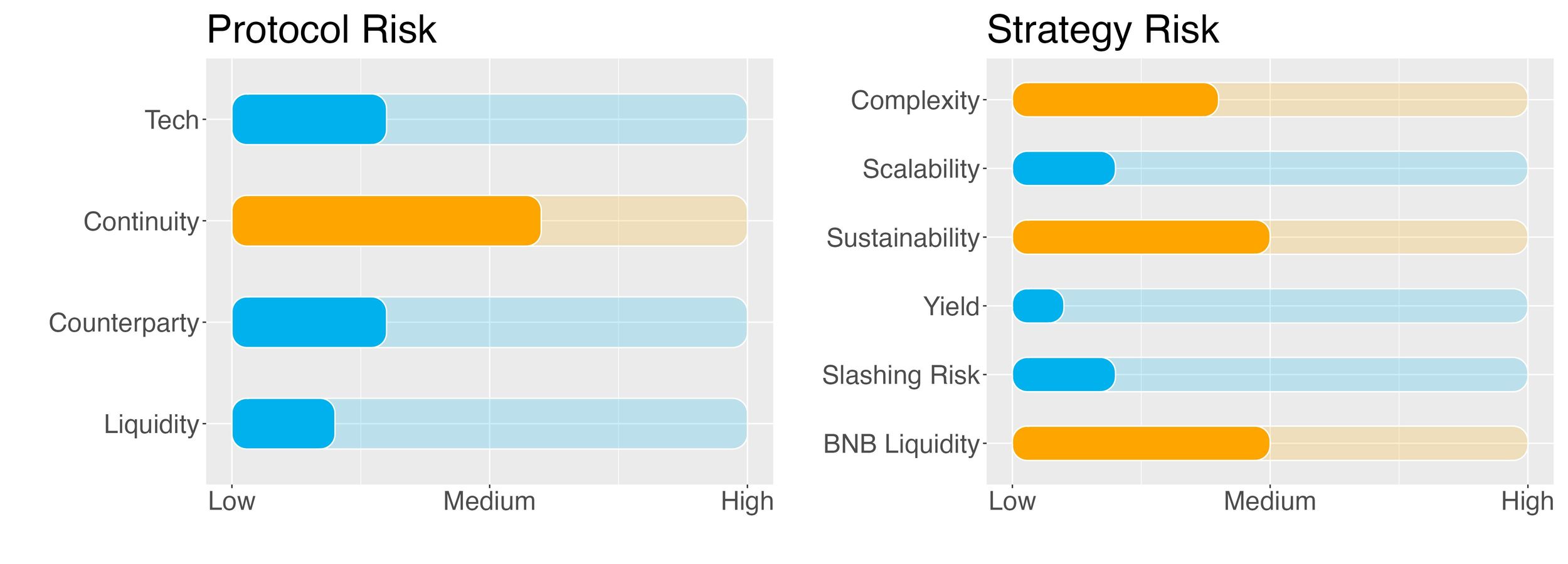

- Risk Checklist

In our view the predominant risks for this strategy are as follows:

- Counterparty risk

- Sustainability risk

- Liquidity risk of staking

1. Strategy Explained

The strategy involves liquid staking BNB tokens in Stader and uses the obtained staking tokens to provide liquidity in the BNBx pool in Wombat.

Pre-Subscription Period: 7 days

Lockup period: 90 days (7-15 days cooldown packed in)

2. Strategy Risks

Trust Score

Two protocols are involved in this strategy:

- Stader, the liquid staking protocol

- Wombat, the farming protocol

Stader Labs is a non-custodial innovative contract-based staking platform that helps users conveniently discover and access staking solutions.

The protocol went live in December 2021 and displays a TVL of around $160m.

Wombat Exchange is a multi-chain stableswap built natively on the BNB Chain. Wombat adopts the concepts of asset-liability management and coverage ratio, enabling various stablecoins to be swapped at minimal slippage and the ability to single-stake stablecoins for sustainable yield.

The protocol went live in September 2022 and displays a TVL of $146m.

SwissBorg trust score for Stader is ‘green’, i.e. the protocol is trustable. The score value is 70% signaling that the protocol is reliable.

Trust score for Wombat is 75%, that is, the protocol is trustable.

Protocol Risks

Project Continuity Risk

Project continuity risk is medium.

Stader

Stader displays a TVL $165m. This puts it in the top 10 staking protocols. The difference with the largest staking protocol, Lido, is however abysmal with Lido having over $8b locked in.

To assess the sentiment around Stader we look at its token price and volatility, as well as at the Google Trend for the last 30 and 90 days. Overall sentiment is medium.

Stader continuity risk is set to 3/10.

Wombat

Wombat’s TVL is around $90m against UniSwap’s $3.8b. Its market share in terms of trading volume is 0.2% compare to UniSwap’s 35%.

Wombat is ranked just outside the top 20 DEXes for volumes and TVL.

Its volume to TVL ratio is 0.15 vs. UniSwap’s 0.29, ranking it in the top 30%.

Within the Binance Smart Chain ecosystem Wombat is ranked fourth behind PancakeSwap, BiSwap and Thena. The difference in both TVL and volumes is however staggering.

Last, it must not be ignored that Wombat works only with pegged assets. This obviously restricts its field of action as a DEX.

Wombat is a relatively new project but was already heavily tested following the Anrk protocol exploit. On December 2, 2022 hackers managed to mint 6 quadrillions aBNB (Ankr’s staked BNB). Wombat’s BNB pool, consisting of aBNB, BNBx and BNB, was drained of BNB and BNBx when the the exploiter swapped huge quantities of aBNB. LPs who provided BNBx and BNB liquidity faced a huge loss. The BNB pool reopened in mid December 2022 and consists now only of BNB and BNBx. These events highlighted the risk of single-pool LPing (see Counterparty Risk below).

This event has had a strong impact on Wombat in terms of market sentiment and TVL.

On the positive side, Wombat is backed by Binance Labs.

Wombat continuity risk is 6/10.

Counterparty Risk

Counterparty risk is deemed medium to low.

Stader

Counterparty risk exists whenever an asset is handed over to an external provider. Any credit events involving the staking provider could affect the assets that have been entrusted to them.

That said, staking via a 3rd party is fundamentally different from depositing funds into a lending protocol that later becomes insolvent.

We seek to select only trustable staking providers in order to minimise counterparty risk.

Stader places utmost importance to ensure users' funds are staked with the best-in-class validators in the ecosystem. In order to be considered for Stader pools, validators need to meet threshold performance criteria (e.g. on up-time).

Each pool has a unique characteristic based on which validators are selected for that particular pool. In the long run Stader would select the validators programmatically and rebalance delegations based on performance filters. Additionally, as the Stader platform is decentralized, governance will determine validator selection criteria, policies, and so on.

Last, a Slashing Insurance will be provided by validators via the Stader tokens staked.

Counterparty risk is set to 2/10.

Wombat

Wombat Exchange works in a similar fashion to Stargate, although the mathematical formulation is different. In order to facilitate swap of stablecoins at low slippage, it introduces single pools as opposed to pools of two stablecoins. When swapping coins, the user would deposit in say pool A and withdraw from pool B.

Liquidity providers can enter a pool with a single stablecoin. The value of deposits can be interpreted as the ‘Liability’ of the pool. The current amount of stablecoins as ‘Assets’.

Within a certain range of this Asset to Liability ratio (i.e. when the pool is in equilibrium), tokens are exchanged in a way similar to CFMM (constant function market maker, i.e. with no slippage). Infinite liquidity is provided near the tail when it deviates from equilibrium (i.e. with slippage). If the ratio is weak, if below 1, deposits are incentivized via a deposit gain, while withdrawals are punished via a fee. The opposite happens when the ratio is above 1.

Similarly to Stargate Finance, there is however a situation where users could lose part of their funds. This happens for example when pools are imbalanced and one coin loses its peg.

Something similar has happened to the BNB pools of Wombat in December 2022, as described in the previous section.

Let’s assume an investor had deposited $1M into the BNBx pool. Having exploited the Ankr protocol, the hacker managed to mint a huge amount of aBNB. He then entered the BNB pool on Wombat, depositing aBNB and swapping them for BNB and BNBx. As a result, the coverage ratio of these two pools collapsed to 0%, while that of aBNB was way above 100%. In practice, there was no BNB and BNBx left in their pools to satisfy any redemption. Moreover, the value of aBNB had collapsed to 0 since it was no longer backed by staked BNB on Ankr.

In this situation, the BNBx and BNB investors lost his entire investment.

The BNB pool on Wombat has since reopened. It does not include aBNB but only BNBx and BNB so the situation described above can no longer be experienced, as long as no other BNB-pegged token enters the pools.

Counterparty risk is 3/10.

Liquidity Risk

Liquidity risk is deemed low.

Stader

Funds held by the staking provider are redeemable at any time (according to the technical lockup period).

Liquidity risk is 2/10.

Wombat

The protocol is always in a balanced state with respect to the total amount of deposits since tokens simply move from one pool to another. For this reason, the protocol itself faces virtually no liquidity risk.

Liquidity risk is 1/10.

Strategy Risks

Complexity

Complexity of strategy is medium.

The strategy involves depositing BNB on Stader to perform staking. The Stader IOU token, dubbed BNBx is then deposited in Wombat to provide liquidity in the overall BNB pools.

Therefore one chain (BSC), 2 tokens and two protocols are required.

Complexity of the strategy is 4/10.

Scalability

Scalability risk of strategy is low.

Staking is a highly scalable practice. Indeed, the more stakers are participating, the higher the safety of the blockchain.

On the other hand, the strategy also involves providing liquidity in the BNB pools in Wombat. Current liquidity in the BNBx pools is over $2m. A cap on the maximum amount of BNB to be moved into this strategy ensures that also the Wombat leg APY is preserved to some extent.

Scalability risk of the strategy is 2/10.

Sustainability

Sustainability risk of strategy is medium.

The yield obtained from this strategy is fully sustainable as it comes from participating in the validation of BNB transactions, the Proof-of-Stake mechanism.

Proof-of-Stake is quite energy efficient when compared to Proof-of-Work chains like Bitcoin and has therefore practically no negative impact on the environment.

Wombat yield is paid in Wombat's own token, WOM. It is not clear to which extent this yield is subsidized by Wombat or by Stader, in addition to the staking and LPing yield.

We take a conservative approach and set the risk around the yield sustainability as medium.

Sustainability risk of the strategy is 5/10.

Yield Risk

Yield risk of strategy is low.

Staking provides a constant stream of income with low variability. The yield from providing liquidity on Wombat depends on the observed exchange volumes.

Yield risk of the strategy is 1/10.

Slashing Risk

Slashing risk on BSC is low.

In order to secure the network from malicious validators, BSC implements “slashing” logic to penalize validators for double-signing (a validator signs two blocks at the same time), instability, or any other negative behavior. To put it simply, slashing refers to the process of taking or “slashing” a fixed amount of a validator’s stake. Such a penalty helps to sustain order and makes validators behave in a righteous manner.

When validating the BSC chain the only risk for delegators is the loss of rewards when their staked validator is slashed. Their staked BNB will not be impacted.

Slashing risk is 2/10.

Liquidity Risks of staking and farming

Liquidity Risk on staking and farming BNB is medium.

Liquid staking on Stader plus Wombat farming requires the investor to lock-up their BNB tokens for a period of 90 days. Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

The liquidity risk associated with the farming leg (LPing in Wombat) stems from the coverage ratio of the BNBx pool. If users were to swap BNB for BNBx the coverage ratio would end up below 100% and there could not be sufficient exit liquidity for all BNBx LPers. Since BNBx is a liquid staking derivative of BNB there is no logical reason to expect that it would be trusted more than BNB itself, unless there are some serious issues with Stader (see the Trust Score above).

Liquidity risk is set to 5/10.

3. Conclusions

BNB staking comes with some risk.

Liquid staking per se is generally considered a very safe investment. Stader, the chosen liquid staking protocol, has been reviewed and approved by the SwissBorg tech team. The staking yield is enhanced by farming the liquid staking tokens in the BNB pools of Wombat. This additional yield comes at the cost of taking on some additional risk.

Last, BNB staking comes with a 90-day lock-up period. This means that redemptions are possible only at the end of the period. Liquidity is therefore not always available.

The SwissBorg Risk Team ranks BNB staking as a Satellite investment, one for an investor with a good understanding of DeFi and yielding, who is willing to take on some risk in exchange for an improved reward on BNB.

Try the SwissBorg Earn today!