CAKE staking in PancakeSwap

Key Takeaways:

- This strategy perfectly fits investors with low risk tolerance.

- The strategy is fairly simple and consists of staking CAKE in PancakeSwap’s Syrup Pool.

- The Yield (APY) is composed of staking rewards.

- A lockup period of 26 and 52 weeks is present and rewards are paid out at the end of the period. For this reason, investors will not be able to quickly adjust to any changes of market conditions (liquidity risk of staking).

- The strategy is highly scalable and yield is expected to display little volatility. The offered APY is however not ‘real’ and relies partially on the fact that CAKE tokens have no limited supply. This creates a tradeoff between offered yield and deflationary pressure on the token price (sustainability risk).

- Risk Checklist: in our view the predominant risks for this strategy are

- Sustainability risk

- Liquidity risk of staking

1. Strategy Explained

Collected CAKE tokens are deposited in the CAKE Syrup Pool on PancakeSwap and locked for 26 or 52 weeks.

The APY is coming in the form of CAKE rewards.

Two types of CAKE staking are offered: flexible and fixed-term.

Flexible staking allows users to stake CAKE and earn rewards with the ability to unstake whenever they please. Fixed-term staking allows users to maximise their yield and earn even more CAKE by locking their staked CAKE for a period of time they choose, earning a linearly boosted yield compared to flexible staking.

Flexible staking and fixed-term staking are both part of the same pool to allow users easy migration between the two staking options.

The proposed strategy enters a fixed-term staking period of 26 (or 52) weeks. Please be aware that investors cannot withdraw the tokens until the end of the lock duration.

2. Risks and Rewards

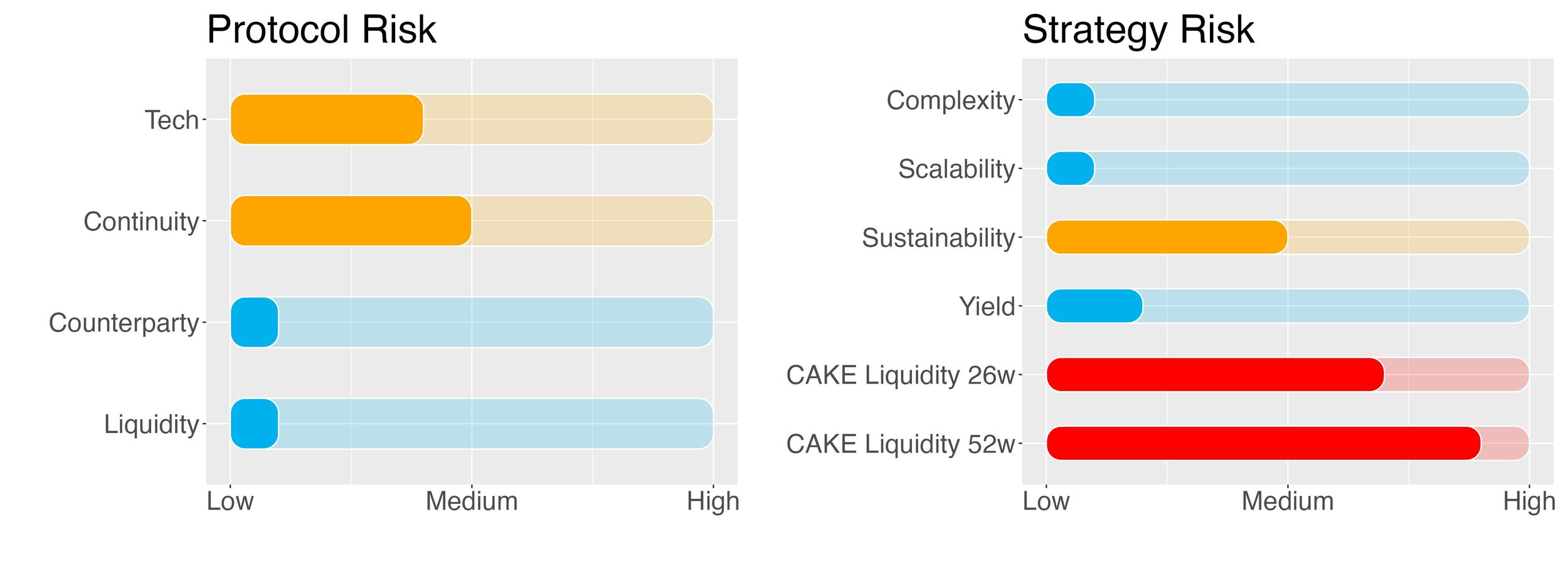

Protocol Risks

Protocol Tech Risk

PancakeSwap is a decentralised exchange (DEX) built on Binance Smart Chain (BSC) that utilises an automated market making (AMM) system. PancakeSwap is a fork of SushiSwap and has an almost identical codebase, but it has the advantage of cheaper and faster transactions from being built on BSC. It also offers additional features compared to SushiSwap, such as yield farming across other protocols, lotteries, and initial farm offerings (IFO).

PancakeSwap was founded by a group of anonymous developers in September 2020.

SwissBorg trust score for PancakeSwap is ‘green’, i.e. the protocol is trustable.

The score value is 6.5/10.

Protocol Continuity Risk

Project continuity risk is medium.

With a TVL of around $2.4b PancakeSwap is the 8th largest DeFi protocol in terms of TVL. Within its ‘DEX’ category, the exchange sits on the last step of the podium. PancakeSwap is also the largest (again in TVL terms) decentralised exchange protocol within the Binance Smart Chain. In terms of valuation the token market capitalization to its TVL is 0.28, in front of a median for the category of 0.88. Overall sentiment is medium/low (poor volatility and social dominance scores).

Pancake continuity risk is 5/10.

Counterparty Risk

Counterparty risk is deemed low.

PancakeSwap is an automated market maker (AMM). It is fully decentralised and its operations are all regulated by smart contracts. There is no counterparty credit risk when providing liquidity to a pool in the protocol or staking tokens into a staking pool.

Counterparty risk is set to 1/10.

Liquidity Risk

Liquidity risk is deemed low.

The CAKE position can be exited at the end of the lockup period. CAKE tokens are received plus the accrued rewards.

Liquidity risk is set to 1/10.

Strategy Risks

Complexity

Complexity risk of the strategy is low.

The strategy involves one token (CAKE), one protocol (PancakeSwap) and one chain (BSC), no leverage. Complexity is hence the lowest possible.

Complexity of the strategy is 1/10.

Scalability

Scalability risk of strategy is low.

The strategy is capped at 30,000 CAKE. While it is not clear if there is an impact in terms of APY dilution, the current staking pool displays a total deposit of around 260m CAKE, 200m of which are locked. This is a very large staking pool and hence there is room for additional deposits.

Scalability risk of the strategy is 1/10.

Sustainability

Sustainability risk is set to medium.

Staking rewards are paid out directly by the protocol in order to incentivize the locking of its native token, CAKE. This token is used on the platform for a wide variety of functions including voting on governance proposals.

CAKE has no fixed supply and tokens are generated at a very high rate. While a certain amount is burned through different channels to manage inflation, it must be noted that there is a much larger generation of tokens than burned.

While the unlimited supply of tokens might guarantee a sustainable yield, this could also deflate the USD price of CAKE due to inflationary pressures. This evident trade-off could affect the sustainability of the offered yield.

Sustainability risk is set to 5/10.

Yield Risk

Yield risk is low.

The APY comes from staking the CAKE tokens in PancakeSwap’s Syrup Pool. Staking provides a constant stream of income with low variability.

Yield risk is set to 2/10.

Liquidity Risks of staking

CAKE liquidity risk is deemed medium to high.

This strategy requires the investor to lock-up their CAKE tokens for a period of 26 (or 52) weeks (i.e. 6 or 12 months). Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

Liquidity risk is therefore set to 7/10.

Worst-case scenarios

To help the investors assess the risks of this strategy we’ve tried to identify the negative scenarios that the strategy could face:

- PancakeSwap CAKE Syrup Pool gets hacked and staked CAKE are stolen (tech risk).

- CAKE tokens experience a sudden rally or the price is plummeting due to negative events around the PancakeSwap protocol. In either case, the user will not be able to trade these events since tokens are locked up (liquidity risk of staking).

- It is not fully clear how the offered yield on CAKE is generated, and if it could get diluted as a result of a large inflow of deposits into the pool (yield risk).

3. Conclusions

Staking represents a low risk yield-generating investment. In our case, this is achieved by obtaining a boosted yield when locking CAKE tokens into the Syrup Pool.

When it comes to the ‘real’ APY, the yield currently provided to users comes in the form of protocol incentive to attract staking deposits.

This strategy on CAKE comes with little risks, mainly related to the duration of the lockup period. The investment strategy is fairly simple and only requires some basic understanding of how DeFi operates. It does involve a 26-week (or 52-week) locking period and rewards are paid out at the end of this period.

The SwissBorg Risk Team ranks CAKE staking on PancakeSwap as a Satellite investment, one for an investor with a basic understanding of DeFi and yielding, who is willing to take on some risk in exchange for an interesting reward on CAKE.

Try the SwissBorg Earn today!