Congratulations, if you are reading this document it’s most probably because you have participated in our Series A and we are delighted to have you as a shareholder. In this guide you will find out all the practical information you need to manage your shares.

Frequently asked questions

1 - Where can I find my shares and how do I calculate my ownership (% of share capital and voting rights)?

2 - As a Series A participant, am I directly owning Shares of SwissBorg ?

3 - How can I directly own my shares and what are the consequences?

4 - What are my rights as a shareholder ?

5 - How can I transfer my shares ?

6 - How can I participate in voting ?

7 - How can I report my shares in my Tax Statement ?

8 - What is the process and in which circumstances will I receive dividends ?

9 - Are the SBorg SA Shares to be acquired by SwissBorg Community AG the Same as SwissBorg’s Founder Shares ?

10 - What is the “ownership” that my SPV Shares (i.e SwissBorg Community SA) grant me in SwissBorg Shares (i.e SBorg SA) ?

11 - What documentation should I expect to receive?

1 - Where can I find my shares and how do I calculate my ownership (% of share capital and voting rights)?

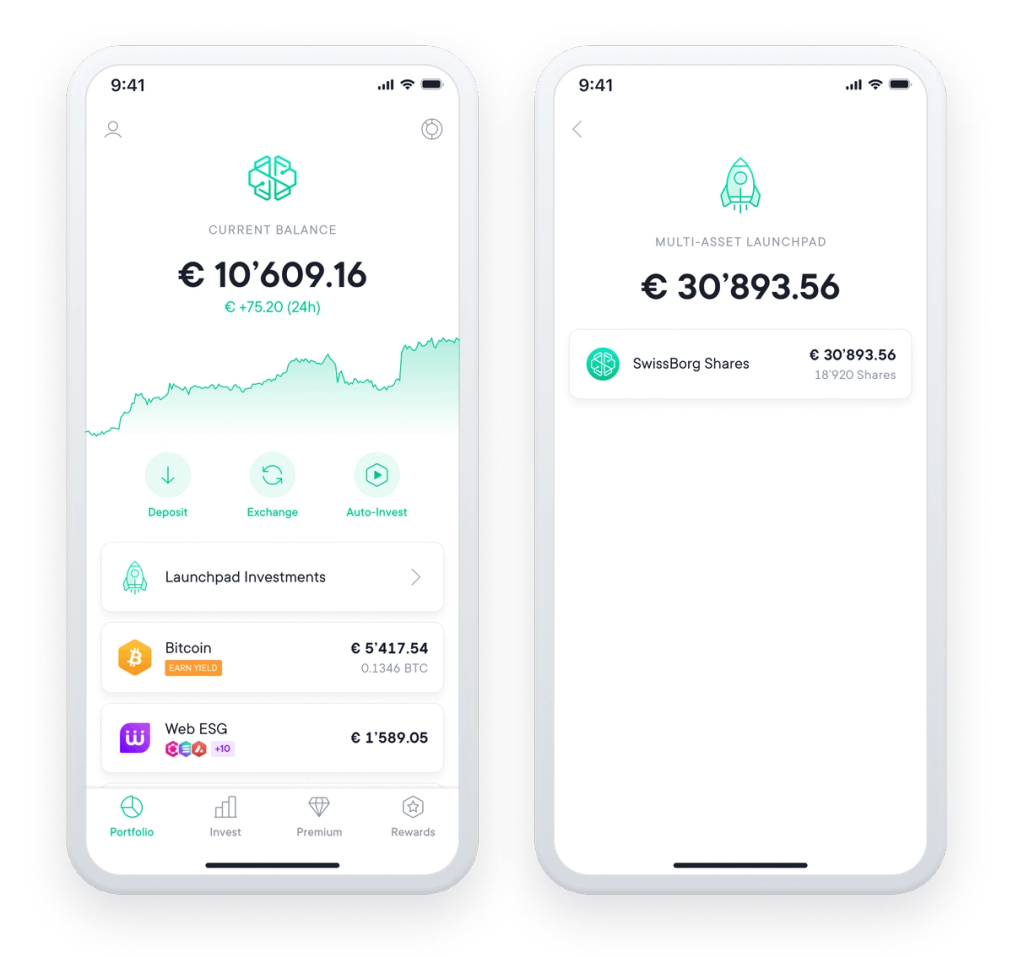

Once the shares have been issued, you will be able to find them in the SwissBorg app.

In the Portfolio screen, tap on "Launchpad Investments" and then select "SwissBorg Shares" to see the details of your purchased shares.

In accordance with the Subscription and Nominee Agreement you have signed, your shares are effectively held on your behalf by a third-party, Apex, which is why what you see on the App is not directly the shares you own, but rather a proof of ownership.

If you still have questions about the fundraise or your Launchpad investment(s), please fee free to contact our Support team.

To calculate your ownership in the company (% of the share capital and of the voting rights), you can divide the number of shares you acquired by the total number of shares composing the share capital, being: 13,651,189.

2 - As a Series A participant, am I directly owning Shares of SwissBorg?

Every single participant of the SwissBorg’s Series A, is owning shares of SwissBorg through indirect ownership. By being a contributor into the Series A, you have accepted two elements:

- To purchase shares of the company SwissBorg Community AG, a “special purpose vehicle” (or “SPV”) whose purpose is is to invest all the proceeds from the fundraise to acquire 9.53% of the share capital of SBorg SA, holding entity of the SwissBorg group; and

- To appoint Apex to act as a nominee shareholder to represent you, as a shareholder, in the share register of the company and to act as your proxy in all your shareholders rights. As a consequence, Apex is holding your shares on your behalf. You can decide to regain the direct ownership of your shares by terminating the Subscription and Nominee Agreement you signed with Apex (see below for more details).

This is a state of the art approach in the industry! Until the shares of a company are fully tokenised, SPVs are very helpful to run successful public offers. Thanks to this scheme, we were able to accept any investors from as little as 100$ (instead of the usual minimum 500,000$) and as a result it became one of the largest public offers in the world in terms of participants. A giant step towards a more inclusive financial world!

This setup has no direct impact on your shareholder’s rights (voting right, information right, financial rights, ability to transfer shares), which are kept in their entirety and expressed through the nominee appointed as a proxy.

3 - How can I directly own my shares and what are the consequences?

You can terminate the Subscription and Nominee Agreement you signed with Apex at any time. If you have the desire to terminate the Subscription and Nominee Agreement, please contact our Support team and we will assist you in the process.

If you decide to terminate the Subscription and Nominee Agreement, you will then assume your own representation, which means that Apex will no longer help you manage the administrative requirements of being a shareholder. You will be directly recorded in SwissBorg Community’s share register as a shareholder and be responsible for expressing your shareholder’s rights directly, notably by personally participating in the general meetings of SwissBorg Community AG, expressing your vote and requesting information. You will also be a party to SwissBorg Community’s Shareholders Agreement and, therefore, subject to the provisions of this agreement, notably regarding any transfer of shares.

4 - What are my rights as a shareholder?

As a shareholder of SwissBorg Community AG, you have rights, primarily governed by the Swiss Code of Obligations (CO). The CO sets out a number of provisions that protect your rights and ensure that you are treated fairly by the company. Some of the key provisions relating to shareholder rights include:

- Right to information (Article 697 CO): Shareholders have the right to request information from the company about its affairs. This includes the right to access the company's financial statements, minutes of shareholders' meetings, and other important documents.

- Right to vote (Article 698 CO): Shareholders have the right to vote on important matters affecting the company, such as the election of board members, the approval of financial statements, and the issuance of new shares.

- Right to participate in meetings (Article 700 CO): Shareholders have the right to participate in shareholders' meetings and to express their views on matters affecting the company.

- Right to request a meeting (Art. 699 CO): Shareholders may request that a general meeting be convened, provided they together hold at least 10 % of the share capital or of the votes.

- Right to request an item on the meeting’s agenda (Art. 699b CO): Shareholders may request that items be placed on the agenda of a general meeting, provided they together hold at least 5 % of the share capital or of the votes.

- Right to dividends (Article 677 CO): Shareholders have the right to receive a share of the company's profits in the form of dividends, provided that the company has sufficient profits and the shareholders have approved the distribution of dividends.

- Right to challenge decisions (Article 706 CO): Shareholders have the right to challenge decisions made by the company's board of directors or executive management if they believe that these decisions are not in the best interests of the company.

- Right to sell shares (Article 697a CO): Shareholders have the right to sell their shares to other investors, subject to any restrictions that may be imposed by the company's articles of incorporation or bylaws.

It is important to note that these provisions are general. Shareholders should always review the company's articles of association to ensure that they understand their rights and obligations..

The interposition of Apex as nominee shareholder does not prevent you from benefiting from and exercising these rights. Thanks to the internal procedure we have in place with Apex, Apex will be implementing all the above-mentioned provisions to ensure your rights are complied with.

5 - How can I transfer my shares?

There is no vesting period for the shares. Shareholders can freely transfer all or part of their shares to a third party, subject to the company’s articles of association and the Shareholders Agreement.

The shares will be held by Apex, a nominee shareholder, on your behalf. A nominee shareholder is an entity holding the shares owned by the ultimate beneficiaries of the shares (the investors) and representing them on a fiduciary basis towards the company. In other words, Apex will be the sole shareholder of the company, unless the Subscription and Nominee Agreement is terminated by one or several investor(s), in which case the investor(s) will be registered as shareholder(s) on his/her(their) own name.

Thus, in order to be able to transfer your shares, you first need to terminate the Subscription and Nominee Agreement (see question above for details) in order to be accounted as shareholder in the company’s register (in place of Apex).

Once this Agreement is terminated, you will have to abide by the company’s articles of association and Shareholders Agreement you adhered to when subscribing the shares.

According to the company’s articles of association and the Shareholders Agreement, the transfer of the shares is subject to the prior approval by the board of directors if the amount of shares to be acquired or sold is equal to or higher than 5% of the share capital.

In addition, the Shareholders Agreement entails specific provisions regarding the transferability of the shares, namely:

- Right of first refusal by the existing shareholders;

- Tag-along (co-sale right);

- Drag-along (co-sale obligation).

We invite you to carefully read the Shareholders Agreement in full before transferring all or part of your shares.

Series A investments are usually illiquid investments. Therefore we make it our mission to enable any investor to easily sell his/her shares. There is no mechanism in place for now and we are exploring different opportunities. You can learn more in this article.

6 - How can I participate in voting?

In accordance with the Subscription and Nominee Agreement, Apex will represent you during the general meetings of the company. Apex undertakes to keep you informed of any communication received from the company and to collect your vote on the meeting’s resolutions. In the absence of any specific voting instructions provided to Apex 7 business days before a meeting, Apex will vote in accordance with voting recommendations of the board of directors.

For this purpose, SwissBorg will implement a framework where all your rights as a shareholder can be expressed (see question 4 above). For technical reasons, this framework may evolve in time.

7 - How can I report my shares in my Tax Statement?

The specific process for reporting your shares in your tax statement will depend on the country in which you are located and the applicable tax laws and regulations. However, in general, you will need to report any income earned from your shares, as well as any capital gains or losses that you have realized from buying or selling shares.

Here are some general steps you can follow:

- Determine the applicable tax laws and regulations: Review the tax laws and regulations in your country to determine how shares are taxed and how they should be reported on your tax statement.

- Gather your investment documents: Gather any documents related to your shares, such as account statements, trade confirmations, and dividend statements.

- Determine your taxable income: Calculate your taxable income from your shares. This may include dividends received, interest income, and capital gains or losses.

- Fill out the appropriate tax forms: Fill out the appropriate tax forms required by your country to report your income from shares. This may include a specific form for reporting capital gains or losses.

- Submit your tax statement: Submit your tax statement to the appropriate tax authority by the deadline specified in your country's tax laws and regulations.

It is important to note that these are general guidelines and the specific steps for reporting your shares in your tax statement may vary depending on the country in which you are located. Additionally, you may wish to seek professional tax advice from a qualified tax advisor to ensure that you are accurately reporting your shares and complying with all applicable tax laws and regulations.

As explained in the questions above, as long as you do not terminate the Subscription and Nominee Agreement, you will not be considered a direct shareholder in the company’s register. Thus, we cannot deliver you a Share Certificate. We will however deliver you a Subscription Certificate, to attest that you subscribed to the shares, held by Apex on your behalf. You will also be able to see a representation of your shareholding in the SwissBorg App. If you desire to receive a Share Certificate, you can terminate the Subscription and Nominee Agreement (see question 3 above) to be recorded in the company’s share register. Please contact us shall you have further questions.

8 - What is the process and in which circumstances will I receive dividends?

The process for receiving dividends and the circumstances under which you will receive them are defined in the company's articles of association. However, in general, the process for receiving dividends will involve the following steps:

- The board of directors of the company will decide whether to distribute dividends: The board of directors will review the company's financial statements and determine whether there are sufficient profits to distribute dividends to shareholders.

- The board of directors will propose a dividend payment to the shareholders: If the board of directors decides to distribute dividends, they will propose a specific amount of dividends to be paid to shareholders. This proposal will typically be presented to the shareholders at the annual general meeting.

- Shareholders will vote on the proposed dividend payment: If a majority of shareholders approves the payment of dividends, the payment will be made.

- The company will distribute the dividend payment to shareholders: The company will distribute the dividend payment to shareholders in accordance with the payment terms outlined in the company's articles of association.

In order to be eligible to receive dividends, you must be, on the dividend payment date, either (1) on Apex’s UBO/indirect shareholders’ list; or (2) a direct shareholder of record upon termination of the Subscription and Nominee Agreement. This means that you must have been on Apex’s UBO/indirect shareholders’ list or owned the shares on or before the dividend record date, which is typically set by the company and announced in advance. Additionally, the amount of dividends you will receive will depend on the number of shares you own and the dividend payment per share.

It is important to note that these are general guidelines and the specific process for receiving dividends may vary depending on the company and the circumstances involved. Additionally, you should consult the company's articles of association to understand the specific rules and regulations governing dividend payments.

9 - Are the SBorg SA Shares to be acquired by SwissBorg Community AG the Same as SwissBorg’s Founder Shares?

The SBorg SA shares that will be acquired by SwissBorg Community AG with the proceeds of the fundraise are the same type (ordinary shares) as the existing shares held by SwissBorg’s founders. No preferential shares have been issued. This means that all shareholders of SBorg SA, including SwissBorg Community AG, will be equally weighted in terms of dilution. If SwissBorg decides to do a further capital increase in the future, all shareholders of SBorg SA (the SwissBorg executives as well as SwissBorg Community AG) will be diluted at the same rate.

10 - What is the “ownership” that my SPV Shares (i.e SwissBorg Community SA) grant me in SwissBorg Shares (i.e SBorg SA)?

As a SwissBorg Community AG shareholder, you will become an indirect shareholder of SBorg SA as soon as SwissBorg Community AG acquires 9,53% of the share capital of SBorg SA.

This percentage (9,53%) is calculated based on the current share capital of SBorg SA, composed of 10,000,000 shares, and is not based on the share capital taking into account the 1,250,000 shares to be issued to employees, consultants and/or members of the Board of Directors of SBorg SA, as initially mentioned in the Term Sheet. Indeed, these 1,250,000 shares are not going to be issued by SBorg SA, meaning that you won’t be diluted because of these shares. You will indirectly hold 9,53% of SBorg SA anyways. Please note this does however not cover a potential future fundraise, in which case you would be subject to a dilution.

To calculate your indirect holding of SBorg SA shares, you simply multiply your holding in SwissBorg Community AG (see question 1 above) by 9,53%. Hence:

>> 1 Share of the SPV (i.e SwissBorg Community AG) represents: 9,53% ÷ 13651189 = 0.0000006981%(indirect) holding of SBorg SA.

11 - What documentation should I expect to receive?

As a shareholder you should expect to receive the following documents:

- Subscription Certificate: You should receive a Subscription Certificate that certifies that you acquired a certain number of shares of the company, held by Apex on your behalf. This certificate will include the number of shares acquired, the acquisition price of the shares and the total subscription amount in CHF.

- Subscription and Nominee Agreement: You should receive a copy of the Subscription and Nominee Agreement you entered into with Apex. This document governs under which conditions Apex will represent you and act on your behalf.

- Shareholders Agreement: You should receive a copy of the Shareholders Agreement you adhered to when subscribing shares. This document governs the relations between the shareholders of the company, their rights and obligations, notably with regards to shares transfers.

- Term Sheet: You should receive a copy of the Term Sheet you agreed to when subscribing shares. This document governs the issuance of the new shares you subscribed to, including the issuance price, the type of these shares and the entity issuing the shares.

- Articles of association of the company: The company’s articles of association will be made available to you and updated when necessary on our website. Articles of association outline the company's organisational structure, rules, and regulations, and provide important information about your rights and responsibilities as a shareholder.

- Financial statements: You should receive the company's financial statements, which typically include a balance sheet, income statement, and cash flow statement. These statements provide information about the company's financial performance.

- Notice of shareholder meetings: You should receive notice of any shareholder meetings, which will typically include information about the agenda of the meeting and a deadline to express a vote.

- Minutes of shareholder meetings: You should receive minutes of the shareholder meetings. These minutes provide a summary of the discussions and decisions made at the meeting.