Staking with Lockup

The ATOM Earn Strategy with Lockup is now live! With SwissBorg Earn, you can stake your ATOM and expect a 12.5% APY.

Read on to learn how we checked it and the key points you need to know.

Key Takeaways

- Liquid staking represents one of the safest options in DeFi to generate yield.

- We only rely on secure and trustable staking providers.

- The yield (APY) is derived from ATOM staking – contributing to the Proof-of-Stake consensus mechanism.

- The Cosmos network was founded in 2014 by developers Jae Kwon and Ethan Buchman. The first brick in the creation of the project was the development of Tendermint, the consensus algorithm that would go on to power Cosmos. By 2016 Cosmos had turned into a reality and on 13 March 2019 the Cosmos Hub was launched.

- ATOM liquid staking represents a very liquid yield-generating investment. However, a 90 days lockup period applies.

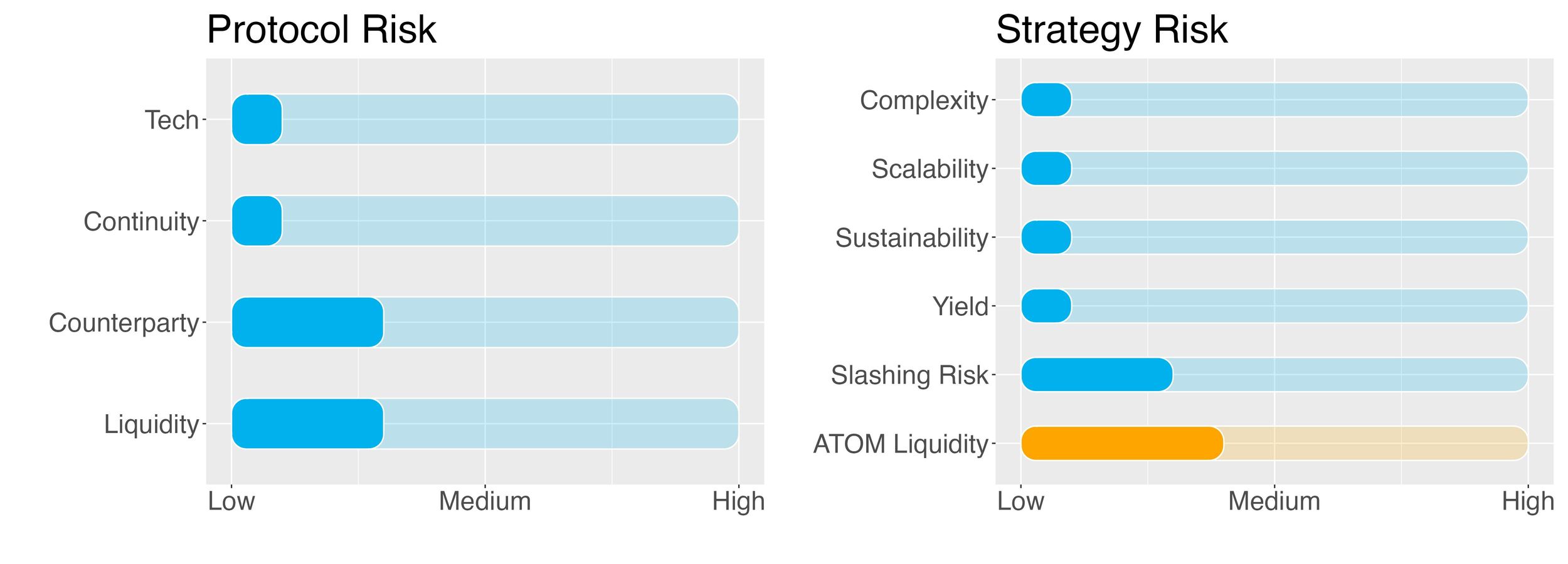

- Risk Checklist: No risk is deemed a concern for this strategy. Nevertheless main potential issues could be related to:

- Counterparty risk

- Protocol liquidity risk

1. Strategy explained

The strategy is fairly simple; deposit ATOM on the provider’s staking pool and receive staking rewards.

Lockup period: 90 days.

2. Risks

The risk profile of this new strategy on ATOM is not different from that of the original one, please refer to the risk report.

The only affected item reflects the lockup period, see below.

Liquidity Risks of staking

Liquidity Risk on staking ATOM is medium to low.

Most staking opportunities require the investor to lock-up their tokens for an agreed period, for hours to days, and even months. This staking strategy on ATOM comes with a lockup period of 90 days.

This means that regardless of the direction the market chooses during this time, your assets will be out of reach.

Liquidity risk is therefore set to 6/10.

Try SwissBorg Earn!