The year 2022 was a rollercoaster ride for the crypto industry, characterised by a series of bankruptcies and scandals. These challenges were reflected in the market's performance, with Bitcoin experiencing a sharp decline to cycle lows around the $15k mark, representing an 80% drop from its previous all-time high. However, such turbulent years can be seen as necessary to weed out bad actors and foster a healthier ecosystem.

As we entered 2023, the industry displayed a renewed and cleansed outlook. Signs of recovery are evident, including record-high hash rates, DApp launches, and notable institutional adoption, even by nation-states like El Salvador. The crypto ecosystem is now fundamentally stronger than ever, reminiscent of the bitcoin halving in 2024.

It appears that we may have left the bearish trends behind. However, caution is still necessary as the cryptocurrency market faces several hurdles that are currently hindering the full resurgence of bullish sentiment.

Here are five key reasons why we're not in a bull market, yet:

1. Global Economic Uncertainty: The market is still dealing with macroeconomic doubt. In a state of suspense, everybody is awaiting the Federal Reserve's next move. Predictions suggest a rate increase is imminent, but the specifics remain unclear. This uncertainty often leads to a period of range-bound trading, as the market remains unclear about the direction that will be taken.

2. Priced-in Institutions?: Major news such as Blackrock's demand for a Bitcoin ETF and the establishment of EDX Market, backed by heavyweights like Citadel Securities and Fidelity Digital Assets, have recently boomed the attention of traditional finance towards crypto. Ripple's partial win against the SEC has likewise had significant positive implications for the industry. Yet, despite these promising developments, Bitcoin has been unable to break through the resistance level at 31K. This begs the question: "What additional catalysts are needed to kickstart a bull run?

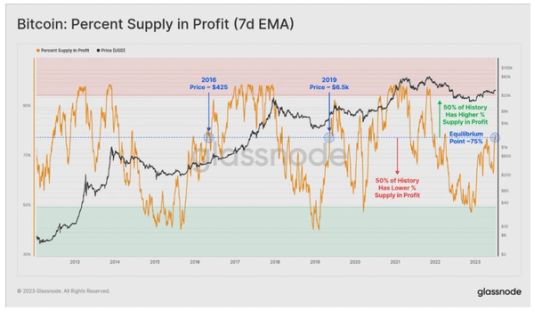

3. Re-accumulation Stage: The market is currently in a re-accumulation phase, with the 30K mark serving as a pivotal point. Here, 75% of the supply is held at a profit, while the remaining 25% is still at a loss. In previous cycles, this pivot level has been a key indicator of market direction.

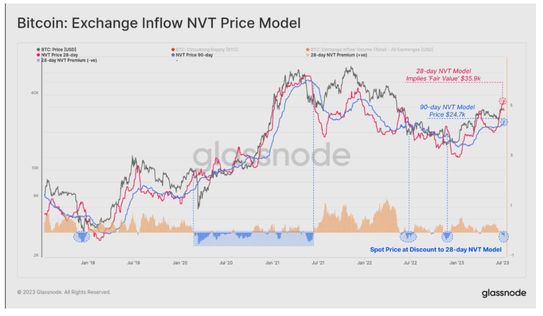

4. The NVT (Network Value to Transactions) Model: This model calculates 'fair value' based on on-chain volume settlement. For the first time since November 2022, the model indicates a fair value of approximately $36K, which is higher than the current spot price. However, the lagging 90-day model still hovers just below $25K, indicating a potential trading range for Bitcoin over the coming two quarters.

5. Liquidity Problem: A report published by Kaiko in May 2023 revealed that crypto market liquidity was at one of its lowest levels in the past 10 months. This decline is largely due to the banking crisis and the downfall of crypto-friendly banks like Signature. This liquidity issue contributes to the difficulty to identify reliable market trends and adds to the current price action tango.

In conclusion, the current market stage remains marked by uncertainty, with Bitcoin's price anticipated to fluctuate between $26K and $36K. Despite the challenges and the foreseeable continuation of a sideways trend, a potential trigger event, such as the approval of a Bitcoin ETF by the SEC, could serve as a turning point towards new bullish territory. As investors, it is crucial to stay vigilant and be prepared to adapt to the evolving market conditions.

How to position yourself in a market with no clear direction?

Wondering how to position yourself in a market that's like a ship without a compass?

In these uncertain times, it's wise to increase exposure to uncorrelated assets. This strategy helps you remain unfazed by market momentum, especially during sideways markets.

Rather than holding your wealth in stablecoins or fiat, which could cause you to miss out on potential market surges, or investing in highly volatile altcoins that may suffer greatly if the market dips, consider the following approaches:

Accumulate Bluechip Assets: If you are comfortable with some volatility, consider accumulating bluechip assets like BTC and ETH, while keeping in mind that some fluctuations can still be expected. These established cryptocurrencies have shown resilience and are more likely to weather market uncertainties.

Leverage dynamic approach: For example, optimise your portfolio by leveraging the allocation dynamics of the Golden Thematic. Such strategies are specifically designed to enhance your investments during both market uptrends and downtrends. Notably, in a sideways market and according to our back testing, the Golden Thematic has outperformed a pure Gold portfolio 91.4% of the time and has demonstrated superior performance compared to a Cash portfolio 100% of the time.

By building a dynamic base for your portfolio, you can position yourself optimally during uncertain times, diversify your risk exposure, and potentially take advantage of various market conditions.