Staking in Sanctum

Key Takeaways:

- Staking represents one of the safest options in DeFi to generate yield.

- Sanctum is considered a secure and trustable liquid staking service.

- The yield (APY) is derived from staking SOL tokens – contributing to the Proof-of-Stake consensus mechanism of the Solana blockchain.

- SOL liquid staking represents a liquidity yield-generating investment. No lockup is present but a 4-day cooldown is required to fully unstake the asset (liquidity risk of staking).

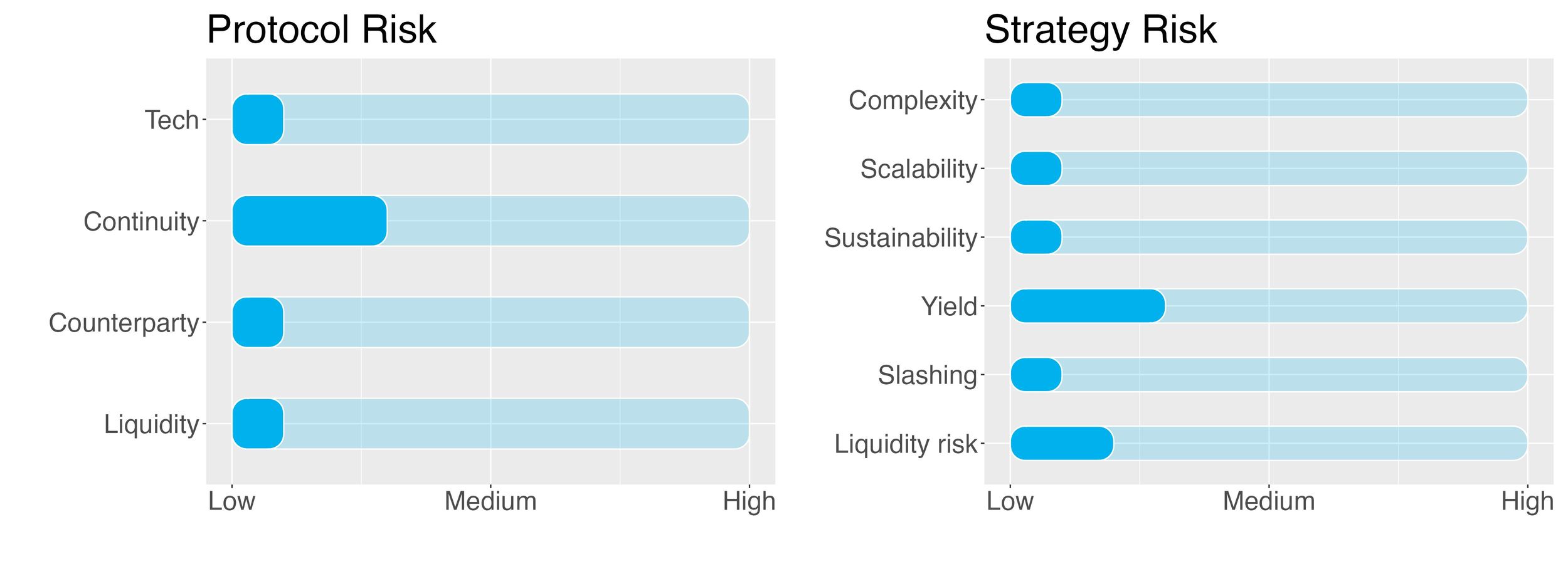

- Risk Checklist. In our view the predominant risks for this strategy are as follows:

- Tech risk

- Project continuity risk

- Liquidity risk of staking

1. Strategy Explained

The strategy involves liquid staking SOL tokens in Sanctum.

Validation is performed using Compass.

The following steps are undertaken:

- SOL are deposited into the pool

- The Sanctum Stake Pool delegates your SOL to Compass, a MEV-enabled validator; compassSOL are received

- Those validators auction off blockspace and receive MEV rewards

- These MEV rewards are redistributed to the stake pool as extra APY

- Your SOL accrues extra yield from priority fees and MEV tip revenue, in addition to staking rewards

Lockup period: none

Cooldown: 4 days

2. Risks

Trust Score

Sanctum is a SOL liquid staking platform. SOL holders can deposit SOL, which are then staked. The staked SOL are solely deposited into Compass, a Solana validator.

The staking pool is noncustodial, which means that neither Sanctum nor Compass can steal your SOL.

SwissBorg has performed its own due diligence on the protocol and considers the protocols trustable with a tech score of 90%.

Protocol Risks

Project Continuity Risk

Project continuity risk is low.

The Sanctum project went live in April 2023. Currently it displays a TVL of around $760m, of which $307m comes from the Sanctum Validator (i.e. the LST module).

This makes the project the fourth LST protocol in Solana (after Jito, Marinade and Blaze).

One innovation introduced by Sanctum is an entirely new method for redeeming LST.

Recall that to redeem an LST (e.g. JitoSOL) a user has two options:

- Unstake on Jito: this comes with a cool-down period of 2-4 days

- Swap using the JitoSOL-SOL pool: this requires deep liquidity to avoid high slippage.

Sanctum came up with a new, more efficient way of redeeming LST. It has done this via the so- called Sanctum Reserve.

This is a pool of over 200,000 SOL. When a user wants to redeem LST, they swap their staking account with the Sanctum Reserve in exchange for instantly liquid SOL. Subsequently, Sanctum deactivates the staking account and receives the paid SOL at the end of the cool-off period.

As a result, SanctumReserve temporarily faces a shortfall in SOL for the duration of the cool-off period, which is eventually recouped. Sanctum charges a dynamic fee based on the percentage of SOL remaining in the reserve pool. This ensures efficient use of SOL during times of high liquidity demand.

The Sanctum Reserve is a significantly more capital-efficient way to liquidate LST than traditional liquidity pools.

In addition, by removing the burden of creating a liquidity pool, this approach allows small, newly established, struggling, or ambitious validators to compete with the big players. This makes the Solana validator set more decentralised and competitive.

Sanctum has been formally audited by Sec3 and is 100% open-sourced. Sanctum is governed by 5 of 8 Squads V3 multisig, providing transparency and security.

Compass is a project running a professional and high performance validator on top tier hardware since October 2022. Compass seeks to guarantee 24/7 uptime, uninterruptible power supplies and plenty of cooling to keep their validator running reliably and fast.

The Sanctum project is relatively new and not battle-tested but given the growth of the staking practise the continuity risk should be contained.

Compass on the contrary has already a couple of years of history and can be considered an established Solana validator.

Continuity risk is set to 3/10.

Counterparty Risk

Counterparty risk is deemed low.

Counterparty risk exists whenever an asset is handed over to an external provider. Any credit events involving the staking provider could affect the assets that have been entrusted to them.

That said, staking via a 3rd party is fundamentally different from depositing funds into a lending protocol that later becomes insolvent.

In a Proof-of-Stake protocol, tokens are locked up in a validator to secure the underlying network and receive staking rewards in return.

Those validators, with the assets and rewards they hold, are fully transparent and always verifiable "on-chain". This is contrary to centralised company reserves which can be opaque and under-collateralised, as it has been seen in the case of some famous crypto exchange, now bankrupt.

With staking, there is no counterparty but the network itself. Validators are rewarded by operations automatically through preset ‘block reward’ rules, as well as through a share of transaction fees. There is no risk of default or bank runs.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

Funds held by the staking provider are redeemable after the required (if any) lockup and cooldown periods. In no circumstances would one expect instances of illiquidity during the redemption process.

Liquidity risk is 1/10.

Strategy Risks

Complexity

Complexity of the strategy is low.

The strategy involves depositing SOL on Sanctum to perform staking. One chain (SOL), 1 token and one staking service is employed with no leverage.

The complexity risk of the strategy is 1/10.

Scalability

The scalability risk is low.

Staking is a highly scalable practice. Indeed, the more stakers are participating, the higher the safety of the blockchain.

The scalability risk of the strategy is 1/10.

Sustainability

The sustainability risk is low.

The yield obtained from this strategy is fully sustainable as it comes from participating in the validation of SOL transactions, the Proof-of-Stake mechanism.

Proof-of-Stake is quite energy efficient when compared to Proof-of-Work chains like Bitcoin and has therefore practically no negative impact on the environment.

The sustainability risk of the strategy is 1/10.

Yield Risk

Yield risk of strategy is medium to low.

Staking provides a constant stream of income with low variability.

In addition to pure yield risk, the strategy also seeks to receive MEV awards (additional APY).

While in principle a minimum APY is guaranteed (staking APY) some volatility on the final strategy APY us to be expected.

Where therefore conservatively set the yield risk to medium to low.

The yield risk of the strategy is 3/10.

Slashing Risk

The slashing risk of the strategy is low.

The Proof of Stake consensus mechanism requires participants to behave responsibly for the overall good of the ecosystem. For this reason, blockchains penalise validators if they step out of line by slashing the value of their stake. The two most common offences are double-signing or going offline when the validator should be available to confirm a new block.

Automatic Slashing is not currently enabled on Solana with the Solana team instead implementing manual safety checks.

Penalties currently include 100% slashing when the node is acting maliciously with examples including those just mentioned as well as signing illegal transactions, and voting for illegal forks.

When a safety violation occurs, the entire chain is brought to a halt, requiring the team to manually search for the node(s) that caused the violation and propose that the stake be reduced after the network is restarted. The stake of the bad node would then be reduced to zero, or the validators could try to vote to remove the offending node. When a node is slashed, all delegated stake from that node are removed.

Compass (the chosen validator) comes with 8 years of experience in bare metal server management - and 20 years of juggling servers and command lines before that. The ensures that the service provides a secure and stable system with maximum uptime.

The slashing risk of the strategy is 1/10.

Liquidity Risk of Staking

Liquidity Risk on staking SOL is low.

Staking SOL on this vault requires no lockup but a cooldown period of 4 days is present.

The liquidity risk is set to 2/10.

3. Conclusions

SOL staking comes with some risk.

Staking per se is generally considered a very safe investment.

Sanctum, the chosen liquid staking service provider, has been reviewed and approved by the SwissBorg tech team. The chosen validator, Compass, has a solid track record.

This SOL staking vault comes with no lockup and a 4-day cool down period.

The SwissBorg Risk Team ranks SOL staking as a Low risk investment, one for an investor with good understanding of DeFi and yielding, who is willing to take little risk in exchange for a potential very nice reward on SOL.

Try SwissBorg Earn today!