Restake ETH via EigenLayer v2

Key Takeaways

- This opportunity is a follow-up of the ETH strategy on EigenLayer launched in July 2023. Please refer to that risk report for all basic information.

- The only differences are:

- Stader’s ETH liquid staking token (ETHx) will be re-staked (the previous strategy was leveraging on Lido’s stETH). - Risk Checklist: in our view the predominant risks for this strategy are

- Tech risk

- Projet continuity risk

- Complexity risk

- ETH liquidity risk

1. Strategy Explained

What is Stader?

Stader Labs is a non-custodial innovative contract-based staking platform that helps users conveniently discover and access staking solutions.

The protocol went live in December 2021 and displays a TVL of around $235m.

When users deposit e.g. ETH into Stader they receive ETHx, i.e. the staked ETH token (same as stETH received from Lido). At any time, ETHx can be unstaked and ETH plus accrued revenues are received.

How will the strategy work?

Within this vault, ETH will be first staked in Stader and ETHx are received. This would represent a floor to the strategy APY.

As per the original strategy, once Stage 2 (expected in Q1 2024) is initiated, the ETHx will be effectively restaked in order to provide security to other protocols/chains. From that moment, the restaking rewards will start.

Lockup period: 6 months.

2. Risks and Rewards

Protocol Risks

Trust Score

SwissBorg trust score for Stader is ‘green’, i.e. the protocol is trustable. The score value is 70% signalling that the protocol is reliable.

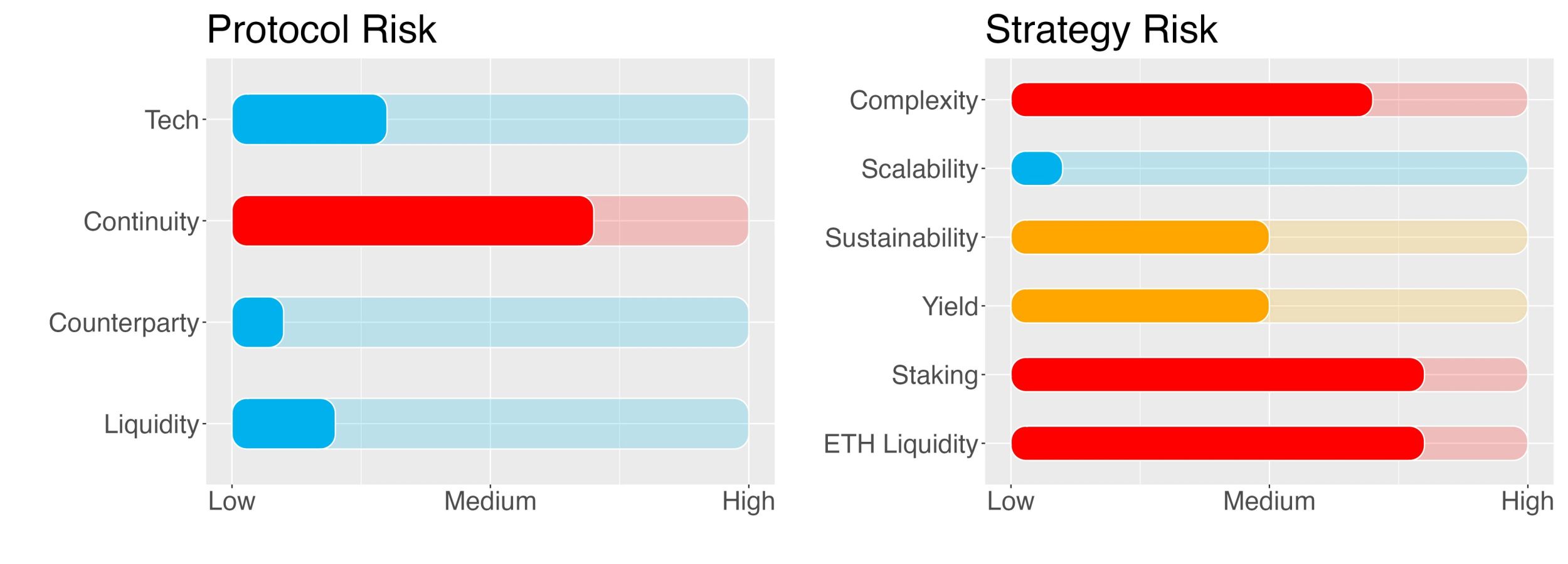

Tech risk is set to 6/10.

Project Continuity Risk

Project continuity risk is medium.

The medium risk stems from the original rating assigned to Eigenlayer.

Protocol continuity risk is 7/10.

Counterparty Risk

Counterparty risk is deemed low.

With staking (and restaking), there is no counterparty but the network(s) itself. Validators are rewarded by operations automatically through preset ‘block reward’ rules, as well as through a share of transaction fees. In principle. there should be no risk of default or bank runs.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

Although a lockup period is present (see in the next section) once the unstaking of the restaked assets is initiated, tokens will be readily available and no liquidity constraints represent a foreseeable risk.

Liquidity risk is 2/10.

Strategy Risks

Strategy risks are the same as per original strategy on EigenLayer.

3. Conclusions/Recommendations

This strategy comes as a continuation of the initial one on EigenLayer.

The SwissBorg Risk Team ranks ETH on EigenLayer as a Satellite investment, one for an investor with a very good understanding of staking and restaking, who is willing to take on extra risk in exchange for a very attractive reward on ETH.

Try the SwissBorg Earn today!