For the sake of transparency towards our community, on a monthly basis we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report will be subject to change based on your feedback and the evolution of the information we receive.

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, as well as offering some of the best yielding conditions available in the market. Learn more about how Smart Yield works.

The DeFi landscape

September has historically been the most underperforming month for traditional markets. For the past 70 years, the S&P 500 has yielded an average return of -0.62%, and the next most underperforming month has been August, with an average return of -0.16%. Whether this is due to causal relationships or a self-fulfilling prophecy, the September Effect is widely recognised.

Bitcoin’s limited history has also shown September to be one of the worst-performing months, with this year being no different. Activity in DeFi typically correlates with crypto market performance, and though total value locked (TVL) did not decline, we saw a stagnating period. This is with the fact that Fantom and Avalanche have started running incentive programs to increase user adoption, where both are offering their respective native tokens for depositing liquidity on some of their DeFi platforms.

We normally headline this security section by outlining the largest or most novel exploits seen in the month. This edition deserves special recognition as the platform under scrutiny is Compound. The platform is considered one of the safest, and arguably started the yield farming trend last year. An update to the Comptroller contract (the risk management layer responsible for determining liquidations, as well as distributing COMP tokens) introduced a bug that let users claim more tokens than intended, leading to approximately $100 million in COMP tokens being mistakenly distributed. Though this incident did not result in direct loss of user deposits, the cost of the exploit is significant.

On the flip side, this month also holds the record for the largest bug bounty paid out. A developer identified and reported an exploit in Belt Finance, which would have cost its users $10 million. Instead, the developer was granted approximately $1 million as a reward, the highest amount awarded so far In DeFi. Both of these events highlight that DeFi is still in its infancy.

Smart Yield wallets analysis

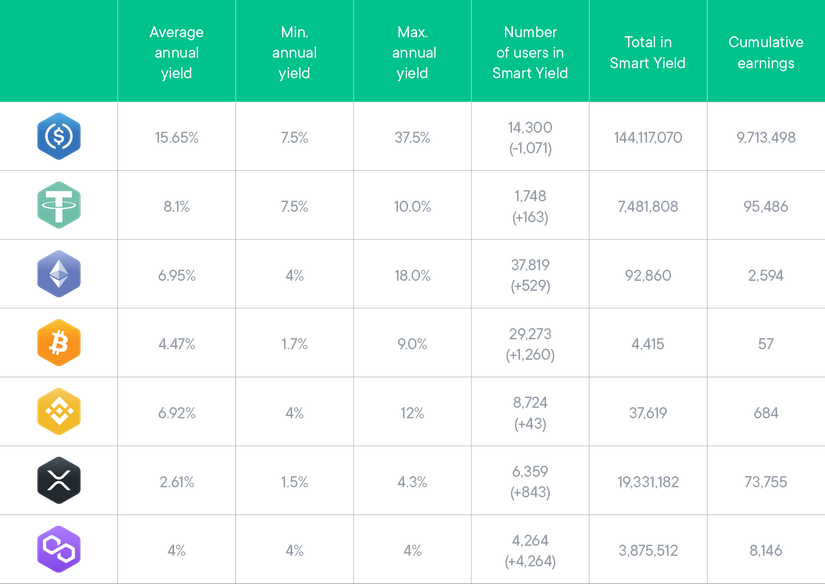

In this new month, a new crypto asset was added to the Smart Yield program: MATIC. MATIC is the native token of Polygon, an Ethereum-compatible blockchain that became very popular early this year for offering a cheap alternative to DeFi platforms. Many users quickly joined the yield wallet, with more than 4,000 users earning a yield on MATIC Smart Yield by the end of the month.

The number of users in the USDC Smart yield continues to decline, with a total of more than 30M USDC being redeemed. This is partly due to the reduction of yield rate as well as more exchanges to other currencies. Despite a growth in the number of users on the BTC and ETH yield wallets, the total amount being yielded stagnated this month. Again, this may be due to the nature of the market and the reducing yield rates.

Strategy optimiser

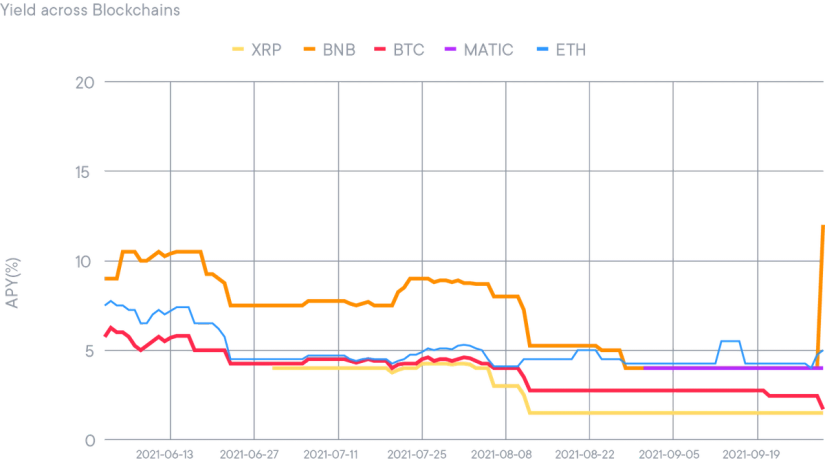

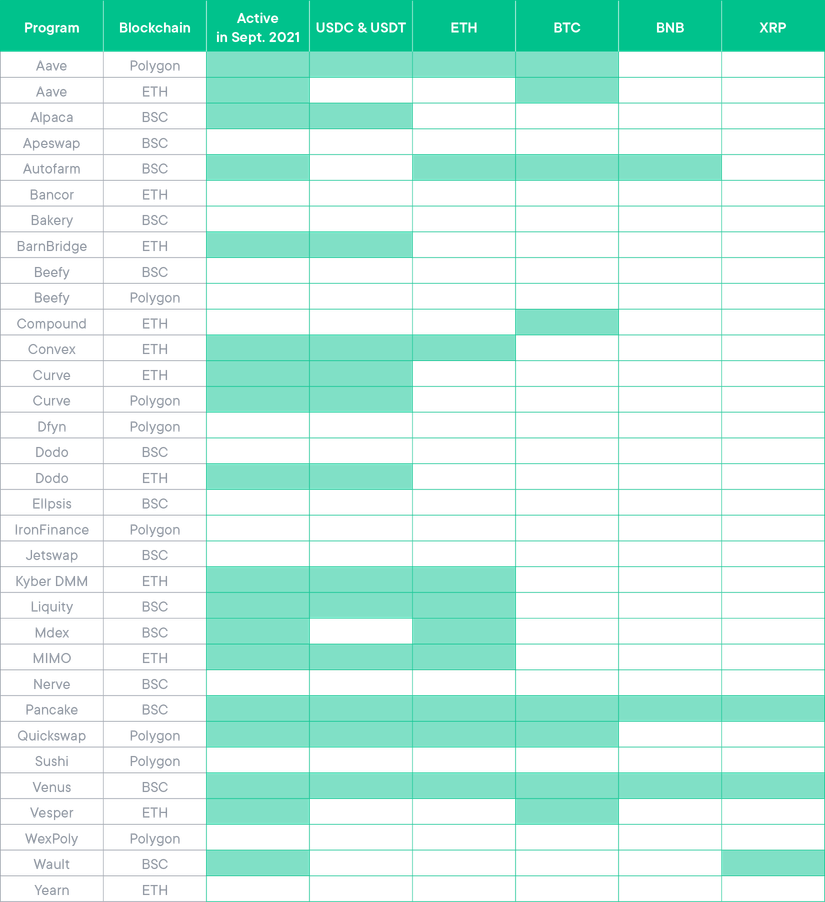

The Smart Yield optimiser increased the exposure to the Polygon chain by joining existing protocols with Polygon. The other allocations were kept similar, no massive change happened on the safe side of DEFI.

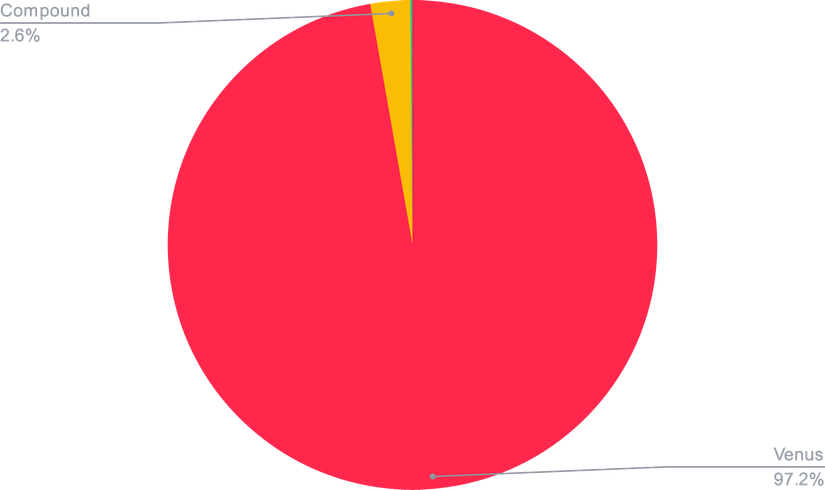

The end of the month was surprising, with BNB suddenly reaching 12%. This was due to an increased demand for lending on Venus.

Safety Net Program

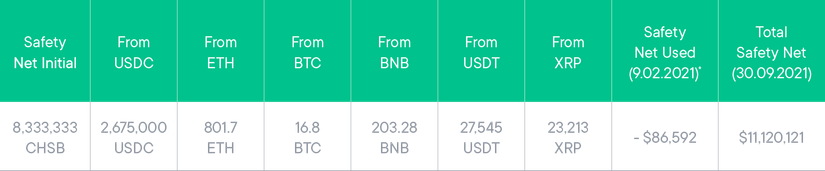

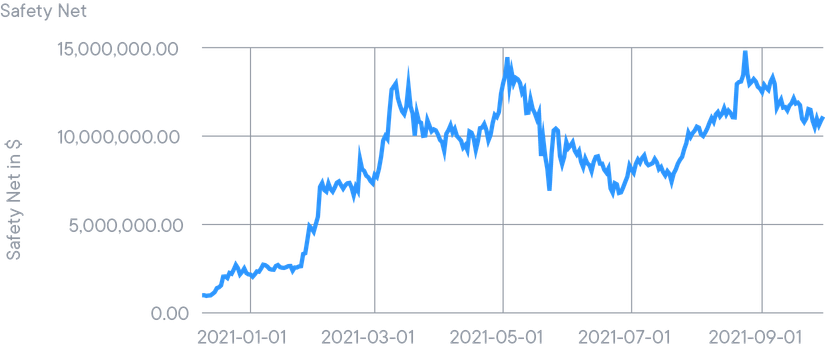

SwissBorg established a USD 1 million Safety Net Program in CHSB (8,333,333 CHSB) to protect against Smart Contract risk, and we have historically put the equivalent of 25% of max yield earnings into that program to ensure it grew alongside our community’s investments.

The Safety Net is a common pot for all Smart Yield wallets and therefore benefits from the yield of all wallets. With the compound growth of the other Smart Yield wallets and the recovery of the market, the Safety Net is above US 10 million at the time of writing, with it’s value fluctuating along with the underlyings prices.

Smart Yield strategy update

At SwissBorg, our goal with the Smart Yield program is to provide the best risk/return ratio, where users would benefit from optimised returns for an acceptable level of risk. During the past nine months, the DeFi space has expanded and evolved at full speed. This evolution is pushing SwissBorg to update our core infrastructure in order to fully optimise and diversify the Smart Yield program. As a result, we are building a highly innovative version of the Smart Yield program and, in the meantime, we are moving towards strategies with the lowest level of risk available in the DeFi space.

This involves updating the Smart Yield strategy in four key ways.

1. Protecting your wealth

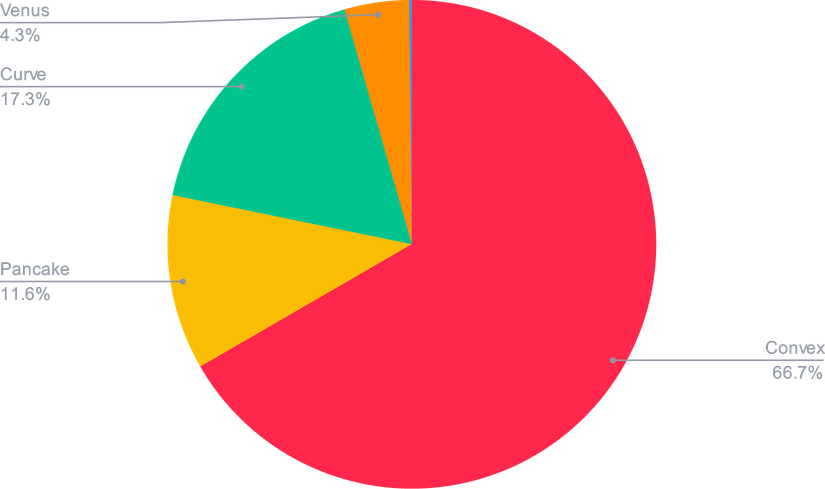

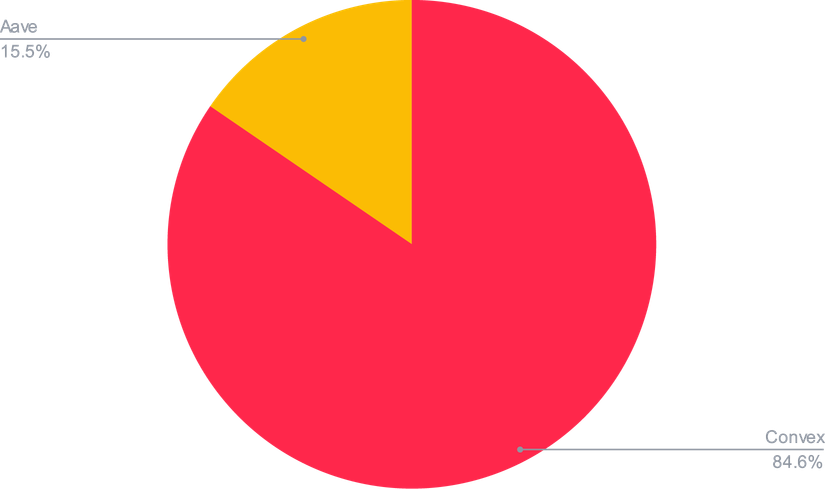

The Smart Yield strategy optimiser will prioritise wealth protection over higher yields. This means the Smart Yield wallets will exclusively deploy funds to the following blue-chip platforms, which prioritise risk management:

- Aave

- Compound

- Curve/Convex

- InstaDapp

- Venus

- PancakeSwap

2. Boosting your yields

After kickstarting the Safety Net Program with $1 million in CHSB, we grew it over time by contributing 25% of maximum yield earnings.

However, because the strategy optimiser will only be deploying funds in the top-rated platforms going forward, there will no longer be the need for a Safety Net Program that makes these continuous contributions. Instead, we will be using the 25% that was originally reserved for the Safety Net to boost your yields, which will take effect from October 7th, 2021!

3. A static Safety Net

While we won’t continue making the 25% contribution towards the Safety Net, we will maintain the existing Safety Net (currently valued at $11 million). (The 20 million CHSB Safety Net for Genesis Premium users will remain unchanged.)

We’re also going to convert the entire Safety Net to CHSB! Currently the Safety Net is composed of the various yield-earning assets in the SwissBorg app (CHSB, USDC, USDT, BTC, ETH, XRP and MATIC). By converting the Safety Net to CHSB, we will be buying back CHSB on the market and putting positive pressure on the price of our token.

Over time, the value of the Safety Net will increase alongside the price of CHSB.

4. More diverse yield offerings

We are also planning to release more options to earn a yield in the SwissBorg app. This will include adding staking to the SwissBorg app, which will give you yet another way to earn a yield. While yield farming doesn’t offer any protection of capital, staking helps diversify the range of strategies available as well as the underlying risk, empowering our users to both protect and grow their wealth.

In the future, once the DeFi ecosystem becomes more mature, the Smart Yield program will consider diversifying into other platforms.