For the sake of transparency towards our community, on a monthly basis, we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report will be subject to change based on your feedback and the evolution of the information we receive. The report has been cleared of overwhelming graphs, and a new table has replaced them.

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, while offering some of the best yielding conditions available in the market. Learn more about how Smart Yield works.

The DeFi landscape

At the beginning of the month, the market was shaken by the US treasury banning the tornado Cash website and wanting to shut down tornado cash. Many events have followed, including major protocols banning addresses that interacted with Tornado Cash and the arrest of some developers. It also raised questions about freedom and anonymity on the internet. The consequences of the “attack” are not over, as some DeFi players are sending “Tornado Cash” ETH to famous holders' addresses to flag them.

The major event that everybody is talking about is the Ethereum Merge, which happened on the 15th September. Ethereum powers most of the smart contracts and other complex structures and products in the crypto world and is undergoing an epochal transformation. In this process, Ethereum switched the way it validates transactions from proof-of-work to proof-of-stake. This allows it to decrease its energy usage and its carbon emissions dramatically.

A fork is already planned; if Ethereum forks (such as a proof of work chain splitting off), the “state” of Ethereum won’t transfer with it. Every stablecoin and DeFi application on the fork is likely to fail immediately. Furthermore, scams will try to benefit from the confusion, and one should be extremely careful about signing transactions on a fork chain, the same private key works on both chains. Make sure your assets are custodied safely on an exchange you trust or a hardware wallet you control.

Curve founder announced the development of a stable coin and its possibility to be launched next month. How will this new contender place itself in the stablecoin race? It definitely comes from a good stable and will make some noise at its start.

Yearn also announced they are cutting management fees on key vaults like ETH, USDC, DAI, and more. The management fee was taken from the full amount (2% per year), while the performance fee is taken from earnings. Their sum often was higher than 22% of earnings, especially in a low-yield environment. This might help the smart yield optimiser to consider Yearn finance once more.

Smart Yield wallets analysis

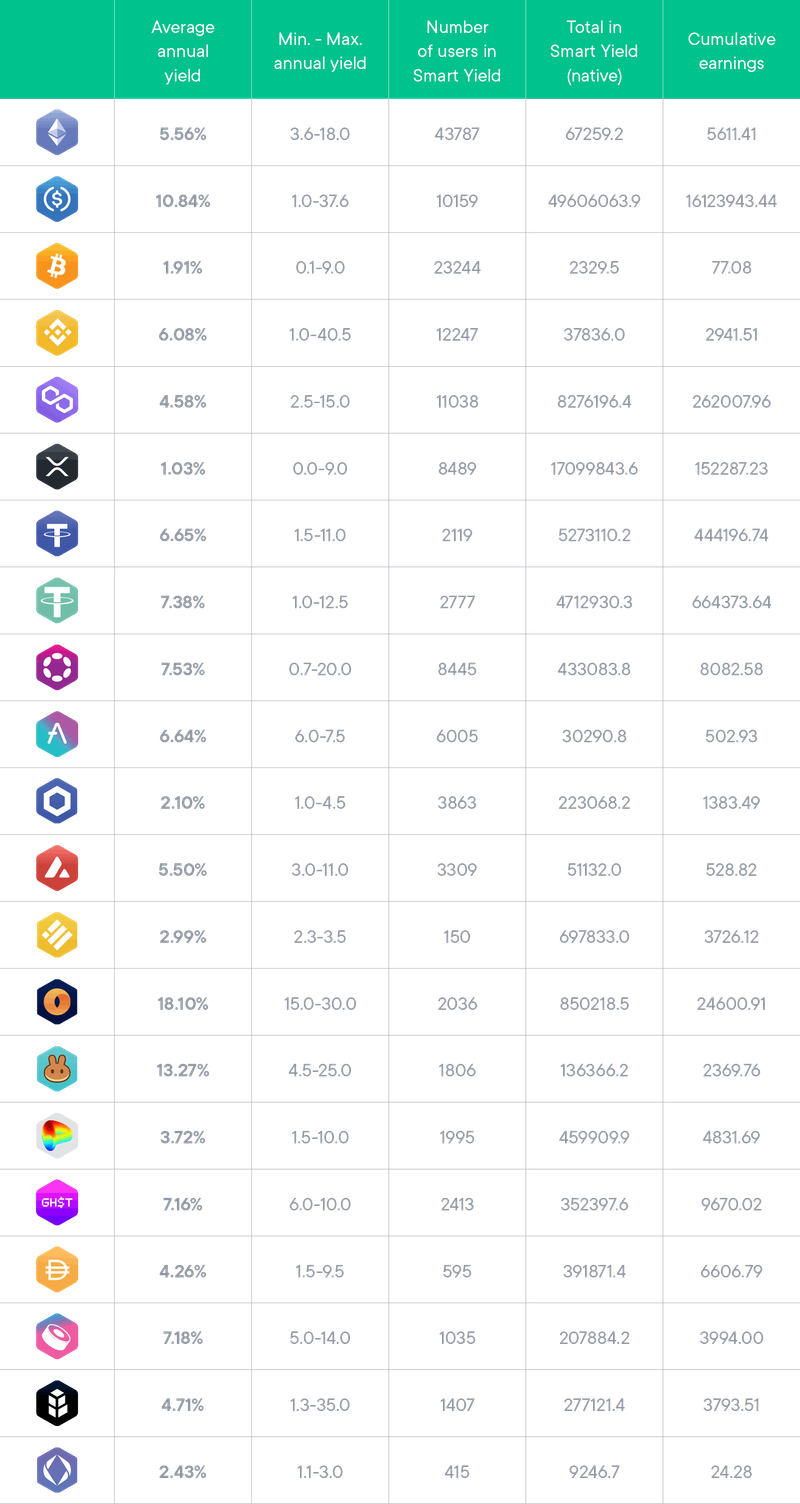

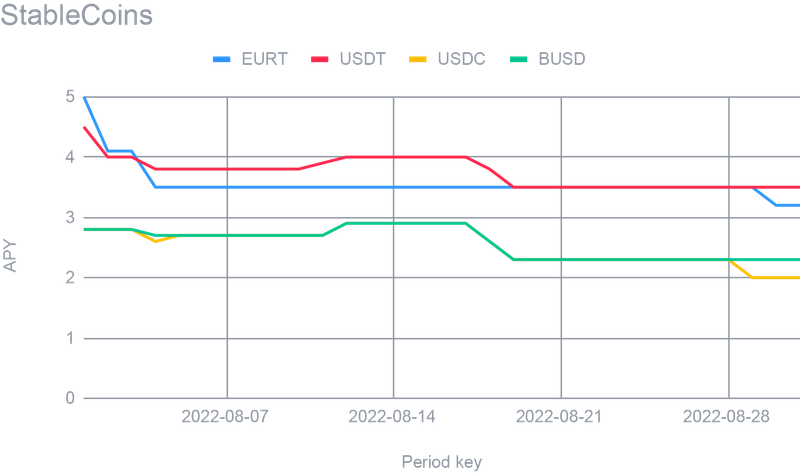

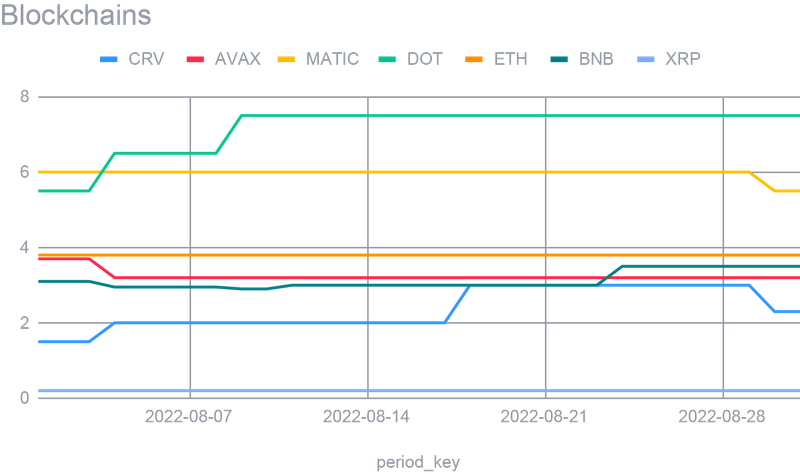

The amount of each wallet has remained stable, with a slight reduction in the USDc yield and an increase in the BTC yield, which is indeed a coin more adopted in uncertain markets. Matic wallet also gained some significant AuM as it became more and more popular throughout this summer. In terms of the native chain tokens, Matic and Polkadot remained the most profitable ones, with the latest reaching first place in APY. As described below, those are among the most secure to generate yield.

Strategy optimiser

The strategy optimiser continues to allocate funds exclusively to blue-chip projects. These are:

- Aave

- Compound

- Curve/Convex

- Lido

- PancakeSwap

- Alpaca

- Beefy

- Mimo

- GotchiVault

- Bancor

- Merit Circle

- Sushi

- Euler

We recall that this selection of protocols always focuses on the less risky strategies out there and therefore may have more conservative APYs. Furthermore, the optimiser only keeps exposure to the underlying asset of the strategy and never spreads it across different assets (for example, by swapping USDc to DAI).

Alpaca protocol has been further used for the USDc and BUSD yield wallets, providing a secure and competitive APY. The smart yield optimiser continues to privilege the most secure sources of yield, which often comes to be staking for the blockchain that offers it. Other relevant protocols are Alpaca, Compound and Aave. Venus has been totally removed from the list since it faced bad debt.