For the sake of transparency towards our community, on a monthly basis we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report will be subject to change based on your feedback and the evolution of the information we receive. The report has been cleared of overwhelming graphs and a new table has replaced them.

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, while offering some of the best yielding conditions available in the market. Learn more about how Smart Yield works.

The DeFi landscape

May was a critical month for the cryptocurrency ecosystem. One of the major stablecoins defaulted along with Luna, a top 10 market cap token. We discussed the death spiral that led to these events on our blog in April. Despite known risks, many had been promoting the safety and benefits of the Terra ecosystem.

The results were dramatic, with millions of dollars lost by many experienced and inexperienced crypto investors, leading to a loss of trust. The public face of the blockchain, Do Kwon, announced a revival plan: a new blockchain where the new Luna token was airdropped to compensate for the loss. Obviously, it was not enough to cover everything that investors lost and the new chain is still struggling to gain confidence.

The fear spreaded so far that some other stablecoins also depegged. USDt had more than 3% depeg, as the old concerns regarding Tether assets rose once more. It also affected staked Ethereum, an asset allowing to earn staking reward on ETH before the merge (and claimable for ETH after the merge).

Smart Yield wallets analysis

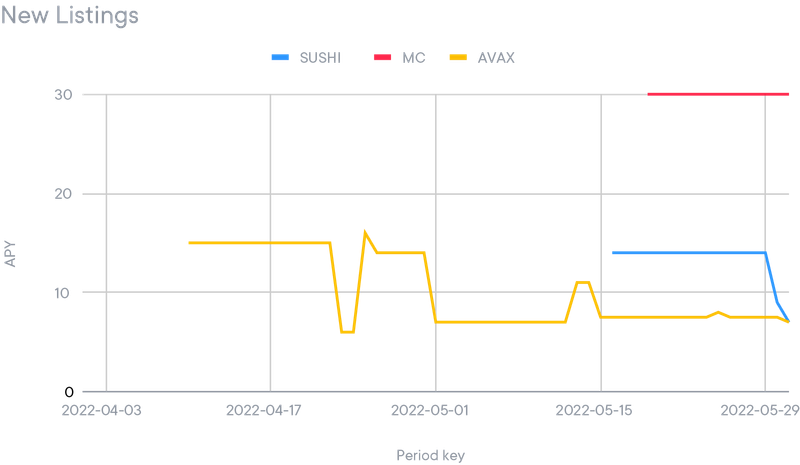

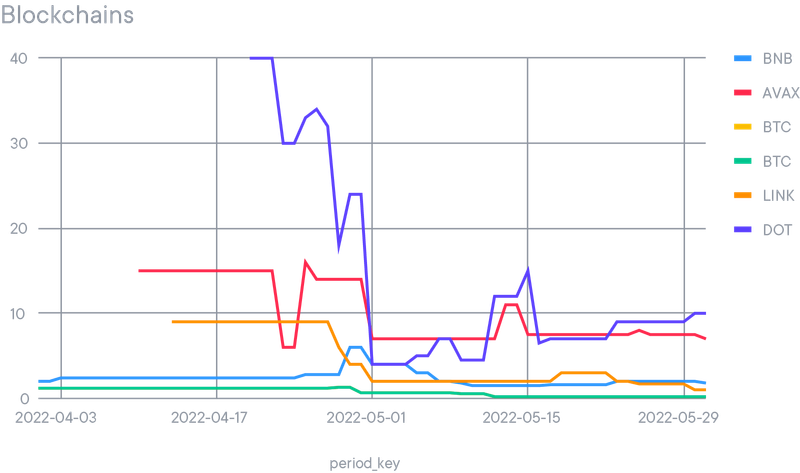

The Terra blackswan event has cast a shadow on all cryptocurrencies, which has been directly noticed on most of the Smart Yield wallets. The total amount pledged has reduced across the wallets as trust in protocols diminished. Interestingly, the number of users using the Smart Yield feature has increased on alt coins (non-BTC, ETH and stables). Those coins have seen higher yield rates than their counterparties.

Strategy optimiser

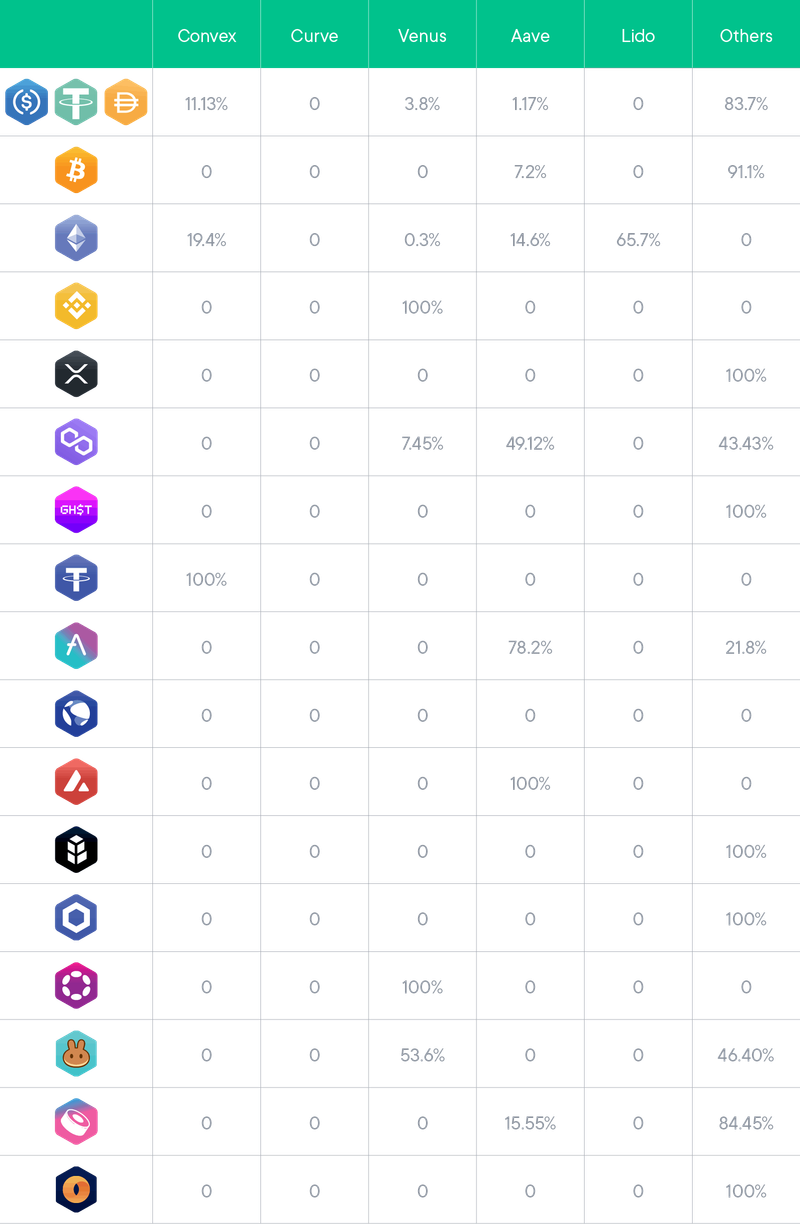

The strategy optimiser continues to allocate funds exclusively to blue-chip projects. These are:

- Aave

- Compound

- Curve/Convex

- Lido

- InstaDapp

- Venus

- PancakeSwap

- Beefy

- Mimo

- GotchiVault

- Bancor

- Merit Circle

- Sushi

We recall that the following selection of protocols always focuses on the less risky strategies out there and therefore may impact the final APY. Furthermore, the optimiser only keeps exposure to the underlying asset of the strategy and never spreads it across different assets (for example by swapping USDc to DAI). Anchor protocol, which was supporting the high yield for UST, was in use in early May but was halted after the death spiral on the Terra blockchain. For this reason, all UST were withdrawn from Anchor, even though the protocol itself never presented any risk for the underlying.