Staking JOE on Trader Joe protocol

Key Takeaways:

- This strategy perfectly fits investors with low risk tolerance.

- Staking in Trader Joe on Avalanche is probably one of the safest ways of getting a yield on JOE.

- The protocol belongs to the top 20 DEXes in terms of TVL and has never been subject to any exploit or hack. Trader Joe is the largest DEX on Avalanche but compared to the Tier 1 exchanges in DeFi it is only a minor player (project continuity risk).

- The strategy is extremely simple. It does not involve any leverage and yield is absolutely sustainable as it is derived from receiving a share of protocol revenue generated.

- The Yield (APY) is composed of the revenues generated by the protocol.

- No data are at disposal to assess the historical behaviour of the JOE staking APY (yield risk).

- The strategy is offering daily liquidity without lockup constraints. Therefore, investors will be able to adjust quickly to any changes in market conditions.

- Risk Checklist: in our view the predominant risks for this strategy are

- Protocol continuity risk

- Yield risk

1. Strategy Explained

The strategy is fairly simple: deposit JOE in Trader Joe on Avalanche and collect the staking rewards.

Lockup period: None. Assets can be redeemed at any time.

2. Strategy Risks

JOE Trust Score

Trader Joe is a decentralised exchange (DEX) on the Avalanche blockchain that offers DeFi services, including swapping, staking and yield farming. The exchange has been growing rapidly, attracting over $4 billion in total value locked (TVL) since it was launched in June 2021.

In October 2021 Trader Joe launched Banker Joe (now rebranded as Trader Joe Lend), a decentralised lending protocol built onto the Trader Joe platform. Trader Joe Lend offers investors the ability to lend or borrow against whitelisted assets, enabling the deployment of flexible DeFi investment strategies on the Avalanche network.

So far the protocol was never subject to any exploit or hack.

SwissBorg trust score for Trade Joe is ‘green’, i.e. the protocol is trustable.

The score value is 7/10.

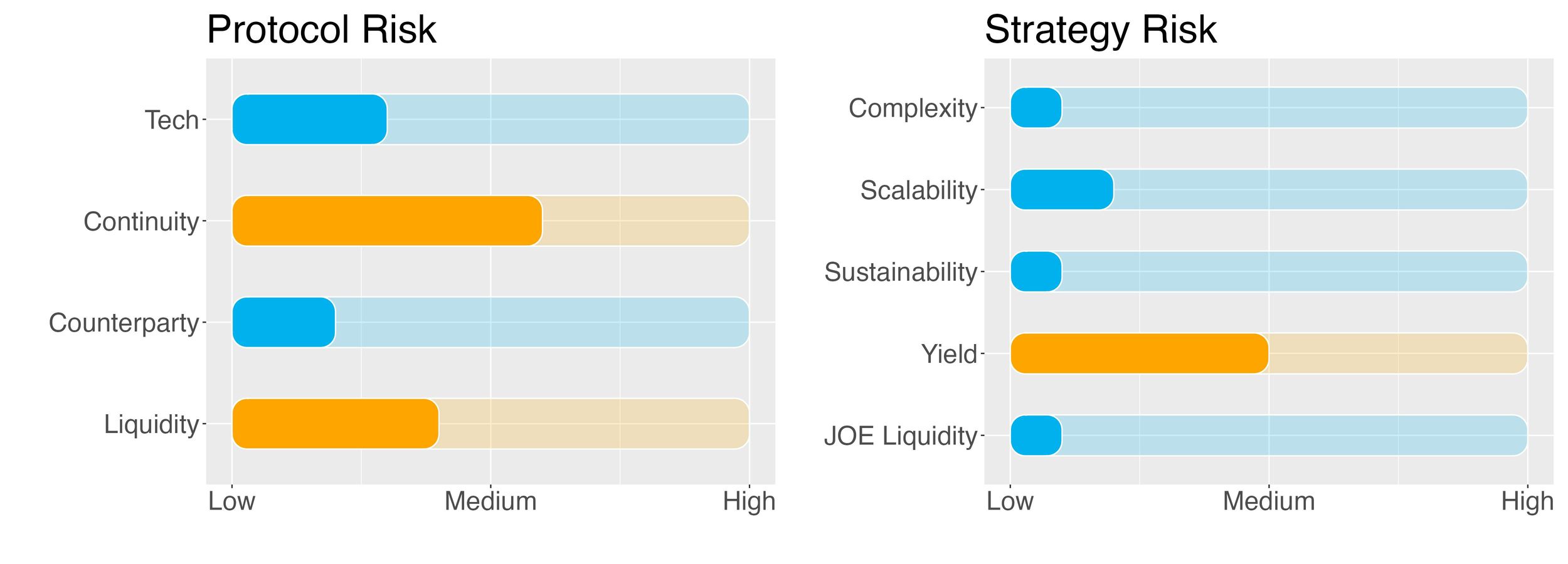

Trader Joe Protocol Risk

Project Continuity Risk

The risk associated with the continuity of the Trader Joe project is deemed medium.

With a TVL of around $54m Trader Joe is the largest dex on the Avalanche network. The difference with the Tier 1 dexes like Curve ($4b TVL) or UniSwap ($3.5b) is however striking.

In terms of valuation the token market capitalization to its TVL is 0.73. It is below 1 which means the protocol could be seen as undervalued. Compared to its peers, this figure is also below the median value of 1.04. Last, the market sentiment score computed from price, volatility and Google trend is 40% (out of 100%).

Project Continuity Risk is 6/10.

Counterparty Risk

Overall Counterparty Risk for Trader Joe is deemed low.

Trader Joe is an automated market maker (AMM). It is fully decentralised and its operations are all regulated by smart contracts. There is hence no counterparty credit risk when providing liquidity to a pool in the protocol.

Counterparty Risk is 2/10.

Liquidity Risk

Liquidity Risk for this protocol is deemed low to medium.

An automated market maker is simply facilitating the exchange of tokens and should not incur in liquidity issues.

On the lending side, the current protocol utilisation rate is 40%. Around ⅓ of deposisted assets are stablecoin (only subject to depeg risk), whereas concentration risk for non-stable tokens is medium (Gini index of 53%, where 100% represents the high concentration risk).

Liquidity Risk is set to 4/10.

Strategy Risk

Complexity

Complexity of strategy is low.

In terms of complexity, the JOE yield strategy on Trader Joe is fairly simple: JOE is staked in the protocol and a yield is received, in part coming from protocol revenues sharing. There is no leverage. Only one token, one protocol and one chain are involved. This strategy hence bears the minimum possible complexity risk.

Complexity of the strategy is 1/10.

Scalability

Scalability risk of the strategy is considered low.

In terms of scalability of the strategy, the JOE staking pool currently displays a total deposits of $24m. This strategy can hence be scaled up with not much risk of diluting the pool and thus pushing down the APY.

Scalability risk of the strategy is 2/10.

Sustainability

Sustainability risk of the strategy is low.

The staking yield comes from participating in the protocol revenue sharing. This form of yield is therefore fully sustainable.

Sustainability risk is 1/10.

Yield Risk

Yield risk is medium.

Yield risk is intended as the volatility of the expected yield on JOE. A time series of historical staking APY is not at our disposal so we conservatively give a medium risk rating.

Yield risk is 5/10.

JOE staking: Liquidity Risk

Liquidity risk for staking JOE is low.

This strategy presents no lockup period and funds can be redeemed at any time.

JOE liquidity risk is 1/10.

3. Conclusions/Recommendations

Staking on Trader Joe on Avalanche is probably one of the safest ways of getting a yield on JOE.

- Protocol is relatively new and small in size, but it is also the principal DEX option on the Avalanche network. No exploit or hack has been experienced so far. Mainly due to the size, the protocol continuity risk receives a medium rating.

- The strategy is extremely simple. It does not involve any leverage and yield is absolutely sustainable as it depends on the protocol trading activity which generates the fees distributed to the JOE stakers.

- The main risk, along with the continuity risk mentioned above, is linked to the volatility of the staking yield, for which no data was at our disposal.

Overall, this strategy perfectly fits investors with low risk tolerance.

Try SwissBorg Earn today!