ETH-wstETH on Balancer

Key Takeaways:

- This strategy fits the profile of an investor who is willing to take on a little risk in exchange for a greater reward.

- The strategy is built on the top of Lido and Balancer protocols by Beefy, a multi-chain decentralised yield optimiser.

- The strategy is is fairly simple but involves some steps: on the Polygoin chain, half of the ETH tokens are swapped into wstETH (wrapped version of Lido staked ETH) and deposited in the Balancer pool to provide liquidity to the wstWTH/ETH pool. All these operations are performed by Beefy. Two tokens and three protocols are involved.

- The Yield (APY) is composed of

- Lido staking on ETH

- Liquidity providing in Balancer for the wstETH/ETH pool

- Protocol incentives - Because of the number of protocols involved smart contract risk is not to be ignored: exploit in one of the protocols would impact the entire strategy (tech risk).

- Around 1/4 of the Annual Percentage Yield (APY) comes from farming/staking rewards. These rewards are subsidised by the protocol and may not be fully sustainable in the future (yield sustainability risk).

- A lockup period of 90 days is present and rewards are paid out at the end of the period (ETH liquidity risk). For this reason, investors will not be able to quickly adjust to any changes of market conditions.

- Staking and LPing are subject to very specific risks, namely slashing and impermanent loss. Lido is a trustable protocol (low slashing risk) and the fact that wstETH is backed 1:1 by staked ETH tokens should ensure that the pair is always trading close to parity (low Impermanent Loss risk).

- Risk Checklist: in our view the predominant risks for this strategy are

- Tech risk

- Sustainability risk

- Complexity risk

- ETH liquidity risk

1. Strategy Explained

The strategy stakes half of the ETH token in Lido Finance in return for stETH, then wrapped into wstETH. Then wstETH and ETH tokens are deposited in a Balancer farm, earning the platform's governance token.

Earned token is swapped for more of the underlying assets in order to acquire more of the same liquidity token. The strategy runs on the Polygon chain.

Lockup period: 90 days.

2. Strategy Risks

Trust Score

Beefy Finance is a decentralised, multichain yield optimiser that allows its users to earn compound interest on their crypto holdings. Beefy aims at earning its users the highest APYs with safety and efficiency in mind. The protocol was launched in October 2020. So far it was not subject to any exploit or hack.

SwissBorg trust score for Beefy is ‘green’, i.e. the protocol is trustable. The score value is 7/10 signalling that this protocol (or better, the smart contract on which the strategy is built on) is safe.

Lido is a liquid staking solution for Ethereum. It allows users to deposit their tokens and take part in the Proof-of-Stake consensus mechanism via delegated staking. Currently, Lido supports the liquid staking of ETH, SOL, MATIC, ETH and KSM. In exchange for the provided tokens, the users receive a staked version, e.g. stETH for ETH. These can be used to earn an additional yield in the DeFi universe. Lido launched its staking app on December 19, 2020 with 1 billion LDO tokens created at genesis.

SwissBorg trust score for Lido is ‘green’, i.e. the protocol is trustable. The score value is 8/10 signalling that Lido is one of the safest options out there.

Balancer is an automated market maker (AMM) running on Ethereum, Polygon and Arbitrum. The protocol was launched in March 2020.

SwissBorg trust score for Balancer is ‘green’, i.e. the protocol is trustable. The score value is 7/10.

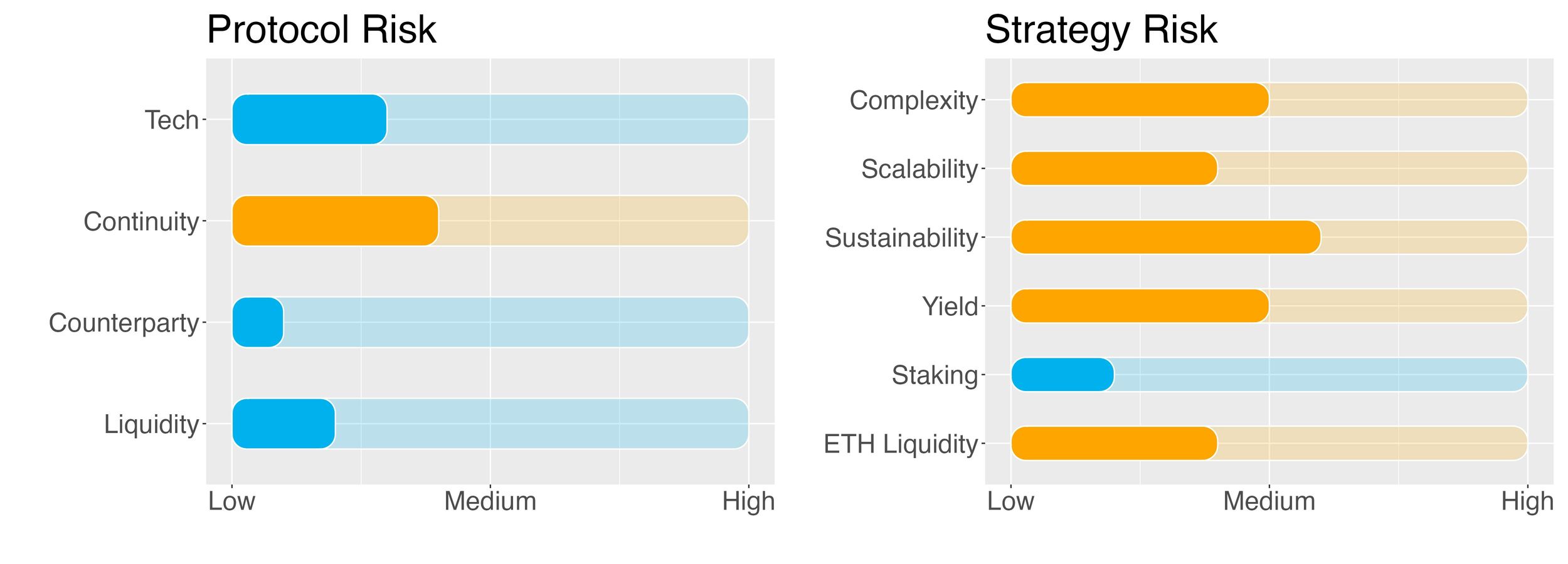

Protocol Risks

Project Continuity Risk

Project continuity risk is medium.

Beefy Finance displays a TVL of around $313m, of which $73m come are locked in the Polygon chain. This puts it in second place in the ‘yield optimiser‘ category in terms of TVL. However, the difference with top DeFi protocols such as AAVE ($4b TVL) or Curve ($5b) is striking.

In terms of valuation the token market capitalisation to its TVL is 0.24. A value below 1 means the protocol could be seen as undervalued. Compared to its peers, this figure is below the median of the yield aggregators which is 0.42.

To assess the sentiment around Beefy we look at its token price and volatility, as well as at the Google Trend for the last 30 and 90 days. Overall sentiment is medium.

Beefy continuity risk is 4/10.

Lido is the leading protocol for liquid staking, displaying a staggering TVL of $8.4b (and a ATH of over $20b). In terms of valuation the token market capitalisation to its TVL is close to 0, in front of a median for the category of 0.16. Overall sentiment is medium.

Lido continuity risk is 2/10.

Balancer is the 13th largest DeFi protocol in terms of TVL with a value of $1.1b (from an ATH of around $3b). Within its ‘DEX’ category, the exchange sits on position 4. Specifically for the Polygon network, Balancer displays a TVL of around $100m.

In terms of valuation the token market capitalisation to its TVL is 0.22, in front of a median for the category of 0.94. Overall sentiment is medium.

Balancer continuity risk is 4/10.

Counterparty Risk

Counterparty risk is deemed low.

Beefy Finance is a yield aggregator, that is, it provides strategies which help aggregate yield from diverse protocols. Because of this, the protocol has no counterparty risk, except for the tech risk assessed above. There are no borrowing/lending facilities or liquidity provisioning. Counterparty risk could be found in the protocols employed by the Beefy strategy: Lido Finance and Balancer.

Lido connects users wanting to stake e.g. ETH with node validators requiring ETH to perform the Proof-of-Stake mechanism. The process is regulated by a smart contact so there is no real counterparty credit risk on the Lido side. For the risk of slashing please refer to the relevant section below.

Balancer is an automated market maker (AMM). It is fully decentralised and its operations are all regulated by smart contracts. There is hence no counterparty credit risk when providing liquidity to a pool in the protocol.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

The strategy can be exited at any time from Beefy (although a 90-day lockup applies). However, an additional step is required, i.e. wstETH needs to be unwrapped and swapped back to ETH using the Curve pool. The stETH/ETH liquidity pool in Curve displays a TVL of around $1.5b so there is plenty of liquidity to perform the conversion.

Liquidity risk is 2/10.

Strategy Risks

Complexity

Complexity of strategy is medium.

The strategy employs one chain (Polygon), 3 protocols (Beefy, which leverages on Lido and Balancer), and two tokens (ETH and wstETH). Because of this the complexity risk of the strategy is deemed medium.

Complexity of the strategy is 5/10.

Scalability

Scalability risk of strategy is low.

Beefy vault liquidity is of around 2,000 ETH (or $3m) and the strategy will be capped at 300 ETH. The risk that the SwissBorg position represents a non-negligible part of this vault is there. However the APY dilution is expected to be limited.

Scalability risk of the strategy is 4/10.

Sustainability

Sustainability risk of strategy is medium.

The strategy generates yield via ETH staking in Lido (i.e. taking part in the Polygon network Proof-of-Stake algorithm) and by providing liquidity to the wstETH/ETH pool in Balancer (i.e. collecting the trading fees).

Part of the Beefy APY is boosted by Lido. Also, most of Balancer APY is subsidised. Because of these incentives the sustainability of the offered APY could not be guaranteed in the long term (obviously, if e.g. Balancer trading volumes were to increase this would change).

Sustainability risk of the strategy is conservatively set to 6/10.

Yield Risk

Yield risk of strategy is medium.

The strategy was launched only a few days ago, on March 7 2023.The starting APY was a staggering 3,200%. The trend since inception is however following a downward trajectory. as more TVL is entering the pool and APY is being diluted.

Thanks to the protocol incentives (see Sustainability risk above) the strategy yield is expected to be floating around the currently observed levels, albeit constantly decreasing.

The yield risk is hence set to medium.

Yield risk of the strategy is 5/10.

Lido Staking Risks

Lido staking risk is deemed low.

The Ethereum blockchain was initially built relying on a Proof-of-Work consensus mechanism, very similar to that of Bitcoin. It has switched on its Proof-of-Stake (PoS) mechanism in 2022 because it is more secure, less energy-intensive, and better for implementing new scaling solutions.

Ethereum PoS enables crypto investors to stake ETH in order to contribute to network security and decentralisation and earn an attractive yield for their staked tokens.

An important risk to be aware when staking ETH of is the possibility of losing your staked assets due to slashing. Slashing is a penalty enforced at the protocol level associated with a network or validator failure.

Liquid staking providers like Lido enable investors to participate indirectly in staking by delegating their tokens to a validator. Validators charge a fee for running a service for delegators. While delegators share rewards with their validators, they also share the risks of slashing. To minimise the risk of slashing, Lido stakes across multiple professional and reputable node operators with heterogeneous setups, with additional mitigation in the form of insurance that is paid from Lido fees.

Slashing risk for the strategy is 2/10.

Balancer LPing Risks

LPing risk is deemed low.

The strategy converts part of the ETH into wstETH in order to enter the Balancer liquidity pool. wstETH may trade lower or higher than unstaked ETH due to demand fluctuation, liquidity issues or technical constraints, exposing you to slippage when entering or exiting an (w)stETH position (see Liquidity Risk above).

In the event of a heavy depeg of wstETH (could be caused by issues with the Lido smart contracts, Lido DAO security and key management, or a slashing event in which staked ETH are lost) both the Balancer and Curve pool would likely be drained out of ETH by users swapping (w)stETH.

In this case the LPer would incur in impermanent loss (IL) since in order to exit the position he will be left with the lower values token.

Additionally, an exploit on the Balancer pool could also put pressure on the peg.

These events are more relevant from a tech point of view and these risks have been covered in the Trust Score section.

In terms of IL it is however unlikely that wstETH price deviates substantially from that of ETH: while one cannot yet unstake stETH from Lido, this is coming in April 2023 with the Shangai fork. There could nonetheless be a liquidity premium attached to the stETH value but this will not likely materially impact the peg.

The risk of providing liquidity is 3/10.

Liquidity Risks of staking

Liquidity Risk on staking ETH is medium.

Liquid staking on Lido plus Balancer farming requires the investor to lock-up their ETH tokens for a period of 90 days. Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

Liquidity risk is therefore set to 6/10.

3. Conclusions/Recommendations

Beefy Finance represents an evolution of DeFI being a decentralised, multi-chain yield optimizer platform that allows its users to earn compound interest on their crypto holdings. This is achieved by implementing multi-protocol strategies on behalf of the investor e.g. by automatically claiming daily rewards and investing them back into the strategy.

In terms of the user process, it’s good and smooth, with a helpful interface and a simple enough process to understand, and this removal of confusion is key in our book. When it comes to the ‘real’ APY, the yield currently provided to users comes from staking and liquidity providing fees, as well as from protocol incentives.

The Beefy strategy in ETH comes with some risks. The investment strategy is fairly simple but yet it requires some understanding of how DeFi operates. It does involve a 90-day locking period and rewards are paid out at the end of the period.

The SwissBorg Risk Team ranks ETH on Beefy as a Satellite investment, one for an investor with a medium understanding of DeFi and yielding, who is willing to take on some risk in exchange for an interesting reward on ETH.

Try the SwissBorg Earn today!