CRV farming in Yearn

Key Takeaways:

- This strategy perfectly fits investors with medium to low risk tolerance

- The strategy is built on the top of Yearn, a yield aggregator protocol

- The strategy is fairly simple but involves some steps: CRV are first exchanged for st-yCRV (Yearn staked CRV) on Yearn in order to start collecting staking rewards. At the end of the lockup period, st-yCRV are converted into yCRV (Yearn locked CRV token) in Yearn and eventually to CRV in Curve to get back the original token (complexity risk).

- The Yield (APY) is derived from:

- Curve admin fees and bribes (i.e. boosted rewards) from staking CRV token - A lockup period of 90 days is present and rewards are paid out at the end of the period. For this reason, investors will not be able to quickly adjust to any changes of market conditions (CRV liquidity risk).

- The ‘hey-days’ of Yearn seem to be long gone. Compared to its main competitors (e.g. Convex), the protocol is suffering in terms of both TVL and token price (continuity risk).

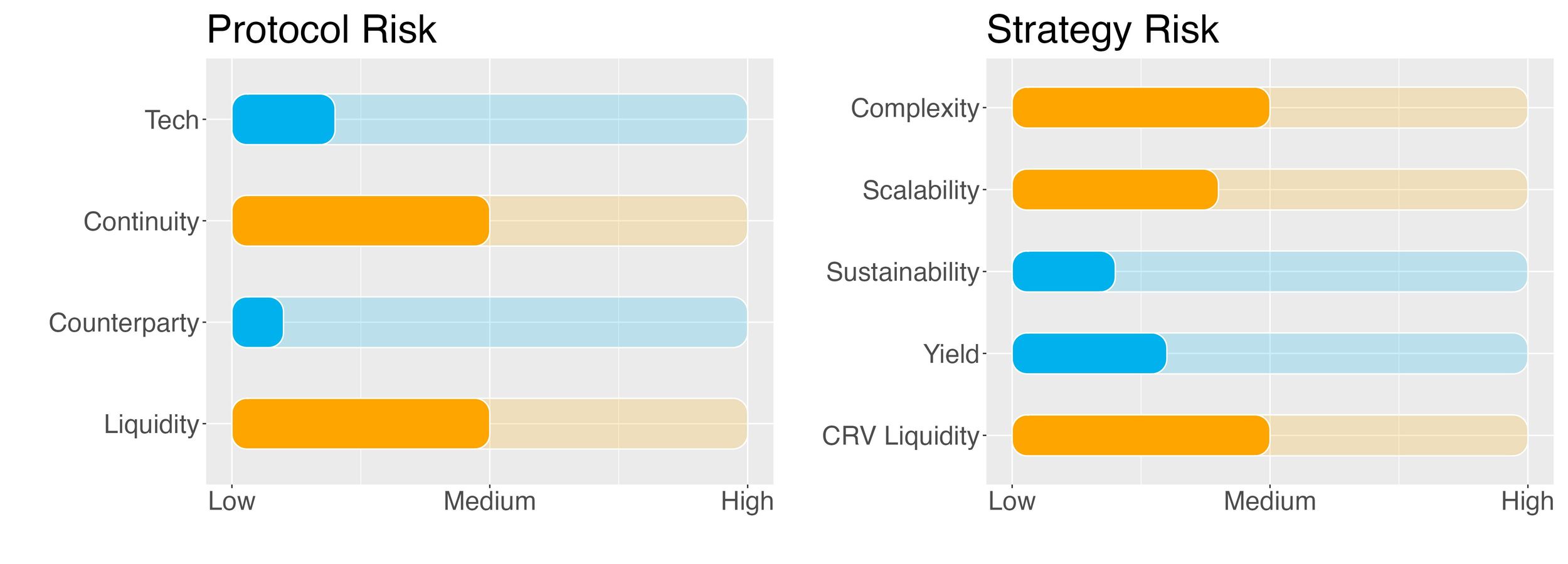

- Risk Checklist: in our view the predominant risks for this strategy are

- Project continuity risk

- Complexity risk

- CRV liquidity risk

1. Strategy Explained

The strategy is fairly simple: CRV are first exchanged for st-yCRV (Yearn staked CRV) on Yearn in order to start collecting staking rewards. At the end of the lockup period, st-yCRV are converted into yCRV (Yearn locked CRV token) in Yearn and eventually to CRV in Curve to get back the original token.

Lockup period: A 90-day lockup period is present.

2. Strategy Risks

Trust Score

Curve is an automated market maker (AMM) that was developed on the Ethereum blockchain and launched in January 2020.

SwissBorg trust score for Curve is ‘green’, i.e. the protocol is trustable.

The score value is 7/10.

Yearn Finance is DeFi’s premier yield aggregator. Giving individuals, DAOs and other protocols a way to deposit digital assets and receive yield. The protocol was launched in February 2020.

Yearn set out to simplify DeFi investment and activities such as yield farming for the broader investor sector. The platform makes use of various bespoke tools to act as an aggregator for DeFi protocols such as Curve, Compound and Aave, bringing those who stake cryptocurrency the highest possible yield.

SwissBorg trust score for Curve is ‘green’, i.e. the protocol is trustable.

The score value is 9/10.

Protocol Risks

Project Continuity Risk

Project continuity risk is medium.

Curve Finance is the 4th largest DeFi protocol in terms of TVL with a value of $4.8b. Within its ‘DEX’ category, the exchange sits on the top. Specifically for the Ethereum network, Curve displays a TVL of $4.5bm. In terms of valuation the token market capitalization to its TVL is 0.16, in front of a median for the category of 0.94. Overall sentiment is medium.

Curve continuity risk is 4/10.

With a TVL of around $440m Yearn is the top DeFi yield aggregator. At its peak, the protocol has a total value of locked coins of around $6b. Compared to Convex, its main competitor in the so-called CRV war, Yearn Finance has shown a significant decline in its TVL. Yearn market cap to TVL is around 0.56, exactly the median of the ‘Yield Aggregator’ category. The overall sentiment is medium. The project continuity risk of Yearn is medium with a negative outlook given the reduction of the protocol’s market share.

Project continuity risk is 5/10.

Counterparty Risk

Counterparty risk is deemed low.

Curve is an automated market maker (AMM). It is fully decentralized and its operations are all regulated by smart contracts. There is no counterparty credit risk when providing liquidity to a pool in the protocol.

Yearn is a DeFi yield aggregator protocol. Similar to Curve, all operations are regulated by smart contracts. There is no economic risk of losing any token since Yearn simply aggregates CRV in order to gain a better voting power on which pool gets boosted rewards, along with the Curve protocol share of admin fees and bribes. There is hence no counterparty risk.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed medium.

The Yearn position can be exited at any time although a 30-day lockup applies. The position is closed by first converting st-yCRV into yCRV (in Yearn, no slippage). Then yCRV needs to be swapped back to CRV (in Curve). Two steps are involved. Moreover, having liquidity in the Curve pool is of paramount importance. The yCRV/CRV liquidity pool currently displays a TVL of around $6.5m so there is plenty of liquidity to perform the conversion.

This could however not always be the case: there could be situations negatively impacting the perceived risk around Yearn and its tokens, e.g. after a security breach (see Trust Score above). In this case, the most likely outcome would be a large imbalance in the yCRV/CRV pool on Curve. While the swap is theoretically always possible, a large slippage would be incurred when converting yCRV to CRV. This could materially affect the final APY of the strategy.

Liquidity risk is 5/10.

Strategy Risks

Complexity

Complexity of strategy is medium.

The strategy involves three tokens (CRV, st-yCRV and yCRV), two protocols (Curve and Yearn), one chain (Ethereum) and no leverage.

Complexity of the strategy is 5/10.

Scalability

Scalability risk of strategy is medium to low.

The strategy is capped at 500k CRV and the Curve pool currently displays over 2m CRV liquidity. The swapping in Curve between yCRV and CRV could incur in some slippage but overall this is not expected to affect the projected APY (expected price impact is around 0.5% at the time of writing).

Scalability risk of the strategy is 4/10.

Sustainability

Sustainability risk of strategy is low.

The APY comes from staking the CRV tokens in Yearn in order to gain boosted rewards from Curve protocol as part of the protocol revenues sharing program. This APY is completely sustainable albeit it obviously depends on the trading activity in Curve.

Sustainability risk of the strategy is 2/10.

Yield Risk

Yield risk of strategy is low.

Yield on yCRV has been ranging within the 35% - 70% APY. Yield increase and decrease has been historically smooth so while the expected return on the investment might change over time, there is only marginal risk of abrupt changes.

Yield risk of the strategy is 3/10.

CRV Liquidity Risk

This strategy requires the investor to lock-up their CRV tokens for a period of 90 days. Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

Liquidity risk is therefore set to 5/10.

3. Conclusions/Recommendations

Yearn represents an evolution of DeFI being a decentralized yield aggregator platform that allows its users to earn passive income by depositing digital assets and receiving yield. In our case, this is achieved by obtaining a boosted yield when locking CRV tokens in Curve Finance's vesting escrow.

When it comes to the ‘real’ APY, the yield currently provided to users comes from Curve admin fees and bribes.

This strategy on CRV comes with some risks. The investment strategy is fairly simple but yet it requires some understanding of how DeFi operates. It does involve a 90-day locking period and rewards are paid out at the end of this period.

The SwissBorg Risk Team ranks CRV on Yearn as a Satellite investment, one for an investor with a medium understanding of DeFi and yielding, who is willing to take on some risk in exchange for an interesting reward on CRV.

Try the SwissBorg Earn today!