Liquidity providing to BTC miners via Block Green

Key Takeaways

This strategy perfectly fits the appetite of investors with some risk tolerance.

- The strategy involves providing BTC denominated liquidity to Crusoe Energy (a US-based private mining company) in exchange for a share of future mining revenues (also BTC denominated).

- Two centralised parties are involved in this strategy: Crusoe Energy, the miner, and Block Green, the intermediary (counterparty risk).

- The final APY depends on the ability of Crusoe Energy to mine bitcoins. A minimum (and maximum) APY is however guaranteed (yield risk).

- Deposited tokens are locked until the redemption date (liquidity risk).

- Bitcoin regulation could affect the miner’s operation and thus the continuity of the strategy.

- The Yield (APY) is composed of Bitcoin mining activities.

- Risk Checklist: in our view, the predominant risks for this strategy are:

- Counterparty risk

- Liquidity risk of providing BTC liquidity

- Regulatory risk

1. Strategy explained

The strategy involves providing BTC denominated liquidity to a bitcoin miner (Crusoe Energy) for a specific period of time, and in return receiving revenues from the mining activity (also BTC denominated). At the end of the contract period, the BTC is returned to the liquidity provider.

The investment APY depends on the ability of the miner to generate BTC via its mining activities. Per contract, this is floored at a level (i.e. minimum return is guaranteed) and capped (if APY exceeds a threshold, the additional part is kept by the miner).

The investment is facilitated by leveraging on the platform built by Block Green.

Block Green is a liquidity protocol centred around Bitcoin. Block Green allows Bitcoin mining operations to access fair and transparent liquidity via dedicated financial solutions on-chain.

Miners will be able to use their live hashrate and its forecasted future Bitcoin revenue in order to access immediate liquidity, which is needed in order to expand and improve their mining operations. This is possible thanks to the presence of liquidity providers (i.e. Bitcoin holders) who in turn expose their assets and receive bitcoin rewards.

Block Green aims at unlocking on-chain liquidity for miners with sustainability in mind and supporting cross-chain financing mechanisms

Block Green allows Bitcoin miners to use their future Bitcoin production as collateral by borrowing against their hash power. In practice, it sits in between Bitcoin miners seeking better financing and Bitcoin holders, seeking to receive a better APY on their Bitcoin holdings.

How it works in practice

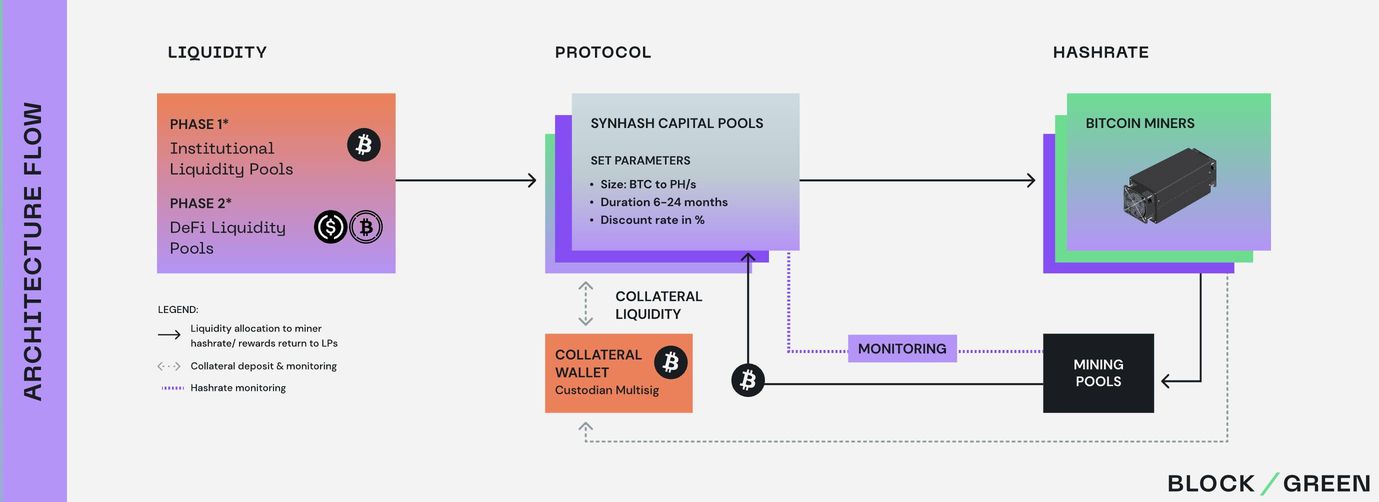

- The BTC holder (i.e. the liquidity provider) deploys the BTC assets to a so-called ‘SynHash’ pool. This is a dedicated pool with predetermined parameters for capital size, duration and discount rate.

- The miner transfers the bitcoin collateral to the multisig collateral wallet. At least 30% of collateral must be on-chain.

- The miner redirects the hashrate to the Block Green accounts paying out rewards to the capital pool.

Payments are paid out daily via rewards to the Reward Pool.

Block Green monitors the daily hashrate and adjusts for hashrate deviations. - At maturity, BTC are returned to the liquidity provider.

Risk appetite and expected APY

As mentioned above, at least 30% of collateral from received BTC must be posted on-chain on a multisig wallet. This means, 70% of the collateral is not on-chain and in the event of default the miners need to be attacked.

To improve the risk profile of the strategy, Block Greens is willing to step in and propose and fully collateralised deal:

- While the miner still needs to post at least 30% of on-chain collateral, Block Green will post the remaining part (70%) so that all collateral is on-chain on a multisig wallet.

Obviously, Block Green will receive part of the miner’s generated hashrate in exchange for providing an additional layer of protection.

The final expected APY of this strategy is floored at 5%.

2. Risks and Rewards

Counterparty Credit Risk

Counterparty Credit Risk is set to medium to low.

Crusoe Energy

Crusoe Energy is a Colorado based company, founded in 2018. The firm has pioneered infrastructure that taps into stranded energy — methane being flared or excess production from clean and renewable sources — to power computing-intensive resources and reduce the environmental impact.

The company operates around 100 modular data centres powered by otherwise wasted and flared natural gas throughout North Dakota, Montana, Wyoming, Colorado, Texas and New Mexico.

Block Green assesses each miner using a proprietary risk scoring model. In particular, they look at operational KPIs like energy costs, power source, average ASIC up-time; and financial KPIs like self-mining revenues, mining gross profit margins, marginal and total production cost per BTC.

Block Green rates Crusoe Energy AAA, i.e. it considers it a company with extremely strong capacity to meet its financial commitments. Among the strength of its operations is the fact that it disposes of cheap energy for mining generated via flare gas. The marginal production cost per BTC is just below $9k so the company operations would stay profitable as long as BTC is above this level.

Block Green

Block Green was founded in December 2021. In September 2022 the company raised $3.7m in a seed funding round led by Founders Fund, with participation from Coinbase Ventures, Blizzard and Dao5. The fund will be used to develop the protocol further and build out its team.

Overall risks

The main risk that this strategy faces is obviously the event that the miner fails in his obligation to deliver the expected APY or even to return back the received.

In addition to that, also the counterparty risk of dealing with Block Green needs to be accounted for. Block Green represents the gate to the BTC miner and it is in charge of the return stream on the provided liquidity.

In case of a credit event on the miner side, at least 30% of the collateral is stored on-chain and would become immediately available to the investors.

For the remaining 70% collateral, this needs to be seized and sold on the market in order to recover the initially provided liquidity. This off-chain collateral comprises physical assets such as mining equipment, power generators, company properties as well as cash or BTC reserves.

In addition, the liquidity provider can choose to pursue legal action against the miner to recoup any balance remaining.

The deal is however structured in a way that Block Green will be the sole creditor in the event of the miner defaulting on its obligations. As mentioned above, Block Green will post on-chain the remaining 70% of collateral. The strategy can be therefore seen as fully collateralised on-chain.

While this transfers the counterparty credit risk from the miner to Block Green, the fact that the collateral has been posted on-chain and its usage is regulated via a multisig wallet in practice should erase the risk of loss.

This process (and also the original setup with 30% on-chain collateral) introduces an additional risk: key management. It is true that the collateral is posted and visible on-chain. But in the event of default, investors need to rely on a multisig from three counterparties (Crusoe Energy, Block Green and SwissBorg) in order to have the collateral released. Key mismanagement or loss of keys could affect the ability to free the collateral.

The strategy involves fully on-chain collateralization and this reduces the counterparty credit risk. However, since the availability of the collateral depends on a multisig wallet, access to the funds could be lost in case of key mismanagement. We therefore take a conservative approach and set the counterparty credit risk to medium.

Counterparty risk is set to 5/10.

Regulatory Risk

Regulatory risk is medium to low.

Regulatory risk is the risk that a change in laws and regulations will materially impact a security, business, sector, or market. A change in laws or regulations made by the government or a regulatory body can increase the costs of operating a business, reduce the attractiveness of an investment, or change the competitive landscape in a given business sector. In extreme cases, such changes can destroy a company's business model.

Crusoe Energy is based in the USA with mining operations in various states. The company makes use of excess natural gas derived from oil drilling operations (known as ‘flare gas’) which would be otherwise burnt. This approach solves critical regulatory and environmental challenges for oil and gas companies by achieving beneficial use, reducing flaring and reducing emissions.

Crusoe Energy offers an alternative to coal-powered mining operations and the construction of new renewable capacity that wouldn’t be used to service the grid. As cryptocurrencies look for a way to blunt criticism about the energy usage involved in their creation and distribution, Crusoe could be an elegant solution.

Regulatory risk within the Bitcoin mining industry is not to be ignored. The state of New York for example this year imposed a ban on some cryptocurrency mining that runs on fossil fuel-generated power. Other states are expected to follow suit.

The industry also faces new federal regulations, including a proposed 30% tax on electricity usage for digital mining and calls by the U.S. Treasury secretary and commodities regulator for a regulatory framework.

Crusoe Energy however has an environmentally friendly approach to mining and should therefore not be impacted by these regulatory issues.

Regulatory risk is set to 3/10.

Jurisdictional Risk

The jurisdictional risk is deemed low.

In the event of a default, the jurisdiction of the miner plays an important role in determining the recourse on the collateral.

Jurisdiction risk is any additional risk that arises from borrowing and lending or doing business in a foreign country. This risk can also refer to times when laws unexpectedly change in an area in which an investor has exposure. This type of jurisdiction risk can often lead to added price volatility. As a result, the added risk from volatility means investors will demand higher returns to offset the higher levels of risk being faced.

Some of the risks associated with jurisdiction risk that investors and companies may face include legal complications, exchange rate risks, and even geopolitical risks.

Crusoe Energy is based in the USA. Block Green is located in Switzerland.

The jurisdictional risk is set to 2/10.

Tech Risk

Tech risk is deemed low.

Since the revenue stream is fully collateralized on-chain via a multisig wallet, the main risk here is related to the event of a hack or key mismanagement (see Counterparty Credit Risk above for the implication of issues with the multisig).

Tech risk is set to 2/10.

BTC Liquidity Risk

Liquidity Risk on BTC is medium.

The strategy requires the investor to lock-up their BTC tokens for a period of 3 months. Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

Liquidity risk is therefore set to 5/10.

Yield Risk

Yield risk is deemed low.

Per contractual agreement, the received BTC rewards from the mining operations is floored at a fixed level (and it is also capped at a fixed level). That is, a minimum APY should always be guaranteed.

Yield risk is set to 2/10.

Worst-case scenarios

To help the investors assess the risks of this strategy we’ve tried to identify the negative scenarios that the strategy could face:

- Crusoe Energy goes bankrupt. In this case, the on-chain collateral will be released and sent back to the investors. Future yield on BTC mining activities will be lost.

- Block Green goes bankrupt. As it represents the main point of contact with the miner and collateral guarantor of the collateral, the strategy will likely be terminated (since the remaining 70% collateral could be needed by Block Green. As per the situation above, expected future yield on BTC will also have to be foregone.

- The multisig wallet where the collateral is stored is hacked. In that case, the deal is no longer fully collateralized on-chain.

3. Conclusion

The proposed strategy involves providing BTC denominated liquidity to a bitcoin miner (Crusoe Energy) for a specific period of time, and in return receiving revenues from the mining activity (also BTC denominated). At the end of the contract period, the BTC is returned to the liquidity provider.

This BTC strategy comes with some risks. The investment strategy is fairly simple but yet it requires some understanding of how BTC mining works.

And importantly, this is not a pure DeFi strategy. It does involve centralised counterparties but the deal is fully collateralized on-chain.

It does require a locking period of 3 months and rewards (along with the initial capital) are paid out only at maturity.

The SwissBorg Risk team ranks the BTC Block Green strategy as a Satellite investment, one for an investor with a medium understanding of the bitcoin mining industry who is willing to take a very acceptable risk in exchange for a very attractive reward on BTC.

Try the SwissBorg Earn today!