SwissBorg's Alpha Early Deals: Unlocking the Future of Blockchain, SocialFi and Web 3.0 Opportunities

Jami Sabety-Javid

Senior Growth Marketing Manager

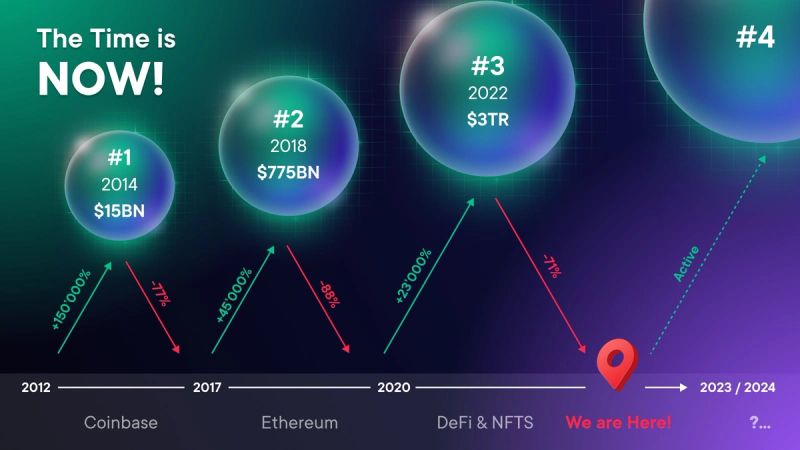

Just like the seasons come and go, the market moves in the rhythm of cycles. Rhythms are a fundamental aspect of the human experience. We experience the rhythms of day and night, the summer's heat and the winter's cold.

While investors would undoubtedly benefit from foresight, the future still remains elusive. However, we understand that economies and markets oscillate in patterns known as cycles. Approaching the market means thinking probabilistically, focusing on likelihoods rather than certainties. As the blockchain industry evolves, the rhythm of the cycles becomes more evident.

As Howards Marks, the CEO of Oaktree Capital hedge fund, describes in his book “Mastering the Market Cycle”, evaluating the current market state is fundamental to developing a sense of where we stand in the cycle and, thus, whether it’s time to build more aggressiveness or more defensiveness into one’s portfolio.

At SwissBorg, the Investment team believes that we are on track to transition from “Crypto Spring” to “Crypto Summer” in other terms, we are going to observe the transition from the current “recovery” market to the next Bull market in the next six to twelve months.

Using basic regression analyses on historical cycle trends, we project that the Total Market Capitalization of the crypto market could surpass $8 trillion in the next cycle, with Ethereum potentially breaching the $10K mark and BTC surpassing $100K.

All in all, it’s clear that the landscape of crypto adoption is heading in a very positive direction, primarily driven by:

- Investment opportunities: amplified by concerns over monetary debasement but also pure asymmetry in return explained by the “early days” of the technology (you are still early!).

- Innovation: tokens as a new means to bootstrap network effect and the emergence of a new business model where users become stakeholders.

- Infrastructure: payment, DEPIN, specifically in the context of recent advancements in Artificial Intelligence (AI).

The big question remains: which sector(s) will usher in a Bitcoin uptrend and lead the alt-coin movement?

In 2021, we identified the power of the blockchain for gaming and were quick to see XBorg through to fruition. Through this process, we both exposed the SwissBorg app to new audiences and solved aching gaps for gamers, and it resulted in a win-win situation for all.

A year later, XBorg’s seed-round vault sold-out in minutes, largely from being powered by SwissBorg’s Investment teams Alpha Early Deals solution.

Today, and ahead of the next market upswing, we have identified SocialFi, GameFi, AIFi & infrastructure as our favourite alt-coin thematics with the most scalability potential.

In this article, we delve into SocialFi, not only as a promising investment avenue but also as a pivotal shift for humanity's future. Tracing its historical roots and evolution, we offer insights into its significance.

Moreover, regardless of your investment background, we present a user-friendly unique opportunity to join this transformative wave early on, thanks to SwissBorg’s upcoming Early Deals solution with Phaver.

SwissBorg Alpha Early Deals

SwissBorg’s Early Deals is a solution where everyday people, like you and me, can engage in opportunities previously exclusive to elite investors. This is not just about levelling the financial playing field but also about fostering a more inclusive future for technology.

By moving beyond the constraints of Web 2.0 tech giants, we can create a more collaborative and less capital-centric digital landscape. Everyone should have the ability to not only own a piece of their future but also have full ownership of their digital footprint and actively participate in the democratisation of ownership powered by Web 3.0.

SwissBorg Early Deals offers a portal to dynamic investment opportunities. While these early-stage deals carry inherent risks (please note: early deals can be highly risky), they also invite you to be more than a passive observer.

Discover the Phaver app now!

SocialFi: The Story

Before diving into what’s next for the Early Deals, let’s start with a moment to visualise this analogy for some context.

It's Saturday morning, and you're feeling that artistic surge within you. You stroll over to your favourite boutique to pick up some paint. In the afternoon, after a refreshing yoga session, you channel your creativity into painting a magnificent work of art.

Years fly by, and an old friend, now an art collector, comes to stay for the weekend. As you give him a tour of your apartment, he stops dead in his tracks in front of your painting. He's completely spellbound by the mesmerising beauty before him. Without a second thought, he offers to buy the piece and promptly transfers $50,000 to you.

When you check the payment link, you realise that the funds were mistakenly sent to the boutique where you purchased your paint. How do you feel now?

Here's the twist: By purchasing the paint from that boutique, you inadvertently signed away your rights to the art you created. Buried within the payment process was a tiny checkbox linking to pages upon pages of legal terms and conditions, which stated that any artwork made with that paint would ultimately belong to the shop.

This tale may sound fanciful, but it mirrors our daily reality. When you buy a device like "Alexa", while you do get the benefit of its features, you're also giving away something precious: your data. This data becomes a major revenue stream for the companies.

Now we ask, who would you pick as your flatmate, Pablo or Jeff?

Our journey to SocialFi seeks to amplify the reality of how Web 3.0 will shape the future of preserving what rightfully belongs to you.

SocialFi: The Driver

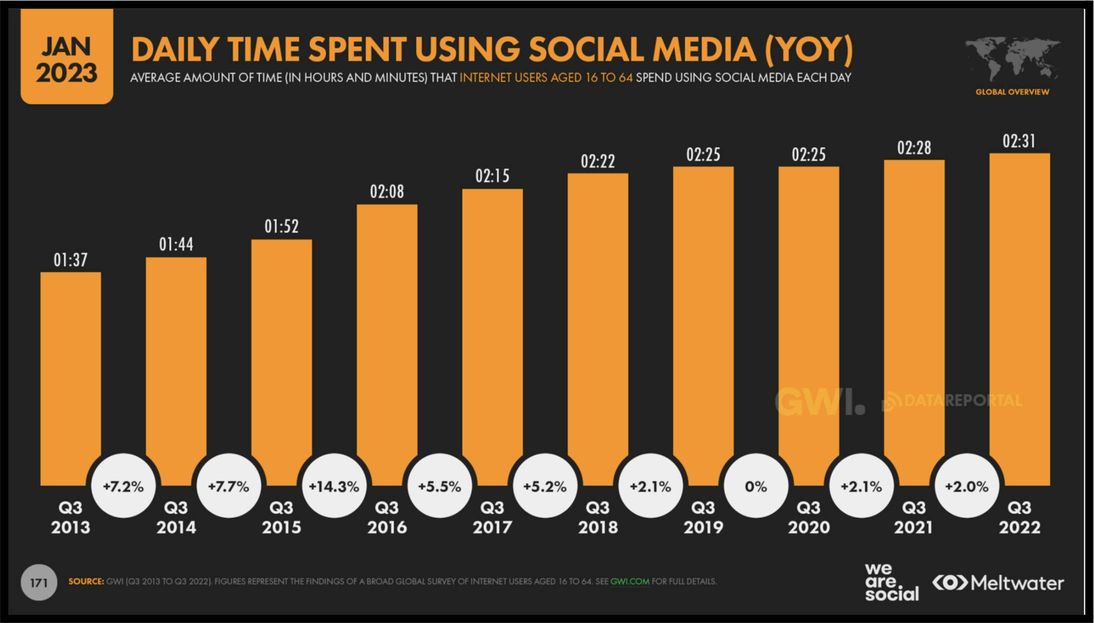

4.9 billion people, more than half the global population, use social media and on average, people create 7 different social media profiles throughout their digital journey.

The success of social media is undeniable, as many platforms have grown to become more populated than some of our biggest nations. However, its downfalls are becoming more apparent to us and more urgent than ever to resolve.

Jaron Lanier, the visionary who coined “virtual reality” and industry pioneer, delves into the issues plaguing Web 2.0's social media landscape in his book, “Ten Arguments for Deleting Your Social Media Accounts.

“Something entirely new is happening in the world. Just in the last five or ten years, nearly everyone started to carry a little device called a smartphone on their person all the time that's suitable for algorithmic behaviour modification. A lot of us are also using related devices called smart speakers on our kitchen counters or in our car dashboards. We're being tracked and measured constantly and receiving engineered feedback all the time. We're being hypnotised little by little by technicians we can't see for purposes we don't know. We're all lab animals now.” - Jaron Lanier

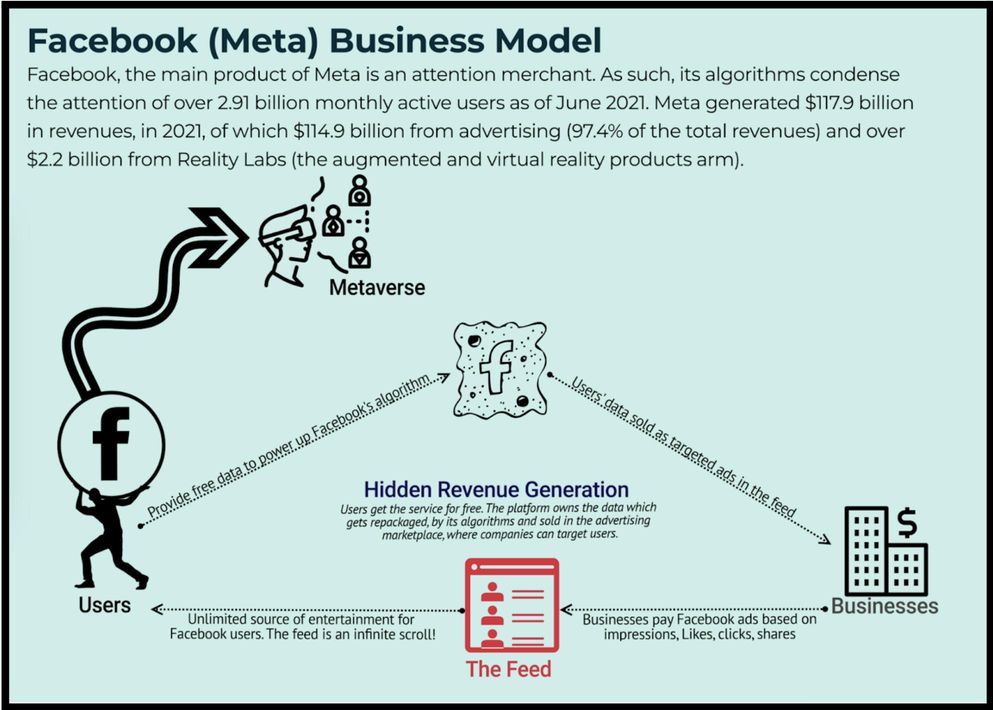

In a study about how Facebook makes money, it’s noted that “Meta managed to increase substantially its revenues in 2021, primarily thanks to the number of ads delivered, which increased by 10% (compared to approximately 34% in 2020).

The primary ad revenue driver was the price per ad increase of 24% in 2021 (compared to a 5% decrease in 2020). This metric is extremely important as it shows that Facebook is squeezing users’ attention to drive up revenues.”

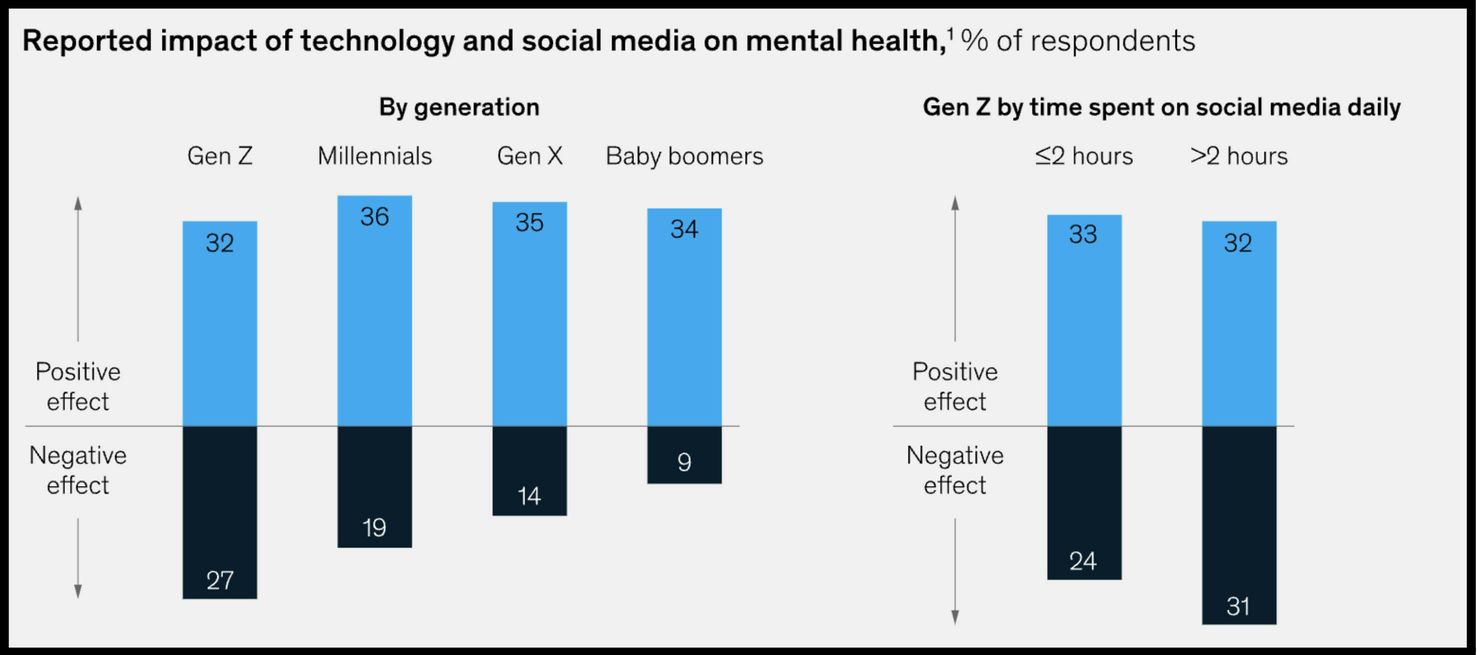

According to Mckinsey, “studies of young adults and their social media use have shown an inverse relationship between screen time and psychological well-being, with higher utilisation associated with poorer well-being.”

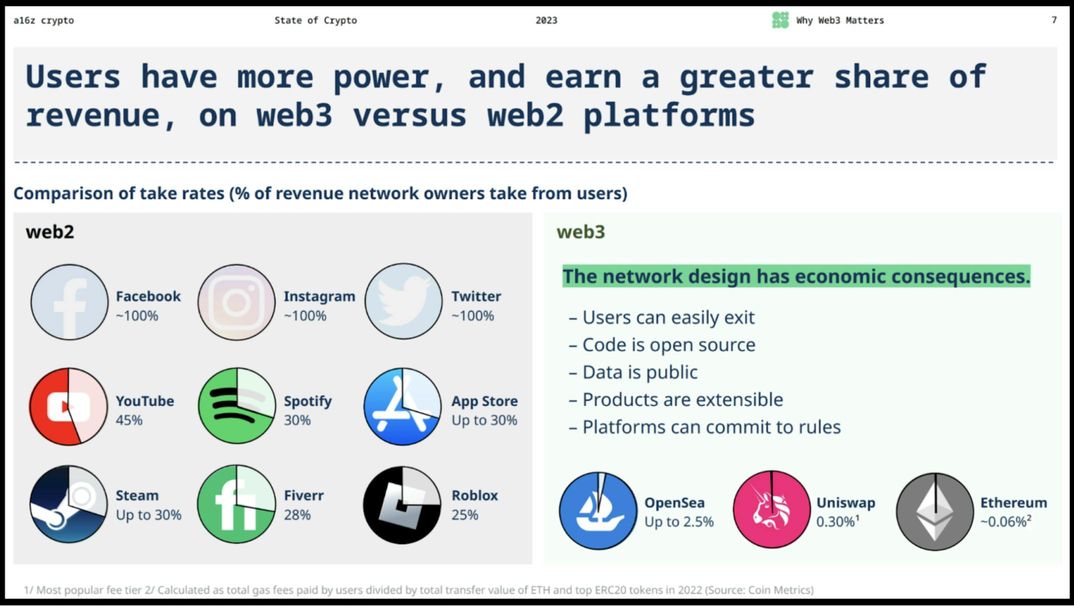

The problem isn't technology itself, but rather the underlying business model. Attention has been commodified by social media platforms, shaped by algorithms, and traded within the realm of “Surveillance Capitalism.”

In the Web 2.0 landscape, we've reached a "too big to fail'' predicament for social media. As a solution, we shouldn't merely rely on human willpower to instigate change. Instead, we should reenvision social media from the ground up, embedding a human-centric approach into its very own technological framework.

This narrative is being made possible by the technology and culture of Web 3.0, and this is why we are excited for the future of SocialFi; not only does it uphold enormous investment potential, but also it can be seen as a necessity for the preservation of our very human nature.

At SwissBorg, we believe in creating a world where technology benefits all by putting the value creation back in the hands of the users. A world where communities grow strong together and in harmony.

Our mission is to invest in and promote the adoption of technology that narrows down the wealth gap and accelerates the distribution of wealth.

SocialFi: The Opportunity

We see social media applications using Web 3.0 technology at the forefront of the blockchain narrative for the next decade to come, and it can begin as early as the next bull run. If nothing but the sheer volume of developers, creators and users who knowingly or unknowingly yearn for a change.

It’s already happening, and the Lens protocol is pioneering the SocialFi movement. Using the technology, culture and the boundless opportunities of the blockchain, SocialFi promises to break the Web 2.0 social media shackles.

“Social products that place content ownership with creators instead of large platforms and allow for vastly more flexible monetization methods. The ultimate goal is to enable a new system for value flows across applications.” Seth Bloomberg, Researcher at Messari

Through the innovation of blockchain protocols like the Lens and dapps like Lenster and Phaver, we’re at the tip of the iceberg for reversing the damaging effects of social media. As Jaron Lanier puts it, we regain ownership over our time, resources and data from the “behaviour modification” empires.

The evolution of SocialFi is largely due to the evolution of Web 3.0 communities.

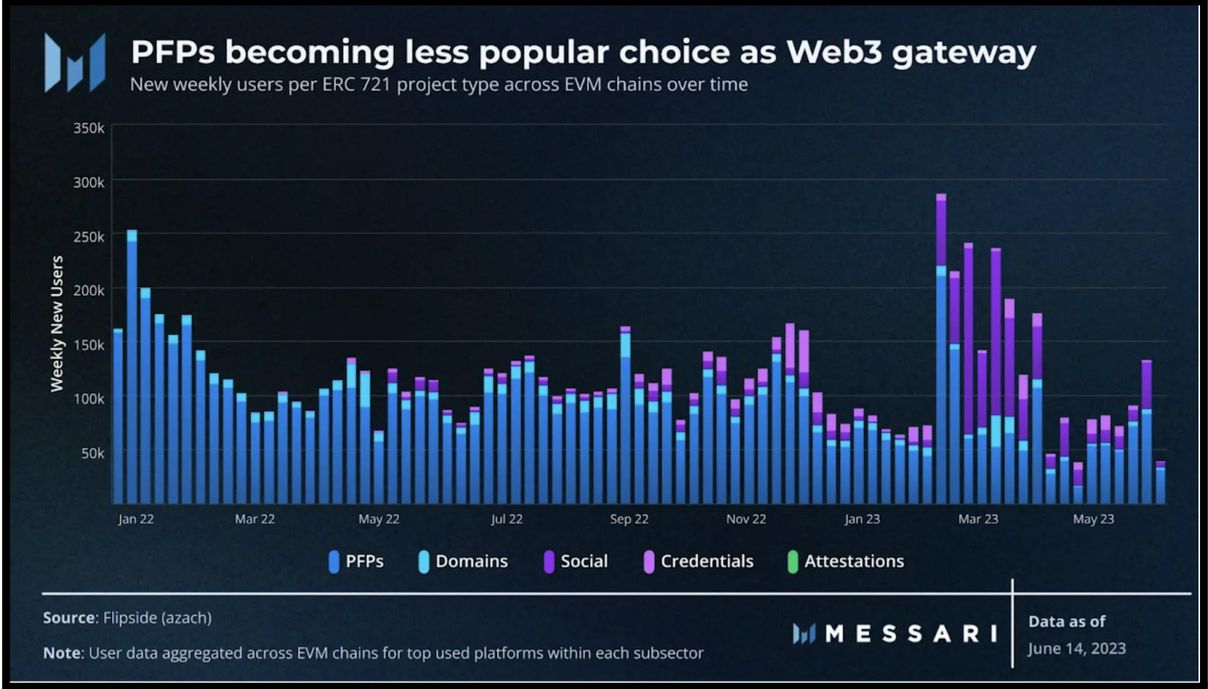

When PFP NFTs took over the industry by storm, everyone wanted to get involved. So, why was it arguably one of the quickest bubbles to (almost) burst?

While the PFP/NFT upheld the value of being part of a community, most projects had very little utility or meaning, and up to 24% of the new NFTs launched in 2022 were pump and dumps.

Nonetheless, NFT ownership has doubled year over year, highlighting the growing popularity of Web 3.0, paired with the demand for NFTs with real utility.

Protocols like Lens and Farcaster are bringing a newly found meaning and value to NFTs by enabling holders to use the asset as their key to decentralised social media platforms.

“Consumer applications focusing on decentralised social media, digital identity, and blockchain-based domain names have experienced a remarkable increase in unique user adoption within the NFT market, with the rate surging by nearly 10x from mid-2021 to early 2022.”

In this chart by Messari, it’s clear that the PFP NFT bubble might have had a tear, but it never really burst. What’s even more clear is that in the past 6 months, Social Projects are booming, leveraging the demand of veering towards this direction. This data serves as the foundation for why the future of SocialFi is bright.

SocialFi: Your next Early Deal Journey with Phaver

In a universe where every particle exerts gravitational influence, the more an individual gives, the more they receive.

In a classroom, students who actively participate, ask questions and engage in discussions are likely to grasp the concepts better and receive higher grades than those who remain passive.

In games, a character initially starts with little to no money. Only by completing missions and quests will a player gain experience and financial rewards. The value of their actions and engagement is the driver of their worth. The same applies to life.

In a world where money is finite, an individual’s wealth extends beyond their net worth. With the power of Alpha Early Deals, you’re incentivised to be more than a passive investor. Early Deals empower you to become an active contributor to the startup’s, and thus your own, success. Your value as an investor is recognised beyond your financial contribution.

Your data, engagement, and influence hold immense potential, shaping the growth of the startups you invest in. The collective activity of our community is what allows SwissBorg to outcompete some of the biggest VC funds in the world. VC funds have the money, but SwissBorg has the community, and without community, Web 3.0 is just code.

We are ready to embark on our next journey and introduce you to our first SocialFi initiative by partnering with Phaver to launch their vault.

We seek to tackle the promotion of better use of technology for social media and highlight personal and spiritual growth opportunities fostered by the merge from Web 2.0 to Web 3.0.

Join the SocialFi movement, get involved with the next Alpha Early Deal with Phaver. To start your journey, create a profile with Phaver, follow SwissBorg on Phaver, and stay tuned for much more.

References

Becher, Brooke, and Brennan Whitfield. 2023. “Did the NFT Bubble Burst?” Built In, May 17, 2023. https://builtin.com/nft-non-fungible-token/nft-bubble.

Chainalysis Blog. 2023. “Crypto Pump and Dump Schemes Make Up 24% of New Tokens.” February 16, 2023. https://blog.chainalysis.com/reports/2022-crypto-pump-and-dump-schemes/.

Cuofano, Gennaro. 2023. “How Does Facebook [Meta] Make Money? Facebook Business Model Analysis 2022.” FourWeekMBA, June 4, 2023. https://fourweekmba.com/how-does-facebook-make-money/.

de Lophem, Daniel. 2022. “Road to Web3.” SwissBorg, December 5, 2022. https://swissborg.com/blog/road-to-web3.

de Lophem, Daniel. 2022. “SwissBorg Series A - Own a Piece of the Future.” SwissBorg, December 13, 2022. https://swissborg.com/blog/series-a-is-here.

Lanier, Jaron. 2018. Ten Arguments for Deleting Your Social Media Accounts Right Now. N.p.: Henry Holt and Company.

Magas, Julia. 2023. “3 Analysts Predicting Bitcoin Will Hit $100,000 by 2024.” Yahoo Finance. https://finance.yahoo.com/news/3-analysts-predicting-bitcoin-hit-231232064.html.

Marks, Howard. n.d. “Mastering The Market Cycle: Getting the Odds on Your Side.” Amazon.com. Accessed August 11, 2023. https://www.amazon.com/Mastering-Market-Cycle-Getting-Odds/dp/1328479250 .

McKinsey. 2023. “Gen Z mental health: The impact of tech and social media.” April 28, 2023. https://www.mckinsey.com/mhi/our-insights/gen-z-mental-health-the-impact-of-tech-and-social-media.

Mirror.xyz. 2022. “Introducing Lens Protocol — Lens Protocol.” February 7, 2022.

“An NFT sold for $2.9 million is now worth $280: Has the bubble burst?” 2023. EL PAÍS English. https://english.elpais.com/economy-and-business/2023-05-01/an-nft-sold-for-29-million-is-now-worth-280-has-the-bubble-burst.html.

Raoul Pal's Crypto/Macro Setup. 2023. Season (Crypto Gathering Day 1), “Is It Game On?” Featuring Raoul Paul.

“Road to Web3.” 2022. SwissBorg. https://swissborg.com/blog/road-to-web3.

Ruby, Daniel. 2023. “Social Media Users 2023 — (Global Demographics).” Demand Sage, July 26, 2023. https://www.demandsage.com/social-media-users/.

Sheikh, Sam. 2023. “XBorg Seed Round Details. A comprehensive breakdown of XBorg’s….” Medium, April 6, 2023. https://medium.com/xborg-official/xborg-seed-round-details-3b7ab8eaeb32.

Zach, Ally. 2023. “Evolution of Web3 Communities.” Messari, (June). https://messari.io/report/evolution-of-web3-communities?referrer=all-research.

Zuboff, Shoshana. 2020. The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power. N.p.: PublicAffairs.

Whitelist your spot for the Phaver early deal!