Yield farming SAND on Sandbox

Key Takeaways:

- This strategy is a perfect fit for investors with low risk tolerance.

- The Yield (APY) is derived from depositing SAND into The Sandbox protocol and receiving a yield from the profits and fees of sales within The Sandbox marketplace.

- The Sandbox is among the earliest movers in the metaverse and ‘virtual world-building’

space, dating back to the early 2000s. SAND is the third largest metaverse crypto token in terms of market capitalisation. - The interest and future prospects of the metaverse don’t point to any particular continuity risks for The Sandbox, but in a persisting bear market this could result in challenging times for the protocol (continuity risk).

- The investment strategy is fairly simple, it does not involve lock-up periods and has the benefit of rewards being paid out daily.

- APY is derived from the profits and fees of sales within The Sandbox marketplace on things like LANDs and ASSETs which are paid out directly from the Sandbox Foundation. For the time being, the yield is fully sustainable. This could change in the future (sustainability risk).

- Risk Checklist

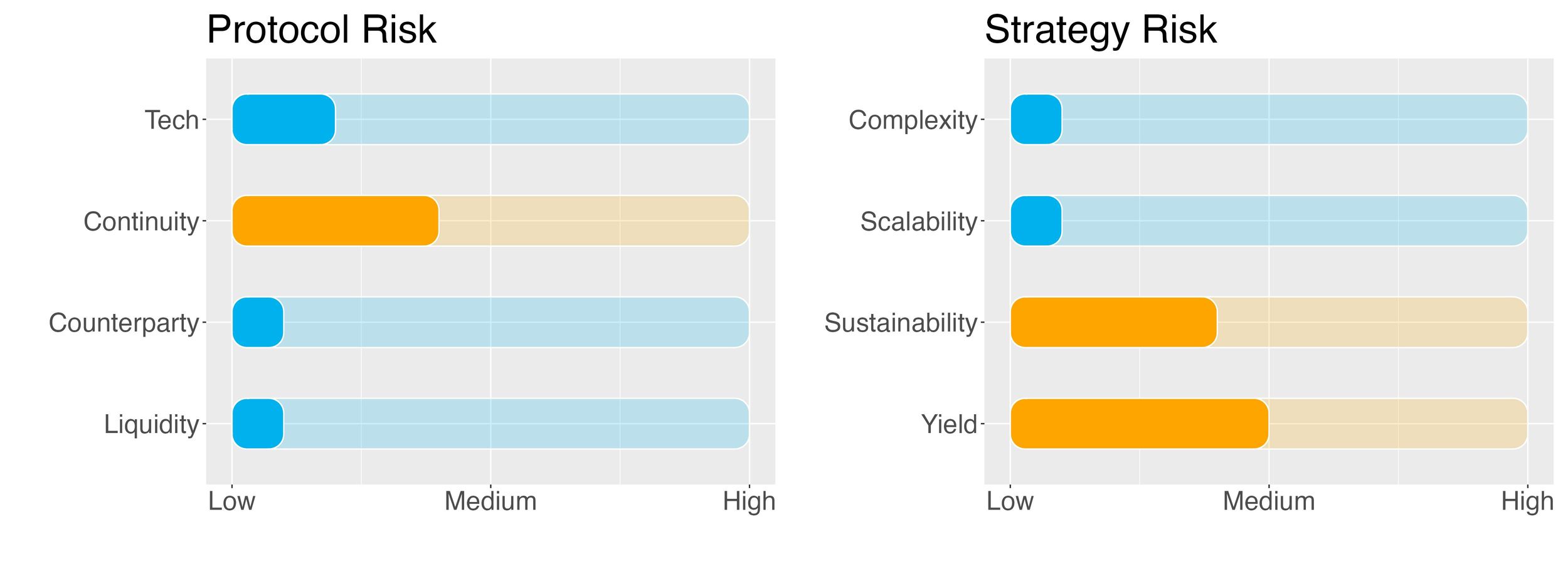

In our view the predominant risks for this strategy are as follows.

- Continuity risk

- Sustainability risk

1. Strategy Explained

The strategy is fairly simple; deposit mSAND (a bridged version of SAND) onto The Sandbox platform and receive a yield.

Profits and fees from sales within The Sandbox marketplace on things like LANDs and ASSETs are split between the foundation fund – used to fund and incentivise metaverse creators – and the staking fund –used to fund the staking program. In other words, all the SAND that is put into The Sandbox goes back to the community.

Lockup period

None. Assets can be redeemed at any time.

2. Strategy Risks

Trust Score

The Sandbox is an Ethereum-based metaverse and gaming ecosystem where users can create, share and monetise in-world assets and gaming experiences. Created by Pixowl, The Sandbox is designed to disrupt the traditional gaming market in which platforms own and control user-generated content limiting the rights of creators and gamers. The exception in The Sandbox is that users have absolute ownership over their in-world creations.

SAND is the native cryptocurrency of the Sandbox ecosystem. It powers all of the ecosystem’s transactions and interactions. For example, SAND tokens are spent to play games, purchase equipment, and customise your avatar. In the future, SAND will also serve as a governance token, allowing its holders to have input on changes to the ecosystem when The Sandbox DAO is established.

The SwissBorg trust score for the Sandbox is ‘green’, meaning the protocol is trustable.

The score value is 75% signalling that our DeFi tech team trusts this protocol.

Protocol Risk

Project Continuity Risk

With a market capitalisation of over $1.3 billion SAND is behind competitors ApeCoin (APA) and Decentralised (MANA) taking the spot of third largest metaverse crypto token.

The Sandbox is among the earliest movers in the ‘virtual world-building’ and metaverse space, dating back to the early 2000s. It first launched as a mobile game in 2010, gave users tools to engage in nonlinear gameplay, also known as ‘sandbox mode’ gaming, allowing them to create their own worlds populated by virtual objects, people, characters and other cool stuff.

The game remained popular until 2018, where it was acquired by Animoca Brands. This parent company would later use the virtual property to build a blockchain-based version of The Sandbox, complete with play-to-earn games, virtual land parcels, tradeable NFTs and more.

The Sandbox metaverse platform as we know it today became publicly available in 2021. It is now one of the most popular metaverse platforms in the world, with investments from Snoop Dogg, Gucci, Republic Realm, PwC and HSBC.

The company behind The Sandbox raised $93 million in November 2021 from investors led by Softbank. In April 2020 it was reported that they were looking to raise about $400 million in a funding round from new and previous backers at a valuation in excess of $4 billion.

Current TVL in The Sandbox is at around $120 million – with a breakdown of $90 million in mSAND standalone, $30 million in the mSAND/MATIC pool and $700 thousand in the mSAND/ETH pool. Because The Sandbox is not a DeFi protocol per se, it isn’t much use to compare its TVL with that of a lending platform like AAVE or a DEX like Uniswap.

According to The Sandbox, locking tokens within staking programs supports the long term vision and benefits of the protocol while creating a layer of trust between all members of the community. Since these staking programs are all fairly new, it will be interesting to monitor their evolution in terms of TVL, as this could prove to be the marker that proves the success and continuity of the protocol.

The market sentiment score computed from the LunarCrush GalaxyScore is 47/100, 47%. The Galaxy Score is a combined measurement of cryptocurrency indicators used to correlate and understand a specific project's overall health, quality and performance. In short, it indicates how well a coin is doing. It comes as no surprise that current bear market conditions are taking a hefty toll on DeFi crypto tokens.

The gaming landscape is the foundation of the metaverse in many ways, paving the way for a future where social experiences, communications, enterprise collaboration and even financial activities can all take place within a metaverse platform.

The interest and future prospects around the metaverse are not pointing to any particular continuity risks for The Sandbox. However, if the current bear market situation were to persist, we could see a cooling down in the attractiveness of this space leading to negative consequences for its major players, like The Sandbox.

Continuity risk is set to 4/10.

Counterparty Risk

Counterparty risk is seen as low.

The Sandbox is not involved in risky activities so insolvency risk is considered minimum.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

Staked SAND can be redeemed at any time so there is no liquidity risk.

Liquidity risk is 1/10.

Strategy Risk

Complexity

Complexity of the strategy is low.

The strategy is very simple; staking – or locking up – SAND tokens into the Sandbox protocol. This strategy involves 1 token, 1 chain and one protocol and no leverage.

Complexity of the strategy is 1/10.

Scalability

Scalability of the strategy is low.

There are currently over $90 million in SAND staked in The Sandbox and $1.4 million under management in the SwissBorg app. With these numbers the strategy is fully scalable.

Scalability of the strategy is 1/10.

Sustainability

Sustainability of the strategy is medium.

The staking APY is derived from the profits and fees of sales within The Sandbox marketplace on things like LANDs and ASSETs and is therefore fully sustainable. It is paid out from The Sandbox foundation. As this could change in the future we conservatively set this risk to medium.

Sustainability of the strategy is 4/10.

Yield Risk

Yield risk of the strategy is medium.

The standalone staking of the SAND token went live only recently. No history of past APY is available and therefore we conservatively assign a medium rating to the volatility of the yield.

Yield risk of the strategy is 5/10.

3. Conclusions

The Sandbox represents an evolution of ideas and progress from a basic idea starting in Y2K until where we are today. This moved from the concept of early ‘virtual world-building’ to one of the top metaverse projects, an unmatched provenance within the space.

In terms of the user process, it’s good and smooth, with a helpful interface and a simple enough process to understand, and this removal of confusion is key in our book. When it comes to the ‘real’ APY, the yield currently provided to users comes from protocol profits and fees. So far, the offered APY has been shown to be sustainable.

Staking SAND in The Sandbox comes with modest risks. The investment strategy is fairly simple, it does not involve locking periods and rewards are paid out daily.

The SwissBorg Risk Team ranks SAND on The Sandbox as a Low risk investment, one for an investor with some understanding of DeFi and yielding, who is willing to take on a modest risk in exchange for an interesting reward on SAND.

Try the SwissBorg Earn today!