Providing liquidity on Alpaca Finance

Key Takeaways

- This strategy fits the profile of an investor who is willing to take on a modest risk in exchange for an acceptable reward on BTC.

- Alpaca Finance is the largest lending protocol allowing leveraged yield farming on BNB Chain. It helps lenders earn safe and stable yields, and offers borrowers undercollateralised loans for leveraged yield farming positions, vastly multiplying their farming principals and resulting profits.

- Although the majority of the assets held by Alpaca Finance are stablecoins, a large chunk is in BNB tokens. Any issue with this token could affect the solvency of the protocol. Moreover, protocol users can leverage their positions up to 6x. This increases the likelihood of bad debt creation in the presence of stressed market conditions (counterparty risk).

- In order to mitigate occurrences of bad debt, the protocol implemented its own Insurance Plan.

- BTC yield strategy on Alpaca Finance is fairly simple; BTC is deposited into the Alpaca Fiance BTC pool, to be available to leveraged borrowers. In return, a yield is received. There is no leverage. Only one token, one protocol and one chain are involved.

- This strategy is only partially scalable; only a limited number of tokens can enter the strategy without massively diluting the current lending APY (scalability risk).

- The yield on BTC from Alpaca Finance is mostly dictated by supply/demand forces, meaning that higher demand (i.e. users borrowing BTC) means higher rates. Only a fraction of the yield comes from staking. For this reason, this yield is sustainable.

- Risk Checklist

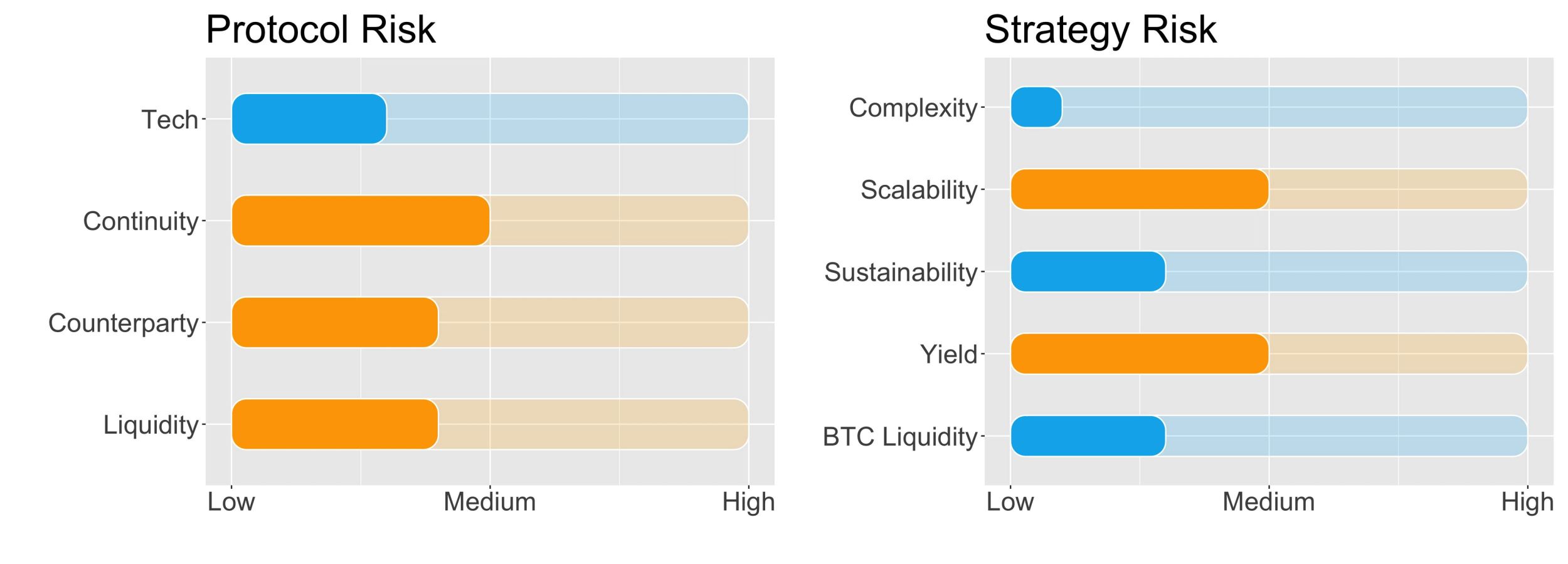

In our view, the predominant risks for this strategy are:

- Continuity Risk

- Counterparty Risk

-Scalability Risk

1. Strategy Explained

The strategy is fairly simple. One deposits BTC in Alpaca Finance on the BNB chain and collects the ‘lending’ yield.

2. Strategy Risks

Trust Score

Alpaca Finance, also referred to as just ‘Alpaca’ in this article, is a lending protocol that allows leveraged yield farming on the Binance Smart Chain (BSC). It went live in March 2021 and since then has helped lenders earn stable yield while offering borrowers undercollateralized loans for leveraged yield farming positions, multiplying their farming principals and resulting profits.

Yield farming is an innovative DeFi concept where users stake or lend their crypto assets in order to receive yield. The leverage in the system comes from other users borrowing capital to increase the leverage of their positions. In other words, the investor borrows funds so she can invest more than her initial amount; if all goes well, her gains are multiplied, but if the market moves against her, the losses are multiplied.

At the time of writing, Alpaca Finance had accrued a total value locked (TVL) of around $500 million making it one of the largest projects on the Binance Smart Chain (BSC) and a top 20 protocol in DeFi across all chains. Lenders and borrowers are incentivised by high APYs and the receival of the ALPACA token, which aside from its valuation is worth holding as it confers governance rights. Also, the majority of platform revenues also accrue to ALPACA token holders.

Additionally, there is an auto-farming stablecoin AUSD, which is over-collateralised by other crypto assets, also known as ‘crypto-collateralized’, a method used by some stablecoins. There are 58 farming pools available, offering 2-6x leverage.

So far Alpaca Finance has not been subject to any exploits or hacks, and the protocol does not display any bad debt.

SwissBorg trust score for Alpaca Finance is ‘green’, meaning the protocol is trustworthy.

The score value is 70%, signalling that Alpaca Finance is deemed safe from a technical point of view.

Protocol Risk

Project Continuity Risk

The risk associated with the continuity of the Alpaca project is ranked at medium.

While ‘leveraged yield farming’ projects are still in their infancy, along with Alpaca, two other projects have managed to attract a significant number of users.

These other projects are:

- Homora on Ethereum, BSC, and Avalanche,

- Apricot on Solana.

Alpaca Finance displays the largest TVL amongst its competitors, with Homora coming in at $64 million and $9 million for Apricot.

According to the DeFiLlama categorisation, Alpaca Finance belongs to the ‘yield’ category in which it holds third place in terms of TVL – the first two being Convex Finance with $3.6 billion and Arrakis Finance at $1.3 billion.

Because Convex and Arrakis are not ‘leveraged yield farming’ protocols, a comparison with Alpaca would seem unfair. That being said, a comparison is still useful to make clear that while Alpaca is the dominant protocol within its niche sector, in terms of the all-important TVL, it is far behind the top DeFi protocols like AAVE (lending), Uniswap (dex) and of course, the aforementioned Curve and Arrakis.

In terms of valuation, the token’s TVL ratio – a calculation of its market capitalisation over its TVL – is 0.17. A protocol with a TVL ratio below 1 can be considered undervalued, and it additionally scores better than most of the other yield protocols, which average a ratio of 0.55.

Lastly, the market sentiment score computed from the LunarCrush GalaxyScore is 41/100, 41%. The Galaxy Score is a combined measurement of cryptocurrency indicators used to correlate and understand a specific project's overall health, quality and performance. In short, it indicates how well a coin is doing. It comes as no surprise that current bear market conditions are taking a hefty toll on DeFi crypto tokens.

Project Continuity Risk is 5/10.

Counterparty Risk

Overall Counterparty Risk for Alpaca Finance is deemed medium to low.

When looking at the possibility of a ‘liability to asset ratio breakdown’ – where the protocol’s liabilities (total borrowed tokens) exceeds the protocol’s total asset (total deposits) – we came up with an estimate of this happening using the Merton default model. This estimate is a conservative theoretical default probability and tells us there is a 15% chance of this event occurring over one year. Because around 50% of deposits to Alpaca are denominated in stablecoins, not much volatility is expected, and the issue of intra-asset correlation is not expected to be severe. Also, the stablecoins deposited in Alpaca are fully collateralized in USD, so the risk of a depeg is minimal.

A bit more worrisome is the fact that around 40% of the total protocol’s deposits onto the BNB chain are in Binance’s BNB token. This high concentration of BNB tokens is reflected in a high Gini index of 66% – with 100% being perfect inequality of deposits – meaning that some concentration risk does exist. BNB token is the 3rd largest cryptocurrency in terms of market capitalization (behind BTC and ETH). It is the native token of the biggest crypto exchange (Binance). These elements mitigate the aforementioned concentration risk.

In a market downturn, the protocol is not expected to experience a cascade of liquidations, possibly affecting its solvency, because the majority of the protocol's collateral is in stablecoins with fixed value. That being said, it must be noted that users who act as the borrowers in the protocol do use leverage when investing in the DeFi strategies proposed by Alpaca.

Leverage is available up to 6x. In normal circumstances, this leverage rate would not be an issue since liquidation would trigger an immediate deleveraging of the position. However, during market turmoil, when asset prices fall quickly, there can be a delay in liquidation, possibly increased by the presence of leverage and/or absence of a liquidy in the market. For example, when everybody is selling, it becomes harder to find a buyer to liquidate the collateral. This situation would likely create ‘bad debt’ and put the protocol and its lenders under pressure.

In order to mitigate instances of bad debt, the protocol implemented its own Insurance Plan. In the case of a shortfall event, up to 50% of future Protocol Revenue going to the Governance Vault that would be available to pay back users who lost funds, for up to a period of 1 year, meaning there would be at least 7 figures of potential cover.

Last but not least, Alpaca’s leveraged strategies rely on other DeFi protocols.

These DeFi protocols are:

- PancakeSwap

- Mdex

- BiSwap,

- SpookySwap

Because of this reliance on other protocols, an additional source of counterparty risk is linked to any loss of funds in these protocols from any type of exploit or hack.

Counterparty Risk is 4/10.

Liquidity Risk

Liquidity Risk for this protocol is deemed medium to low.

Liquidity risk for Alpaca is measured by looking at its leverage in terms of Utilisation Rate (UR), that is, the ratio between total borrowed tokens and the total deposits, both measured in USD. The current utilisation rate for Alpaca on Binance chain is at 37%, representing a low leverage.

Liquidity Risk is 4/10.

Strategy Risk

Complexity

Complexity of the strategy is low.

In terms of complexity, the BTC yield strategy on Alpaca Finance is fairly simple; BTC is deposited in the Alpaca BTC pool, and a yield is received. There is no leverage, only one token, one protocol and one chain are involved. Because of the simplicity of the strategy, it holds the minimum possible complexity risk.

Complexity of the strategy is 1/10.

Scalability

Scalability risk of the strategy is medium.

In terms of the scalability of the strategy, the BTC pool on the Alpaca Binance chain currently displays a total supply of $20 million. The SwissBorg yield program currently holds around $57 million in BTC. A large influx of BTC into the Alpaca pool could somehow depress the current APY. On the other hand, it could also attract more borrowers (lower borrowing rate). This in turn would help raise the APY.

The scalability risk of the strategy is 5/10.

Sustainability

Sustainability risk of the strategy is low.

BTC yield on Alpaca is dictated by supply and demand forces; higher demand from users borrowing BTC also implies higher rates for depositors but heightened risk in terms of liquidity (see below). The risk to return trade-off is perfectly reflected in this strategy.

Only a fraction of the yield comes from staking the liquidity tokens that Alpaca provides, in this case, ibBNB, which is in essence a subsidised yield. At the time of writing, the staking APY is 0.7% compared to the lending APY of 2.6%.

In our view, the offered total yield has a high degree of sustainability.

Sustainability risk is 3/10.

Yield Risk

Yield risk is medium.

Yield risk represents the volatility of the expected yield on BTC. Alpaca’s lending rates depend on the borrowing rates, which in turn depend on the pool utilisation; the more the people borrow, the higher the borrowing and lending rates.

At the moment, we do not have either a time series of past APY on BTC or a history of the pool utilisation ratio. We can, therefore, conservatively assume a medium yield risk.

The yield risk is 5/10.

BTC on Alpaca Binance chain strategy specific – Liquidity Risk

BTC liquidity risk is low to medium.

One specific risk associated with any lending strategy is linked to the inability to exit the position due to lack of liquidity. The BTC pool in Alpaca shows the use of around 40% of its liquidity, so in principle, there is enough exit liquidity available to users, even if SwissBorg were to enter the pool with a high amount of tokens.

BTC liquidity risk is 3/10.

3. Conclusions

Providing BTC for liquidity on Alpaca Finance comes with risks. As leveraged yield farming is a relatively new feature in DeFi, it lacks the public testing over time needed to find and fix issues, as well as create user trust. That being said, so far, there have not been any cases that could be cause for alarm.

The assets that Alpaca uses for its yield consist of 40% BNB tokens, representing a risk as an issue with these tokens could affect the solvency of the protocol, leading to instability and the following results, giving it a higher continuity risk than we would like to see.

In terms of the user process, it’s good and smooth, with a helpful interface and a simple enough process to understand, and removing confusion is key in our book.

When it comes to staking, only a fraction of the yield provided to users comes from staking, a good feature for stable, sustainable yield.

The SwissBorg Risk Team ranks BTC on Alpaca as a Low risk investment, one for an investor with some understanding of DeFi and yielding, who is willing to take on a modest risk in exchange for an acceptable reward on BTC.

Disclaimer: This report is intended for general guidance and informational purposes only and does not constitute any offer to the public of virtual assets or financial instruments, financial advice, investment advice, or any other type of advice, and should not be interpreted or understood as any form of promotion, recommendation, solicitation, offer or endorsement to (i) buy or sell any product, (ii) carry out transactions, or (iii) engage in any other legal transaction.

Any opinions expressed herein are those of the authors and do not represent the views or opinions of SwissBorg Solutions OÜ and neither of its affiliates. Neither SwissBorg Solutions OÜ nor its affiliates, make any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of this report, nor to it being free from error. Recipients alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information contained in this report before making any decision based on such information and should not act upon this information without seeking prior professional advice.

Try the SwissBorg Earn today!