DOT Liquid Parachain Staking

Key Takeaways:

- This strategy perfectly fits the appetite of investors with some risk tolerance.

- The currently observed price differential between BDOT and DOT is exploited knowing that at the parachain auction’s end (October 2023) BDOT is redeemable for DOT at 1:1 value.

- Two centralised exchanges are employed by the strategy (Binance and Kraken, counterparty risk).

- The final APY depends on the behaviour of the BDOT-DOT rate (yield risk).

- Deposited tokens are locked until the redemption date (liquidity risk).

- The Yield (APY) is composed of

- Price difference between BDOT and DOT

- Staking yield from BDOT

- Staking yield from DOT on Kraken

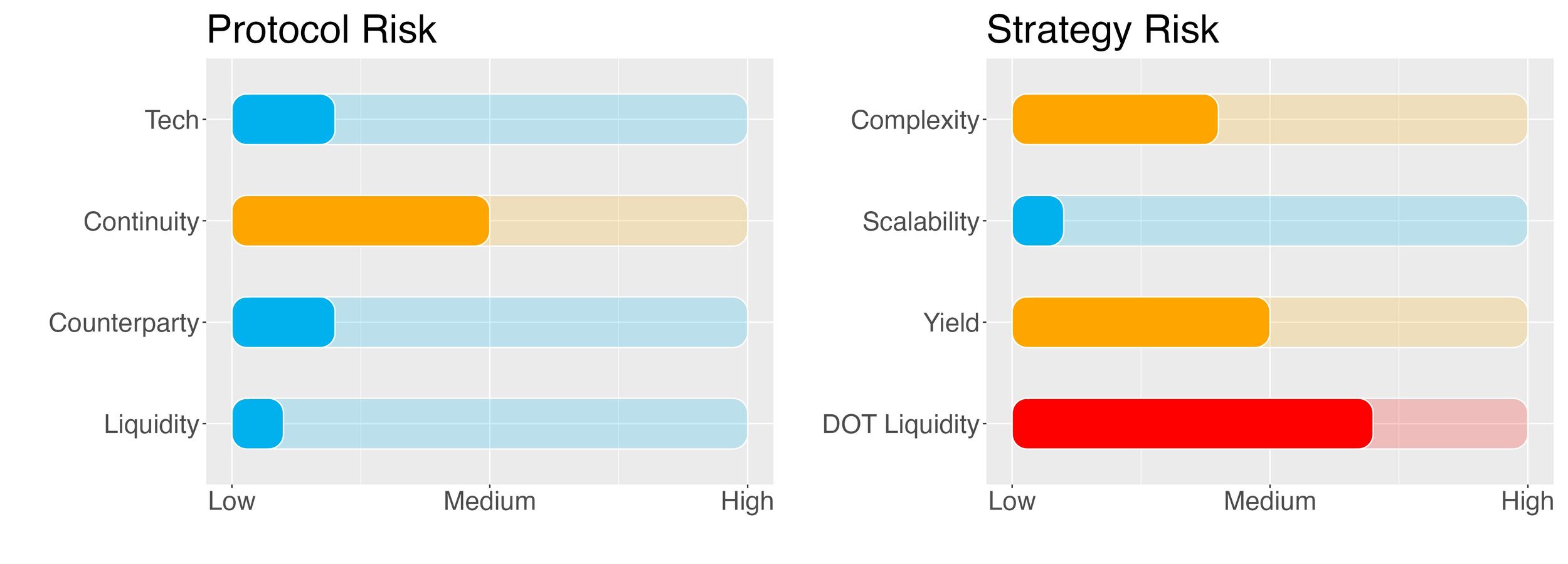

- Risk Checklist: in our view, the predominant risks for this strategy are:

- Counterparty risk

- Yield risk

- Liquidity risk of staking DOT

1. Strategy Explained

https://polkadot.com/auctions/

The strategy consists of first depositing DOT on Binance in order to exchange it for BDOT. At maturity, i.e. on October 4th 2023, BDOT is then redeemed for DOT at a 1:1 ratio.

BDOT is a tokenised asset representing the staked DOT in the DOT Slot Auction, convertible to DOT at a 1:1 ratio. During the lease period, which may take 96 weeks or even longer, users will not be able to redeem their DOT.

The strategy exploits the fact that BDOT is trading under par with respect to DOT but at maturity, it is going to be redeemed at par. An additional source of yield comes from staking DOT (BDOT representing the staked version of DOT).

The projected APY thus reflects:

- the liquidity premium for holding BDOT as opposed to DOT

- the counterparty risk on Binance

- the staking yield on DOT

The strategy seeks to dynamically exploit this BDOT-DOT price differential by exchanging DOT for BDOT using the following guidelines:

- Whenever BDOT/DOT exchange rate is below 0.80

- It is after May 1st, 2023 and the BDOT/DOT exchange rate is below 0.90

- It is after Aug 1st, 2023 and the BDOT/DOT exchange rate is below 1.

When not converted into BDOT, deposited DOT is kept in the Kraken exchange and staked there, thus ensuring a 6%-8% yield.

2. Risks & Rewards

Protocol Risks

Protocol Tech Risks

Protocol Tech risk is deemed low.

Two protocols are involved, both are CEX (centralized exchanges): Binance and Kraken.

With a total asset balance of over $55b, Binance is the largest crypto (centralised) exchange (CEX). In terms of security, the exchange is ranked third among CEXes according to the CER security score.

Kraken displays a total asset of around $10b. According to CER, this exchange represents the safest CEX option available.

Counterparty Risk

Counterparty risk is set to medium.

Following FTX collapse, Binance released in late 2022 a Proof of Reserves system that allows users to verify their assets using a Merkle tree. The initiative, however, was criticized by competitor exchanges as it failed to include liabilities.

In terms of transparency, Kraken offers a comprehensive approach to Proof of Reserves that verifies not just reserves, but also liabilities. Cryptographically proving that Kraken holds clients’ covered assets in reserve at the time of an audit is only half the battle. Kraken’s Proof of Reserves also includes covered liabilities (i.e., tokens in client accounts).

After the FTX collapse the trust in centralized crypto entities has reached its lowest limits. Leading to efforts to improve the transparency around reserves and liabilities.

While all information at our disposal points to an improved situation in terms of counterparty risk when depositing funds into a centralized exchange, we take a conservative stance and assign an overall medium risk.

Liquidity Risk

Liquidity risk is set to low.

Liquidity risks are present whenever there is a chance that invested funds cannot be fully recovered at maturity due to constrained availability caused by unexpected events.

In the proposed DOT strategy liquidity issues could be experienced under extreme market conditions.

Funds held by Kraken, are redeemable at any time (unless differently agreed upon). Due to very adverse market conditions, some of the funds are under pressure and, although an unlikely event, this could pose liquidity constraints on the platform.

Strategy Risks

Complexity

The complexity risk of this strategy is medium.

The strategy involves two tokens (DOT and BDOT), on one chain (Polkadot) and one protocol (Binance exchange). No leverage is in place.

To avoid ‘moving the market’ when swapping DOT to BDOT (i.e. causing the price to increase due to buying pressure), the execution of the transaction must carefully consider the timing and the market depth of this trading pair.

Scalability

Scalability risk is low.

The strategy has some clear execution rules in order to only swap DOT for BDOT if certain conditions are met (price-wise and time-wise). This ensures that the APY will not be diluted (i.e. price will not be moved when performing the conversion).

This approach ensures that the strategy remains fully scalable with respect to the maximum

amount of DOT allowed to be invested (DOT cap is present).

Yield Risk

Yield risk is set to medium.

While the price of BDOT-DOT remains to some extent volatile (the annualized standard deviation of price changes is around 13%), the execution rules described in the section above along with the capped invested seek to guarantee a yield very close to that which is projected.

The future dynamics of the BDOT-DOT price are obviously unknown and it could be the case that the price deviation reduces quicker than the strategy manages to swap DOT for BDOT. Under this scenario, only a part of the deposited DOT will be yielding as projected (the remaining being staked in Kraken).

Liquidity Risks of staking

Liquidity risk of this strategy is deemed medium to high.

The strategy locks up the invested DOT until the redemption of BDTO to DOT expected on October 25, 2023. Regardless of the direction the market takes at this time, your assets will be out of reach. That is, if the price of DOT collapses, the investor will not be in a position to sell. This aspect needs to be carefully considered when entering the bDOT strategy.

Worst-case scenarios

To help the investors assess the risks of this strategy we’ve tried to identify the negative scenarios that the strategy could face:

- Binance and/or Kraken become insolvent. While both provided a Proof-of-Reserves, it could be that their reserves have deteriorated approaching the default event. In this case, not all DOT staked in Kraken might be recovered; and not all BDOT in Binance could be redeemed for DOT (counterparty risk).

- Binance gets hacked and tons of BDOT are minted, effectively killing the peg with DOT - more BDOT in circulation than DOT backing them (tech risk).

- The price of BDOT to DOT increases quicker than we manage to swap all invested DOT. This event would depress the yield since only a portion of deposited DOT is swapped into BDOT (yield risk).

3. Conclusion

Parachain auctions are auctions that are held on the Polkadot relay chain (i.e. the main blockchain) to determine which blockchain will connect to the parachain slot (independent blockchains linked to the Relay Chain in such a way that they can use the Relay Chain’s computing power to scrutinize transaction data). Once the auction starts, any project on the network can submit its bid to the relay chain.

When a Parachain Auction is held, DOT holders can pledge their respective tokens to the project they think deserves the parachain slot during the 5-round auction intervals. BDOT (a sort of IOU) is received for pledging DOT. At the end of the slot usage period (maximum duration of 96 weeks), BDOT can be redeemed 1:1 for DOT.

The proposed strategy exploits the price differential between BDOT and DOT, knowing that at maturity BDOT can be redeemed at the peg.

This DOT strategy comes with some risks. The investment strategy is fairly simple but yet it requires some understanding of how DeFi and CeFi operate. It does require a locking period (until October 2023) and rewards are paid out only at maturity.

The SwissBorg Risk team ranks DOT DOT Liquid Parachain on Binance as a Satellite investment, one for an investor with a medium understanding of DeFi and yielding, who is willing to take some risk in exchange for a very attractive reward on DOT.

Try the SwissBorg Earn today!