Receive DAI Saving Rate (DSR) by staking in Summer.fi protocol

Key Takeaways:

- The DSR is a special module in the MakerDAO smart contract system that allows DAI holders to receive a share of the revenue earned by MakerDAO, the decentralised autonomous organisation (DAO) maintaining and regulating DAI. MakerDAO pays deposits in the DAI Saving Rate the shown APY continuously on every block.

- The yield (APY) is derived from DAI staking into the Maker protocol. The DSR helps balance supply and demand of DAI and will be one of the monetary policy levers that decentralised Maker Governance can control.

- The MakerDAO community approves and executes changes to the DSR.

- Launched on December 18, 2017, by MakerDAO, DAI has since become one of the most well-known and widely used stablecoins in the cryptocurrency space. DAI is unique in that it is not backed by traditional reserves like USD in a bank account (like USDT or USDC); instead, it achieves its price stability through a decentralised system of collateralised debt positions (CDPs) and smart contracts on the Ethereum blockchain.

- DAI staking represents a relatively safe and liquidity yield-generating investment. No lockup period is present.

- The strategy is simple: deposit DAI into the DSR smart contract via Summer.fi protocol and receive the DSR. The difference in incentives between MKR holders and DAI stakers could pose serious problems to the sustainability of the DSR.

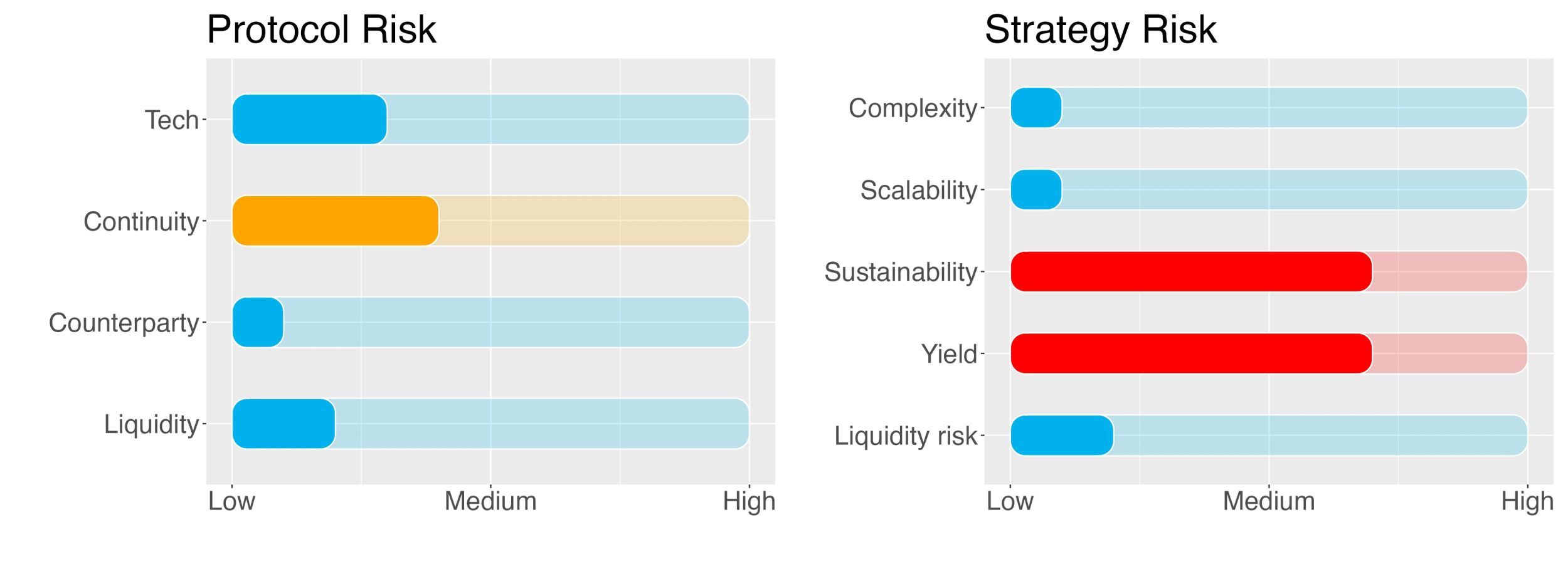

- Risk Checklist. In our view the predominant risks for this strategy are as follows:

- Tech risk

- Sustainability risk

- Yield risk

1. Strategy Explained

The strategy involves liquid staking DAI token into the Maker protocol in order to receive the DAI staking rate (DSR). In very simple words: Maker’s DSR contracts let DAI holders earn from the protocol’s revenue by depositing DAI into it.

Summer.fi (a DeFi protocol previously known as Oasis) is employed to stake the DAI.

1.1 DAI and RWA

1.1.1 A new approach to DAI...

DAI is pegged to the US dollar by relying on an over-collateralisation model. This means that users are required to deposit more digital assets than the value of the DAI they wish to mint.

This model however has a significant limitation: to increase the amount of DAI in circulation, MakerDAO must first collateralise an even larger amount of assets, leading to capital inefficiency. This, in turn, constrains the growth of DAI's market cap when compared to other stablecoins. This has the protocol to be more and more dependent on USDC collateral to improve DAI capital efficiency.

However, the Silicon Valley Bank (SVB) bankruptcy and its impact on USDC (it was a custodian of USD for Circle, the USDC issuer) highlighted the intrinsic risk of DAI’s exposure to USDC (and its counterparty risk to Circle).

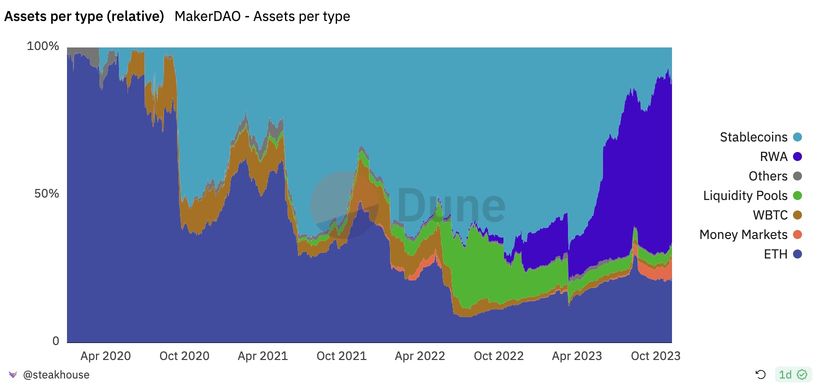

To overcome these challenges, Maker's Aggressive Growth Strategy was implemented in March 2022. The strategy identified the need to shift towards RWAs to enable Maker to scale to the next order of magnitude and beyond. This approach allowed Maker to diversify its collateral portfolio and mitigate counterparty risks, thereby improving the protocol's stability and long-term viability.

The proposed strategy involves issuing loans in the form of DAI to financial institutions for investments in real-world projects, such as real estate and infrastructure. These institutions would pay interest on the loans and return the original loan amount to Maker as per the agreed-upon loan conditions.

In order to mitigate the risk of default and ensure the stability of the DAI peg, Maker has implemented measures to manage the default risk of loans issued through its protocol. One key factor in this risk management strategy is to ensure that the default risk on loans is lower than the prevailing interest rate.

As we can see from the figure below, this new approach led to a significant increase in MakerDAO’s exposure to Real World Assets (RWA), as well as an increase in their stability fees. This move has allowed Maker to capitalise on being a first mover in the crypto industry's integration with real-world assets.

1.1.2 …and the new risks

Obviously, the shift of DAI towards a more RWA-oriented approach comes with some additional risks.

In the traditional DAI overcollateralised solely by crypto assets (e.g. ETH) the main risk was that of bad debt triggered by improper liquidations (e.g. if ETH would decrease faster than the borrowing positions can be closed).

The additional risk of the USDC-dependent DAI was linked to the counterparty risk on Circle (and its USD custodians).

Now, with DAI collateralised by RWA the risk profiles has changed and the following risks must be considered:

- Regulatory Risks: MakerDAO occupies a legally grey area as a decentralised finance (DeFi) protocol. The potential for regulatory gaps and compliance challenges has increased with the protocol pivoting towards a greater reliance on RWAs.

- Collateral Risk

- MakerDAO faces collateral risks from potential defaults on pledged real-world assets (RWAs), which can create shortfalls and destabilise DAI’s 1:1 USD peg.

- Sudden significant shifts in the DAI Savings Rate (DSR) could also strain liquidity buffers if unexpectedly large amounts of DAI are minted or burned, outpacing execution capabilities (see ‘Yield Risk’ below).

- Many RWAs held by MakerDAO are also subject to duration risk, where the portfolio’s sensitivity to interest rate fluctuations can lead to losses if redemptions are required before maturity. - Counterparty Risk: MakerDAO engages with several counterparties and is consequently vulnerable to their associated credit risks, encompassing liquidity, reputation, and settlement challenges.

- Centralisation and transparency risks:

- The additional returns for MakerDAO (and DAI) comes at the cost of a higher level of centralisation)

- In addition, onboarding more real-world assets (RWAs) as collateral decreases transparency compared to on-chain crypto assets.

1.2 What is the DAI Saving Rate (DSR)?

A person who holds DAI can lock and unlock DAI into a DSR contract at any time. Once locked into the DSR contract, DAI continuously accrues, based on a global system variable called the DSR.There are no restrictions or fees for using DSR other than the gas required for locking and unlocking.

According to MakerDAO, this creates a whole new dimension of incentives for balancing the supply and demand for DAI. This model allows for capital to be more efficiently deployed while still fulfilling its core role of providing users with strong, decentralised stability.

1.3 How DSR works

The DSR is funded out of the Stability Fees paid by collateralised debt positions (CDP, i.e. locked up collateral in exchange for stablecoin). For example, if the average Stability Fees collected on CDPs is 3%, it could be used to fund a DSR of 2%.

The DSR helps balance supply and demand of DAI and will be one of the monetary policy levers that decentralised Maker Governance can control.

It is a global parameter that needs to be adjusted often to deal with short-term changes in market conditions of the DAI economy. This is in contrast to Risk Governance, which is a long-term process that involves setting Stability Fees, and other risk parameters individually for each collateral type.

Together, these two mechanics provide a set of tools to guard DAI stability both in the short-term and long-term.

The fundamental logic when setting the DSR is as follows:

- If the market price of DAI is below 1 USD, the DSR will increase. This boosts demand and stifles supply, by incentivizing more DAI holders, and fewer CDP users, which should increase the market price up towards the 1 USD target price.

- If the market price of DAI is above 1 USD, the DSR will decrease. This stifles demand and boosts supply, which should reduce the market price of DAI down towards the 1 USD target price.

This logic is very similar to that employed when setting the MakerDAO Stability Fee. DSR adjustments are basically the same, except that with the DSR, incentives for DAI holders are also affected in addition to the existing effect of Stability Fee adjustments on CDP users.

Pre-Subscription Period: 1 days

Lockup period: None.

2. Strategy Risks

Trust Score

Summer.fi, a platform for decentralised finance (DeFi) where users can borrow stablecoins against cryptocurrencies, is employed to stake DAI and receive the DSR.

The protocol (formerly known as Oasis) went live in December 2021 and currently displays a TVL of around $2.2b.

Importantly. Only the frontend of Summer.fi is employed but not its smart contracts (see Counterparty risk below).

SwissBorg trust score for Summer.fi is ‘green’, i.e. the protocol is trustable. The score value is 70% signalling that the protocol is reliable.

Protocol Risks

Project Continuity Risk

Project continuity risk is medium.

Summer.fi is the biggest protocol within the category ‘Services’ (as per DeFiLlama) with a TVL of around $2.2b. This is ahead of Instadapp with $1.8b. Then TVL drops dramatically to only $82m of DefiSaver.

Summer.fi does not possess a token so its current trend cannot be checked.

The protocol is however the most well-known interface for MakerDAO (and originally developed by Maker) so there should not be too many concerns on the project continuity per se..

Still, after the DAI ‘endgame plan’ (a proposal to overhaul and improve the governance and tokenomics of the Maker ecosystem) was announced, many core devs have been leaving in the past months. This is not only related to Summer.fi (Oasis) but to the Maker project in general.

Summer.fi continuity risk is conservatively set to 4/10.

Counterparty Risk

Counterparty risk is deemed low.

Counterparty risk exists whenever an asset is handed over to an external provider. Any credit events involving the staking provider could affect the assets that have been entrusted to them.

That said, staking via a 3rd party is fundamentally different from depositing funds into a lending protocol that later becomes insolvent.

The strategy enters the DSR through sDAI, which is a wrapped version of DSR deployed by MakerDAO.

Summer.fi is solely employed for its frontend. In case of issues with the protocol, the sDAI contract will be directly used. The counterparty risk is hence reduced to the minimum.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

Funds held by the DSR staking contract are redeemable at any time.

Liquidity risk is 2/10.

Strategy Risks

Complexity

Complexity of strategy is low.

The strategy involves depositing DAI on Summer.fi in order to stake it into the DSR smart contract.

Therefore one chain (Ethereum), 1 token and 1 protocol is required.

Complexity of the strategy is 1/10.

Scalability

Scalability risk of strategy is low.

Depositing into the DSR contract is a highly scalable practice. Eventually, the offered APY will be used, amongst other things, to incentivise (or discourage) the staking, so that the optimal scalability can be achieved.

Scalability risk of the strategy is 1/10.

Sustainability

Sustainability risk of strategy is medium to high.

The yield obtained from this strategy is in principle fully sustainable as it comes directly from the MakerDAO revenues. Indeed, the DSR is funded out of the Stability Fees paid by CDPs. For example, if the average Stability Fees collected on CDPs is 3%, it could be used to fund a DSR of 2%.

On the other hand, MakerDAO stability fee is also directly linked to the revenues to MKR holders. Thus, any growth in DSR directly reduces the profits of MKR holders.

These dynamics could create a misalignment of incentives between MKR holders and DAI holders.

A high DSR would eat MKR holders' revenues. This could be detrimental to the value of MKR.

A low value of MKR could lead to a sort of ‘hostile takeover’ from malicious actors accumulating cheap MKR tokens. This is because the governance of the protocols falls into the responsibility of MKR holders.

Similarly, the incentive of MKR holders is to maximise their profits, and this can be achieved by setting the DSR to 0%.

Note indeed that whenever there exists another ‘zero risk’ yield on DAI (e.g. lending on Compound) and this yield is higher than the DSR, investors would not shift their DAI to DSR. So a 0% DSR would actually represent the optimal equilibrium for both MKR and DAI holders.

Eventually, it boils down to the difference between the DSR (DAI holders) and the MakerDAO stability fee (MKR holders).

To conclude, it is not clear if and how MKR and DAI holders incentives are aligned. This issue could have a negative impact on the sustainability of the DSR, and onto the proposed strategy.

Sustainability risk of the strategy is 7/10.

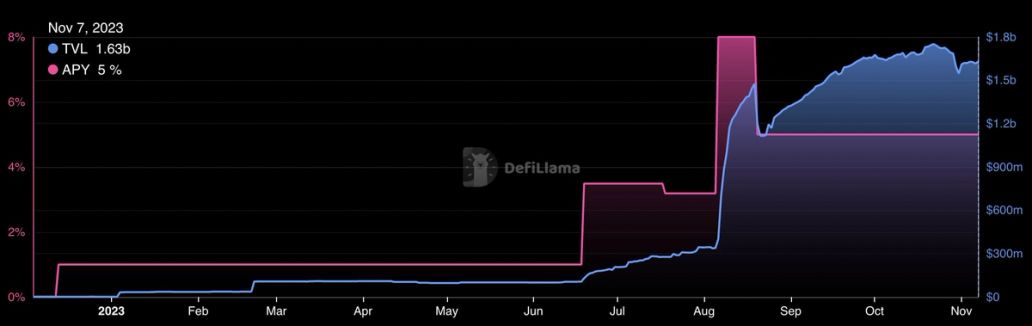

Yield Risk

Yield risk of strategy is medium to high.

The APY of this strategy is dynamically set by a governance vote within the MakerDAO. As per section above, it is not clear how incentives of MKR holders and DAI holders are aligned. This could have a negative effect on the volatility of the DSR.

The figure below shows the most recent evolution of the DSR. Before Dec 2023 it was at 0.01%. It then increased to 1%, 3.5%, 8% and it’s now at 5%. The volatility of the APY is non negligible.

The increase to 8% was obviously done to increase the TVL on DAI. It is too early to know if this will prove only to have a temporary effect or will help DAI retake its market shares.

We conservatively set the risk to medium/high.

Yield risk of the strategy is 7/10.

Liquidity Risks of staking

Liquidity Risk on staking DAI is low.

Depositing DAI into the DSR smart contract comes with no lockup as DAI can be redeemed at any time.

Liquidity risk is therefore set to 2/10.

3. Conclusions

DAI staking comes with some risks.

The DSR is a special module in the MakerDAO smart contract system that allows DAI holders to receive a share of the revenue earned by MakerDAO. MakerDAO pays deposits in the Dai Saving Rate the shown APY continuously on every block.

The process is straightforward. When you deposit your DAI into the DSR, it becomes part of a larger fund pool used by MakerDAO to generate revenue.

This is in principle one of the lowest-risk yield products on DeFi, it has no IL risk, and its smart contracts have been battle tested.

It is however a DeFi strategy, and even the most battle-tested protocols are not immune to exploits (see e.g. Curve reentrancy attack of Aug 4, 2023). In addition, it is not clear if and how incentives of MKR holders (DRS setters) and DAI holders (DRS beneficiaries) are aligned. This could affect the healthiness of the DSR approach (sustainability risk) and the offered APY (yield risk).

The SwissBorg Risk Team ranks the DSR strategy in DAI as a Low risk investment, one for an investor with a good understanding of MakerDAO and DAI work, who is willing to take on some risk in exchange for a fair reward on DAI.

Try the SwissBorg Earn today!