Crunching the data from 13 protect and burns: Do they work?

Bastien Muster

Chief Analytics Officer

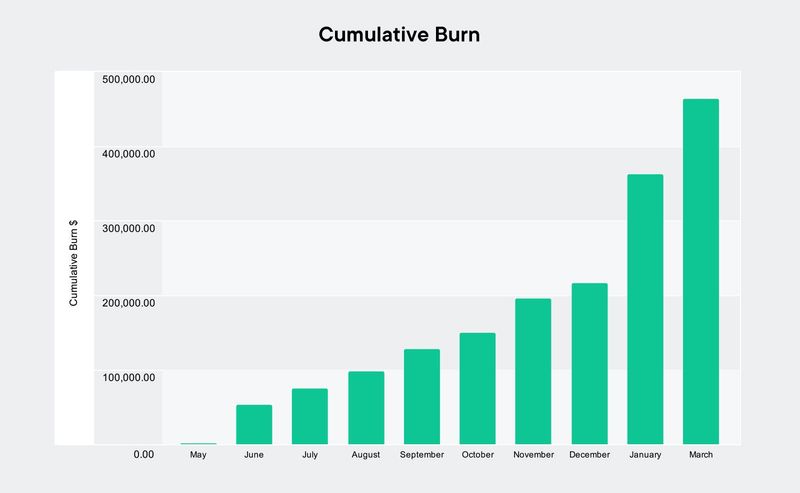

In May 2020 we ran our first token burn of over 97 thousand CHSB. Almost one year later and we’ve now conducted 13 protect and burns, valued at almost $500,000, with over $1.7 million left in the protect and burn pool.

What has the impact been on CHSB’s price? Keep reading to find out.

How does our protect and burn work?

Every month we add 20% of the revenues made from fees in the SwissBorg app to our protect and burn balance. Because this balance is based on fees, when more users join the Wealth App, the larger the reserve will be, giving us an even greater ability to protect CHSB’s price.

When CHSB’s price moves into a bearish zone based on the 20-day moving average, we automatically place orders to buy back tokens from the market. These tokens are then burnt, permanently reducing the total supply of tokens.

This is different to most buyback and burn programs, as traditional token burning programs accumulate tokens and initiate burning according to a publicly shared schedule. This means short-term speculators can game the system by purchasing tokens before the buy back and selling immediately after once the price has increased. This doesn’t provide any real benefit to loyal token holders.

At SwissBorg, because we only place orders when the price of our token enters a bearish zone, it’s more difficult for speculators to predict when this will take place to take advantage of short-term price volatility. This acts as an incentive to continue to hold CHSBs as the protect and burn balance accumulates, as well as rewarding long-term CHSB holders as their investment is protected over time.

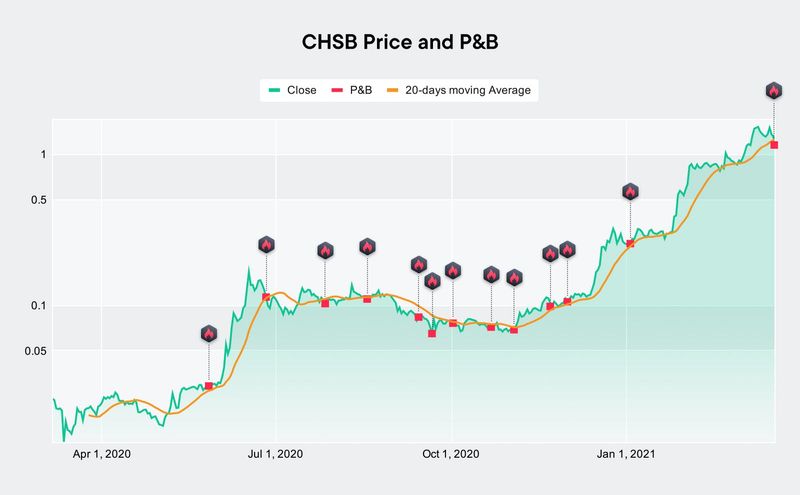

You can see each time we initiated a protect and burn in the chart below:

For real-time information, remember to check the CHSB overview page, which shares the latest information about the SwissBorg token, including price, the amount of CHSB staked, the protect and burn level, pending protect and burns and a list of all burn transactions.

So… does our protect and burn really work?

There are two factors to consider when judging how well our protect and burn program works - whether the burns did protect CHSB’s price, and if the amount burned was consistent with (or more than) a traditional monthly buy back and burn program.

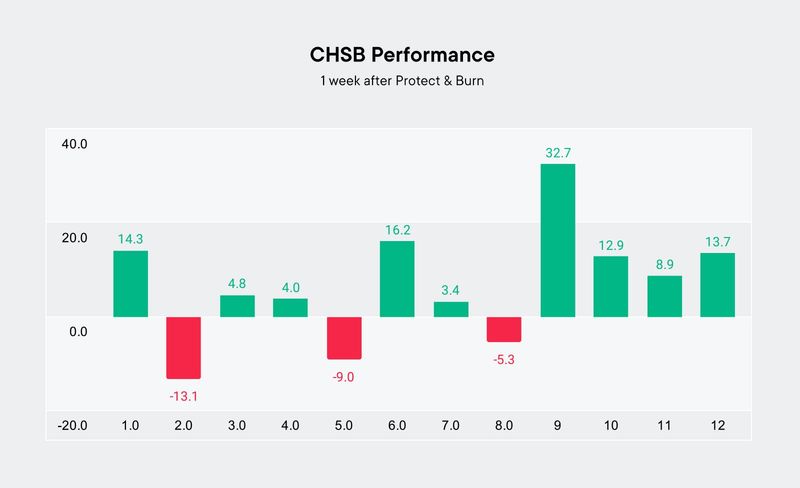

First, let’s look at CHSB’s price. The theory is that when we reduce supply, if demand remains the same the price of CHSB will increase. To validate this theory, our data team analysed CHSB’s price action following each of our nine protect and burns, and we found that in 77% of cases, the price of CHSB was higher in the week following the burn than before the burn.

This, and the historical price chart, demonstrate how our protect and burns have helped to build support beneath CHSB’s price.

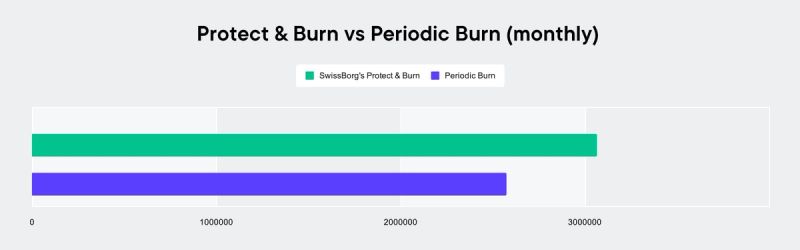

We also performed a comparison of how many tokens we would have burned if we’d just followed a monthly buy back and burn schedule versus the current protect and burn. We found that by following our protect and burn program, we burned 20% more CHSB tokens than we would have if we just followed a monthly schedule!

The best news is that the protect and burn program is getting stronger all the time, as the community using the SwissBorg app is constantly growing. In addition, 25% of all returns from our Smart Yield wallets go towards the SwissBorg ecosystem, including our protect and burn program.

Open your smart yield wallet today!