SwissBorg Partners with Kevin Follonier to Launch Exclusive Investment Club

CyBorg

SwissBorg expert

We are excited to announce the partnership between SwissBorg and Kevin Follonier, host of the influential podcast When Shift Happens, which features top crypto thought leaders and Founders such as Arthur Hayes (Maelstrom), Jordi Alexander (Selini), Arthur Cheong (Defiance), Ben Zhou (Bybit), Luke Belmar (Capital Club), Luca Netz (Pudgy Penguins), Keone Hon (Monad), Meow (Jupiter Exchange), Guy Young (Ethena) and many others.

How Does SwissBorg Benefit?

Kevin, a Swiss-born entrepreneur and podcaster, will spearhead our newly launched investment club program. Through years of experience engaging with thought leaders in the industry, Kevin has demonstrated that these insights are crucial to developing a coherent investment thesis. More importantly, his extensive network of entrepreneurs provides access to deals that will significantly enhance SwissBorg’s range of alpha investment opportunities.

The Investment Club is designed with two objectives in mind:

- Enable SwissBorg to cover a broad spectrum of deals without compromising the quality of selection.

- Provide investors with context through insightful content creation throughout their membership.

Our north star for this initiative remains unchanged: helping anyone become a better investor.

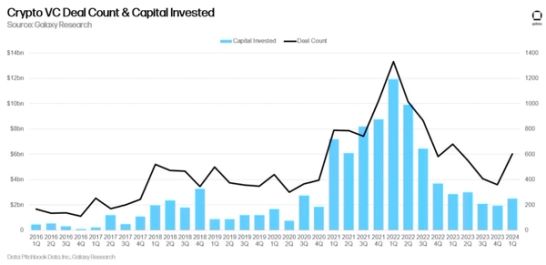

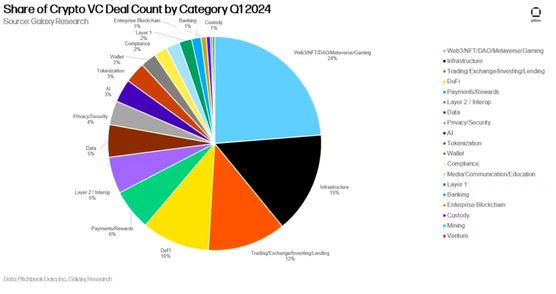

In Q1 2024, venture capitalists invested $2.49bn (+29% QoQ) into crypto and blockchain-focused companies across 603 deals (+68% QoQ).

Source: https://www.galaxy.com/insights/research/crypto-and-blockchain-venture-capital-q1-2024/

Not only is the number of deals increasing, but the diversity of the sector is also expanding at an exponential rate

Why Kevin?

SwissBorg has always been committed to its mission of providing financial freedom to its community, believing that a long-term investment mindset results in a superior source of alpha.

Every week, Kevin dives into deep conversations with the heavy hitters of the crypto world on his podcast. He gets the inside scoop, straight from the horse's mouth, before anyone else. Think of it as receiving the hottest tips directly from those shaping the future of crypto. These insights help him to refine his investment thesis.

We have designed this club not for day traders but for committed long-term investors dedicated to mastering the crypto game and prioritising legacy over short-term gains.

The goal is to focus on projects and actionable alpha deals that have the potential to significantly impact the crypto world over the next five years rather than the next five weeks.

Who is this club for?

The club is designed for long-term investors seeking to expand their exposure to the primary market while also taking advantage of opportunistic investments in the secondary market when the timing is opportune (i.e. when Kevin gets exclusive alpha and industry insights from its guests).

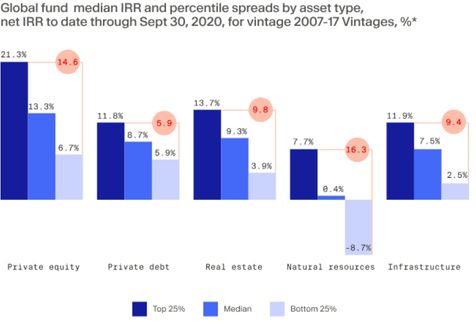

Private equity is well-known as a high-performing asset class.

Crypto investments in the primary market are relatively more volatile than traditional private equity or the stock market, with the higher risk traditionally rewarded by greater returns.

Unfortunately, too often, the primary crypto market is exclusively captured by venture capitalists, other private investment firms, or insiders. By partnering with Kevin, we are challenging this exclusivity and giving access to a select few in his private investment club

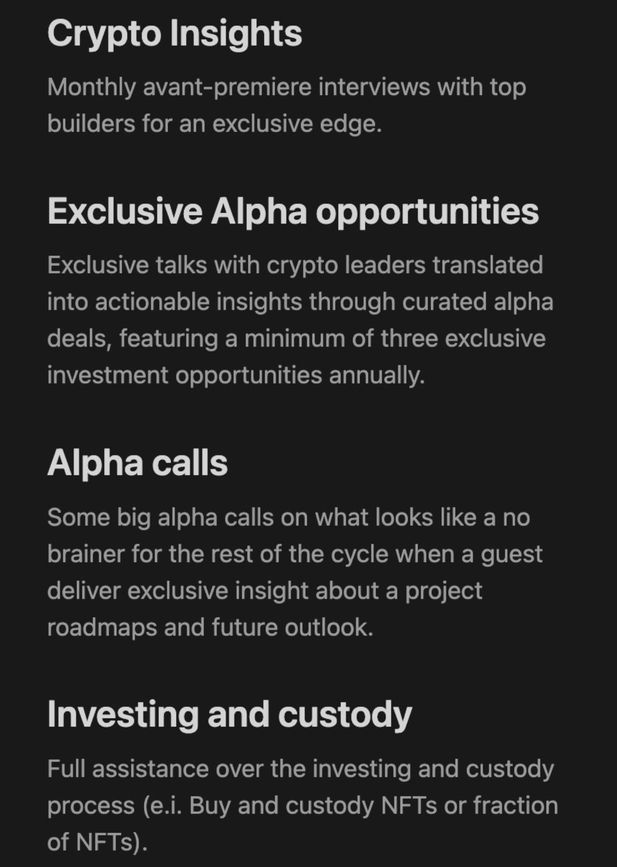

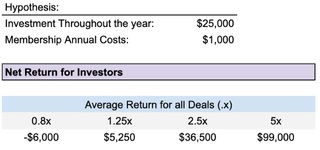

The annual subscription fee for this club is set at 1,000 USDc. In exchange for this fee, members will receive:

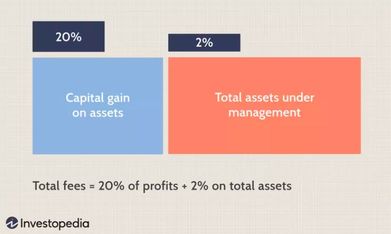

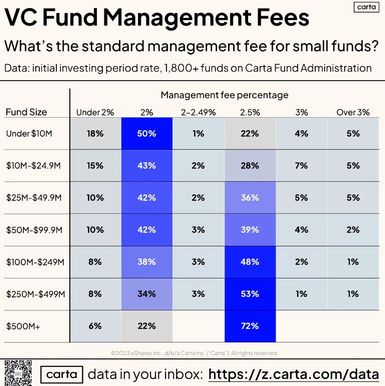

The standard practice of the deal syndicate industry follow the famous 2% Management Fees & 20% fees Model:

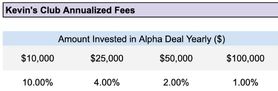

When considering the annual fees in relation to the total investment that a member intends to make in the proposed alpha deals each year:

Kevin’s Investment Club aims to strike a minimum of three deals per year. Therefore, if you are unable to commit to investing a minimum of $5,000 per deal, or a total amount of $15,000 annually, we advise against joining the club. Since the deals are designed for long-term investments, they require a commitment to sustained financial engagement.

What to expect?

We believe that, in addition to having access to the best alpha (an absolute necessity in crypto), the success of an investor is directly correlated with the confidence level they have in their investment thesis. Psychology plays a crucial role in the decision-making process of investors. Often, an investor's initial idea proves correct over time, but the execution of this idea is frequently weak and leads to losses.

The primary objective of this club is to create the context for investment decisions. Throughout the year, Kevin shares insights from top industry leaders, which in turn help to establish a clear context for each alpha opportunity. This approach increases the confidence that investors can place in their investments. Moreover, SwissBorg also acts as an advisor to weigh the pros and cons of every deal.

Concretely speaking, an AI-themed alpha deal will often be preceded by an extensive set of interviews and insights about the future of AI within the Web 3.0 space. This process ensures that investors gain valuable insights, and we help them translate these insights into actionable investment opportunities through alpha deals.

The investment club will aim to introduce deals where the full unlock of tokens will not exceed 36 months.

Join the revolution!