The SwissBorg Monthly Market Update August 2025

Franklin Lacroix

Director of Investment Success

Market Summary

August marked a historic month for crypto markets as both Bitcoin and Ethereum reached new all-time highs, with BTC peaking at $124,457 and ETH breaking above $4,950 for the first time. Growing institutional inflows drove the rally, sustained ETF demand, and renewed speculation around a more accommodative monetary policy later this year.

Volatility was more contained compared to July, allowing for clearer technical setups and consistent capital deployment. Capital rotated across themes from Layer 2s to meme coins while BTC dominance held relatively steady, confirming broad-based market participation.

SwissBorg maintained its cadence with the launch of two new Trading Vaults (AVAX and PEPE), and several ongoing strategies nearing their take-profit targets. Deployment increased across the board as market conviction strengthened.

Looking ahead, we remain focused on high-conviction setups

Trading Vaults

Trading Vaults offer simple one-tap access to advanced trading strategies managed by the SwissBorg investment team. They capture short to mid-term market opportunities through carefully selected entry points, stop-losses, and take-profits.

1. Live Vaults

Commentary

In August, we continued building on our momentum with the launch of two new vaults AVAX and PEPE both designed to capture short- to mid-term market opportunities. As overall market conditions improved and volatility became more directional, we increased deployment across active vaults with higher conviction. Several positions are now approaching their take-profit levels, while our laddered entry strategy has helped mitigate downside risk.

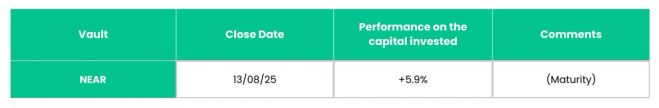

2. Vault Closed in June/July

Summary

- Summary

- Vaults Launched in August: 2

- Vaults Closed in August: 1

- Active Vaults (incl. older): 9

- Total Capital Raised Across All Vaults: $10.3M

- Total Capital Deployed (Buy Orders Executed): $6.122M

- Deployment Ratio: ~60%

- Total PnL on Deployed Capital (August launches): $51,445

- Average Return (Closed Vaults): 5.9%

- Average Return (Deployed Capital): 16%

Commentary

August was a quieter month in terms of vault closures, with most strategies still in progress and approaching their take-profit levels. Rather than force exits, we maintained our disciplined approach and allowed trades to mature within their predefined setups. This reflects our conviction in the current positioning and our confidence in the underlying assets.

While few vaults were officially closed, performance among open positions remained strong, with several vaults in double-digit unrealized gains. This patient and structured execution aligns with our core philosophy: protect capital, scale into opportunities, and exit only when conditions align with our targets.

Keep an eye on your notifications and the Investment screen in your app to see when future Trading Vaults are launching!

Crypto Bundles

Crypto Bundles offer a simple way to gain exposure to specific sectors without the hassle of selecting and rebalancing the position.

Period: August 2025

Below is the performance snapshot of our Crypto Bundles:

*The benchmark is constructed as an equal-weighted index, where each investible token within the sector is given the same weight (1/N), providing a neutral reference for sector-wide performance.

Commentary

Golden: BTC underperformed in August, down 6.46%, while Gold gained 5.8%, which helped protect the portfolio from deeper losses.

Outperformers: RWA, supported by LINK, PYTH, and Gold, along with DeFi, driven by LINK, PUMP, and ENA, and Top Borger, boosted by ETH and LINK, all delivered strong performances and outperformed their benchmarks.

Under Pressure: The Meme sector suffered the most, falling 18.6%. However, by maintaining exposure to large caps, we managed to limit the downside to 9.5%.

General Comment: The overall market declined 3.4%. Historically, August and September tend to be weak months, yet despite this context, the Bundles delivered solid performances and outperformed their benchmarks.

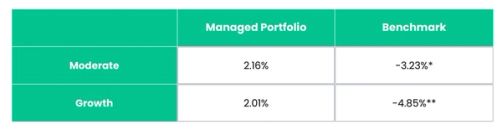

Managed Portfolios

Managed Portfolios offer a smarter, more dynamic approach to crypto investing. Simply choose your risk level, and we handle the asset management for you.

*Benchmark for the moderate portfolio 50%BTC/50% USDC

** Benchmark for growth portfolio 75%BTC/25% USDC

Commentary

Both the Moderate and Growth portfolios managed to stay positive in August, delivering +2.16% and +2.01% respectively, compared to their benchmarks at -3.23%* and -4.85%**. This resilience was largely driven by maintaining around 25% exposure to ETH, which delivered a strong performance during the month.

Invest using the SwissBorg app today!