The SwissBorg Monthly Market Update July 2025

Franklin Lacroix

Director of Investment Success

Market Summary

How did our investment products perform in June & July? First, let’s set the scene…

During July, financial and crypto markets experienced heightened volatility due to escalating tensions between Iran and Israel. These tensions have since begun to ease. Bitcoin continues to strengthen its position as a store of value, demonstrating resilience amid geopolitical uncertainty. Meanwhile, the U.S. maintains its pro-crypto stance, advancing several legislative initiatives to establish a clear regulatory framework that supports future growth. Given the inherent market instability, the focus was on protecting capital and taking calculated risks.

Trading Vaults

The Trading Vaults offer an effortless way to capture short to mid-term market opportunities through carefully selected entry points, stop-losses, and take-profits.

1. Live Vaults

Commentary

Throughout June and July, we maintained a steady pace of launching one new vault per week. We capitalized on heightened market volatility to secure attractive entry points through well-placed limit orders. Thanks to this strategy, we were able to deliver several successful vaults, notably XRP, UNI (n°2), and SUI (n°2).

2. Vault Closed in June/July

Summary

- Summary

- Vaults Launched in June/July: 7

- Vaults Closed in June/July: 6

- Active Vaults (incl. older): 8

- Total Capital Raised Across All Vaults: $6.71M

- Total Capital Deployed (Buy Orders Executed): $3.05M

- Deployment Ratio: ~57%

- Total PnL on Deployed Capital (June/July launches): $293,910.44

- Average Return (Closed Vaults): 28%

- Average Return (Deployed Capital): 21.12%

Commentary

Returns ranged from –11% to +63.4%, with an average return of 25.27% and a win rate of 83.3% (5 out of 6 vaults). Most vaults reached maturity and delivered solid performance despite a volatile environment. Two vaults were closed early after hitting their stop loss due to geopolitical tensions, resulting in one slight loss and one slightly positive outcome.

Keep an eye on your notifications and the Investment screen in your app to see when future Trading Vaults are launching!

Crypto Bundles

Crypto Bundles offer a simple way to gain exposure to specific sectors without the hassle of selecting and rebalancing the position.

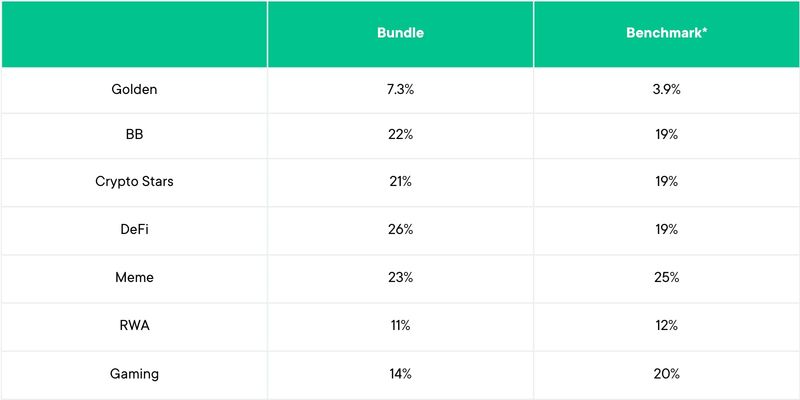

Period: July 2025

Below is the performance snapshot of our Crypto Bundles:

*The benchmark is constructed as an equal-weighted index, where each investible token within the sector is given the same weight (1/N), providing a neutral reference for sector-wide performance.

Commentary

Safe Haven: The Golden Bundle continued to demonstrate resilience in a volatile environment. The increased BTC exposure enabled it to outperform its benchmark (7.3% vs 5%).

Outperformers: The Best Blockchain, DeFi, and Crypto Stars bundles significantly outperformed their benchmarks, confirming sustained investor interest in large-cap and established crypto assets.

Under Pressure: The Gaming and RWA bundles remained under pressure and underperformed their respective benchmarks, indicating that these narratives remain out of trend compared to the broader market.

General Comment: Overall, our model performs well in capturing momentum in mature and trending sectors. However, it face challenges in capturing short-term moves in more volatile and narrative-driven tokens.

Managed Portfolios

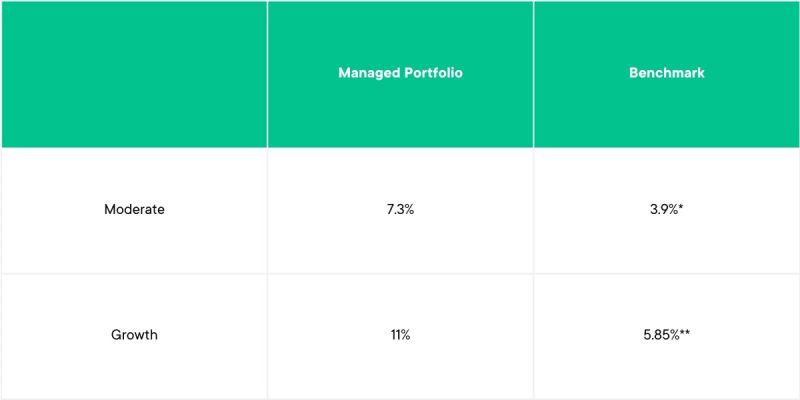

Managed Portfolios offer a smarter, more dynamic approach to crypto investing. Simply choose your risk level, and we handle the asset management for you.

*Benchmark for the moderate portfolio 50%BTC/50% USDC

** Benchmark for growth portfolio 75%BTC/25% USDC

Commentary

In July, the managed portfolios outperformed their respective benchmarks by timely increasing exposure to ETH, SOL, and XRP. This strategic adjustment anticipated a shift in market dynamics, as Bitcoin dominance declined and capital began rotating into altcoins. Our active management approach enabled us to capture these emerging trends while remaining aligned with the portfolios’ defined risk profiles.

Invest using the SwissBorg app today!