Dear Borgerz,

Can you believe we’re already halfway through 2024? Time flies when you’re riding the crypto rollercoaster! This July has been nothing short of eventful, both in the crypto world and here at SwissBorg. Let’s dive into the highlights.

What's New in the Cryptosphere?

July was a challenging month for the crypto markets. Bitcoin and Ethereum faced downward pressure, with prices dipping as investors reacted to broader economic uncertainties. The most significant development came from Japan, where a surprising economic decision sent ripples through global markets, including crypto.

Boost your portfolio today with SwissBorg! Join the crypto revolution! 🚀📈

In a bold and unexpected move, the Bank of Japan decided to raise interest rates for the first time in years, departing from its long-standing ultra-loose monetary policy. This decision, aimed at tackling inflation and stabilising the yen, had far-reaching consequences—not just for traditional markets, but also for the crypto world. Japan’s rate hike led to an immediate strengthening of the yen, which caught many investors off guard. Global markets reacted with increased volatility as investors recalibrated their portfolios in response to the new economic landscape. The move also triggered a broader risk-off sentiment, with investors pulling back from more volatile assets, including cryptocurrencies.

The crypto markets were hit particularly hard by this development. As Japan’s interest rates rose, the yen appreciated, leading to a sell-off in riskier assets, including Bitcoin and other major cryptocurrencies. Many investors liquidated their crypto holdings to rebalance their portfolios, seeking safety in more traditional assets like bonds and stocks, which suddenly became more attractive due to the higher returns.

The market sentiment turned bearish as fears grew that other central banks might follow Japan’s lead, potentially tightening liquidity conditions globally. This added to the downward pressure on crypto prices, with some assets experiencing double-digit losses. For crypto investors, this serves as a reminder of the asset class’s vulnerability to macroeconomic factors and the importance of staying informed and adaptable.

Beyond economic shifts, geopolitical tensions are also making headlines and contributing to market volatility. The situation between Israel and Iran is becoming increasingly tense, with fears of a potential conflict escalating. The possibility of a larger, even global, conflict has investors on edge. Such geopolitical risks typically lead to heightened market instability as uncertainty drives investors towards safe-haven assets. For the crypto market, this could mean increased volatility, as global tensions often cause rapid shifts in asset allocation. Keep an eye on this situation, as further developments could have significant implications for the broader financial landscape, including crypto.

On the political front in the United States, the race between Kamala Harris and Donald Trump is tightening. According to Polymarket odds, Harris is closing in on Trump’s lead, a development that has caught the attention of the markets. The market had already started to price in a Trump victory, which many believed would lead to certain economic policies favourable to risk assets. However, with Harris gaining ground, there’s increased uncertainty about the future political landscape. This political uncertainty is contributing to market volatility, as investors grapple with the potential policy shifts that could come with either outcome. The crypto market, sensitive to such uncertainty, is likely to remain volatile as the U.S. presidential race unfolds.

SwissBorg Updates

The Rise of Meme Coins

Meme Coins have taken the crypto world by storm, capturing the imaginations of both seasoned investors and newcomers alike. Originally born from internet memes and social media trends, these tokens have evolved beyond their humorous origins to become significant players in the cryptocurrency market. Meme Coins like Dogecoin and Shiba Inu have built vibrant communities fueled by collective enthusiasm and a shared sense of fun. They epitomise the spirit of decentralisation, where humour and culture intersect with finance, creating unique opportunities for engagement and investment.

At SwissBorg, we’re celebrating this unique culture with our community-driven Meme Coins Battle Royale. Each week, two contenders go head-to-head, with the winner determined by votes on X. After weeks of fierce competition, the grand finale was here, featuring FLOKI vs. PONKE. The ultimate winner ended up to be FLOKI, which will be granted a bigger allocation in our Meme Coins Crypto Bundle, sitting on top of the meme world.

Alpha opportunity update

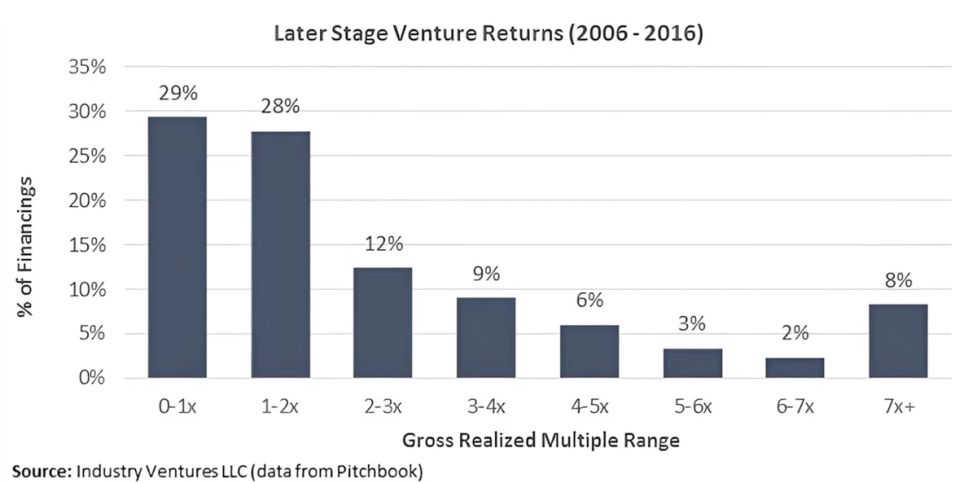

Florent Koenig, our beloved Investment analyst has written a very interesting piece about this state-of-the-art product. At SwissBorg, we want to empower everyone on their journey to financial freedom. One way to make this vision a reality is by giving our community access to exclusive investment opportunities with the same or even better terms as professional investors. This is why we have carefully crafted our alpha opportunities to allow our community to invest in early-stage projects in the same way that VCs secure their deals. Because let’s face it, in crypto, the highest rewards are found in the private sphere, and we want to ensure that our community has access to that. But as the saying goes,“on ne peut pas avoir le beurre et l’argent du beurre”. So if you want to play the same game as early-stage investors, you also need to accept the inherent risks. The harsh reality is that getting access to promising early-stage projects does not guarantee a return. It often works a bit in the opposite way: the earlier you invest in a project, the higher the potential rewards, but the greater the risk as well. The typical “successful” venture portfolio is often described as having the following outcome:

- 1/3 of investments fail

- 1 /3 of investments break even or make a small amount of money

- 1/ 3 of investments do well and are responsible for most of the portfolio returns

This is a generalisation, but one that is widely accepted and makes the point that venture investing is typically characterised by a skewed return profile: a high failure rate and a handful of investments that drive the bulk of the returns. In the words of Peter Thiel, a legend in the venture space, “the biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined”. This is a key point to keep in mind when approaching our Alpha Deals as it comes with an inherent element of risk associated with early-stage investing. Again, as stated earlier, “you can't have the cake and eat it too.” Since the beginning of this Alpha journey, our objective at SwissBorg has been to select projects that we believe have the potential to fall on the right side of the distribution chart. That’s why we implemented a rigorous investment due diligence process, analysing all the metrics we deem important to decide whether a project should participate in the alpha deals. This approach has led us to select various projects for our alpha deals:

- XBorg

- Phaver

- GoGoPool

- Creta

- Colony Lab, and many more

Miscellaneous

July also saw other improvements, articles, etc. The most important ones are a terrific article called “It is not over for Bitcoin”. It explains how five months ago, Bitcoin broke its past all-time highs (ATH), and the general market sentiment was euphoric. Many altcoins showed impressive performance, the on-chain fundamentals of major blockchains appeared stronger than ever, and even the largest traditional financial institutions (TradFi) discussed the bullish case for crypto. Fast forward to today: Bitcoin is down big time from its previous highs, most altcoins have suffered dramatically, and market sentiment has deteriorated substantially. However, during these moments, maintaining a clear mind, gaining perspective beyond the day-to-day noise, and trying to see things from a higher level is the most valuable thing one can do.

The second important input to the app was the listing of Sanctum (CLOUD). Sanctum protocol specialises in the domain of liquid staked tokens (LSTs) on the Solana blockchain. It streamlines the process of generating, exchanging, and overseeing these tokens. Among its standout offerings is the "Infinity" protocol, engineered to maximise staking returns and liquidity.

Conclusion

Looking ahead and preparing for tomorrow and as we move into August, we’re focusing on building even stronger foundations. The world of crypto may be unpredictable, but with the SwissBorg family, we’re confident that we can face any challenge head-on. Thank you for being part of this journey. Let’s continue to build, learn, and grow together!

Proud Founder and CEO of SwissBorg 🇨🇭, always here to serve you 🙏,

To the moon and beyond,

Cyrus Fazel ✍️

🚀💼🌟

Meme of the month: