Staking on Moonbeam

Key Takeaways:

- Staking represents one of the safest options in DeFi to generate yield.

- The yield (APY) is derived from staking GLMR tokens – contributing to the Proof-of-Stake consensus mechanism of the Moonbeam blockchain.

- Moonbeam is a Layer 1 blockchain on the Polkadot parachain, providing cross-chain-connected applications that unite functionality between Ethereum, Cosmos, Polkadot, and more. GLMR is an ERC-20 token that serves as the native currency of the Moonbeam network.

- GLMR liquid staking represents a liquidity yield-generating investment. No lockup period is present for this strategy but a 14-day cooldown is required to fully unstake the asset.

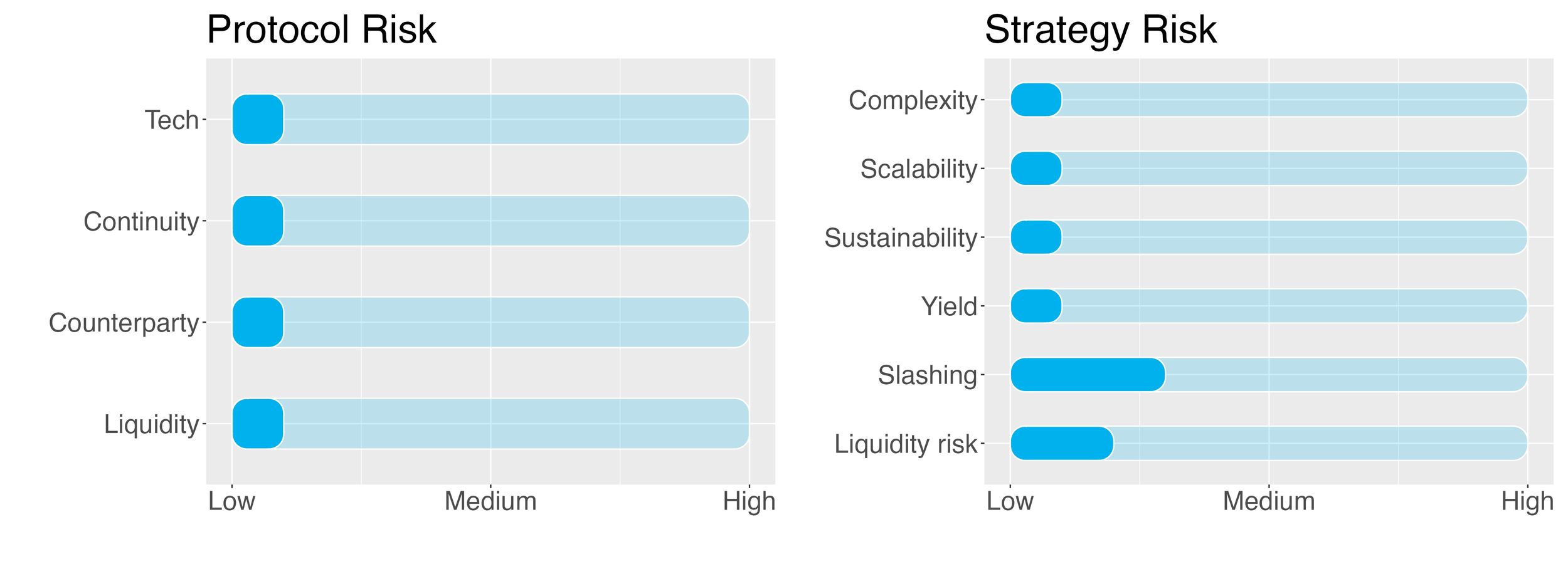

- Risk Checklist. In our view the predominant risks for this strategy are as follows:

- Slashing risk

- Liquidity risk of staking

1. Strategy Explained

The strategy involves staking GLMR tokens in order to provide security to the Moonbeam blockchain.

The first step in the staking process involves choosing a so-called ‘collator’, i.e. a block producer that collects transactions from users and produces state transition proofs for the relay chain to validate.

In order to stake GLMR, the SwissBorg tech team will filter by collators’ APY, take into account the collators’ amount of staked GLMR (since there is a limited set of active collators and bigger ones are preferred in order to avoid losing rewards) and if possible, will take collators linked to the Moonbeam Foundation, their developers or trusted third-parties.

Lockup period: None.

Cooldown: 14 days

2. Risks

Trust Score

GLMR staking is done directly using the Moonbeam app.

Staking is embedded directly into the network and no additional protocol is required. Therefore no tech risk is expected.

The tech risk is set to 1/10.

Protocol Risks

Project Continuity Risk

Project continuity risk is low.

Moonbeam was founded in 2019 by Derek Yoo, CEO of PureStake, which provides secure public blockchain infrastructure for application developers, projects and enterprises.

Moonbeam is a smart contract platform that enables developers to build applications that operate across multiple blockchains. Developers can use popular Ethereum tools to build or redeploy projects created using the Solidity programming language and Substrate.

Substrate is an open-source development framework for customised blockchains. It includes support to connect to the Polkadot and Kusama chains.

GLMR launched in January 2022 with a total supply of 1bn tokens. A portion of the tokens was reserved to ensure that Moonbeam maintains a parachain slot on the Polkadot network. Portions were also reserved for community funding. The maximum supply of GLMR is uncapped and Moonbeam is targeting an annual inflation rate of 5% “to pay for ongoing security needs of the network.

The Moonbeam chain is relatively small, displaying a TVL of only $36m (ATH in Jan 2020 with $275m). As staking is embedded directly into the network, there is no risk that the staking provider stops functioning. The main risk here would be that the Moonbeam blockchain ceases its operations. This risk is however out of scope for this report.

Moonbeam staking continuity risk is set to 1/10.

Counterparty Risk

Counterparty risk is deemed low.

Counterparty risk exists whenever an asset is handed over to an external provider. Any credit events involving the staking provider could affect the assets that have been entrusted to them.

That said, staking via a 3rd party is fundamentally different from depositing funds into a lending protocol that later becomes insolvent.

In a Proof-of-Stake protocol, tokens are locked up in a validator to secure the underlying network and receive staking rewards in return.

Those validators, with the assets and rewards they hold, are fully transparent and always verifiable "on-chain". This is contrary to centralised company reserves which can be opaque and under-collateralized, as it has been seen in the case of some famous crypto exchange, now bankrupt.

With staking, there is no counterparty but the network itself. Validators are rewarded by operations automatically through preset ‘block reward’ rules, as well as through a share of transaction fees. There is no risk of default or bank runs.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

Funds held by the staking provider are redeemable after the required (if any) lockup and cooldown periods. In no circumstances would one expect instances of illiquidity during the redemption process.

Liquidity risk is 1/10.

Strategy Risks

Complexity

Complexity of the strategy is low.

The strategy involves depositing GLMR on Moonbeam to perform staking. One chain (Moonbeam), 1 token and one staking service is employed with no leverage.

The complexity risk of the strategy is 1/10.

Scalability

The scalability risk is low.

Staking is a highly scalable practice. Indeed, the more stakers are participating, the higher the safety of the blockchain.

The scalability risk of the strategy is 1/10.

Sustainability

The sustainability risk is low.

The yield obtained from this strategy is fully sustainable as it comes from participating in the validation of GLMR transactions, the Proof-of-Stake mechanism.

Proof-of-Stake is quite energy efficient when compared to Proof-of-Work chains like Bitcoin and has therefore practically no negative impact on the environment.

The sustainability risk of the strategy is 1/10.

Yield Risk

Yield risk of strategy is low.

Staking provides a constant stream of income with low variability. The only issue could be related to missing rewards, see the ‘slashing risk’ section below.

The yield risk of the strategy is 1/10.

Slashing Risk

The slashing risk of the strategy is medium to low.

The Proof of Stake consensus mechanism requires participants to behave responsibly for the overall good of the ecosystem. For this reason, blockchains penalise validators if they step out of line by slashing the value of their stake. The two most common offences are double-signing or going offline when the validator should be available to confirm a new block.

The Moonbeam blockchain does not currently impose slashing. The worst that can happen is that GLMR rewards are not received. This may happen under 3 circumstances:

- The selected collator goes out of the active set, i.e. it stops collating. If this happens, one would need to unstake the tokens, and stake with another collator.

- The selected collator stops authoring blocks. This could be due to the collator being down or having technical difficulties.

- The selected delegation might be “outbid” by other delegations. Only the top 300 delegations per collator receive rewards, so if there are 300 delegations that are higher than the chosen one, the staker won’t receive anything.

While there is no slashing risk, there could still be the chances that rewards are not fully received during the period.

The slashing risk of the strategy is 3/10.

Liquidity Risk of Staking

Liquidity Risk on staking GLMR is low.

Staking GLMR on Moonbeam requires no lockup but a cooldown period of 14 days. Regardless of the direction the market chooses during this time, your assets will be out of reach.

The liquidity risk is therefore set to 2/10.

3. Conclusions

GLMR staking comes with little risk.

Staking per se is generally considered a very safe investment.

GLMR staking comes with no lockup but a 14-day cool down period. Liquidity is therefore readily available. Staking is embedded in the Moonbeam chain and it therefore comes with no additional risk.

The SwissBorg Risk Team ranks GLMR staking as a Low risk investment, one for an investor with some understanding of DeFi and yielding, who is willing to take on a minimum amount of risk – while remembering that there is no free lunch! – in exchange for an acceptable reward on GLMR.

Try the SwissBorg Earn today!