Restake ETH via EigenLayer

Key Takeaways

- This strategy fits the profile of an investor who is willing to take risk in exchange for a greater reward for entering a brand new ETH primitive.

- The strategy makes use of EigenLayer, a new protocol built on Ethereum that introduces restaking, a new primitive in cryptoeconomic security. This primitive enables the reuse of ETH on the consensus layer (project continuity risk).

- The strategy is fairly simple: Kiln staked ETH (e.g. native staking, no liquid staking protocol involved) are restaked into EigenLayer and used to provide security to Actively Validated Services (AVS) protocols supported by Kiln.

- The Yield (APY) is composed of Staking ETH (secure the Ethereum PoS consensus mechanism), Stage I and Restaking ETH (reuse the staked ETH to provide security to the AVSes), Stage 2 (happening in Q2 2024).

- There is some risk associated with the smart contract involved. However, the fact that native staking is performed means the strategy does not rely on liquid staking protocols like Lido, thus smart contract risk is reduced (tech risk).

- A cooldown period of 18 days is present and rewards are paid out at the end of the period (ETH liquidity risk). For this reason, investors will not be able to quickly adjust to any changes of market conditions.

- Staking and restaking subject to very specific risks, namely slashing. At this stage slashing of tokens is not introduced yet. On the restaking side during the process, ETH tokens are subject to slashing conditions imposed by the other protocol, as well as Ethereum.

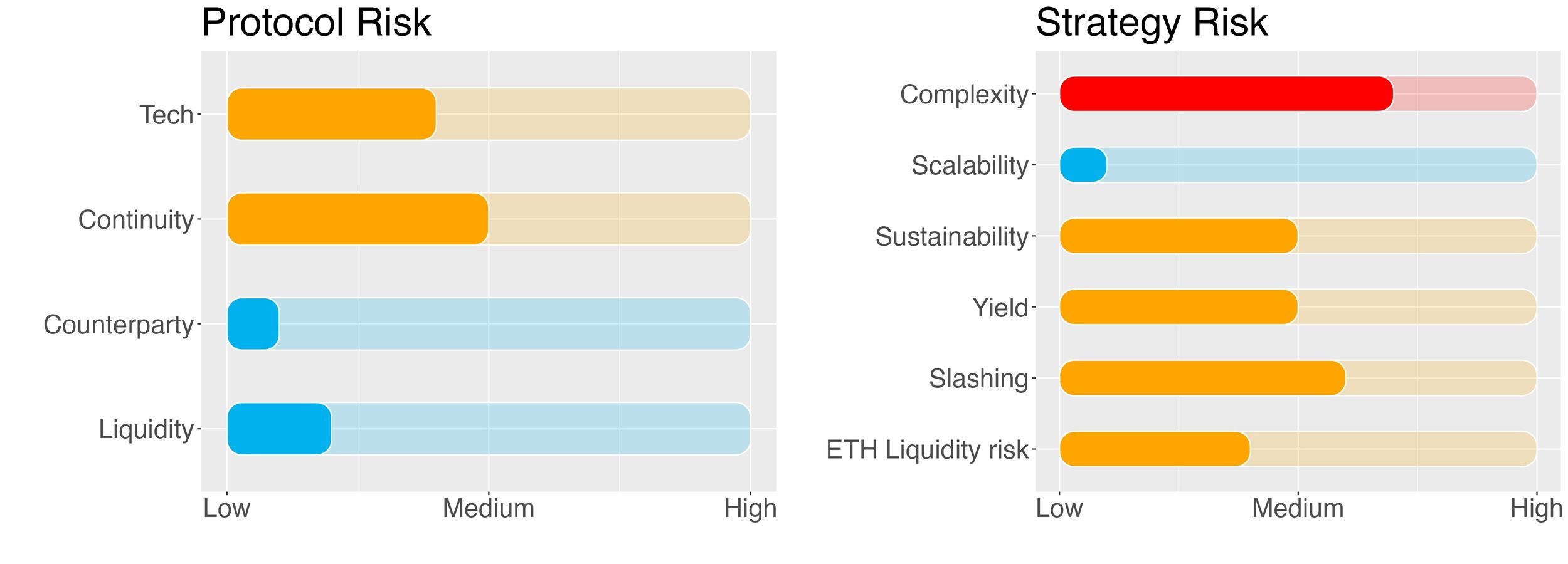

- Risk Checklist: in our view the predominant risks for this strategy are

- Tech risk

- Projet continuity risk

- Complexity risk

- ETH liquidity risk

- Staking and restaking risks

1. Strategy Explained

What is staking and what is restaking?

Staking is the process of validators confirming transactions in a proof-of-stake consensus blockchains. Restaking is EigenLayer’s revolutionary idea that allows these validators to opt-in to transaction mining for other applications / middleware (e.g. oracles and bridges). To put it simply, restaking allows users to stake the same ETH on both Ethereum and on other protocols, securing all of these networks simultaneously. Hence, restaking allows for leverage of existing trust networks.

In simpler words: what the protocol does could be seen as the equivalent of rehypothecation in traditional finance: re-using previously pledged collateral as the collateral for a new loan.

When restaking, investors take on a new set of slashing conditions (i.e. risk). In exchange, ETH restakers can receive additional rewards to supplement their traditional staking yields.

What is EigenLayer?

EigenLayer is a middleware that is built on the Ethereum network, which lets protocols that integrate with it leverage Ethereum’s highly secure trust network without needing to establish its own validator set.

This means that protocols can integrate EigenLayer to leverage Ethereum's underlying security by ‘renting’ it. This is achieved by allowing ETH stakers to restake their ETH to secure these protocols.

The goal of EigenLayer is to create a much more robust blockchain ecosystem, with the bulk of protocols being highly secure.

What is Kiln?

Kiln is the leading enterprise-grade staking platform, enabling institutional customers to stake assets, and to whitelabel staking functionality into their offering. The platform is API-first and enables fully automated validators, rewards, data and commission management.

What is AVS?

Actively Validated Services (AVS): Any system that requires its own distributed validation semantics for verification, such as sidechains, data availability layers, new virtual machines, keeper networks, oracle networks, bridges, threshold cryptography schemes, and trusted execution environments.

Once launched, restakers will be able to delegate stake to node operators performing validation tasks for AVSes in exchange for service payments.

Why does this matter?

Stakers provide security to the protocol. Before EigenLayer, providing proper security was one of the biggest hurdles to overcome for new blockchains. Even if successful, the security is only as strong as the number of validators.

EigenLayer is presents itself as a win-win protocol for Ethereum ecosystem:

- On one hand, you have stakers who can now earn extra rewards on their ETH

- On the other, you have projects who can now rent Ethereum’s security at a fraction of the cost

How will the strategy work?

With this first vault, ETH are deposited through an ad-hoc EigenPod, which deploys those ETH directly onto Kiln validators. An EigenPod is a smart contract managed by users, designed to facilitate the EigenLayer protocol in monitoring and managing balance and withdrawal statuses.

On the validator Kiln is going to run the Eigen node software in order to perform restaking.

Once Stage 2 (expected in Q2 2024) is initiated, the staked ETH will be effectively restaked in order to provide security to AVSes. From that moment, the restaking rewards will start.

Simply put, the deposited ETH are first natively staked in Kiln (i.e. they provide security to the Ethereum chain), and then re-staked in order to bootstrap Proof-of-Stake security to the AVS protocols, leveraging on the already staked ETH.

Initially, all AVSes that Kiln supports will be in scope for restaking, and no slashing will be implemented yet. Once slashing is activated SwissBorg will perform a due diligence and restake only on protocols deemed trustable.

Users will receive all relevant information in due time.

Cooldown period: 18 days.

2. Risks and Rewards

Protocol Risks

Trust Score

Developed by EigenLabs, EigenLayer is led by University of Washington professor Sreeram Kannan, with team members from AWS, Compound, ConsenSys, Facebook, Microsoft and Protocol Labs.

EigenLabs has raised ~$65 million from investors including Blockchain Capital, Polychain Capital, Ethereal Ventures, Electric Capital, Figment Capital, Coinbase Ventures and more.

Kiln is a Paris-based start-up that provides a service known as “staking” for blockchains.

By locking up their tokens (i.e. stake them), users join others in validating transactions on the blockchain, which protects the network from potential attack.

At the time of writing Kiln AuM is over $6b in staked tokens.

The project is relatively new and not battle tested but given the growth of the staking practise the continuity risk should be contained.

Both Kiln and EigenLayer have a ‘green’ score in our tech due diligence, but since EigenLayer is not battle tested, we set the tech risk to (the lower bound of) medium.

Tech risk is set to 4/10.

Project Continuity Risk

Project continuity risk is medium.

EigenLayer app mainnet launch happened on June 14, 2023.. This followed a successful completion of the Stage 1 Testnet for restaking functionality.

The stETH, rETH and cbETH pools have been filled within minutes and a total of over 14,000ETH is restaked in the protocols’ smart contracts.

Other liquid staking protocols joined the party, along with liquid re-staking protocols like Kelp, Renzo, Ether.fi etc…

With a TVL of over $10b, EigenLaye has established itself as ‘the’ protocol for ETH restaking.

Kiln is a well established project with very low continuity risk.

Overall, since restaking has not been yet implemented in practice, we take a conservative approach and set the overall project continuity risk to medium.

Protocol continuity risk is 5/10.

Counterparty Risk

Counterparty risk is deemed low.

EigenLayer brings the advantages of the Proof-of-stake consensus mechanism to a next level by allowing staked tokens to be staked again to provide security to other networks/protocols.

The protocol is fully decentralised and its operations are all regulated by smart contracts.

With Proof-of-stake, participants referred to as “validators” lock up set amounts of cryptocurrency or crypto tokens—their stake, as it were—in a smart contract on the blockchain. In exchange, they get a chance to validate new transactions and earn a reward

Those validators, with the assets and rewards they hold, are fully transparent and always verifiable "on-chain".

With staking (and restaking), there is no counterparty but the network(s) itself. Validators are rewarded by operations automatically through preset ‘block reward’ rules, as well as through a share of transaction fees. In principle. there should be no risk of default or bank runs.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

Although a cooldown period is present (see in the next section) once the unstaking of the restaked assets is initiated, tokens will be readily available and no liquidity constraints represent a foreseeable risk.

Liquidity risk is 2/10.

Strategy Risks

Complexity

Complexity of strategy is medium to high.

The strategy employs one chain (Ethereum), 1 native staking service (Kiln), 1 protocol (EigenLayer) and Kiln-supported AVS whose security is guaranteed via staking ETH.

Restaking is not yet live so we conservatively set the complexity risk to medium/high.

Complexity of the strategy is 7/10.

Scalability

Scalability risk of strategy is low.

Staking is a highly scalable practice. Indeed, the more stakers (and restakers) are participating, the higher the safety of the blockchains/protocols involved.

Scalability risk of the strategy is 1/10.

Sustainability

Sustainability risk of strategy is medium.

The strategy generates yield via Kiln native ETH staking (i.e. taking part in the Ethereum network Proof-of-Stake algorithm) and by restaking ETH.

APY from Kiln native staking is ‘real’.

As for the restaking APY, it could also depend on protocol’s incentives employed to attract validators. This could create a trade-off between restakers and existing protocol participants (see the sections below): If too many rewards are given to restaking participants, it will impact the protocol’s tokenomics, causing existing participants to leave. Conversely, if rewards are too low, restaking participation may decrease - and so its security. Thus, each protocol needs to carefully consider how to distribute token rewards before introducing EigenLayer.

Sustainability risk of the strategy is set to 5/10.

Yield Risk

Yield risk of strategy is medium.

The strategy yield is at the time of writing unknown. This is because restaking has not started yet and we are thus not in a position to comment on the APY evolution.

Obviously the APY is floored at the Kiln native ETH staking APY.

Yield risk of the strategy is conservatively set to 5/10.

Staking and restaking Risks

Risks associated with ETH restaking are to be considered medium to high.

For a detailed explanation of the general risks associated with restaking please refer to the first EigenLayer Risk Report.

During the restaking process, ETH tokens are subject to slashing conditions imposed by the other protocol (the AVS), as well as Ethereum.

If a validator participating in the restaking process loses their staked ETH tokens due to the slashing conditions of an AVS, they will still lose their staked ETH tokens even if they have followed the Ethereum network’s rules.

Participating in restaking doubles the risk, but it also increases the total reward by receiving not only Ethereum block rewards but also rewards from other protocols.

As mentioned before, initially no staking is implemented. Once staking goes live, only protocols in line with SwissBorg risk appetite (trade-off between rewards and slashing risk) wil be selected for restaking.

As an additional risk mitigant, it's noteworthy that Kiln has never experienced an instance of slashing, neither on Ethereum nor on any other chain for which they provide staking services.

Risks associated with restaking are set to 6/10.

Liquidity Risks of restaking

Liquidity Risk on staking ETH is medium to low.

Restaking ETH in EigenLayer requires the investor to lock-up their ETH tokens for a period of 18 days. Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

Liquidity risk is therefore set to 4/10.

3. Conclusions/Recommendations

EigenLayer represents an evolution of the concept of staking.

What the protocol does could be seen as the equivalent of rehypothecation in traditional finance: re-using previously pledged collateral as the collateral for a new loan.

When restaking, investors take on a new set of slashing conditions (i.e. risk). In exchange, ETH restakers can receive additional rewards to supplement their traditional staking yields.

The EigenLayer strategy in ETH comes with risks. The investment strategy is fairly simple but yet it requires some deep understanding of how restaking works.

It does involve a 18-day cooldown period and rewards are paid out at the end of the period.

The SwissBorg Risk Team ranks ETH on EigenLayer as a Satellite investment, one for an investor with a very good understanding of staking and restaking, who is willing to take on extra risk in exchange for a very attractive reward on ETH.

Try the SwissBorg Earn today!