Everyone feels it.

Prices are volatile, headlines are dramatic, social media is full of perma-bears and perma-bulls shouting at each other. Many investors are asking the same question:

“Are we in a bull market, a bear market, or something in between?”

In a special Pow Wow episode, Cyrus and Alex stepped back from the noise and looked at the market through six objective pillars. The goal was simple: remove emotion, look at the facts, and ask what is most probable from here.

The surprising conclusion:

Things are much clearer than they feel.

Bull or Bear?

Let us walk through the six pillars, the key milestones ahead, and the strategy they believe makes the most sense for long term investors.

Why We Use Six Pillars Instead Of Vibes

Rather than guessing “bull” or “bear”, Cyrus and Alex frame the market as a probability problem.

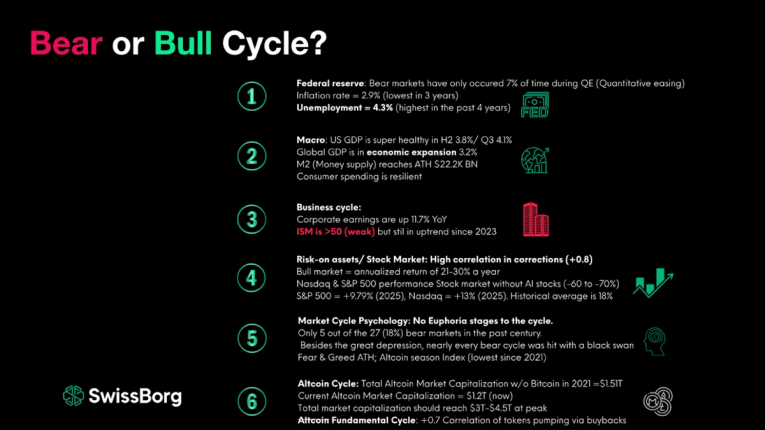

They look at:

- Federal Reserve and monetary policy

- Macro Economics

- Business cycle

- Risk on assets and equity markets

- Market cycle psychology

- Altcoin cycle

With a simple analysis, five of these pillars currently lean positive, one is more mixed. Taken together, they paint a picture of a market in correction and accumulation, not a finished bull market or a classic recession driven bear.

Pillar 1: The Federal Reserve

Whether we like it or not, the Federal Reserve still has a huge influence on global liquidity and risk assets.

Right now:

- The Fed is signalling an entry into a new Quantitative Easing (QE) phase, where it injects liquidity into the system.

- Historically, bear markets only occurred about 7 percent of the time during QE. In other words, 93 percent of QE periods were associated with bull markets or at least constructive conditions.

- Inflation is around 2.9 percent, the lowest level in three years.

- Unemployment is about 4.3 percent, the highest in four years. That sounds negative, but it actually increases the pressure on the Fed to cut interest rates and support growth.

Unless we see a brutal U turn from the Fed, this pillar is clearly supportive for risk assets and crypto.

Pillar 2: Macroeconomy

If you only watched the news, you might think the world is on the brink of collapse. The actual data tells a different story.

- US GDP is strong. Recent figures show growth of 3.8 percent and 4.1 percent in the last two quarters, beating expectations.

- Global GDP is around 3.2 percent, which is classified as economic expansion, not recession.

- Money supply (M2) is at an all time high, roughly 22.2 trillion dollars. There is a record amount of money in the system.

- Household consumption remains resilient. People are still spending.

So why does it feel so bad?

Because uncertainty is high. A lot of that money is still on the sidelines, waiting to decide between risk on and risk off. If QE truly begins and confidence returns, that liquidity can move very quickly into assets like equities and crypto.

From a macro perspective, the backdrop is healthier than the narrative suggests.

Pillar 3: The Business Cycle

Here we find the one pillar that is more mixed.

- Corporate earnings are up roughly 11.7 percent year on year, which is clearly positive.

- The ISM Manufacturing Index (PMI), which tracks industrial activity and supply chains, is still below 50. That level signals weakness, although the trend has been improving since 2023.

The takeaway: the business cycle is not in crisis, but it is not as strong as the macro data and Fed backdrop. It is a yellow light rather than a clear green.

This is the main “negative” in the six pillar framework.

Pillar 4: Risk On Assets And The Equity Market

Crypto does not live in a vacuum. During corrections, the correlation between stocks and crypto is very high, around 0.8. So it matters a lot whether equities are in a real bull market or not.

What defines a bull market in stocks?

- Roughly 2.7 years of rising prices

- Annualised returns of 21 to 30 percent

Now look at the current cycle:

- If you remove AI leaders like Nvidia, Alphabet and others from the S&P 500 and Nasdaq, performance drops dramatically.

- Without AI, the S&P 500 is up around 9.79 percent in 2025.

- Without AI, the Nasdaq is up around 13 percent.

- The Nasdaq’s historical average is closer to 18 percent.

In other words, most of the apparent “bull market” in equities has been a sector boom in AI, not a broad based risk on rally.

That actually matters a lot for crypto. It suggests that a true full market bull phase has not played out yet. The global risk engine is not fully switched on.

Pillar 5: Market Cycle Psychology

Numbers are only half the story. Investor psychology is the other half.

Cyrus and Alex highlight a few key points:

- Historically, out of 27 bear markets in the past century, only five (about 18 percent) happened without a clear euphoria phase first.

- Most serious bear markets start after a period of mania, not out of nowhere.

- In this cycle we have not seen euphoria in crypto. We have seen strong rallies in Bitcoin, Ethereum and a few tokens with strong fundamentals, but not the wild, broad based altcoin mania that typically marks the top.

- The Fear and Greed Index has recently hit extreme fear levels.

- The Altcoin Season Index is at its lowest level since 2021.

Put simply, the emotional state of the market looks much more like a bear trap and correction than the end of a cycle.

Smart contrarian investors usually want to accumulate when fear is high and distribute when greed is extreme, not the other way around.

Pillar 6: The Altcoin Cycle

If there is one topic everyone is obsessed with, it is altcoin season.

Has it already happened and we missed it, or is it still ahead of us?

The data suggests it is still to come.

- In the previous cycle, the total altcoin market cap (excluding Bitcoin) peaked around 1.51 trillion dollars.

- Today it sits closer to 1.2 trillion dollars, below that previous all time high.

- This is despite four extra years of innovation, thousands of new projects and entire new sectors such as restaking, AI tokens and modular chains.

If you go further and strip out Ethereum and even stablecoins, the picture becomes even clearer. Stablecoins such as USDC and USDT have grown massively since the last cycle, which inflates the headline market cap without reflecting speculative altcoin flows.

Under the surface, we have not seen a true altcoin blow off top. What we have seen is a fundamental season, where projects with strong cash flows and buyback mechanics have outperformed. That is very different from a classic 50 to 100x alt season driven by pure narrative.

So Where Are We Really?

cross the six pillars:

- 5 pillars lean positive or very constructive

- 1 pillar (business cycle) is more cautious

There has been:

- No broad based equity bull market

- No crypto euphoria

- No real altcoin season

- No new systemic crisis on the scale of 2022

From this perspective, it looks less like a completed bull market and more like a long, painful recovery and accumulation phase after a historic crash.

Corrections of 30 percent or more during a bull phase are normal. They shake out leverage, force weak hands to capitulate and let stronger holders accumulate.

The key is how we respond.

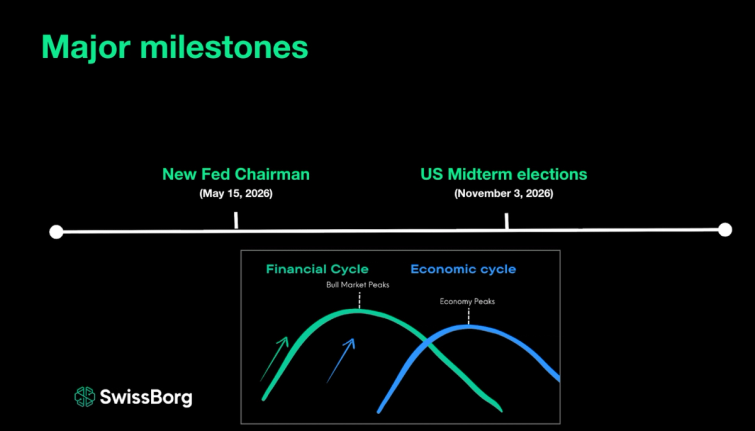

Key Milestones To Watch

Of course, this constructive picture relies heavily on what happens next with policy and politics.

Two milestones stand out:

- Change of Fed Chair, May 2026A new chair is likely to align with the current political leadership and will have every incentive to keep markets and the economy healthy. That usually means lower rates and accommodative policy.

- US midterm elections, November 2026No government wants crashing markets going into an important vote. Historically, the period into elections is often supportive for risk assets.

Along the way, every FOMC meeting remains important. If the Fed were to completely reverse course and abandon QE, that would clearly change the picture and could bring renewed pain.

For now, the base case remains constructive, with bumps and volatility along the way.

The Best Strategy In Uncertain Times: DCA With A Cash Buffer

Knowing that the probability favours a constructive outcome is one thing. Acting sensibly in the meantime is another.

Cyrus and Alex are very clear about the strategy they personally favour:

- Keep around 20 percent of your portfolio in cash.

- Use that to auto-invest regularly into the tokens you truly believe in.

- Do this on the way in and on the way out. Accumulate through corrections, and then gradually take profits during strong rallies, instead of trying to time the exact top or bottom.

This is classic Dollar Cost Averaging (DCA), but with clear rules:

- You are always liquid enough to take advantage of big drawdowns.

- You are always exposed enough to benefit from a strong recovery.

- You are not forced to make emotional, all in or all out decisions based on headlines or fear.

In the SwissBorg app, this is incredibly simple to implement with Auto-Invest. You choose:

- The token you want to buy, for example Bitcoin, Ethereum, or Solana

- The frequency, for example weekly

- The amount and the funding account

Then the app does the work for you in the background while you get on with life.

You can set it for a fixed period, such as two months during a dip, or keep it running as a long term habit.

Final Thoughts: Clarity In A Noisy World

If you only listen to doomers, it feels like everything is about to collapse.

If you only listen to hopium, it feels like we are “early” every single month.

The six pillar framework that Cyrus and Alex share is a way to step outside that noise and ask:

- What are the facts?

- What is most probable?

- How do I build a strategy that works through different outcomes?

Right now, those pillars suggest that:

- We are not at the end of a classic bull cycle

- We have not seen a true altcoin season

- The macro and policy backdrop is more positive than the sentiment implies

In that kind of environment, the winners are usually those who:

- Stay calm

- Keep some cash

- DCA into high conviction assets

- Avoid guessing tops and bottoms

- Let time and compounding work in their favour

As always, nothing here is financial advice. It is an invitation to look at the data, build your own thesis, and use tools like Auto-Invest in a way that fits your risk profile.

The future is never guaranteed, but it is often less scary and more structured than the headlines suggest. The road to financial independence is open to you. You just need the right map - and our video is a great place to start!

Continue the conversation: