SwissBorg’s Paid to Trade & $BORG Buyback Model: A Game-Changer or a Failure?

Alexander Fazel

Chief Partnership Officer

Why We Launched Paid to Trade?

On September 30, 2025, SwissBorg introduced a data-driven model with new Loyalty Ranks and Cashback. For every trade on the SwissBorg Meta-Exchange, we charge a 0.99% fee, use it to buy back our native $BORG token, and return up to 90% of it to traders.

This system addresses two key issues:

- High fees

- $BORG price volatility

We’ve achieved competitive fees—under 0.1% for top users—with plans to reduce them further. This article focuses on the Paid to Trade/Cashback program’s impact on $BORG’s price.

The crypto market is volatile, with rapid price swings. Experienced investors emphasise “time in the market, not timing the market.” SwissBorg’s buyback system embodies this long-term approach, rewarding users who stay invested. By accumulating $BORG cashback, users can capitalise on potential token appreciation, turning trades into profits.

Can We Really Pay Users to Trade?

Consider this example: You trade enough to incur $100 in weekly fees. As a PLATINUM rank holder with 65% cashback, you receive $65 in $BORG the following Monday at $0.30 per token. Months later, due to buyback mechanics and market conditions, $BORG reaches $0.50. Your $65 in $BORG is now worth $108—covering your fees and yielding a net profit. This mirrors what happened for trades in March 2025 held until September.

For other ranks:

• GOLD (50% cashback): Net fees of $10 (0.01% effective rate—lower than Jupiter).

• DIAMOND (75% cashback): Net profit of $10.

• ELITE (90% cashback): Net profit of $20.

This scales with volume; some users have received thousands in cashback, amplifying gains.

Key lessons for SwissBorg users:

• Lock $BORG to unlock your best rank.

• Collect weekly cashback.

• HODL until profitable, ranking up organically.

• Get paid to trade (or hold for greater returns).

Now, let’s examine the data.

Why did $BORG’s Price Correct?

Three factors contributed:

- Capital Flow Cycle Model: Old holders exit at profits, paving the way for new inflows.

- Major Resistance at $0.50.

- Market Volatility and Fear.

1. Capital Flow Cycle Model

Per Frazzini & Pedersen’s Capital Flow Cycle, long-term holders (especially since $BORG’s underperformance from 2022) take profits first. This applies to Bitcoin, too, where early whales are now selling.

We saw the largest $BORG unlocking since 2022: Over 16 million tokens unlocked above $0.60. Many investors profited and sold, which is healthy for the ecosystem (often rotating into other tokens), but pressured $BORG. During our keynote, we flagged $0.50 and $1 as tough barriers, but we’re confident in the buyback/cashback fundamentals.

About 16 million $BORG were sold, including from dormant accounts (>1 year inactive), with three whales contributing most. Our relationship managers confirmed these whales (DCAing since 2022) took profits without concerns about the program’s utility—positive news. This group now holds little unlocked $BORG (though some retain it for premium tiers). Surprisingly, many ex-Explorers sold their 500 $BORG, content with standard tiers after fee reductions.

The buyback couldn’t sustain prices above $0.50 but held support around $0.30. Now, with the sell-off easing, we’re building long-term.

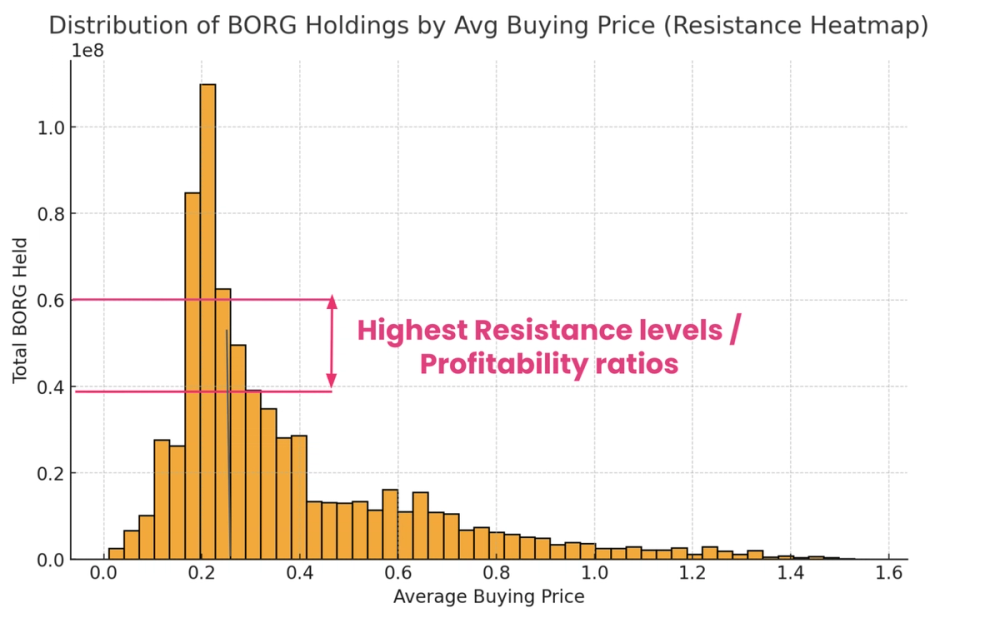

2 Major Resistance at $0.50

During the keynote presentation, we highlighted $0.50 as the toughest resistance levels, where a significant number of loyal holders, accumulating $BORG since 2022, would hit 2x–3x ROI on their average purchase prices ($0.15-$0.25).$1 and previous ATH levels are more of psychological zones, which may not be broken over a single buyback period, but over time and especially with the current growth in revenues and buybacks, we will be able to absorb these resistance levels with a compounding effect of buybacks.

3. Market Downturn

The largest liquidation since FTX/ UST occurred on October 10th (estimated at $20BN) + political & geopolitical issues, crashed the markets with a major risk-off sentiment. Bitcoin dipped below 103k, wiping out 20% from its previous high, Solana fell below $150, its lowest since July, and almost all other tokens followed, creating a lot of stress and selling pressure. It became a bit of a bad time for Crypto to perform on the upside, and although the Buyback can withhold some of the pressure, it can get overwhelmed when put in a difficult situation such as this one.

Bitcoin dropped below $103K (20% from highs), Solana below $150 (July lows), and most tokens followed. This overwhelmed the buyback amid broader selling.

Why It Will Succeed Long-Term

Despite challenges, positives emerged: We reactivated over 5,000 dormant users, boosting revenues and buyback pressure.

Volatility was expected with such changes—upside on launch, downside from markets. The model’s core persists: Massive buy pressure and reduced selling via locks create supply-demand asymmetry, fostering long-term uptrends.

Cashback isn’t for quick wins; it’s designed to outperform over time. Lower volatility strengthens buybacks and rebounds.

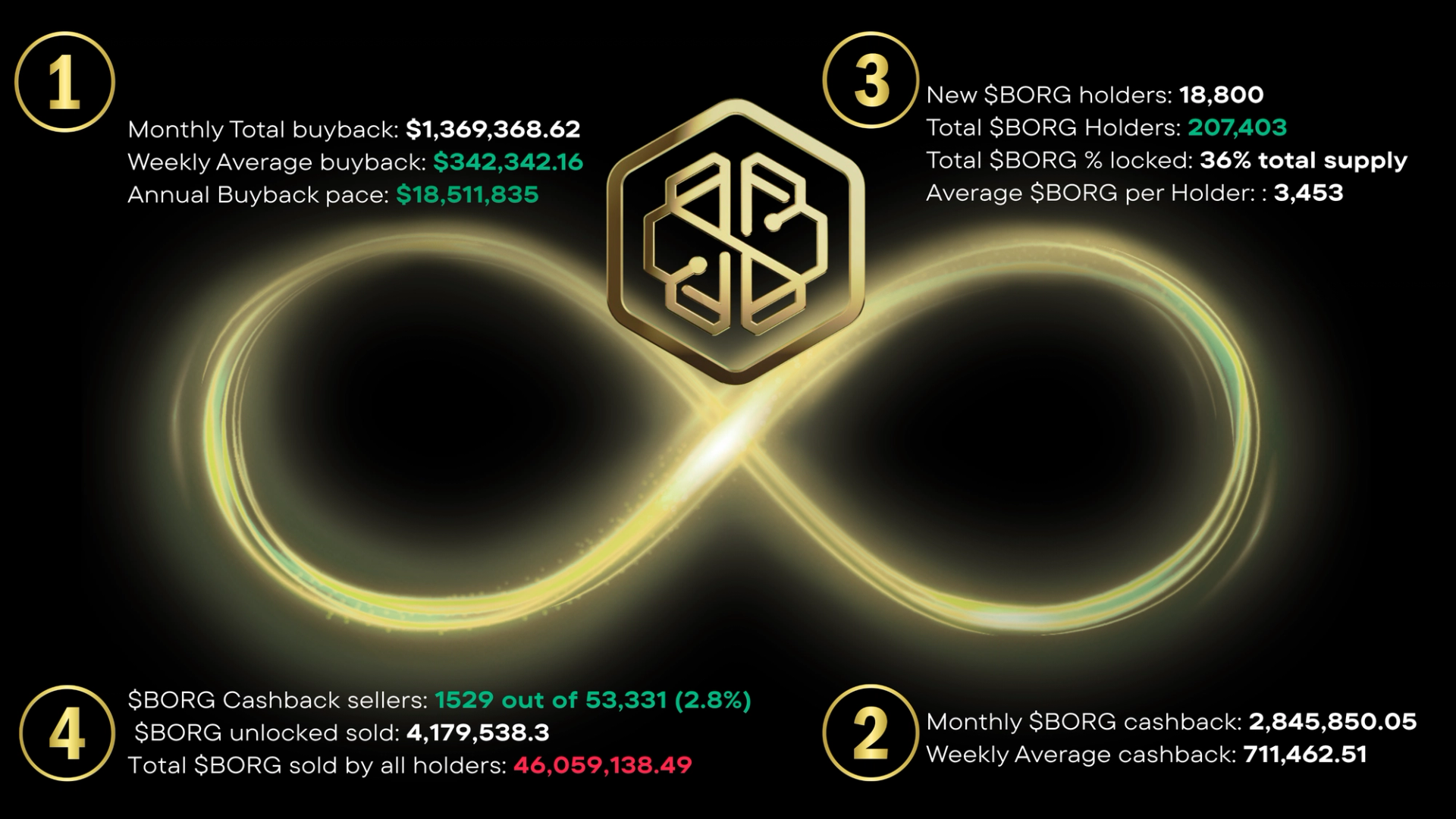

Key stats from the first month:

• $1.57M in $BORG buybacks

• 20,000 new holders

• $1.7M in cashback distributed

Last week:

• Trade Volume: $53,497,046.99

• Buyback $BORG: $198,561.84

• Buy Pressure: $2,907,735.85

• Cashback Distributed: 513,502.40 $BORG

• $BORG Locked: 354,332,465

• $BORG Supply: 982,252,834.50

• $BORG Scarcity: 64% (in circulation)

Looking Ahead

1. $BORG Outperformance

Despite headwinds, $BORG outperformed many ecosystem tokens and stayed resilient. At Cashback launch, 55% of top 150 cryptos were above their 200-day MA (bullish signal). Today, only 17% are—yet $BORG holds above its 200-day MA, proving the model’s strength. (Source: link).

2. Enhanced Buyback Features

New tools like the SwissBorg debit card and web app will boost $BORG utility, adoption, and engagement—growth not yet priced in. Every trade, lock, or interaction strengthens the token economy.

3. Altcoin Market Timing

When markets turn bullish, $BORG is primed. With expanding holders, locks, and scalable rewards, the upside is significant. For context, SwissBorg’s peak 2021 week had $450M volume, equating to ~$2.25M weekly buyback—exceeding average selling pressure. Paired with momentum, this could be explosive for holders.

The foundation is solid, the model is validating, and the community is robust. Fundamentals are at their peak, all that’s needed is time.