Liquid staking on GoGoPool

Key Takeaways

- Liquid staking represents one of the safest options in DeFi to generate yield. The yield is further improved by farming the liquid staking tokens. Obviously, this additional yield comes with some additional risk.

- GoGoPool is considered a secure and trustable liquid staking protocol.

- The yield (APY) is derived from AVAX staking – contributing to the Proof-of-Stake consensus mechanism.

- Launched in 2020, Avalanche is a layer one blockchain that functions as a platform for decentralised applications and custom blockchain networks. It is one of Ethereum’s rivals, aiming to unseat Ethereum as the most popular blockchain for smart contracts. The Avalanche network consists of three individual blockchains: the X-Chain, C-Chain and P-Chain. Each chain has a distinct purpose, which is radically different from the approach Bitcoin and Ethereum use, namely having all nodes validate all transactions. Avalanche blockchains even use different consensus mechanisms based on their use cases.

- AVAX liquid staking represents a mid term liquidity yield-generating investment. No lockup period is present. However, after unstaking is initiated, a cooldown period of 15 days applies to this yield strategy and funds can be redeemed only at the end of this period.

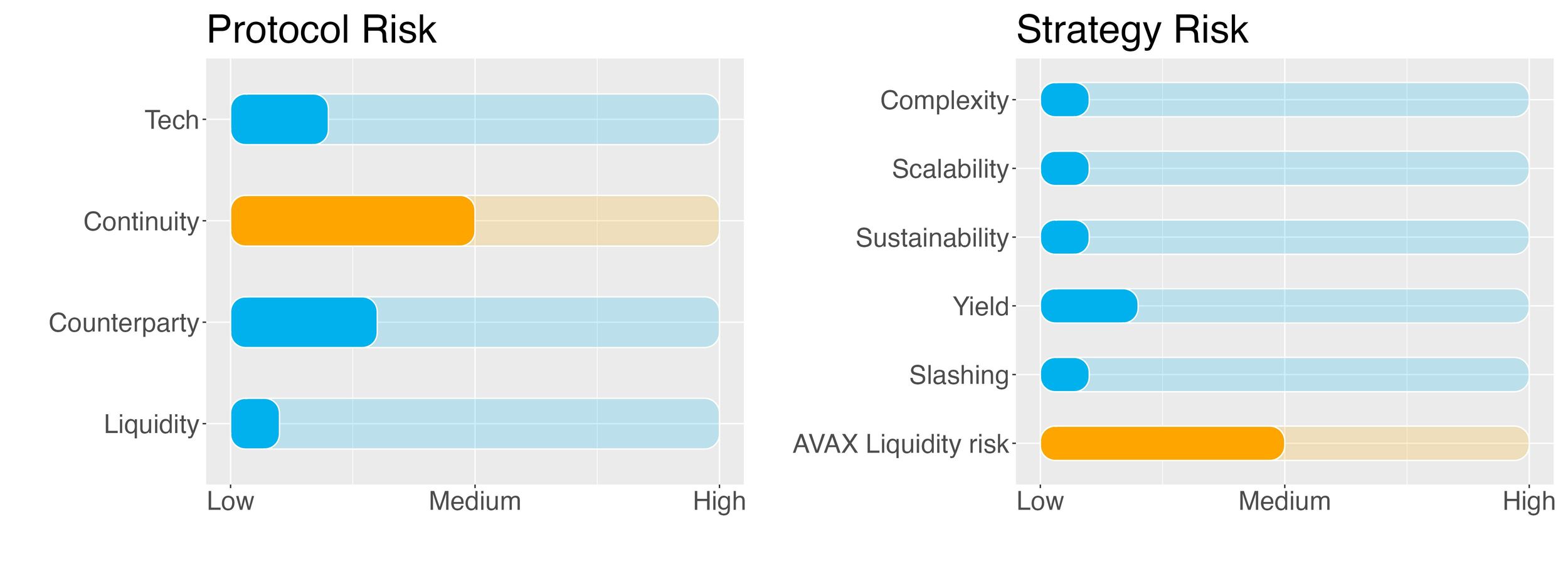

- Risk Checklist. In our view the predominant risks for this strategy are as follows:

- Protocol continuity risk

- Liquidity risk of staking

1. Strategy Explained

The strategy involves liquid staking AVAX tokens on GoGoPool.

Lockup period: None. Cooldown of 15 days.

2. Strategy Risks

Trust Score

GoGoPool is the first permissionless staking protocol built for Avalanche Subnets to lower the cost of running a validator node via liquid staking and minipools. To become a validator with Avalanche, a node needs 2000 AVAX. Through GoGoPool, the node operator contributes half of this amount, while the remaining half is sourced from the liquid staking deposit pool. This newly created validator is called 'minipool'.

When using GoGoPool to liquid-stake AVAX, users receive the ggAVAX token, which is a new staking token representing their staked AVAX plus any rewards it has accrued in real-time.

The protocol went live in April 2023 and displays a TVL of around $2m.

SwissBorg trust score for GoGoPool is ‘green’, i.e. the protocol is trustable. The score value is 80% signalling that the protocol is reliable.

Protocol Risks

Project Continuity Risk

Project continuity risk is medium.

GoGoPool displays a TVL of just $2m. This puts it in position 72 of all staking protocols (source). The difference with the largest staking protocol, Lido, is gigantic with Lido having over $14b locked in.

The protocol token GGP is not covered by CoinMarketCap. It can be traded in TraderJoe but liquidity is virtually non-existent.

Given that the protocol is new and the TVL so low, we conservatively set the project continuity risk to 5/10.

Counterparty Risk

Counterparty risk is deemed low.

Counterparty risk exists whenever an asset is handed over to an external provider. Any credit events involving the staking provider could affect the assets that have been entrusted to them.

That said, staking via a 3rd party is fundamentally different from depositing funds into a lending protocol that later becomes insolvent.

Staked AVAX are locked into smart contracts. When moving from the C-chain (contract) to the P-chain (platform, where staking is performed), GoGoPool regulates the transfer of tokens via their advanced multisig technology which minimises counterparty risk.

Counterparty risk is 2/10.

Liquidity Risk

Liquidity risk is deemed low.

Funds held by the staking provider are redeemable at any time (cooldown period applies).

Liquidity risk is 1/10.

Strategy Risks

Complexity

Complexity of strategy is low.

The strategy involves depositing AVAX on GoGoPool to perform staking.

Therefore one chain (AVAX), 1 token and 1 protocol is required.

Complexity of the strategy is 1/10.

Scalability

Scalability risk of strategy is low.

Staking is a highly scalable practice. Indeed, the more stakers are participating, the higher the safety of the blockchain.

Scalability risk of the strategy is 1/10.

Sustainability

Sustainability risk of strategy is low.

The yield obtained from this strategy is fully sustainable as it comes from participating in the validation of AVAX transactions, the Proof-of-Stake mechanism.

Proof-of-Stake is quite energy efficient when compared to Proof-of-Work chains like Bitcoin and has therefore practically no negative impact on the environment.

Sustainability risk of the strategy is 1/10.

Yield Risk

Yield risk of strategy is low.

Staking provides a constant stream of income with low variability.

In addition, GoGoPool has its own mechanism to incentivise the node operators to be active and generate the expected stream of staking revenues:

Node Operators have to stake a minimum amount of GGP tokens to secure their assigned staking funds as insurance for good behaviour. At genesis the minimum will be 10% of their AVAX staked amount, but the operator can choose to stake as much as 150%.

If a node operator has excessively low uptime and causes a loss of rewards for the protocol, stakers are compensated from the GGP insurance put up by the Node Operator. This socialises the risk of being matched with a bad operator, and minimises any potential losses. Slashed GGP can be sold to token holders at a discounted rate, with AVAX proceeds awarded to Liquid Stakers

Yield risk of the strategy is 2/10.

Slashing Risk

Slashing risk on AVAX staking is low.

Slashing is a measure adopted by some proof-of-work blockchains to punish suboptimal node behaviour which involves taking away a certain number of tokens from a misbehaving node.

The Avalanche blockchain does not use slashing. The design philosophy behind this decision is influenced by a desire to avoid potential drawbacks associated with slashing, such as the risk of discouraging participation or the possibility of accidental slashing due to network issues

Slashing risk is 1/10.

Liquidity Risks of staking

Liquidity Risk on staking AVAX is medium.

Liquid staking on GoGoPool requires no lockup but a technical cooldown period of 14 days. Conservatively, 15 days are assumed.

During this period (in the event of a market event), tokens will be out of reach.

Liquidity risk is therefore set to 5/10.

3. Conclusions

AVAX staking comes with a small level of risk.

Liquid staking per se is generally considered a very safe investment. GoGoPool, the chosen liquid staking protocol, has been reviewed and approved by the SwissBorg tech team.

AVAX staking comes with no lockup, but a 15-day cooldown period is required. This means that redemptions are possible only at the end of the period. Liquidity is therefore not always available.

The SwissBorg Risk Team ranks AVAX staking as a Low risk investment, one for an investor with a good understanding of DeFi and yielding, who is willing to take on little risk in exchange for a fair reward on AVAX.

Try the SwissBorg Earn today!