25. Februar 2026

Vielen Dank an alle Investoren, die sich an der SwissBorg Serie A beteiligt haben. Die Zahlen sprechen für sich: eine Rekordbeteiligung!

21,27 Mio.

Gesammelter Betrag (CHF)

16.660

Investoren

Vor 5 Jahren hatten wir einen Traum. Eine Vision von der Demokratisierung der Vermögensverwaltung. Eine Mission, die Spaß macht, fair ist und die Community in den Mittelpunkt stellt. Wir sammelten 52 Millionen Dollar von 24 Tausend einzigartigen Investoren und bauten eine der stärksten Krypto-Communities der Welt auf. 5 Jahre später haben wir 700.000 verifizierte Nutzer, erzielten über 150 Mio. Umsatz und sind preisgekrönte Brancheninnovatoren.

1 Mrd. $

Höchste Bewertung im Jahr 2021 erreicht

910.200

Gesamtzahl der verifizierten Nutzer

1,088 Mrd. $

Gesamtwert aller Krypto-Assets der App-Nutzer

250+

SwissBorg Mitarbeiter

Die Anteilseigner kommen in den Genuss von Erträgen durch den Kursanstieg ihrer Aktien und die damit verbundenen Dividendenansprüche. Zu den Ausstiegsmöglichkeiten gehören Leverage Buyouts (LBOs) und öffentliche Angebote an einer börsennotierten Börse wie der SIX Swiss Exchange (IPOs).

Generell gilt: Je früher die Investition, desto höher das Risiko, aber auch der Ertrag. Eine Serie A bezieht sich auf eine frühe Finanzierungsrunde, die in der Regel auf eine Seed-Runde folgt und vor weiteren Runden stattfindet, die die Buchstaben des Alphabets fortsetzen (Serie B, C, D und so weiter).

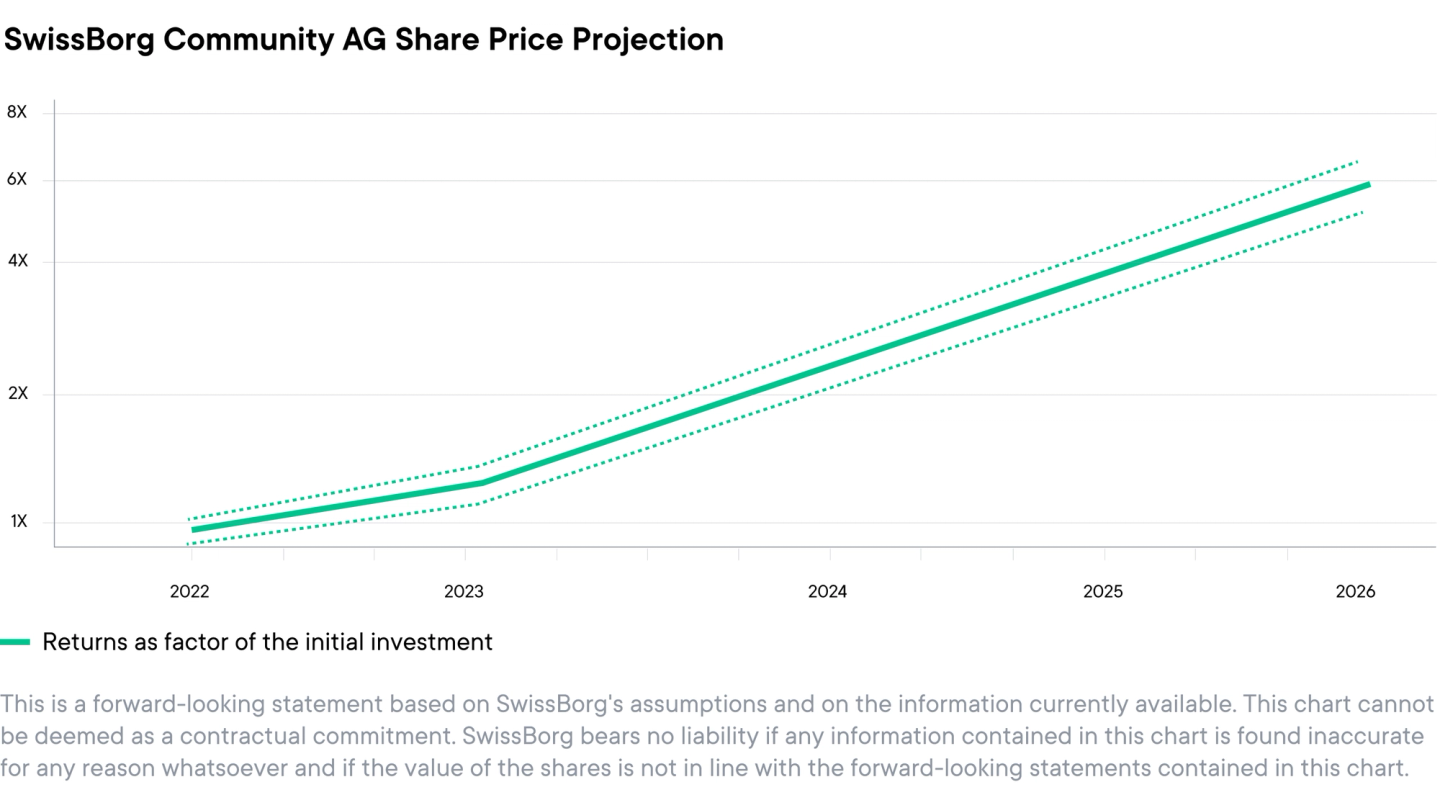

Wie aus der obigen Grafik hervorgeht, folgen Aktien einem höheren Investitionshorizont. Ihr Trend korreliert grundsätzlich mit dem Kernwachstum des Ökosystems des Unternehmens (Nutzerbasis, Lizenzen, Infrastruktur, geistiges Eigentum und gehaltene Vermögenswerte).

Private Märkte bieten bei weitem die höchsten Erträge, die bis zu einem hohen Vielfachen der Anfangsinvestitionen reichen und ihre Gegenspieler an der Börse weit in den Schatten stellen. Bis jetzt. Diese lukrativen Möglichkeiten waren jedoch institutionellen und akkreditierten Anlegern vorbehalten. Die SwissBorg Serie A ändert dieses Paradigma und demokratisiert den Zugang zu Kapitalbeteiligungen direkt für die Community.

CHF 1.66

pro Stammaktie. Aussteller: SwissBorg Community AG.

ab 13. Dezember 2022

bis zum Erreichen der Finanzierungsgrenze - Ende des Angebots am 31.03.23

CHF 25 Mio. Gegenwert

Es gelten regionale Grenzen. Vorbehaltlich von Devisenschwankungen.

Heute haben wir erneut einen Traum. Wir sind davon überzeugt, dass es uns möglich ist, im kommenden exponentiellen Zeitalter ganz an die Spitze zu gelangen. Wir werden von der Vision angetrieben, eine transformative Vermögensverwaltungsplattform zu werden, die die Off-Chain- und On-Chain-Welt miteinander verbindet. Unsere Mission ist es, das Wertesystem von Web3 über das SwissBorg-Ökosystem an Dutzende von Millionen von Menschen zu verbreiten.

Die systematische Geldentwertung, ausgelöst durch ausufernde Verschuldungszyklen und verstärkt durch einen demographischen Rückgang, bringt das Fiat-System auf einen zunehmend fragilen Weg, der auf ein strukturelles Fiasko zusteuert. Da Fiat-Währungen unter dem Druck von Stagflation und politischer Spaltung zusammenbrechen, wird sich die natürliche Verschiebung hin zu hartem und zensurresistentem Geld nur beschleunigen.

Web3 ist die Absicherung gegen den Zusammenbruch des Petrodollar-Finanzsystems. Die Welt kann nicht weiterhin durch die Erschöpfung der natürlichen Ressourcen wirtschaftliches Wachstum erzielen. Künftiger wirtschaftlicher Fortschritt wird aus sich gegenseitig verstärkenden technologischen Innovationen resultieren. Web3 ist das gesamte Wert- und Geldsystem (Übertragung, Speicherung und Eigentum), das für die exponentiellste Umverteilung von Reichtum in der Geschichte der Menschheit geschaffen wurde.

Während wir unseren zweiten Bärenmarkt gut meistern, wurden alle schlechten Unternehmen ausgemerzt, was die Branche widerstandsfähiger und solider macht. Wir befinden uns auf dem Marktniveau von 2018, aber mit einer viel breiteren Adoptionsrate, institutioneller Zustimmung und einem gesicherten Gesamtwert. Die Überlebenden dieses Bärenmarktes befinden sich in der stärksten Position für den nächsten Aufschwung. Während unsere Konkurrenten aufgeben, bauen wir unsere Widerstandsfähigkeit und unsere Produktvision weiter aus.

SwissBorg ist strategisch im Zentrum von Web3 positioniert: Wir stehen im Zentrum der verschiedenen Asset-Typen und verbinden Krypto und TradFi zu einem wachsenden Ökosystem. Angesichts der Stärke der Überlebenden und der Insolvenz vieler unserer Konkurrenten sehen wir eine Chance, diesen fragmentierten Markt zu konsolidieren und als Branchenführer aufzutreten. Dies ist der Moment, um zu expandieren und unseren Wettbewerbsvorteil zu festigen.

Heute sind wir strategisch an der vorderen Front der Web3-Innovation positioniert. Wir haben das beste Gateway für das Finanzwesen von morgen geschaffen.

Durch die Möglichkeit, 16 Fiat-Währungen per Überweisung und Karte sowie direkte P2P-Krypto-Zahlungen einzahlen zu können, ist SwissBorg die Brücke zum Web3.

Mit unserem leistungsstarken Order-Management-System findet SwissBorg den besten Preis und die beste Liquidität an mehreren Kryptobörsen für Tausende von Trading-Paaren.

Wir haben eine vielseitige Plattform für passives Einkommen entwickelt, die es den Nutzern ermöglicht, ihre Einkommensstrategien auf der Grundlage von Risiko und Ertrag zu wählen.

Unsere diversifizierten Krypto-Portfolios sind auf bestimmte Themen zugeschnitten und ermöglichen es dir, in ganze Sektoren zu investieren.

Das Web3 wird die größte Verlagerung des Wohlstands in unserer Zeit bewirken. SwissBorg wird die Demokratisierung dieses Wohlstands anführen. Wir vereinfachen alle Aspekte des Web3-Finanzwesens und ermöglichen den Zugang zum exponentiellen Zeitalter von morgen.

Übertragung von Eigentumsrechten an die Communities. Demokratisierung des Zugangs zu exklusiven Deals bereits in der Frühphase.

Wir wollen grenzenlose Investitionsmöglichkeiten in der digitalen Welt von morgen bieten, von NFTs bis hin zu Immobilien, Rohstoffen und mehr.

KI-basierte, maßgeschneiderte Vermögensverwaltungsrichtlinien, die auf individuelle Vorlieben, Überzeugungen und Ziele zugeschnitten sind.

Wir begannen unsere Reise mit einem 9-köpfigen Team und einem erfolgreichen ICO im Jahr 2018. Heute sind wir ein Team von mehr als 200 Mitarbeitern, die sich dafür einsetzen, das Bankwesen der Zukunft zu schaffen.

Gestärkt durch unsere Vielfalt und Leidenschaft werden wir auch in den kommenden Jahren weitermachen.

“Ihr Ansatz beim Onboarding der Nutzer ist unübertroffen: Bildung und Sicherheit haben oberste Priorität. Was SwissBorg jedoch auszeichnet, ist die dynamische Community, die immer auf dem neuesten Stand der Entwicklungen in Bezug auf Investitionsmöglichkeiten in Kryptowährungen ist. Ich bin stolz, ein Teil davon zu sein.”

Sébastien Borget

COO & Co-Founder - The Sandbox

“SwissBorg ist eines der ersten Unternehmen der Branche, das verstanden hat, dass der Mensch im Mittelpunkt stehen muss! Mit einem talentierten Team, das durch Bescheidenheit, Geduld und Uneigennützigkeit ausgezeichnet ist, bietet SwissBorg eine langfristige Vision und eine innovative Lösung an, die das Potenzial hat, den gesamten Bereich zu revolutionieren.”

Sami Chlagou

CEO & Co Founder - Cross The Ages

Wir gestalten die Zukunft des Investments und geben jedem Einzelnen die Kontrolle zurück.