Managed Portfolio

Achieve your financial goals with crypto portfolios aligned with your risk profile and goals

Discover SwissBorg’s expertly managed crypto investment strategies. Your portfolio is dynamically reallocated based on market conditions, ensuring optimal exposure guided by seasoned professionals.

What makes Managed Portfolios unique?

Dynamic Allocation

Your crypto portfolio is continuously optimised to adapt to evolving market conditions, maximising potential returns in favorable markets while protecting your capital during turbulent times.

Expert Oversight

SwissBorg’s investment team actively monitors and analyses the market. Every decision is guided by expert insights and analysis to keep your portfolio aligned.

Why choose Managed Portfolios?

Hassle-Free Crypto Investing

SwissBorg takes care of everything, from market analysis to portfolio adjustments, so you can focus on your financial goals.

Protection in Downturns

In bearish markets, portfolios shift to defensive strategies to reduce potential losses, focusing on capital preservation to help safeguard your wealth.

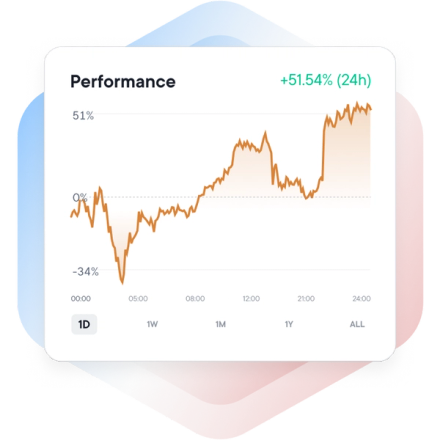

Transparent Tracking

Access clear, regular updates on your portfolio’s performance and allocations, ensuring you stay informed every step of the way.

What are the different Investor Profiles?

SwissBorg offers three distinct investor profiles: Conservative, Moderate and Growth.

Your investor profile will be determined through a quick Investor Profile Assessment when you first access the Managed Portfolio marketplace in the SwissBorg app.

If your profile is Conservative or Moderate, we recommend avoiding Managed Portfolios, as they may not align with your lower risk tolerance.

What are the Managed Portfolios offered in the app?

SwissBorg currently provides one Managed Portfolio, designed specifically for Growth-oriented investors seeking long-term returns with a higher risk tolerance.

Designed for investors seeking higher returns through increased exposure while carefully managing volatility.