Money. Some love it, some fear it, some don’t care about it, and some have so much that they stash it in the walls of their houses. In any case, managing your money effectively is the key to increasing your wealth over the long term.

Money management is often seen as something that only very wealthy people do, because many people are more concerned about making sure they have enough money from month to month. However, the truth is that everyone can benefit from consistent money management, and even small sums that are properly managed will add up over time and will help you reach your financial goals. The key is to create an effective system that will enable you to put money aside on a continuous basis.

In this article, we will cover what money management is, its importance for crypto investors, and my top money management strategy for beginners. Your future self will be glad (and wealthier!) that you implemented them straight away.

What is money management?

Money management is a set system for managing your wealth. The management process can be broken down into five areas:

- Income: The money you earn each month, including salary, asset growth, interest, yields, and profit from the sale of assets.

- Expenses: How much money you spend each month.

- Spending behaviour: How you spend your money.

- Financial destination: Your goals, needs and wants and how much money you require to achieve them.

- Time vs. money: All your money is acquired with your time. How do you actually spend your most valuable asset, your time?

Why is money management important?

Money management is important for everyone.

If you don’t manage your money well, the consequences can range from not generating the highest returns for your income to being unable to provide for your physical needs like food and shelter.

A simple example is looking at having a savings account versus investing in a yield wallet. Someone who isn’t actively monitoring their financial health and looking at ways to grow their wealth might just put extra income into a savings account each month. However, savings accounts often return less than 1% per annum (so if you have $100 in a savings account, after one year you will have $101). While this might sound good on the surface (it’s money for nothing, after all!), 1% is actually lower than the rate of inflation, which is usually 1-2% in the EU. This means you’re losing money in the long run, because your savings will have less purchasing power over time.

On the other hand, if you invested in a crypto yield wallet, like SwissBorg’s Earn wallets , you would let your wealth grow without effort. This is a simple example of how taking a bit of time to manage your money effectively can lead to much higher returns.

At the more serious end of the spectrum, if you aren’t managing your money well you could end up holding debts with high interest rates, be unable to keep up with car, rent or mortgage payments, and be unable to provide for your loved ones. This then has mental and physical costs.

On the other hand, if you do manage your money well, it will help you to pave the path for your financial freedom.

Effective money management will enable you to put money aside each month. This means you will have a nest egg for emergencies and surprise expenses, which could range from needing to get your car repaired, to covering potential job loss.

Once you have an emergency fund, you can then start using the money you set aside to grow your wealth. This includes both using the spare funds to pay down debt, as well as investing. Some investment ideas include investing in a yield wallet for passive income, actively speculating on the crypto market, or investing in other assets like real estate or the stock market.

Why is money management important for crypto investors?

We’ve covered why money management is important in general, but how can it help crypto investors specifically?

Crypto is a very volatile market, and tokens can gain and lose 10% to 50% in a single day. On top of this, there are always new and exciting projects being launched, and dozens of social media influencers talking about the next big idea or trend.

This means crypto investors are vulnerable to getting carried away by their emotion - especially the fear of missing out, or ‘fomo’ as we call it in the crypto space.

As an investor (even a crypto investor!) there is nothing worse, for me, than making investments based on emotions.

Investments need to be calculated, based on financial goals and following a clear strategy. Rather than chasing after the big win, most successful long-term investors make their money by using effective money management strategies day after day.

If you want to achieve substantial results as a crypto investor, you need to have a clear strategy in place for your investments, including how much money you plan on putting into your portfolio and clear metrics to track your portfolio’s performance. What you don’t measure can’t be improved. Therefore, tools like SwissBorg’s Portfolio Analytics are invaluable for giving you insights on how much money your investment has grown over time and where your wins or losses are coming from.

A simple money management strategy

To manage your money, the best place to start is by monitoring your spending behaviour so you can see where your money goes. Once you have an idea of what you are spending money on each month, you will have a better understanding of what you can save to either pay off debt or build your wealth.

One useful strategy for figuring out how to allocate your money each month is the 6 Money Management Jars System from Harv T. Eker.

Each jar stands for a specific part of your life that’s essential to save and spend money on:

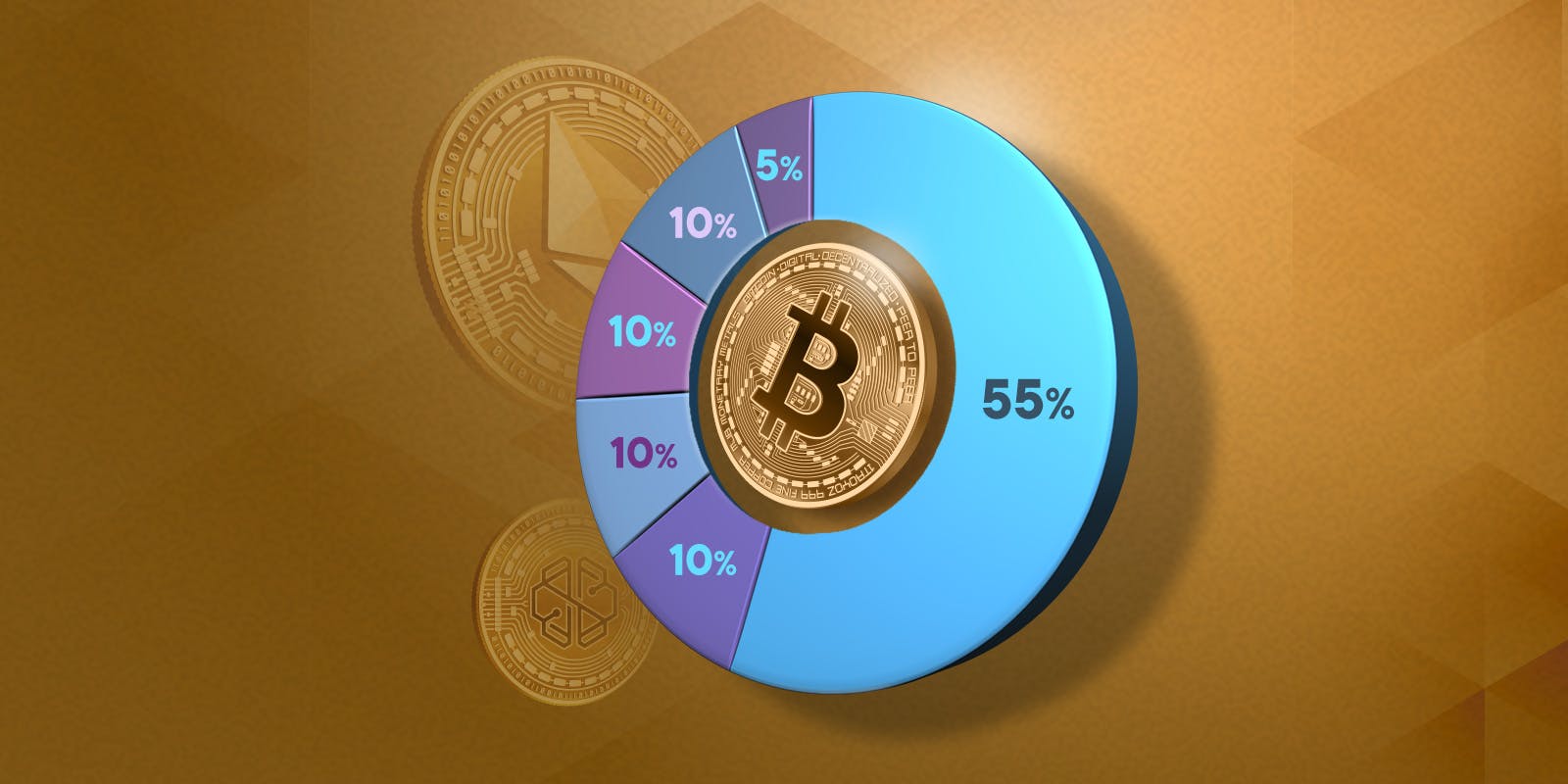

- 55% of your income goes towards basic needs like rent, food, hygiene articles and bills.

- 10% should go toward your personal education, since the most important investment is in your own knowledge! Use books, online courses, study programs, and coaching to make yourself more valuable.

- 10% should go into your financial freedom account, which will generate passive income over time. These investments might include crypto yield wallets, stocks, real estate and more - anything that you expect will increase in value and/or generate an income over time. The SwissBorg app offers Earn wallets , which will earn you passive income on your crypto investments .

- 10% of the money management strategy is meant for play. Spending money in outrageous ways that you wouldn’t dare to do in your usual spending behaviour. This might include getting a 5-course menu, buying a new watch or travelling to Japan (or wherever you prefer!). The intention of this jar is to start appreciating the money and the beautiful experiences it can enable you. Together with the donation jar, it will help you to create an abundance mindset while spending money to feel good.

- 10% of your funds go to long-term investments. These are assets you invest in with the intention of holding them for a long time, such as investing towards your retirement. This is similar to the financial freedom account, in that it will increase your net worth over time. However, the difference is that your financial freedom investments are designed to generate income - like cryptos earning a yield, stocks earning dividends, or real estate where you get paid rent. Long-term investments, on the other hand, are investments that you buy and hold over time, in the belief that their value will increase over time and you can sell them in the future at a profit. So holding Bitcoin for 30 years would be a long-term investment, while putting that Bitcoin in a yield wallet would turn it into a passive income generating asset.

- The last 5% of your income goes towards donations for social projects that are dear to your heart. For me, the fight against climate change and education for kids who need it. Donating money for people and projects that make the world better will help you appreciate the power of money more, not to mention generating karma points that the universe will return by sending you your donated money back in the most awesome ways you can imagine. It will also help you to establish a mindset of abundance that is necessary for riches.

To set up this system, you can use physical glass jars if you like, but in most cases it will be easier to manage this digitally. Simply, when you receive your income each month, you can transfer 10% to your education account, 10% to your financial freedom account, 10% to your play account, and 5% to your donations account, leaving the remaining 55% in your transaction account for everyday spending. Many banks can even automate these transactions for you.

From here, you can either transfer these funds directly to the allocated expense (e.g. you can transfer your 10% for financial freedom directly to your SwissBorg account for investing), or you can let the account grow until it is large enough to spend it on what you want (e.g. if you plan to spend your play money on a trip to Japan, it might take a few months to save up enough).

Finally, if you find there isn’t enough money left each month for each of these jars (even after you’ve cut down on unnecessary spending), start with what you can. Even just putting 5% into your financial freedom account each month is better than nothing.

Appreciate your money

A healthy habit to follow is simply being thankful for your money. One strong but simple habit I learned from the Japanese writer Ken Honda, who got the technique from the Japanese billionaire Wahei Takeda, was to be thankful for all the money I spend. In Japanese, the word for thank you is arigato. So, the next time you spend money for a coffee or anything else take a moment to say in your mind: arigato money. Gratitude is a powerful feeling and you can never experience it enough. Let it change your money-mindset!

By being thankful and appreciating each Euro I spend or invest, my investments started to grow substantially.

Appreciation is a powerful mental state, because it forces you to slow down and be in the moment, rather than getting caught up in FOMO. Because of this, by appreciating each of your assets, you will start to invest in projects that align with your principles and will ensure you aren’t overtaken by harmful emotions while investing. Feeling grateful with each investment will prime your mindset in a powerful way by ensuring that losses can be seen as lessons that teach you to manage your money better and profits as results of how much you improved.

How to start managing your money effectively

- Write down all your expenses and categorise them. Are your current spending habits in alignment with your goals? Cut away the things that don’t align with your goals and put that money towards things you really care about.

- Start using the money jars system so you are consistently investing to make your money work for you and your future. In five, ten, twenty or fifty years, you will reap the benefits of thinking ahead, rather than looking back on your life in the future and wondering why you weren’t able to create the lifestyle you want.

- Set up recurring bank transfers so your investments don’t have to rely on you each month. This way, your money will start growing automatically, and you can start benefiting from compound returns.

Key takeaways

- Money management is a system that helps you to direct your money towards the thing you really care about

- By managing your money effectively your wealth can grow tremendously, enabling you to achieve your goals and dreams

- Use a digital version of the 6 Jars to ensure a smart and easy money management system

- Be grateful for all the money you have, get and can spend and create your abundance money-mindset

Disclaimer: The information contained in or provided from or through this article (the "Article") is not intended to be and does not constitute financial advice, trading advice, or any other type of advice, and should not be interpreted or understood as any form of promotion, recommendation, inducement, offer or invitation to (i) buy or sell any product, (ii) carry out transactions, or (iii) engage in any other legal transaction. This article should be considered as marketing material and not as the result of financial research/independent investments.

Neither SBorg SA nor its affiliates (“Entities”) make any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of the Article, nor to it being free from error. The Entities reserve the right to change any information contained in this Article without restriction or notice. The Entities do not accept any liability (whether in contract, tort or otherwise howsoever and whether or not they have been negligent) for any loss or damage (including, without limitation, loss of profit), which may arise directly or indirectly from use of or reliance on such information and/or from the Article.